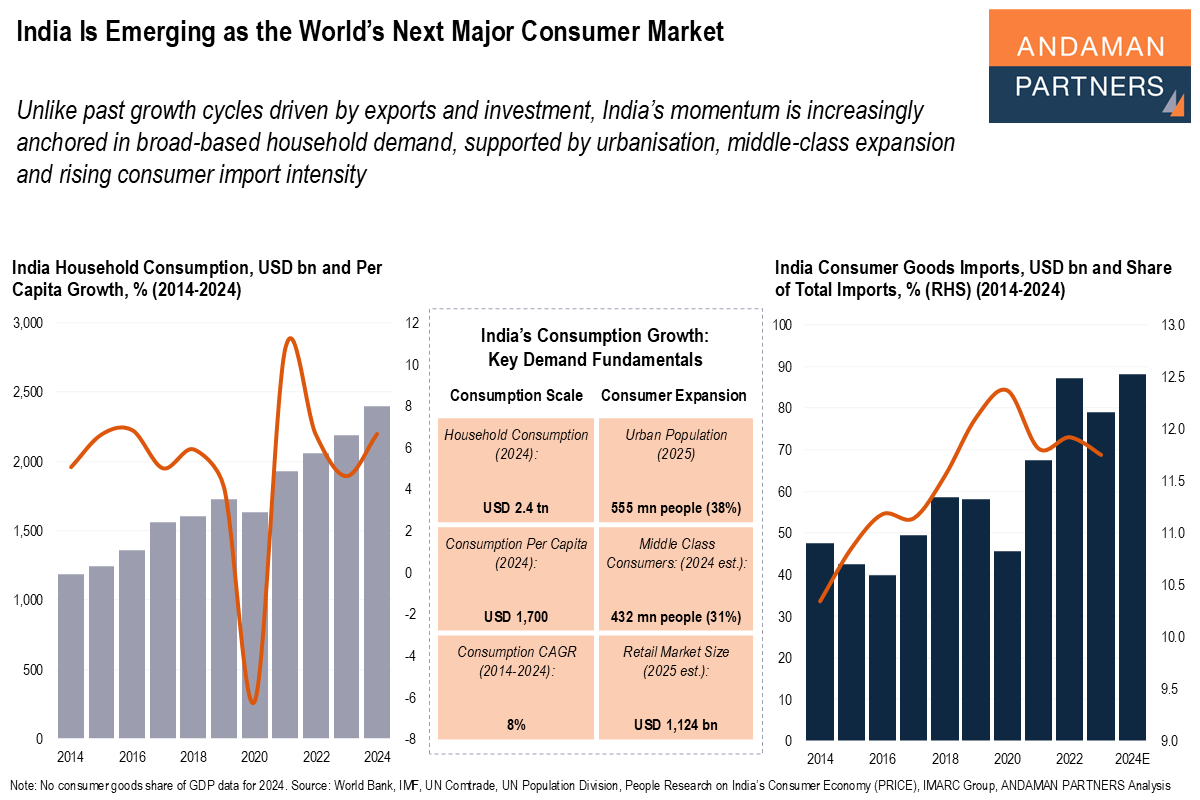

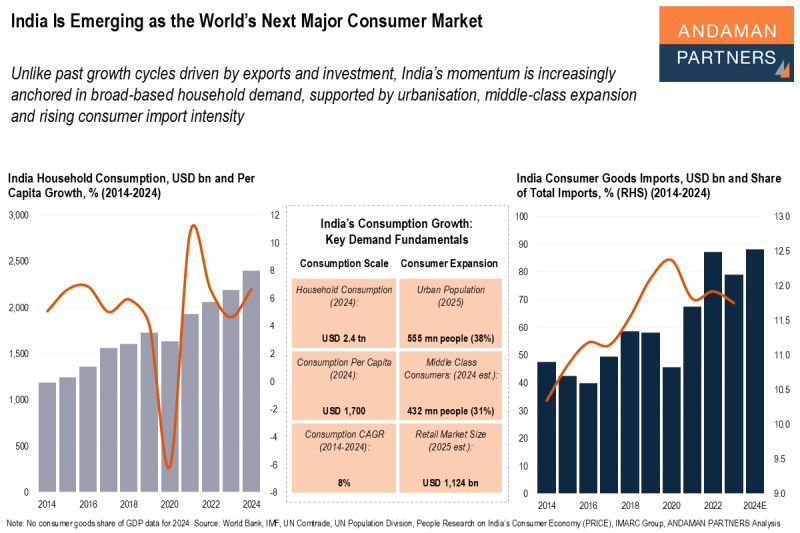

Unlike past growth cycles driven by exports and investment, India’s momentum is increasingly anchored in broad-based household demand, supported by urbanisation, middle-class expansion and rising consumer import intensity.

India’s consumer economy is no longer a supporting act in its growth story; it is becoming a core engine of demand. Household final consumption has roughly doubled to an estimated USD 2.4 trillion in 2024, up from under USD 1.3 trillion a decade ago, with per-capita spending near USD 1,700. This reflects not just broad aggregate growth but deeper, more distributed purchasing power across Indian society.

Two structural forces underpin this expansion. First, urbanisation and demographic shifts are enlarging India’s consumer base. An estimated 38% of the population, around 555 million people, now live in urban areas, and a significant share of Indians are entering middle-income brackets. The middle class, defined by rising discretionary incomes, is estimated at around 432 million people in 2024 and projected to expand further, potentially reaching over 700 million by 2030 and more than a billion by 2047. Second, the organised retail economy is scaling rapidly, with the broader Indian retail market estimated at around USD 1.1 trillion in 2025 and expected to exceed USD 3.5 trillion by 2034 on a 13% CAGR (2026-2034).

India’s consumption growth is clearly reflected in the country’s changing trade profile. Consumer goods imports have risen in absolute terms, and their share of total imports has edged higher, signalling growing demand for products not yet fully supplied domestically. In the future, Indians are likely to import and consume more electronics and appliances, personal vehicles and parts, luxury and branded goods, specialised food products, health and wellness goods and high-end services. This has significant implications for global exporters: markets in East Asia, Europe and the Americas stand to benefit from India’s rising demand for both durable and discretionary consumer goods.

In short, India is transitioning into a large, diversified consumption market; a shift that matters not just for GDP numbers but for global trade and investment flows over the coming decades.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

India Is Emerging as the World’s Next Major Consumer Market

India’s momentum is anchored in broad-based household demand, supported by urbanisation, middle-class expansion and consumer import intensity.

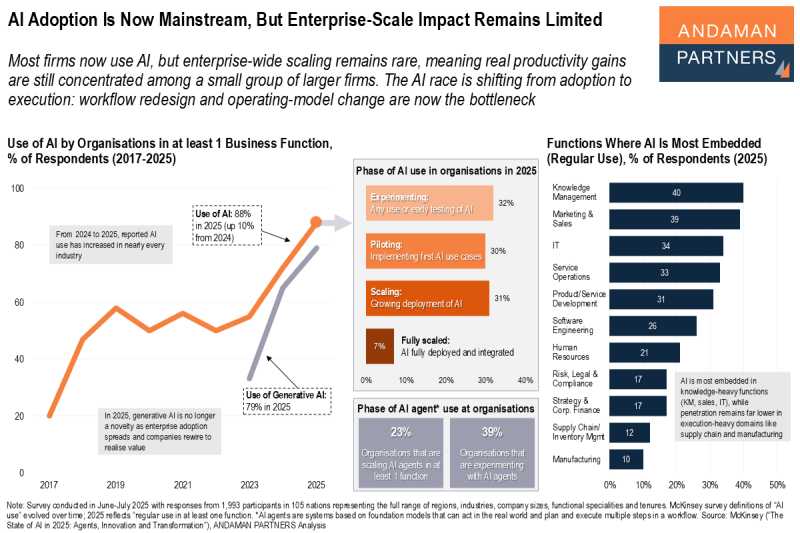

AI Adoption Is Now Mainstream, But Enterprise-Scale Impact Remains Limited

Most firms now use AI, but enterprise-wide scaling remains rare, meaning productivity gains are concentrated in a small group of larger firms.

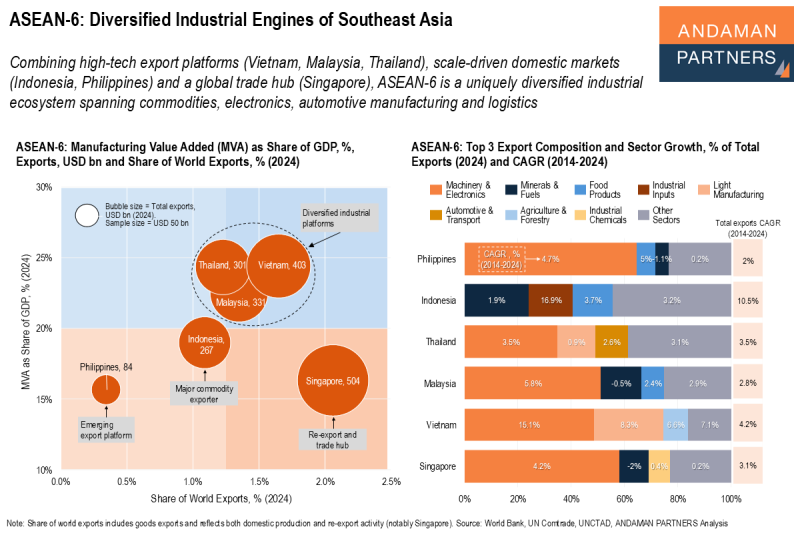

ASEAN-6: Diversified Industrial Engines of Southeast Asia

Combining high-tech export platforms, scale-driven domestic markets and a global trade hub, ASEAN-6 is a uniquely diversified industrial ecosystem.