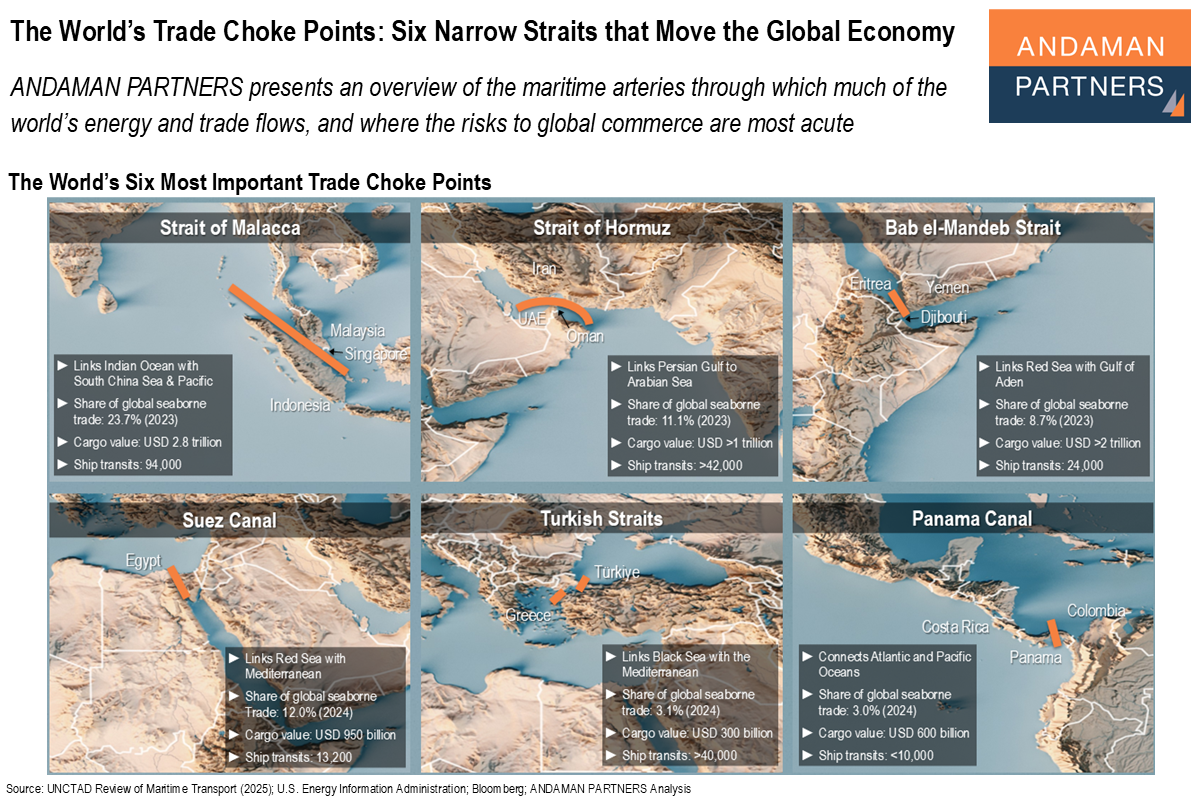

ANDAMAN PARTNERS Maps the Most Important Trade Choke Points

Choke points are the narrow arteries of world trade, slim maritime corridors through which a large share of the world’s oil, gas, grains and manufactured goods must pass.

Often only a few kilometres wide, these sea lanes are vital to global commerce yet dangerously exposed to conflict, congestion and climate risks. Together, they illustrate both the connectivity and fragility of the global trading system.

The uninterrupted operation of the six choke points listed below underpins the global economy. Yet, their exposure to conflict, climate and congestion makes them the most strategic vulnerabilities in world commerce.

Strait of Malacca

Location: 900-km channel between the Malay Peninsula and Sumatra, linking the Indian Ocean with the South China Sea and the Pacific.

Share of Global Seaborne Trade (2023): 23.7%; total cargo value above USD 2.8 trillion.

Significance: The world’s busiest shipping lane and the shortest sea route between the Middle East and East Asia.

Cargo: >23 million barrels per day of crude oil and petroleum products (around 70% of global traffic) flow eastwards; electronics, machinery and manufactured goods flow westward.

Ship Transits (2023): >94,000.

Risks: Piracy, volcanic activity and accidents near Singapore, where the Strait narrows to just two nautical miles.

Strait of Hormuz

Location: 40-km passage between Iran and Oman, connecting the Persian Gulf to the Arabian Sea.

Share of Global Seaborne Trade (2023): 11.1%; cargo value exceeding USD 1 trillion.

Significance: The only maritime outlet for five of the world’s top ten oil producers (Saudi Arabia, Iraq, the UAE, Kuwait and Iran), making it the world’s most critical energy chokepoint.

Cargo: Mostly oil and gas: About 34% of global seaborne oil exports and 30% of liquefied petroleum gas (LPG) exports.

Ship Transits (2024): >42,000.

Risks: Regional conflict, geopolitical tension and military confrontation.

Bab el-Mandeb Strait

Location: 50-km channel between Yemen and the Horn of Africa (Djibouti and Eritrea), connecting the Red Sea with the Gulf of Aden.

Share of Global Seaborne Trade (2024): 8.7%; total cargo value above USD 2 trillion.

Significance: A vital link between the Indian Ocean and the Mediterranean via the Suez Canal; any disruption directly impacts Europe-Asia trade.

Cargo: Crude oil, liquefied natural gas (LNG) and containerised goods, including roughly 12% of global seaborne oil exports and 8% of LNG exports.

Ship Transits (2023): 24,000 (down nearly 50% in 2024 amid Red Sea conflict).

Risks: Armed attacks on shipping and prolonged regional instability.

Suez Canal

Location: 193-km canal through northeastern Egypt, linking the Red Sea and the Mediterranean.

Share of Global Seaborne Trade (2024): 12%; total cargo value about USD 950 billion.

Significance: The shortest route between Asia and Europe, bypassing the Cape of Good Hope. Essential for Asia-Europe container traffic and Middle Eastern energy exports to Europe.

Cargo: Containerised goods, crude oil, refined products, LNG, chemicals and grains.

Ship Transits (2024): 13,200 (down 50% from 2023 as Red Sea attacks diverted shipping).

Risks: Proximity to conflict zones and exposure to security threats in the Red Sea.

Turkish Straits

Location: Two narrow waterways (Bosporus, 30 km; Dardanelles, 68 km) linking the Black Sea with the Mediterranean via the Sea of Marmara.

Share of Global Seaborne Trade (2024): 3.1%; total cargo value of USD 300 billion.

Significance: The only maritime outlet for Ukraine, Georgia, Romania and Bulgaria; a crucial route for Black Sea energy, grain and steel exports.

Cargo: Crude oil, oil products, natural gas, grain, fertilisers and containerised goods.

Ship Transits (2024): >40,000.

Risks: High collision risk in the Bosporus, the world’s narrowest international strait (just 700 metres wide at its northern entrance).

Panama Canal

Location: 80-km canal cutting across the Isthmus of Panama, connecting the Atlantic and Pacific Oceans.

Share of Global Seaborne Trade (2024): 3.0%; total cargo value of USD 600 billion.

Significance: A critical artery for trade between the U.S. Gulf and East Coast, Latin America and Asia, serving both container and bulk carriers.

Cargo: Automobiles, grains, chemicals, crude oil, gas and petroleum products. Northbound flows are mainly South American agricultural exports; southbound flows are machinery and vehicles from the U.S. and Europe.

Ship Transits (2024): <10,000 (down 42% from 2023 due to drought).

Risks: Dependence on rainfall and freshwater levels in Gatun Lake.

Sources: UNCTAD Review of Maritime Transport (2025); U.S. Energy Information Administration; Bloomberg; ANDAMAN PARTNERS Analysis.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

Media

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

AAMEG Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to sponsor and support the AAMEG pre-Mining Indaba Cocktails & Canapes event.

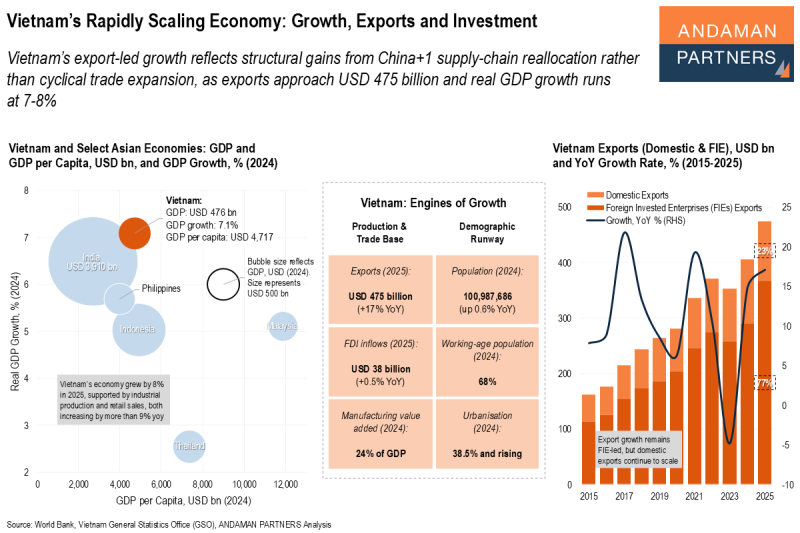

Vietnam’s Rapidly Scaling Economy: Growth, Exports and Investment

Vietnam’s export-led growth reflects structural gains from China+1 supply-chain reallocation rather than cyclical trade expansion.

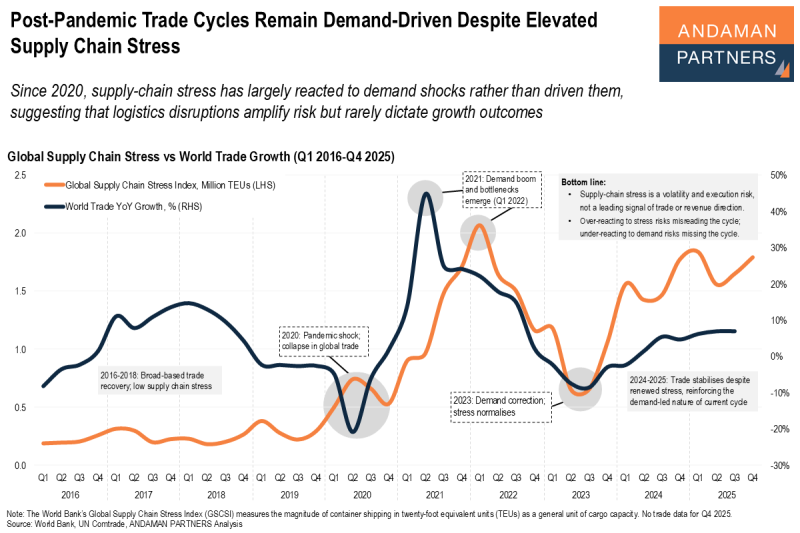

Post-Pandemic Trade Cycles Remain Demand-Driven Despite Elevated Supply Chain Stress

Supply-chain stress has largely reacted to demand shocks rather than driven them, suggesting that logistics disruptions rarely dictate growth.

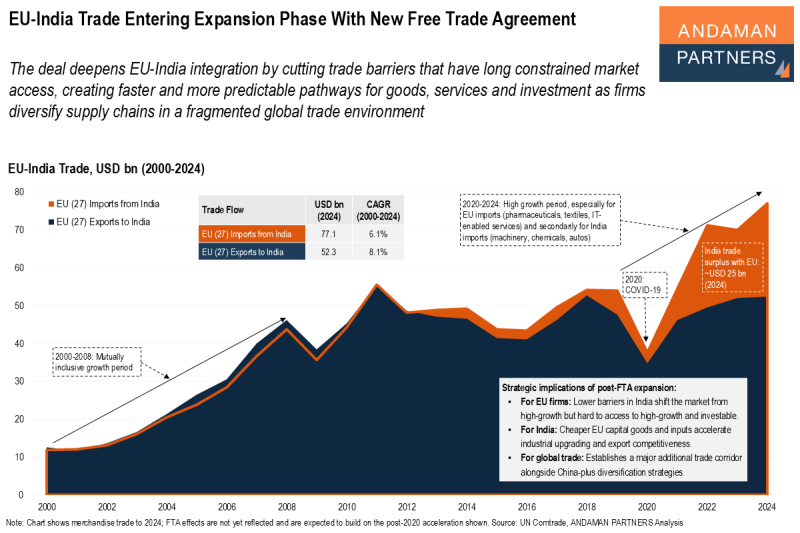

EU-India Trade Entering Expansion Phase With New Free Trade Agreement

The deal deepens EU-India integration by cutting trade barriers that have long constrained market access.