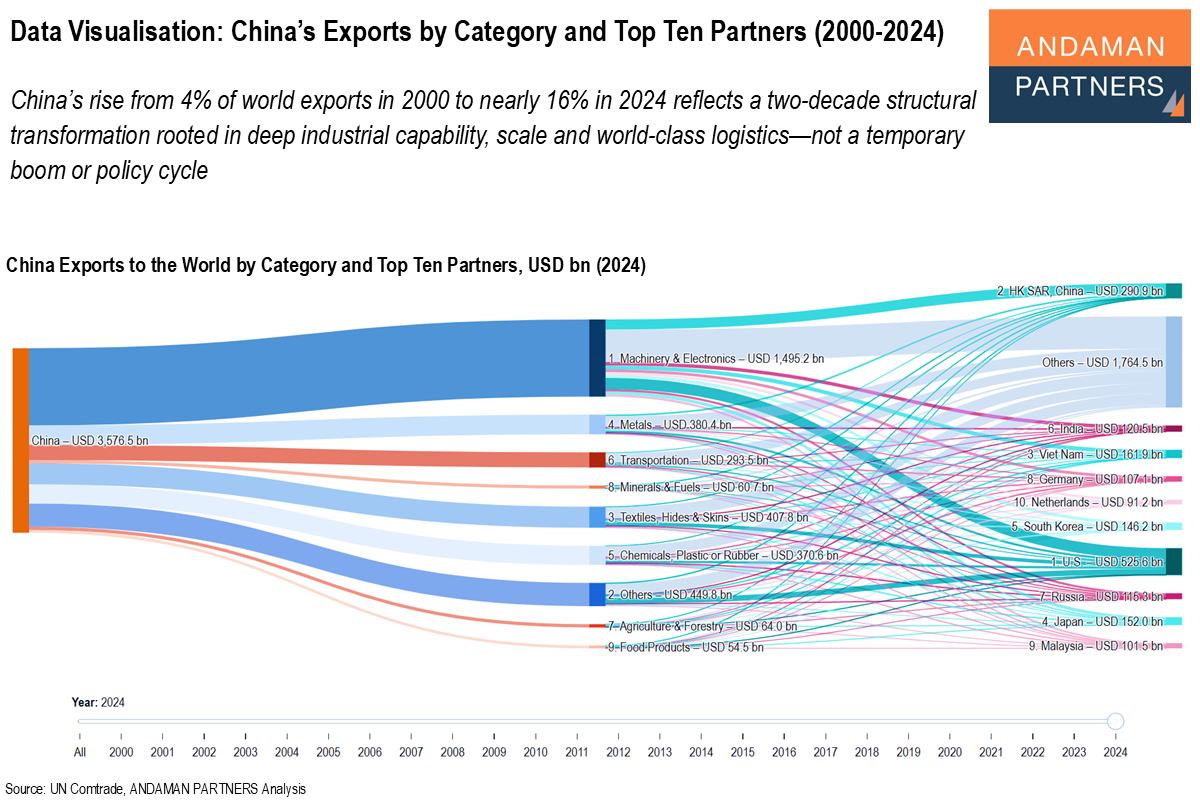

China’s rise from 4% of world exports in 2000 to nearly 16% in 2024 reflects a two-decade structural transformation rooted in deep industrial capability, scale and world-class logistics—not a temporary boom or policy cycle.

China’s export structure has long been anchored by Machinery & Electronics, which rose from roughly 30% of exports in 2001 to a stable 40-45% from the mid-2000s onward. In 2024, the category reached USD 1.50 trillion, accounting for 41.8% of national exports.

Over 2000-2024, Transportation was China’s fastest-growing category (15% CAGR), followed by Machinery & Electronics (13%), Chemicals (13%), Metals (12%) and Food Products (10%). By contrast, traditional labour-intensive sectors such as Textiles, Minerals & Fuels and Agriculture & Forestry posted more moderate growth of 7-8%.

The long-run sectoral shift is stark: Textiles fell from 27.6% of exports in 2000 to 11.4% in 2024, reflecting rising wages and China’s move into higher-value production. Transportation products, such as cars, electric vehicles (EVs) and ships, expanded from 3.7% of exports in 2000 to 8.2% in 2024, driven by automotive upgrading and the global spread of Chinese EVs and machinery.

China’s partner mix also changed profoundly. The U.S. has been China’s largest single-country market since 1999. Hong Kong, still the second-largest destination in 2024 with USD 292 billion (8.6%), functions mainly as a re-export and logistics gateway (around 99% of its merchandise exports are re-exports).

But since 2000, China’s export geography has become more diversified and more regional. As China’s coastal ports, inland logistics corridors and supply-chain linkages expanded, exports to Hong Kong and Japan declined, while flows to Southeast Asia (Vietnam, Malaysia, Thailand), South Asia (India) and newer hubs such as Mexico, the UAE and Russia rose sharply.

By 2024, after the U.S. and Hong Kong, China’s following four largest export markets were all in Asia (Japan, South Korea, Vietnam, India), each accounting for under 5% of total exports. Russia moved up to seventh place, while Germany and the Netherlands represented China’s key European destinations; Malaysia completed the top ten. Markets 11-20 span the Western Hemisphere (Mexico, Brazil), Europe (the U.K.), the Middle East (UAE) and Asia (Indonesia, the Philippines), underscoring China’s increasingly multipolar export footprint.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

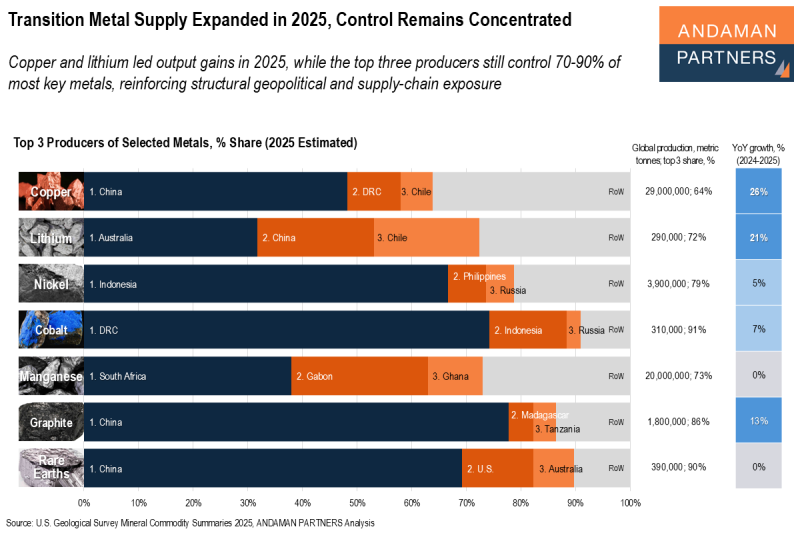

Transition Metal Supply Expanded in 2025, Control Remains Concentrated

Copper and lithium led output gains in 2025, while the top three producers still control 70-90% of most key metals.

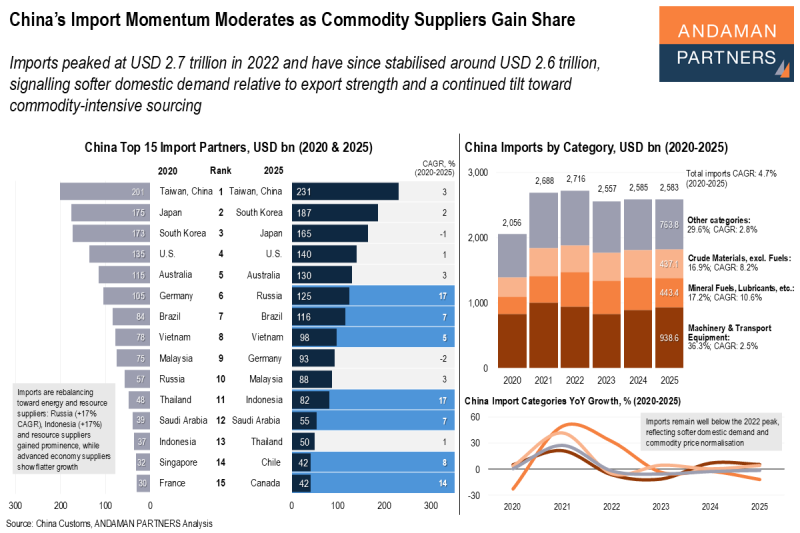

China’s Import Momentum Moderates as Commodity Suppliers Gain Share

Imports have stabilised around USD 2.6 trillion, signalling softer domestic demand and a continued tilt toward commodity-intensive sourcing.

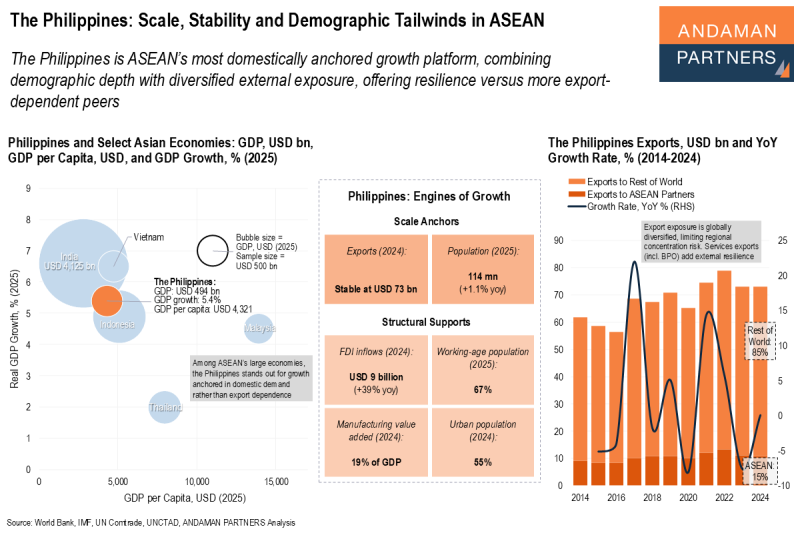

The Philippines: Scale, Stability and Demographic Tailwinds in ASEAN

The Philippines is ASEAN’s most domestically anchored growth platform, combining demographic depth with diversified external exposure.