What China buys and where it buys it have reshaped supply chains, commodity flows and trade balances worldwide.

Highlights:

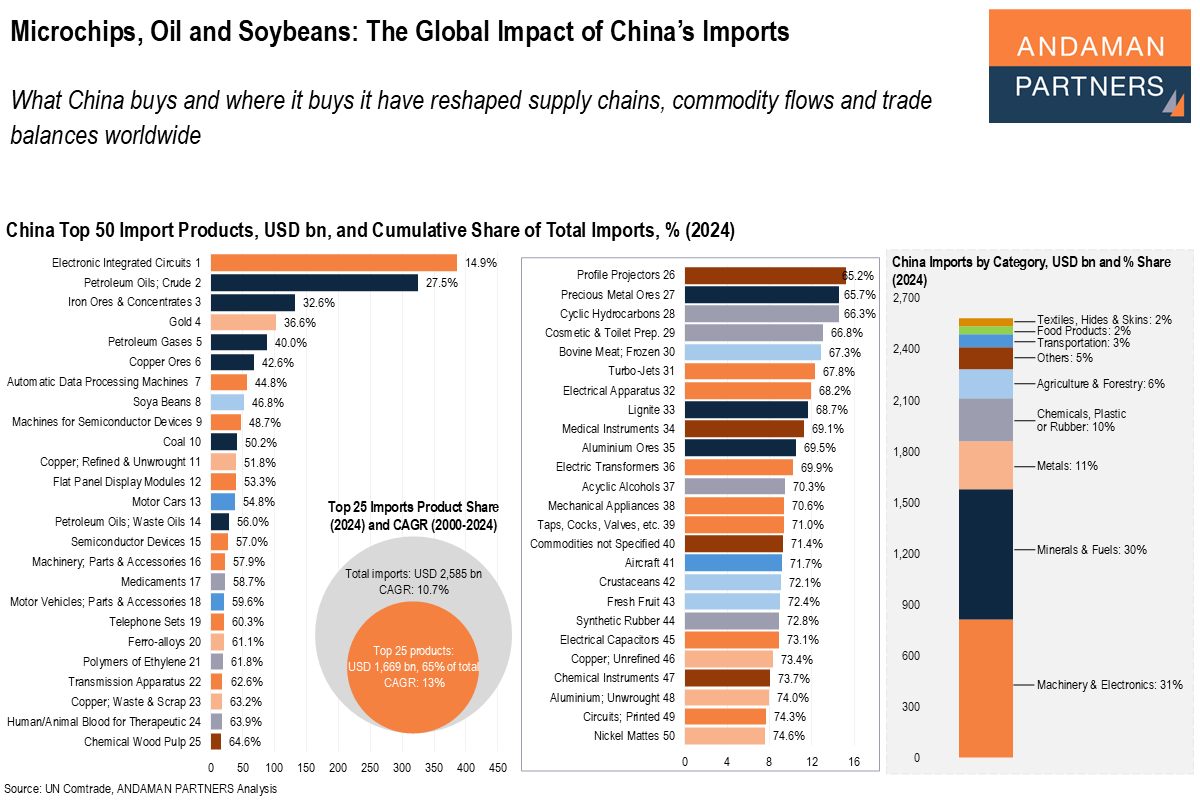

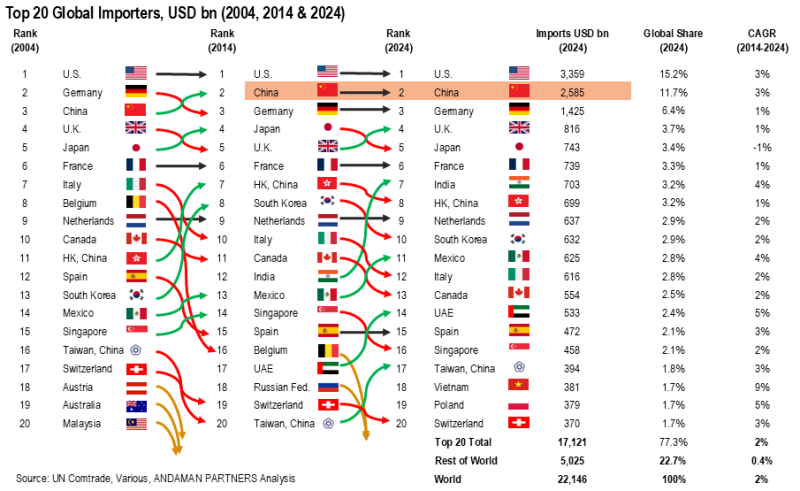

- China is the world’s second-largest importer, accounting for 11.7% of world imports.

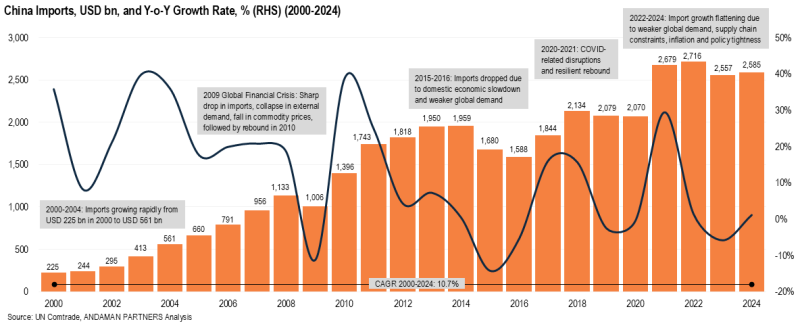

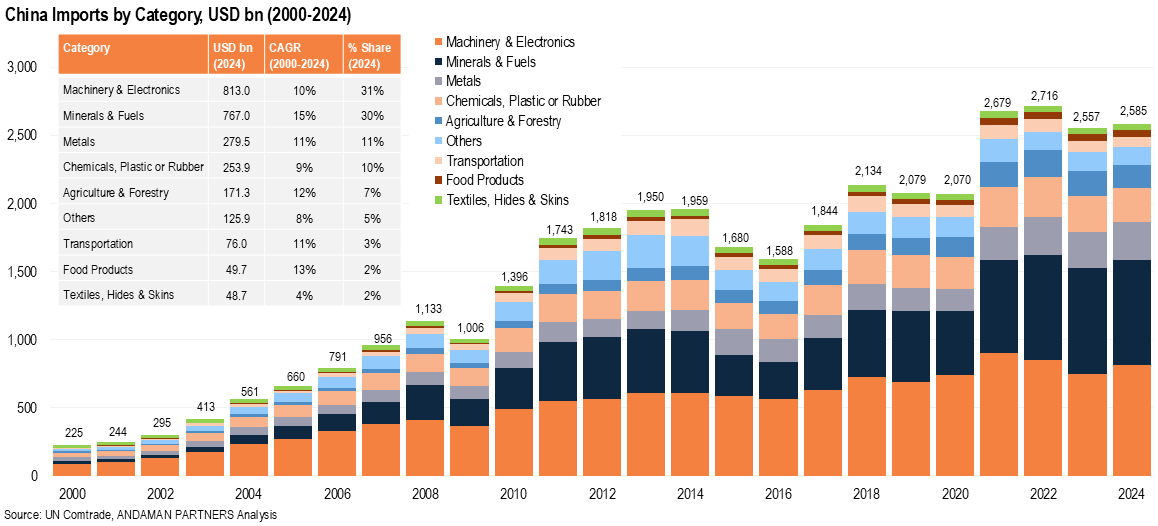

- From 2000 to 2024, China’s imports had a CAGR of 10.7%, with an annual peak of USD 2.7 trillion in 2022.

- Two products, electronic integrated circuits and crude petroleum oil, accounted for more than a quarter of China’s imports in 2024.

- Three of China’s top 15 imports are semiconductor-related, reflecting the country’s central role in global electronics assembly and strategic reliance on foreign chip technologies.

- In 2000-2024, Minerals & Fuels and Food Products were the fastest-growing import categories, while Textiles and Chemicals were the slowest-growing.

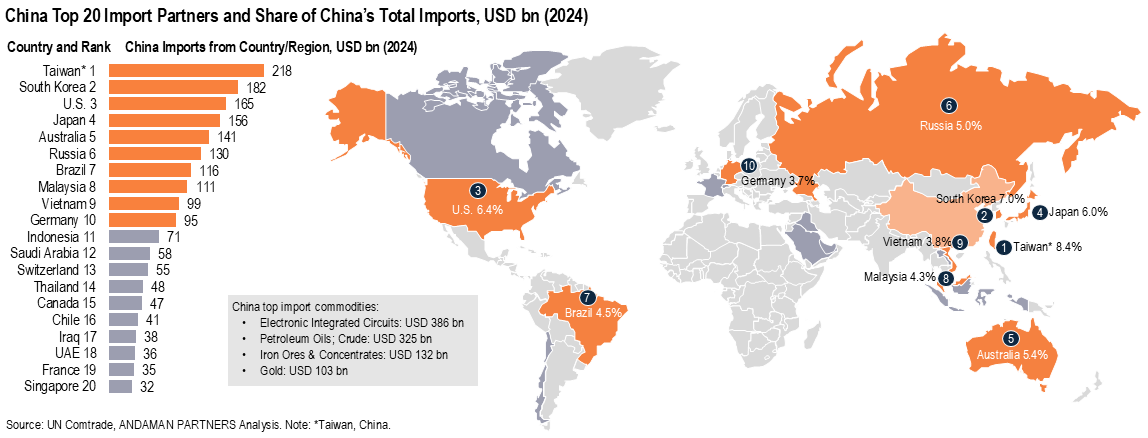

- China’s largest single import partner is Taiwan (China) with a share of 8.4% of total imports in 2024, followed by South Korea (7%) and the U.S. (6.4%).

China is the world’s second-largest importer, behind the U.S., with imports totalling USD 2.6 trillion in 2024, accounting for 11.7% of global imports. China is simultaneously the world’s leading exporter and one of the largest importers, underscoring its role as both a leading producer and consumer in global value chains.

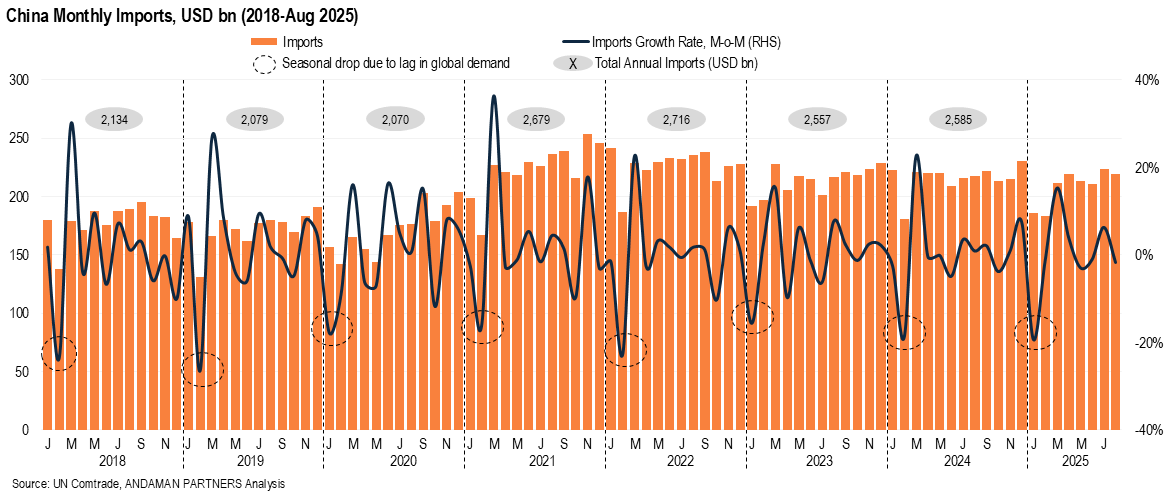

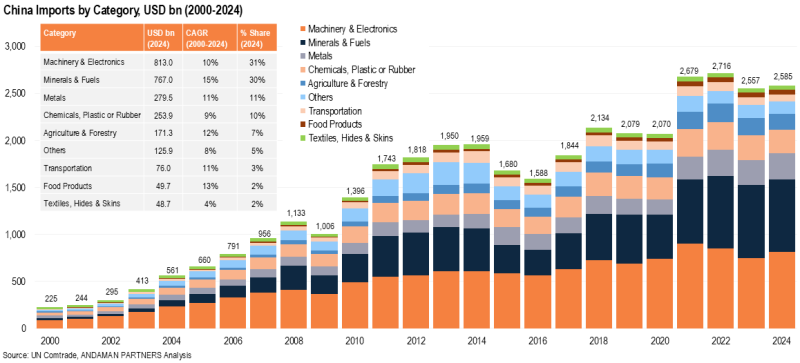

From 2000 to 2024, China’s imports had a CAGR of 10.7%, with peak year-on-year growth rates of 36% in 2004, 25% in 2011 and 30% in 2021. From 2014 to 2024, the CAGR was more muted at 3%. After annual imports surpassed USD 2 trillion in 2018, China’s yearly import growth rates were flat in 2019 and 2020, before growing by 30% in 2021 and surpassing USD 2.6 trillion amid the post-COVID recovery in global demand. Imports reached a record high of USD 2.7 trillion in 2022, and hovered around USD 2.5 trillion in 2023-2024, with a 6% annual decrease in 2023 and a 1.1% increase in 2024.

World merchandise exports in 2024 amounted to USD 22.1 trillion, of which the U.S. accounted for USD 3.3 trillion, a share of 15.2%. China overtook Germany in 2009 to become the world’s second-largest importer, and has held that position ever since, with its share of world imports almost doubling from 6% in 2007 to 11.7% in 2024. In 2024, Germany was the third-largest importer, with imports totalling USD 1.4 trillion, accounting for 6.4%.

In 2024, Hong Kong (China) was the 8th-largest importer at USD 699 billion (a share of 3.2%), and Taiwan (China) was the 17th-largest importer at USD 394 billion (1.8%).

Developing and emerging economies that featured in the top 20 importers included India (USD 703 billion) in seventh place, Mexico (USD 625 billion) in 11th, the UAE (USD 533 billion) in 14th, Vietnam (USD 381 billion) in 18th and Poland (USD 379 billion) in 19th. In 2024, the top 20 importers accounted for 77% of world imports.

China’s monthly imports reached a record high (USD 254 billion) in November 2021. In the first eight months of 2025, however, China’s monthly import totals have been mainly in the USD 210-220 billion range. The aggregate total for January to August 2025 is slightly down year-on-year, down 2.3% compared to the same period in 2024.

What China Buys

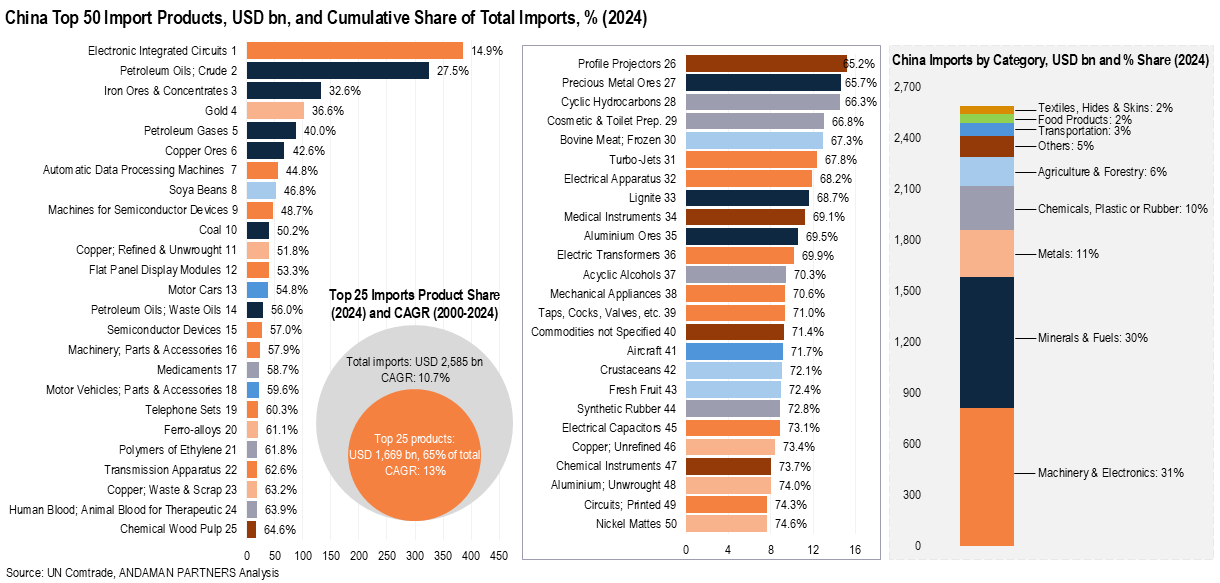

China’s import mix in 2024 was dominated by two categories: Machinery & Electronics (USD 813 billion, a share of 31%) and Minerals & Fuels (USD 767 billion, share of 30%). Just two products, electronic integrated circuits and crude petroleum oil, accounted for more than a quarter (27.5%) of China’s total imports in 2024.

Three of China’s top 15 imports are semiconductor-related, spanning different stages and components of the microchip supply chain and reflecting both China’s central role in global electronics assembly and its strategic reliance on foreign chip technologies.

In 2024, China imported integrated circuits (finished semiconductor devices such as processors and memory chips used in smartphones, electric vehicles and other products) worth USD 386 billion, the largest single import product, with large volumes imported from Taiwan (China), South Korea, Japan and Malaysia.

Machines for manufacturing semiconductor equipment were the 9th-largest import product at USD 47 billion, with the leading suppliers being the Netherlands, Japan, the U.S. and South Korea. Discrete semiconductor devices (such as diodes, transistors, and sensors) were the 15th-largest import product, valued at USD 27 billion.

Other Machinery & Electronics products among the top 20 import products were data processing machines (USD 57 billion), flat panel display modules (USD 40 billion), machinery parts & accessories (USD 23 billion) and mobile phones (USD 20 billion).

Apart from integrated circuits, China’s two largest import products were in the Minerals & Fuels category: crude petroleum oils (USD 325 billion) and iron ores & concentrates (USD 132 billion). Other Minerals & Fuels products among the top imports were petroleum gases (USD 88 billion), copper ores (USD 67 billion), coal (USD 40 billion) and waste petroleum oils (USD 29 billion).

Metals accounted for 11% of China’s imports in 2024, including gold (USD 103 billion) and refined copper (USD 40 billion). Chemicals, Plastic or Rubber accounted for 10%, with the largest product being medicaments (USD 23 billion). Agriculture & Forestry accounted for 6%, including soybeans (USD 53 billion). Transportation accounted for 3%, including motor cars of USD 38 billion. Food Products and Textiles accounted for 2% each.

From 2000 to 2024, Minerals & Fuels was the fastest-growing import category with a CAGR of 15%, followed by Food Products (13%), Agriculture & Forestry (12%), Transportation (11%), Metals (11%) and Machinery & Electronics (10%). The categories with the slowest growth over this period were Textiles (4%) and Chemicals (9%).

The differing growth trajectories of textiles and chemicals, compared with those of fuels and food imports, reflect structural shifts in China’s production model, consumption patterns and strategic resource dependence. China is the world’s largest textile and garment producer, and textile imports are limited to niche high-end fabrics or specialty inputs. China invested massively in domestic petrochemical and chemical industries from the 2000s onward, and is now one of the world’s largest producers of base chemicals, plastics and fertilisers.

Imports of fuels and food products, however, went in the opposite direction, as industrialisation, resource constraints and dietary shifts drove a structural dependence on foreign supply. China went from being a net oil exporter in the 1990s to one of the world’s largest oil importers. Urbanisation and rising incomes triggered a shift to protein- and resource-intensive diets of meat, dairy, soybeans and wine. China is now the world’s largest importer of soybeans and meat, and one of the largest importers of dairy and grains.

Import Regions

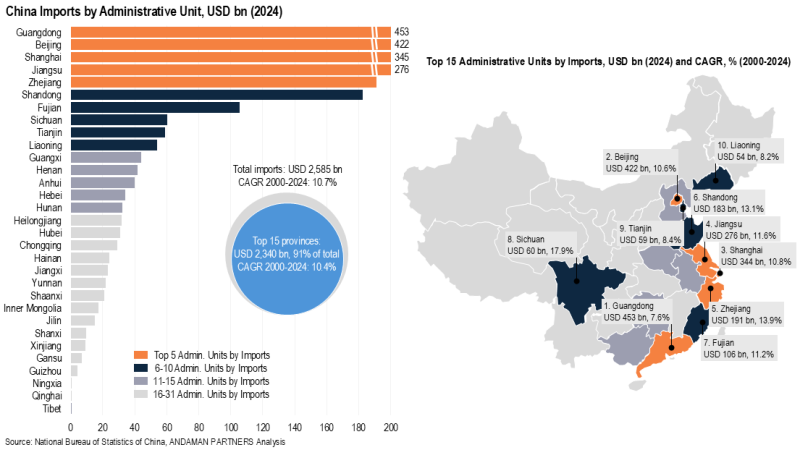

Three coastal provinces, along with the municipalities of Shanghai and Beijing, accounted for 65% of China’s imports in 2024.

Guangdong accounted for USD 453 billion, a share of 17.5%, of total imports, followed by Beijing (16.3%), Shanghai (13.3%), Jiangsu (10.7%) and Zhejiang (7.4%). Guangdong was also China’s largest exporter in 2024, and two other coastal provinces (Zhejiang and Jiangsu) and the municipality of Shanghai were also among the five largest exporters.

Rounding out the top ten largest importers were the coastal provinces of Shandong and Fujian, the western province of Sichuan, the municipality of Tianjin and the northern coastal province of Liaoning. The administrative units ranked eleventh to fifteenth (Guangxi, Henan, Anhui, Hebei and Hunan) are in the central regions of the country. The top fifteen administrative units accounted for 91% of China’s total imports.

The ten administrative units whose imports had the fastest CAGRs from 2000-2024 were all located beyond the coastal belt in the central regions, led by Guangxi (CAGR of 20.1%), Jiangxi (18.2%), Henan (18.0%), Sichuan (17.9%) and Hainan (17.7%).

Guangdong’s imports over this period had one of the lowest CAGRs (7.6%), while the coastal provinces generally had CAGRs of 10-14%.

Where China Buys

China’s largest single import partner is Taiwan (China), which accounted for USD 218 billion, a share of 8.4%, of China’s total imports in 2024, followed by South Korea (7%) and the U.S. (6.4%). Four other Asia-Pacific economies (Japan, Australia, Malaysia and Vietnam) featured among China’s ten largest import partners, along with Russia, Brazil and Germany.

China’s import partners ranked 11-20 are spread around Asia (Indonesia, Thailand, Singapore), the Middle East (Saudi Arabia, the UAE, Iraq), Europe (Switzerland, France) and the Americas (Canada, Chile).

China imports Machinery & Electronics, especially integrated circuits and semiconductor equipment, mainly from Taiwan (China), South Korea and Japan. Minerals & Fuels, especially crude oil and iron ore, are primarily imported from Australia, Russia, Brazil, Malaysia and Saudi Arabia.

Metals, notably gold, copper and ferro-alloys, are imported mainly from Switzerland, Indonesia and Canada. The leading suppliers of Chemicals, Plastics or Rubber are Japan, South Korea and the U.S.

Brazil and the U.S. are the largest suppliers of Agriculture & Forestry products, especially soybeans. Germany, Japan and the U.S. are the leading suppliers of Transportation products, especially motor vehicles and parts.

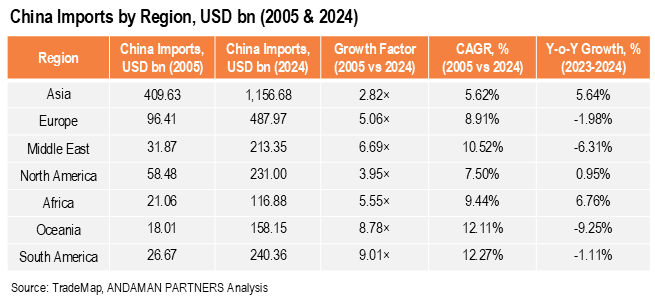

Comparing China’s regional imports from 2005 to 2024 shows that Oceania and South America had the highest growth rates over this period. Imports from South America expanded by a factor of 9, and imports from Oceania by almost 9; both regions posted CAGRs in excess of 12%.

Imports from the Middle East also proliferated, with a growth factor of 6.7 and a 10.5% CAGR. Imports from Africa grew 5.5 times with a CAGR of 9.4%. Imports from Europe and North America both had growth factors of around 4-5 times and CAGRs of 7-9%, while imports from Asia expanded the slowest, with a growth factor of 2.8 times and a CAGR of 5.6%.

Imports from the Middle East also proliferated, with a growth factor of 6.7 and a 10.5% CAGR. Imports from Africa grew 5.5 times with a CAGR of 9.4%. Imports from Europe and North America both had growth factors of around 4-5 times and CAGRs of 7-9%, while imports from Asia expanded the slowest, with a growth factor of 2.8 times and a CAGR of 5.6%.

Conclusions: The Global Impact of China's Exports

China’s rise as the world’s second-largest importer has reshaped the map of global commerce. What China buys—and from whom—has reconfigured supply chains, redirected commodity flows, and shifted trade balances in every region of the world:

- China Is a Gravitational Centre of Global Demand:

China’s nearly 12% share of world merchandise imports anchors trade flows for critical goods from microchips to crude oil, making Chinese demand a primary driver of global trade volumes. - China’s Semiconductor Demand Has Rewired High-Tech Supply Chains:

China’s heavy reliance on imported chips and equipment has deepened interdependence with advanced manufacturing economies in East Asia, the U.S. and Europe, shaping the global electronics trade corridor. - Resource Dependency Has Created Powerful Trade Linkages:

Massive imports of oil, iron ore, copper and food products have tied China to resource-rich regions, particularly in Oceania, the Middle East and Latin America, making it a dominant buyer in global commodity markets. - Structural Shifts Inside China Mirror Changing Global Trade Flows:

As China built domestic capacity in textiles and chemicals, import growth in these sectors slowed, while surging demand for energy, minerals and food intensified upstream extraction and agricultural trade worldwide. - Global Trade Balances Hinge on Chinese Demand:

For most economies, China is now a top buyer of their exports; its cyclical swings in import demand ripple through global shipping rates, commodity prices and partner trade balances.

China’s import profile is not just a reflection of its economy; it is a structuring force in the global trading system, shaping supply chains, pricing power and strategic dependencies far beyond its borders.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

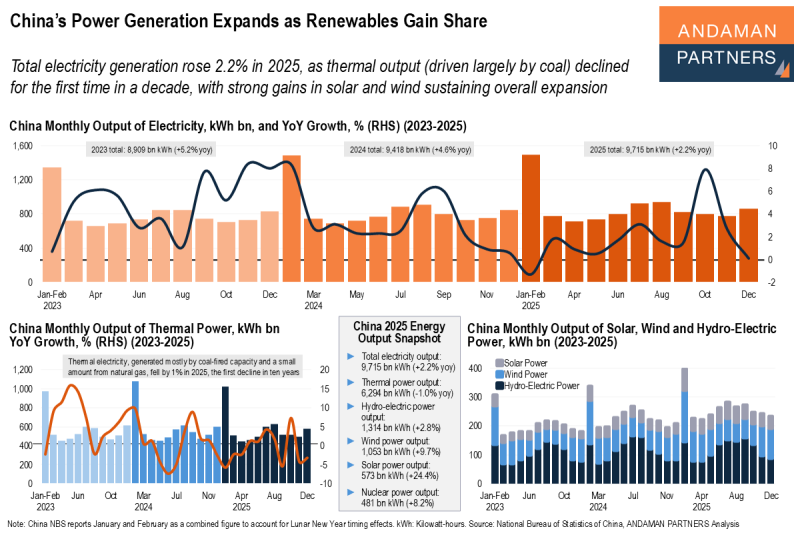

China’s Power Generation Expands as Renewables Gain Share

Electricity generation rose 2.2% in 2025, as thermal output declined for the first time in a decade, with strong gains in solar and wind.

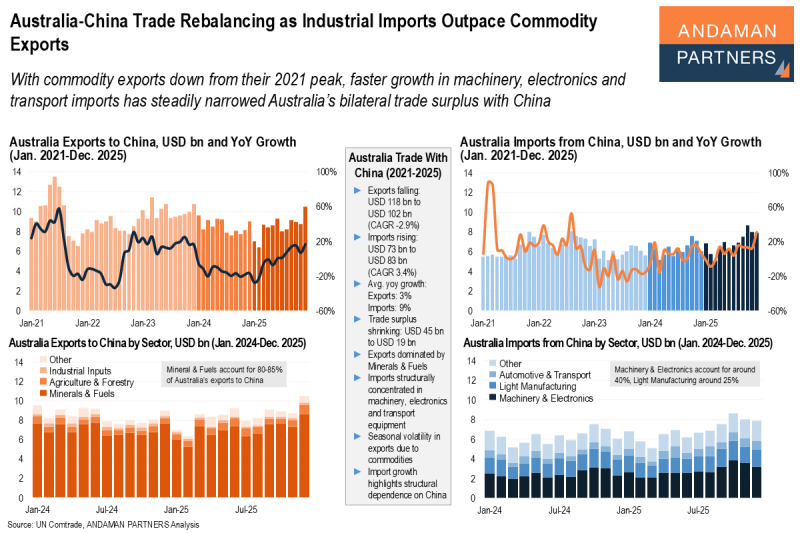

Australia-China Trade Rebalancing as Industrial Imports Outpace Commodity Exports

With commodity exports down from 2021, faster growth in machinery, electronics and transport imports has narrowed Australia’s trade surplus.

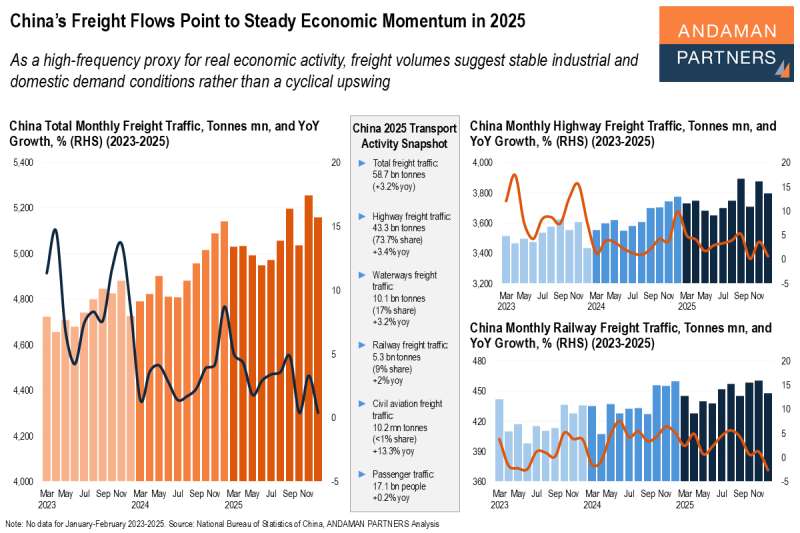

China’s Freight Flows Point to Steady Economic Momentum in 2025

Freight volumes suggest stable conditions in industrial and domestic demand rather than a cyclical upswing.