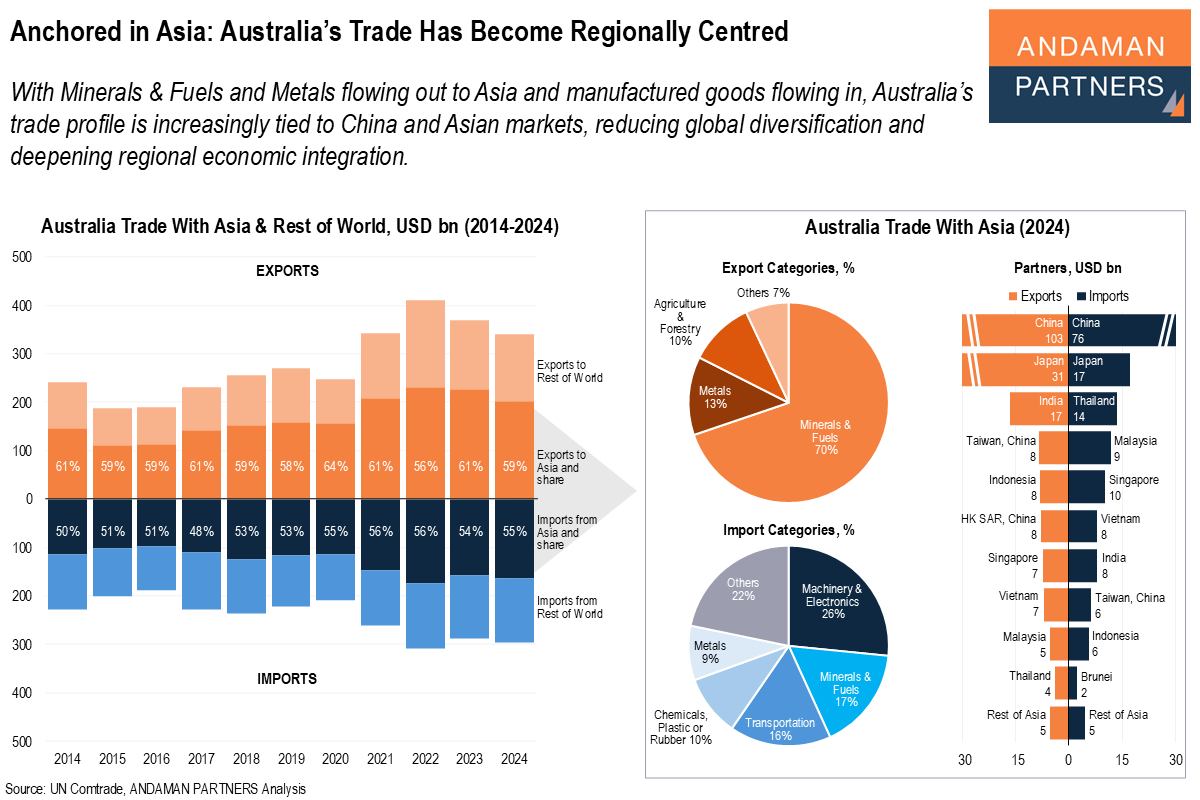

With Minerals & Fuels and Metals flowing out to Asia and manufactured goods flowing in, Australia’s trade profile is increasingly tied to China and Asian markets, reducing global diversification and deepening regional economic integration.

Australia’s trade profile has undergone a structural transformation over the past two decades, shaped by its role as a significant global supplier of minerals, fuels and metals, and by its deep reliance on foreign manufacturing ecosystems.

Australia’s exports have risen sharply over this period, driven by global demand for iron ore, LNG, coal and refined metals, while imports have grown steadily, dominated by machinery, electronics, transport equipment and chemicals. The result is a trade structure in which Australia’s economy is heavily influenced by shifts in global resource markets on the one hand, and by foreign manufacturing supply chains on the other.

Within this broader pattern, Asia, and especially China, now accounts for a larger share of Australia’s trade than ever before. While Australia has long been a commodity exporter, the scale, composition and direction of its trade have become increasingly concentrated. In 2005, Asia accounted for 48% of Australia’s exports and 46% of its imports; in 2024, these shares had increased to 59% and 55%, respectively.

China remains the dominant partner by a wide margin, accounting for USD 103 billion of Australia’s USD 341 billion in exports in 2024, primarily Minerals & Fuels, and supplying USD 76 billion of the country’s total imports of USD 296 billion in return. Japan, South Korea, India, Singapore, Malaysia and Indonesia form a secondary layer of significant partners, but no country approaches China’s commercial weight. This geographic concentration reflects both Australia’s resource endowment and Asia’s industrial and energy needs, reinforcing a trade corridor that is increasingly distinct from the country’s exchanges with Europe, North America and other regions.

The composition of Australia’s trade with Asia underscores the structural nature of the country’s trade profile. Minerals & Fuels account for 70% of exports to Asia, with Metals adding another 13%. These products feed directly into Asia’s energy systems, industrial production and infrastructure pipelines. Conversely, 26% of Australia’s imports from Asia are Machinery & Electronics, with Transportation goods and Chemicals each contributing around 10-16%. In effect, Australia supplies the raw materials that power Asia’s industrial economies and receives in return the manufactured goods that support its own households, businesses and public services.

This deepening interdependence creates both opportunity and risk. On the opportunity side, Asia’s industrialisation and energy demand continue to anchor Australia’s export revenue, supporting fiscal stability and enabling long-term investment in mining, infrastructure and regional development. Asia’s manufacturing scale provides Australia with competitively priced imports across critical categories.

But concentration also amplifies vulnerability. Economic slowdowns in China, shifts in regional energy policy, disruptions in Asian supply chains or geopolitical frictions can reverberate quickly across Australia’s economy. With minerals flowing out and manufactured goods flowing in, Australia’s commercial exposure is increasingly asymmetrical, reducing diversification while tightening the country’s integration into Asian economic cycles.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

AAMEG Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to sponsor and support the AAMEG pre-Mining Indaba Cocktails & Canapes event.

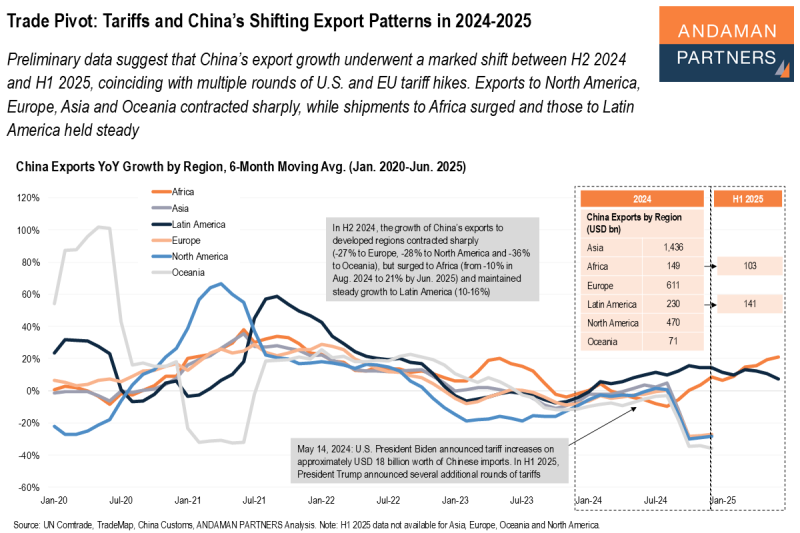

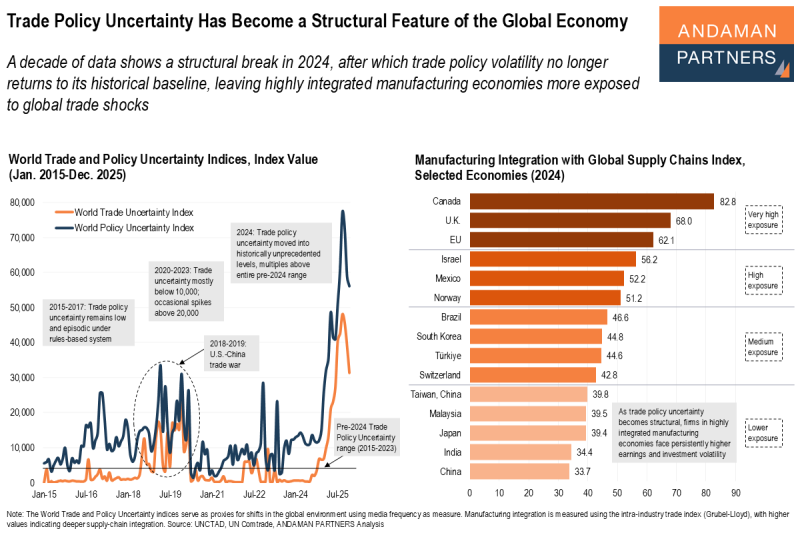

Trade Policy Uncertainty Has Become a Structural Feature of the Global Economy

A decade of data shows a structural break in 2024, after which trade policy volatility no longer returns to its historical baseline.

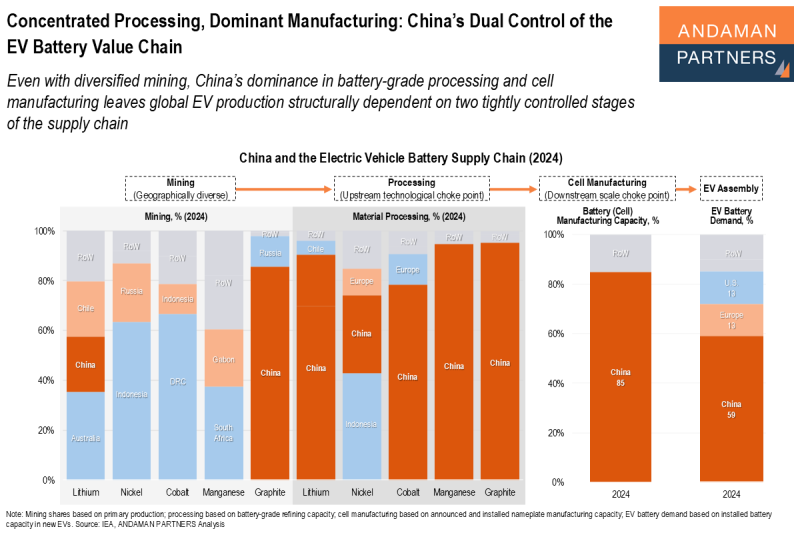

Concentrated Processing, Dominant Manufacturing: China’s Dual Control of the EV Battery Value Chain

China’s dominance in battery-grade processing and cell manufacturing leaves global EV production dependent on two stages of the supply chain.

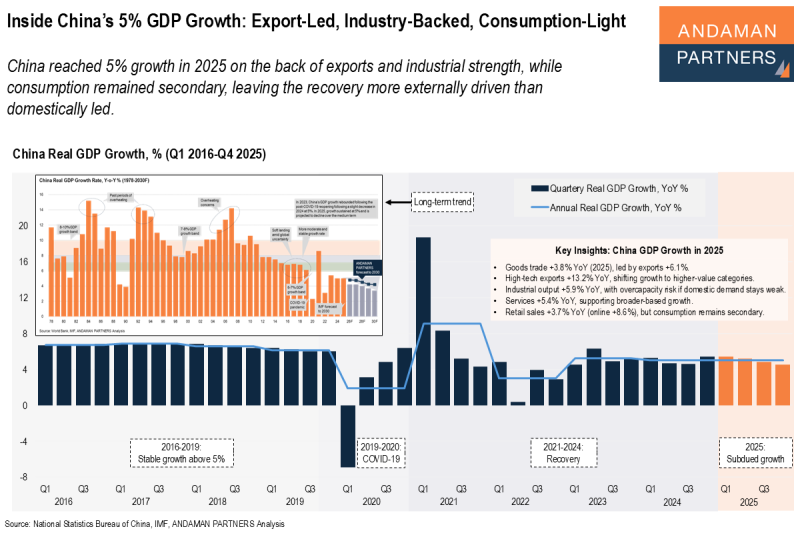

Inside China’s 5% GDP Growth: Export-Led, Industry-Backed, Consumption-Light

China reached 5% growth in 2025 on the back of exports and industrial strength, while consumption remained secondary.