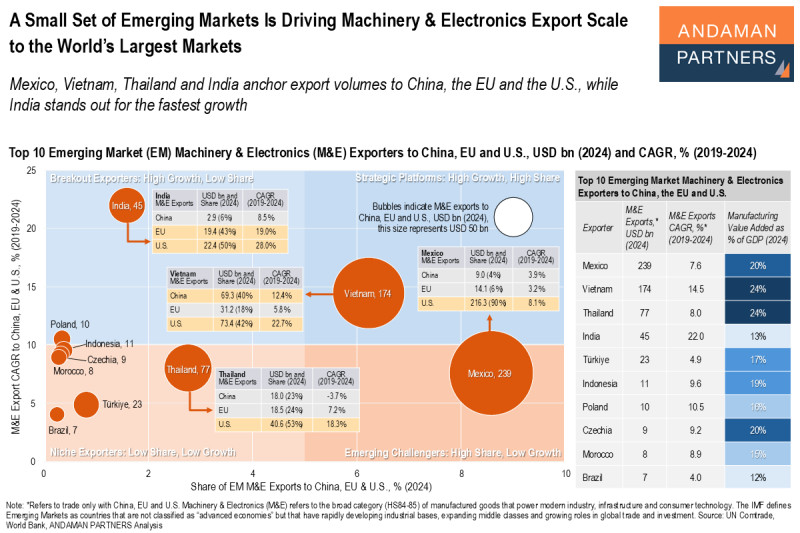

Mexico, Vietnam, Thailand and India anchor export volumes to China, the EU and the U.S., while India stands out for the fastest growth.

A procurement and manufacturing reshuffle is increasingly evident in trade data: a small set of emerging markets is now supplying meaningful volumes of Machinery & Electronics (M&E) to China, the European Union (EU) and the U.S., creating new options for diversification at scale.

Mexico is the volume anchor. With USD 239 billion of M&E exports to these three markets in 2024, it is overwhelmingly U.S.-linked (~90% of exports), making it the clearest “near-market” platform for North America, supported by a solid industrial base (Manufacturing Value Added, MVA, of 20% of GDP in 2024).

Vietnam is the standout multi-market platform, with exports to the three big markets of USD 174 billion, combining strong growth (14.5% CAGR 2019-2024) with a more balanced footprint across China, the EU and the U.S., along with high manufacturing intensity (24% of GDP).

Thailand operates in the “scale and steady growth” lane (USD 77 billion in exports and 8.0% CAGR), with similarly high manufacturing intensity (24% of GDP), making it a credible choice for firms seeking depth in established electronics supply chains.

India is the breakout exporter: a smaller base (USD 45 billion to the big three markets), but the fastest expansion (22.0% CAGR), with exports split mainly between the EU and U.S., with a lower manufacturing intensity (13% of GDP) that signals rapid catch-up is still underway.

The following are the second-tier emerging market exporters:

- Türkiye (USD 23 billion in exports to the big three markets, 4.9% CAGR and 17% MVA) offers proximity-driven integration;

- Indonesia (USD 11 billion exports, 9.6% CAGR and 19% MVA) is scaling from a smaller base;

- Poland (USD 10 billion exports, 10.5% CAGR and 16% MVA) and Czechia (USD 9 billion exports, 9.2% CAGR and 20% MVA) reflect EU-adjacent industrial depth;

- Morocco (USD 8 billion exports, 8.9% CAGR and 15% MVA) is an emerging EU corridor; and

- Brazil (USD 7 billion exports, 4.0% CAGR and 12% MVA) remains a more niche exporter.

The rise of these emerging-market exporters illustrates that diversification is broadening, and that the most actionable new opportunities are concentrated in platforms that can deliver both scale and execution.

For global manufacturers and procurement leaders, the next phase of supply-chain resilience will be won not by adding marginal suppliers, but by building deeper strategic positions in a small set of scalable hubs that are rapidly becoming indispensable to the world’s largest import markets.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

AAMEG Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to sponsor and support the AAMEG pre-Mining Indaba Cocktails & Canapes event.

A Small Set of Emerging Markets Is Driving Machinery & Electronics Export Scale to the World’s Largest Markets

Mexico, Vietnam, Thailand and India anchor export volumes to China, the EU and the U.S., while India stands out for the fastest growth.

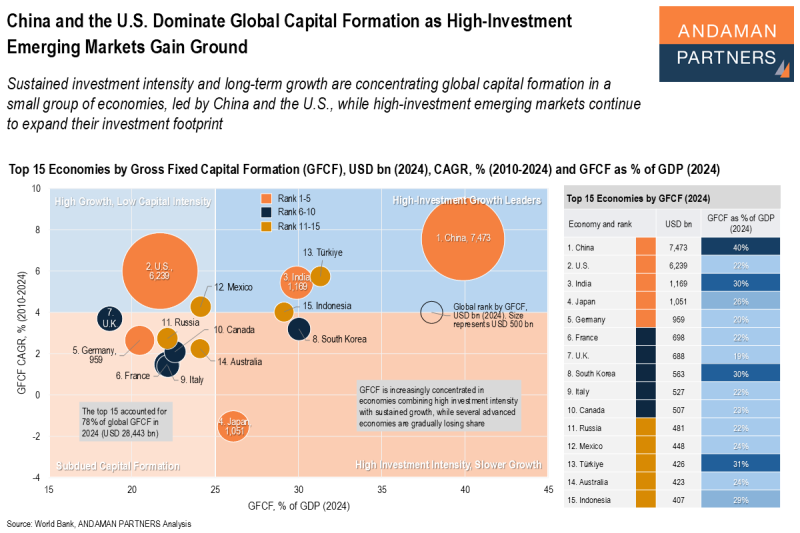

China and the U.S. Dominate Global Capital Formation as High-Investment Emerging Markets Gain Ground

Sustained investment intensity and long-term growth are concentrating global capital formation in a small group of economies, led by China and the U.S.

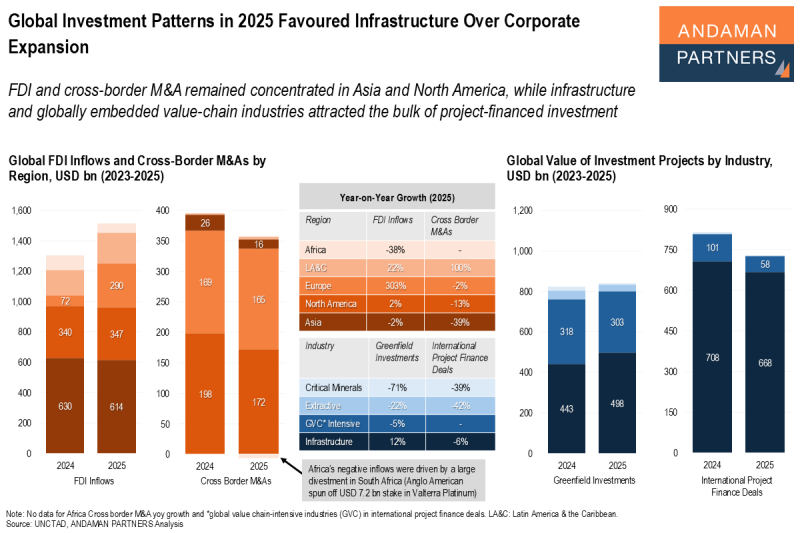

Global Investment Patterns in 2025 Favoured Infrastructure Over Corporate Expansion

FDI and M&A remained concentrated in Asia and North America, while infrastructure attracted the bulk of project-financed investment.