China is the world’s largest consumer of energy and runs large trade deficits for primary fuels, especially crude oil and petroleum gases. Similar to its reliance on imported metals, China remains a significant opportunity for global fuel exporters.

In 2024, China consumed 163.8 exajoules (EJ) of energy, more than the U.S., European Union and Japan combined (162.8 EJ). China was the second-largest consumer of oil, the third-largest consumer of natural gas and by far the largest consumer of coal, according to the Energy Institute’s Statistical Review of World Energy 2024.

China’s vast manufacturing and industrial base drives unparalleled demand for energy and industrial inputs, making the country structurally dependent on imported strategic minerals and primary fuels.

China is the world’s largest importer of both crude oil and gas, with imports accounting for 74% of the country’s total oil supply and 42% of its gas supply in 2024. Imports of primary fuels surged in 2021 as global demand rebounded following the COVID-19 pandemic. Despite a rapid expansion of renewables, fossil fuels remain essential for powering China’s heavy industry, transportation and urban consumption.

Annual fuel imports exceeded USD 460 billion from 2022 to 2024, while exports remained minimal, producing a yearly trade deficit of more than USD 450 billion. This deficit highlights the extent of China’s reliance on external energy sources.

Between 2014 and 2024, China’s fuel import bill nearly doubled, driven mainly by crude oil and petroleum gases. Crude oil imports reached USD 325 billion in 2024, rising at a 4% CAGR since 2014, while petroleum gases climbed to USD 88 billion (+11%), reflecting the structural transition from coal and oil toward cleaner fuels. Coal imports, though smaller at USD 40 billion (+5%), also rose as China rebuilt reserves and stabilised power supplies after 2021.

Supplying China’s Vast Fuel Demand

Coal remains a central component of China’s energy security. Although the country is largely self-sufficient, coal imports surged to record highs in 2023, allowing exporters such as Indonesia, Mongolia, Russia and South Africa to capture greater market share.

For oil exporters, notably Saudi Arabia, Russia, Iraq, the UAE, Brazil, Angola and Malaysia, as well as gas suppliers such as Qatar, Australia, Russia and the U.S., China remains the largest single customer and a strategic long-term partner.

Even with rapid growth in renewables, China’s import dependence remains above 70% for oil and 45% for gas, ensuring sustained import demand. Commercial opportunities in China are found in long-term supply contracts, infrastructure co-investment and joint ventures in liquefaction, port and storage facilities. Future opportunities will include low-carbon LNG, cleaner coal logistics and hydrogen feedstocks, all of which align with China’s decarbonisation agenda.

For global fuel suppliers, China will continue to be a bastion of predictable, large-scale demand, anchoring global energy trade for the foreseeable future.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

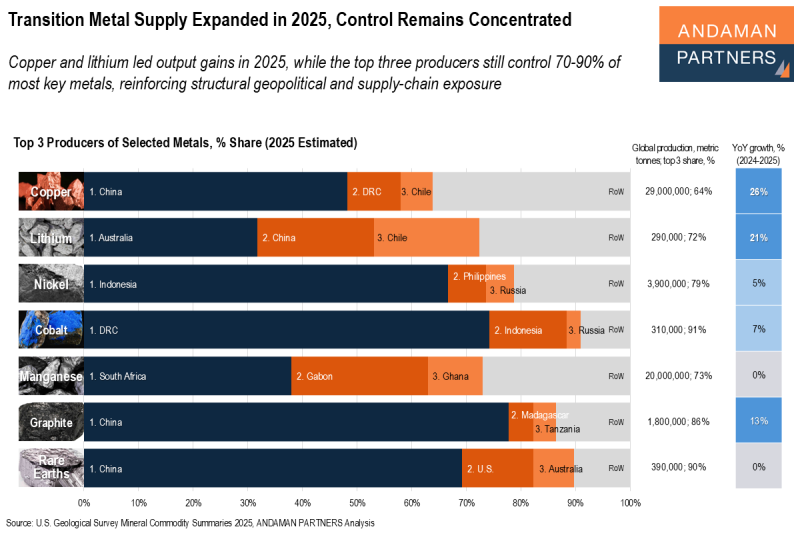

Transition Metal Supply Expanded in 2025, Control Remains Concentrated

Copper and lithium led output gains in 2025, while the top three producers still control 70-90% of most key metals.

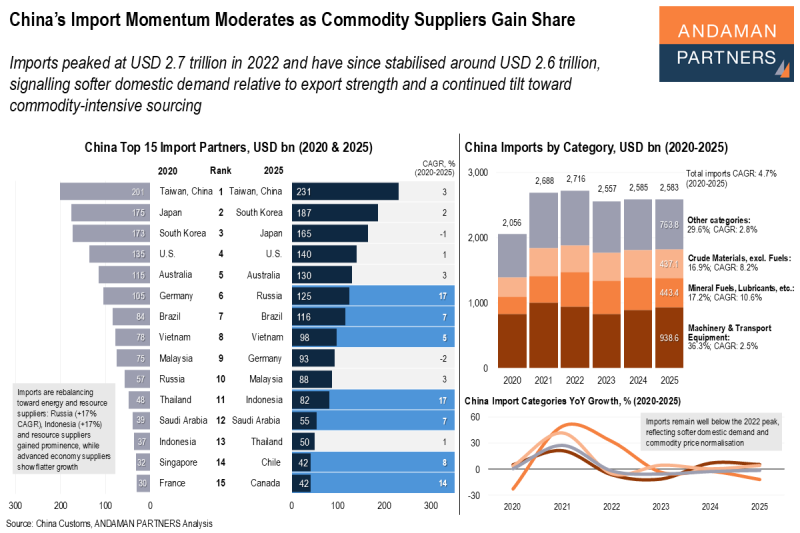

China’s Import Momentum Moderates as Commodity Suppliers Gain Share

Imports have stabilised around USD 2.6 trillion, signalling softer domestic demand and a continued tilt toward commodity-intensive sourcing.

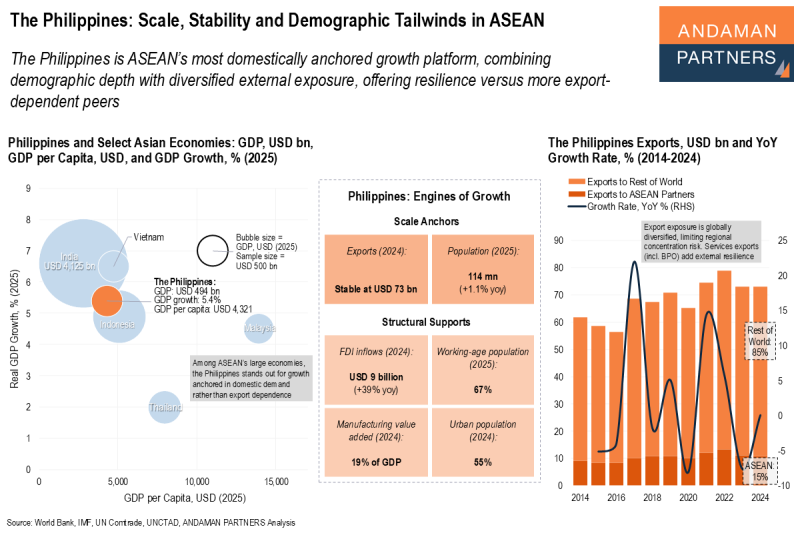

The Philippines: Scale, Stability and Demographic Tailwinds in ASEAN

The Philippines is ASEAN’s most domestically anchored growth platform, combining demographic depth with diversified external exposure.