What China sells, where it sells it and how the country’s export dominance has reshaped global trade.

Highlights:

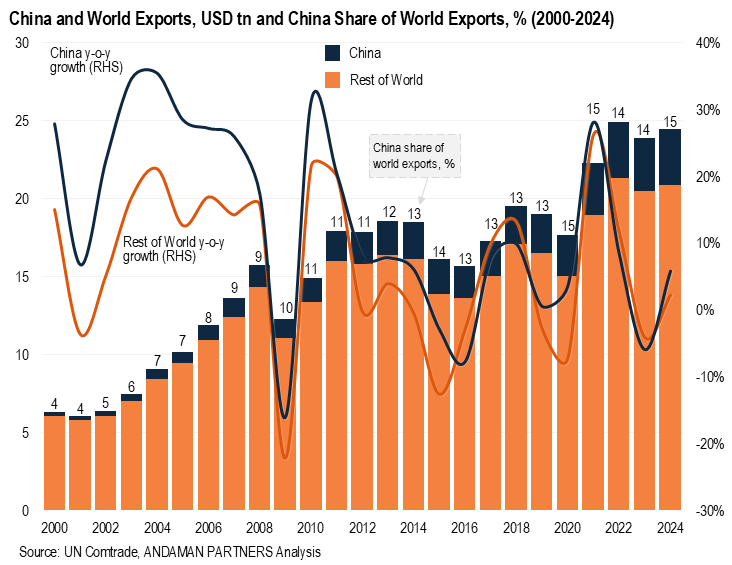

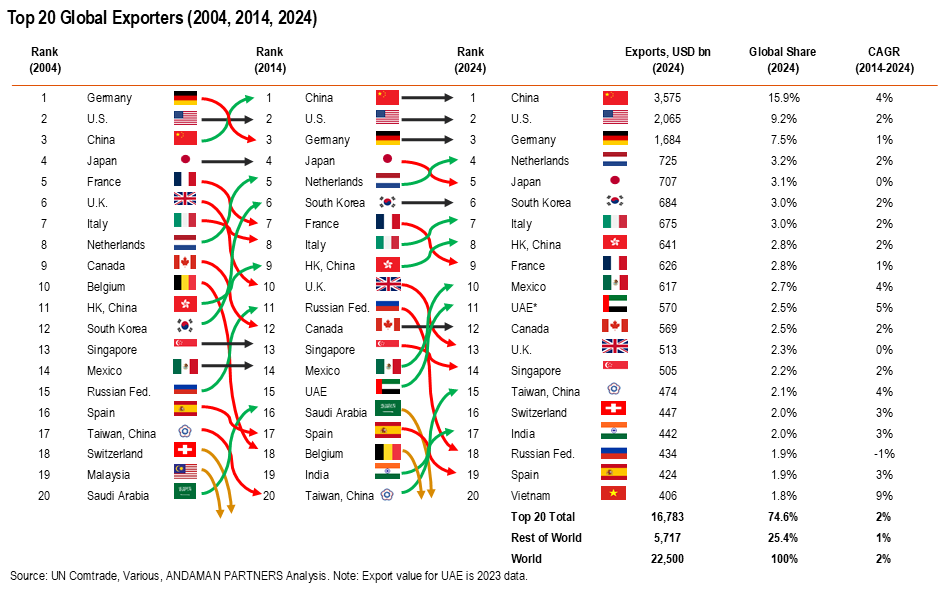

- In 2009, China became the world’s leading exporter. In 2024, China was responsible for 15.9% of world exports, accounting for one in every seven export dollars.

- From 4% of world exports in 2001 to 16% in 2024, China’s rise was based on a two-decade structural evolution based on enduring capabilities, ecosystems and institutions.

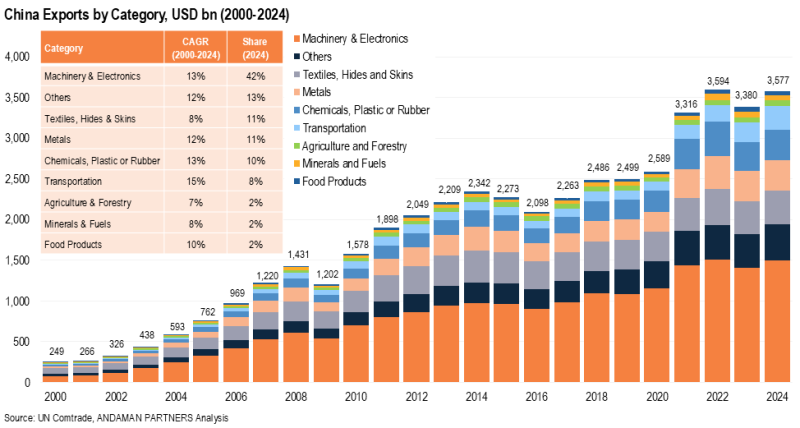

- China’s exports are dominated by Machinery & Electronics. From a share of 30% in 2001, this category has remained at 40-45% since 2004.

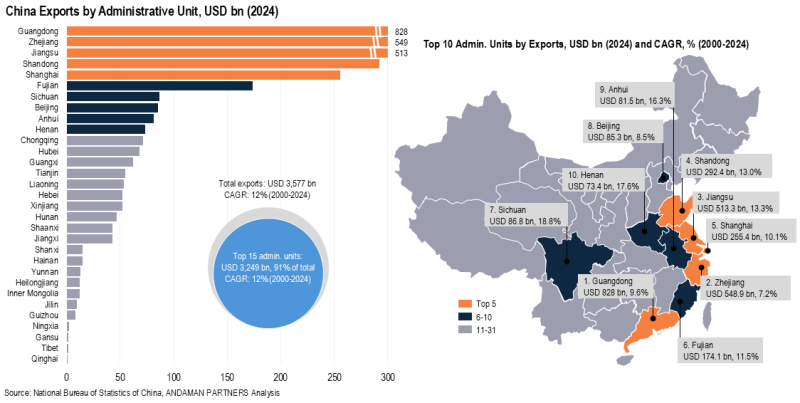

- Five coastal provinces and the municipality of Shanghai account for almost three-quarters of China’s exports.

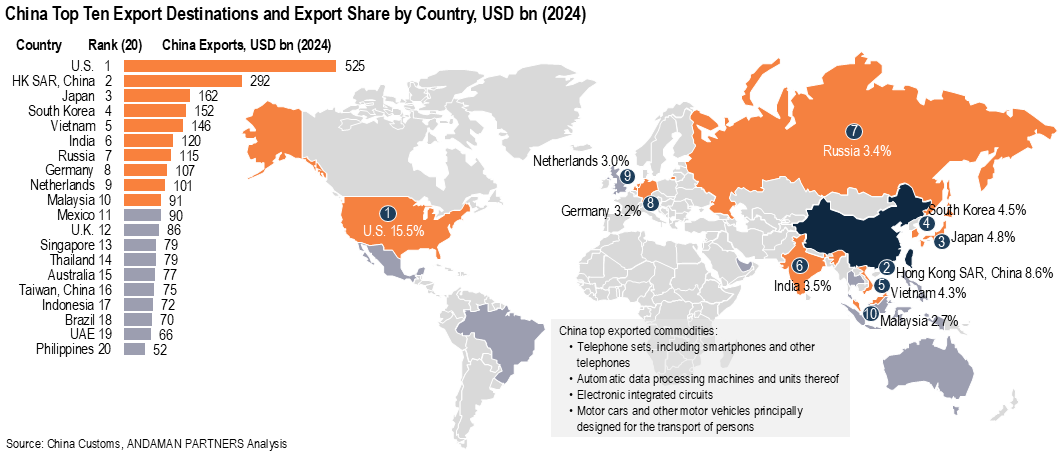

- Almost 40% of China’s exports go to five markets (the U.S., Hong Kong, Japan, South Korea and Vietnam).

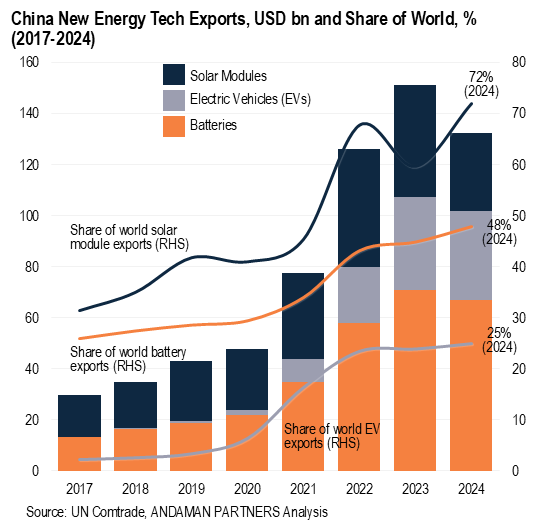

- In 2024, China accounted for 25% of the world’s electric vehicle exports, 48% of battery exports and 72% of solar module exports.

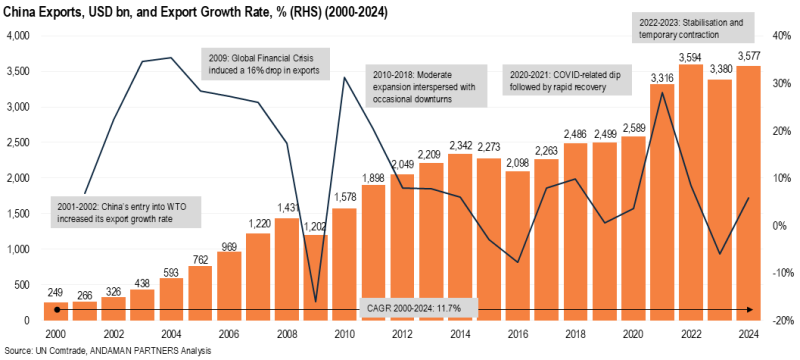

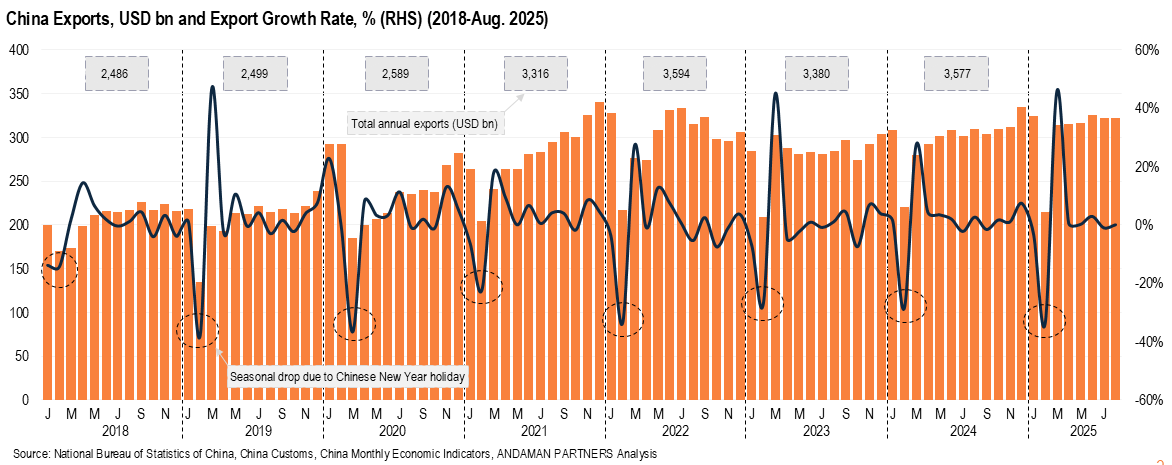

In 2024, China’s exports amounted to USD 3.57 trillion (an increase of 5.8% year-on-year), accounting for 15.9% of world exports of USD 24.43 trillion. This means that China accounted for almost one in every seven export dollars. From 2000 (USD 249 billion) to 2024, China’s exports expanded at a CAGR of 11.7%.

The start of China’s remarkable export growth trajectory was in 2001 when the country joined the World Trade Organisation (WTO). At the time, China accounted for 4.3% of world exports. In the years since, with only a few exceptions (e.g., 2016-2018 and 2022-2023), China’s export growth consistently outperformed the global average. From 2001 to 2024, world export growth swung between -22% and 26%, while China’s growth ranged from -16% to 35%, with surges above 30% in the early 2000s.

From 2002 until 2011 (apart from the Global Financial Crisis years of 2008-2009), China’s annual export growth remained above 20%. From 2012 to 2024, growth was more muted, remaining below 10%, except for the 28% recorded in the pandemic recovery year of 2021.

In 2009, at the height of China’s export growth spurt, the country became the world’s leading exporter, surpassing the U.S. and Germany, and China has remained firmly at the top in the years since. In 2024, China’s exports were only slightly smaller than those of the U.S. (USD 2.07 trillion) and Germany (USD 1.69 trillion) combined.

In the COVID-19-affected year of 2020, China’s exports still grew, albeit at an annual growth rate of 4%, compared to a drop of -4% for world exports. In the pandemic recovery year of 2021, however, China’s exports came roaring back, reaching a historic high of USD 3.32 trillion, followed by a further increase to USD 3.59 trillion in 2022. In 2023 and 2024, China’s exports were slightly below the peak of 2022.

From January to August 2025, China’s exports have outperformed recent years, with monthly exports exceeding USD 310 billion from March to August (in 2024, this level was only exceeded in November and December). For the first eight months of 2025, China’s total exports were 3% higher than the same period in the peak year of 2022, meaning that 2025 might deliver a new record high for China’s exports.

From 4% of world exports in 2001 to almost 16% in 2024, China’s rise as an export power was not based on a short-term boom or temporary policy blip, but rather a two-decade structural evolution based on enduring capabilities, ecosystems and institutions.

More Than Just Machinery & Electronics: What China Sells

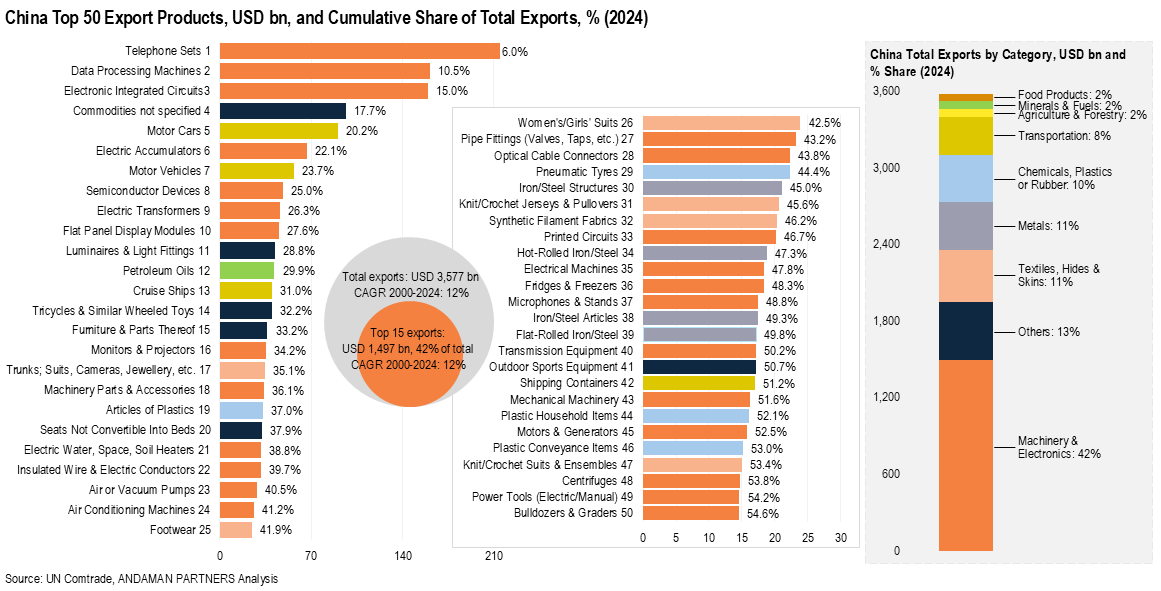

China’s exports have consistently been dominated by Machinery & Electronics. From a share of about 30% in 2001, this category has remained at 40-45% since 2004, and accounted for USD 1.50 trillion, or 41.8% of total exports in 2024.

China’s three largest export products in 2024 were all in the Machinery & Electronics category: Mobile phones (USD 215 billion), data processing machines, i.e., computers (USD 161 billion) and integrated circuits (USD 160 billion). Other Machinery & Electronics products in the top ten were electric accumulators, i.e., electric batteries (USD 67 billion), semiconductors (USD 48 billion), transformers (USD 46 billion) and flat panel display modules (USD 45 billion).

Other notable categories in China’s 2024 exports were Textiles (11%), Metals (11%), Chemicals (10%) and Transportation (8%). From 2000 to 2024, the Metals and Chemicals categories increased by small margins in China’s overall export mix. Textiles and Transportation, however, went in opposite directions as the country’s exports evolved.

From 2000 to 2024, Transportation was China’s fastest-growing export category at 15%, compared to Machinery & Electronics (13%), Chemicals (13%), Metals (12%) and Food Products (10%). Textiles, Minerals & Fuels and Agriculture & Forestry were the slowest-growing categories at 7-8% each.

In 2000, Textiles accounted for 27.6% of China’s total exports. By 2010, this share was down to 16.9%, and in 2024, it dropped to 11.4%. Toys is another low-margin category that has fallen by the wayside in China’s exports, although Tricycles & Wheeled Toys was the 14th-largest export product in 2024 at USD 40 billion.

The Transportation category, by contrast, increased from a share of 3.7% in 2000 to 5.6% in 2010 and 8.2% in 2024. In 2024, China’s fifth-, seventh- and thirteenth-largest exports were Transportation products: Motor Cars (USD 90 billion), Motor Vehicles (USD 57 billion) and Cruise Ships (USD 40 billion).

The composition of China’s exports in 2024 reveals that the country’s export profile has shifted decisively from textiles and light manufacturing to more advanced products that reflect deepening industrial capacity. Cars, batteries and advanced shipping have become essential pillars of China’s exports, alongside smartphones, computers and integrated circuits, indicating deeper upstream capabilities, not just assembly scale.

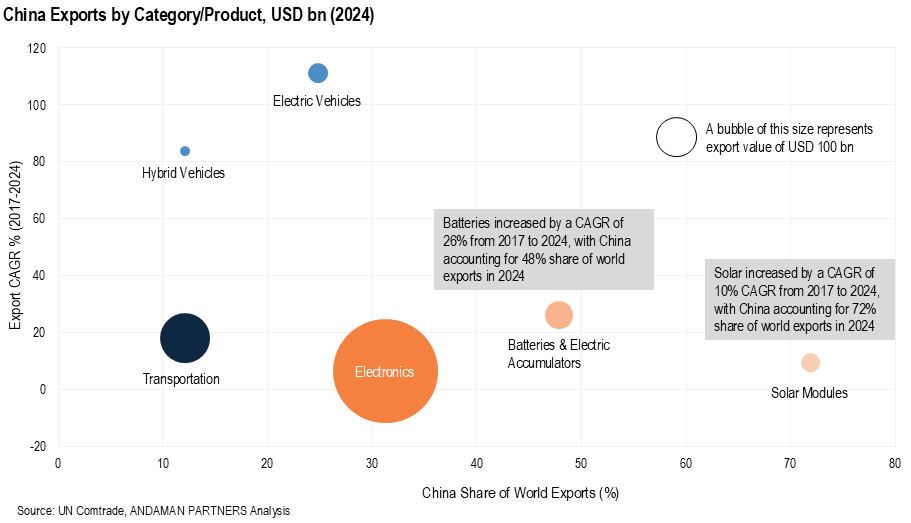

In terms of Electronics as a whole, China accounted for 31% of the world’s exports in 2024, and 12% of the world’s Transportation exports.

New Avenues of Dominance: Clean Tech Exports

China’s exports now also encompass the three core elements of the new energy technology revolution: Batteries, Electric Vehicles (EVs) and solar modules—and the extent of the country’s prominence in supplying the world with these products is extraordinary.

China’s exports now also encompass the three core elements of the new energy technology revolution: Batteries, Electric Vehicles (EVs) and solar modules—and the extent of the country’s prominence in supplying the world with these products is extraordinary.

As mentioned above, in 2024, China exported batteries of USD 67 billion (the sixth-largest export product overall). In the same year, China exported EVs of USD 34.62 billion and solar modules of USD 30.60 billion.

From 2017 to 2024, China’s battery exports increased by a CAGR of 26%, solar module exports increased by 9.3%, and EV exports increased by 111%. In 2024, China accounted for 25% of the world’s EV exports, up from barely 2% in 2017; 48% of the world’s battery exports, a share that almost doubled from 2017; and 72% of the world’s solar module exports, up from 31% in 2017.

China’s Export Belt

Five coastal provinces, along with the municipality of Shanghai, accounted for almost three-quarters (73%) of China’s exports in 2024. Guangdong province alone accounted for nearly a full quarter (23%) of the total, followed by Zhejiang (15%), Jiangsu (14%), Shandong (8%), Shanghai (7%) and Fujian (4%). The western province of Sichuan, the municipality of Beijing and the coastal-adjacent provinces of Anhui and Henan round out the top ten, each accounting for around 2% of total exports. Chongqing, Hubei, Guangxi, Tianjin and Liaoning round out the top 15, each accounting for less than 2% of the total.

These 15 administrative units accounted for 91% of China’s exports in 2024. The coastal belt from Shandong down to Guangdong has been the backbone of China’s exports for decades, but the inland regions are growing more rapidly. From 2000 to 2024, Sichuan’s exports rose at a CAGR of 18.8%, followed closely by Henan (17.6%) and Anhui (16.3%). Growth in the coastal belt varied over this period, with Jiangsu (13.3%), Shandong (13.0%) and Fujian (11.5%) performing well, while Shanghai, Guangdong, Beijing and Zhejiang registered growth ranging from 7% to 10%.

The following table provides an overview of some of the export specialisations of China’s ten leading exporting administrative units.

International Entrepôt: Where China Sells

In 2024, 38% of China’s exports went to five markets (the U.S., Hong Kong SAR, Japan, South Korea and Vietnam), and 76% went to the top 20 partners. The U.S. was the largest buyer of Chinese exports in 2024, accounting for USD 525 billion, a share of 15.5%.

The U.S. has been China’s largest single-country export market since 1999, when it overtook Hong Kong, which was the second-largest recipient of Chinese exports in 2024, accounting for USD 292 billion, a share of 8.6%. Hong Kong plays an outsized role in China’s exports because it acts as a re-export and trans-shipment hub: In 2024, about 99% of Hong Kong’s merchandise exports were re-exports.

Aside from the U.S. and Hong Kong, China’s following four largest export markets were all in Asia, each accounting for less than 5% of China’s total exports: Japan, South Korea, Vietnam and India. Russia was the seventh-largest market, followed by the European markets of Germany and the Netherlands; Malaysia rounded out the top ten. China’s top 11-20 export markets range from the western hemisphere (Mexico and Brazil), Europe (the U.K.) and the Middle East (the UAE) to Asia (Indonesia and the Philippines) and Australia.

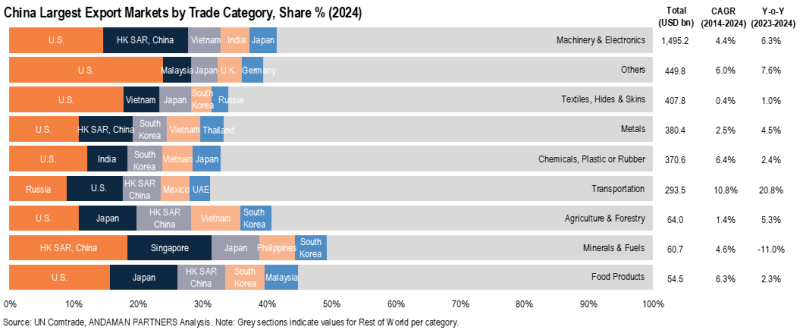

On a per-category basis, the U.S. is the largest buyer of most categories, including Machinery & Electronics, Textiles, Metals, Chemicals, Agriculture & Forestry and Food Products. Minerals & Fuels are mostly shipped to Hong Kong, followed by Singapore and Japan; and Transportation mostly goes to Russia, followed by the U.S. and Hong Kong. China’s Machinery & Electronics are also shipped in large volumes to Hong Kong, Vietnam, India and Japan; and Textiles to Vietnam, Japan, South Korea and Russia.

India is a significant buyer of China’s chemicals, along with South Korea and Vietnam. Japan is a significant buyer of China’s agricultural and food products, along with Vietnam and South Korea. Singapore, Japan, the Philippines and South Korea are all among China’s top five destinations for Minerals & Fuels exports.

Since 2000, China’s export market mix has become more diversified and regionalised, with stronger intra-Asian trade routes. As China’s ports and logistics infrastructure developed, exports to Hong Kong and Japan steadily decreased, with exports to Southeast Asia (especially Vietnam, Malaysia and Thailand) and South Asia (especially India) increasing rapidly.

China’s exports to Mexico and the UAE have increased substantially in recent years, and exports to Russia rose rapidly from 2022, but overall, China’s leading export destinations continue to be large economies with high absorption capacity and advanced logistics networks, notably the U.S. and advanced European and Asian markets.

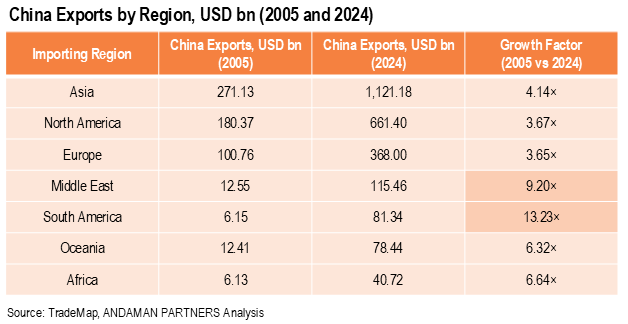

On a regional basis, from 2005 to 2024, China’s exports to the Middle East expanded by more than nine times, and to South America by more than 13 times, although in both cases from a relatively low base. China’s exports to these regions grew considerably faster than shipments to Africa and Oceania. China’s substantially larger exports to Asia, North America and Europe expanded by much lower growth rates over this period.

On a regional basis, from 2005 to 2024, China’s exports to the Middle East expanded by more than nine times, and to South America by more than 13 times, although in both cases from a relatively low base. China’s exports to these regions grew considerably faster than shipments to Africa and Oceania. China’s substantially larger exports to Asia, North America and Europe expanded by much lower growth rates over this period.

Initial trends in 2025 suggest that China is re-routing more exports toward Africa, Latin America, the Middle East and Southeast Asia. Preliminary 2025 data indicate strong China export growth to Africa (+21.6% year-on-year) and steady flows to Latin America, while exports to Europe, North America and Oceania have contracted sharply. Chinese exports to Africa surged in the first half of 2025, especially in a few leading importing markets such as Nigeria, Côte d’Ivoire, Guinea and Angola.

Conclusions: The Global Impact of China’s Exports

In 2025, it has been a quarter of a century during which China’s role as the world’s leading exporter became firmly entrenched. The following are some of the standout ways in which China’s exports have reshaped global markets:

- Sustained Price Compression and Consumption Growth:

China’s rise as the world’s pre-eminent exporter in the 2000s and 2010s provided the scale, supply clusters and industrial inputs that drove sustained price compression in electronics, appliances and machinery, thereby lowering the world’s cost base and enabling a significant expansion of global consumption. - Clean Tech Industrialisation and Cheaper Clean Energy:

From the 2010s onwards, China’s vast industrial capacity and exports of lithium-ion batteries, solar modules and EV powertrains enabled a significant reduction in hardware costs, expanding the viable market for electrified mobility and renewable energy. - Global Supply Chains Anchored on China:

China’s dominance in manufacturing provided the country with significant global market share gains in key sectors like consumer electronics, solar modules and automobiles. Even as international companies started to diversify their manufacturing and sourcing operations beyond a singular focus on China, much of global manufacturing and supply chains remain centred on Chinese parts, tooling and know-how. - Exports As a Core Component of China’s Geopolitical Ascent:

Export dominance provided China with enormous leverage in trade corridors and logistics, expanded the country’s role as lender and builder and made market influence a core geopolitical asset. - Shifting the Economic Centre of the World From West to East:

China’s export dominance made East Asia the manufacturing centre of the world, with supplier networks and industrial ecosystems clustered around hubs in China. Jobs and value-added manufacturing migrated East, while the West imported most of the resulting finished goods. China rerouted the world’s main shipping lanes through Asian corridors, leading to bigger Asian trade surpluses and foreign exchange reserves.

In short, between 2000 and 2025, China did not just vastly increase its exports; it reset global prices, reshaped supply chains, accelerated clean and renewable technology adoption and recentered logistics networks

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

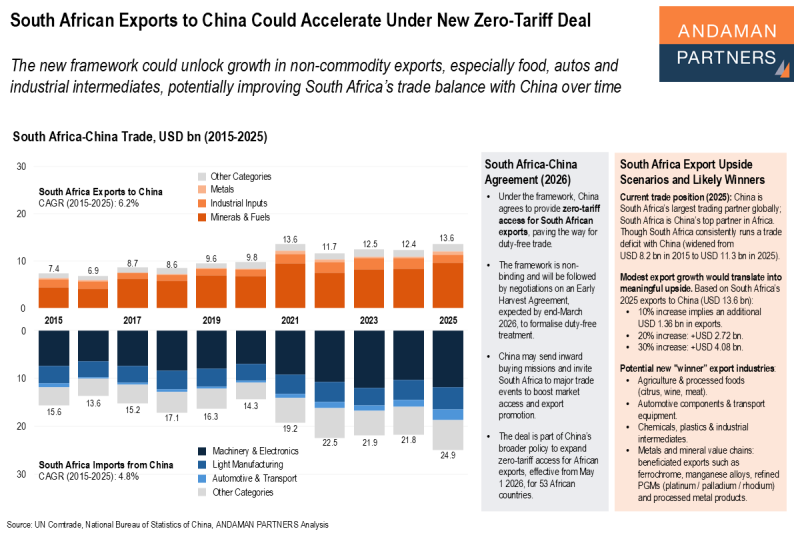

South African Exports to China Could Accelerate Under New Zero-Tariff Deal

The new framework could unlock growth in non-commodity exports, especially food, autos and industrial intermediates.

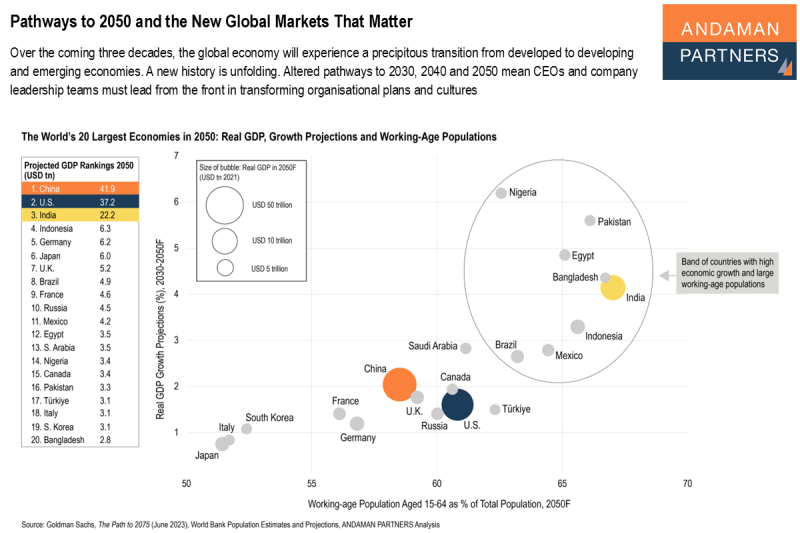

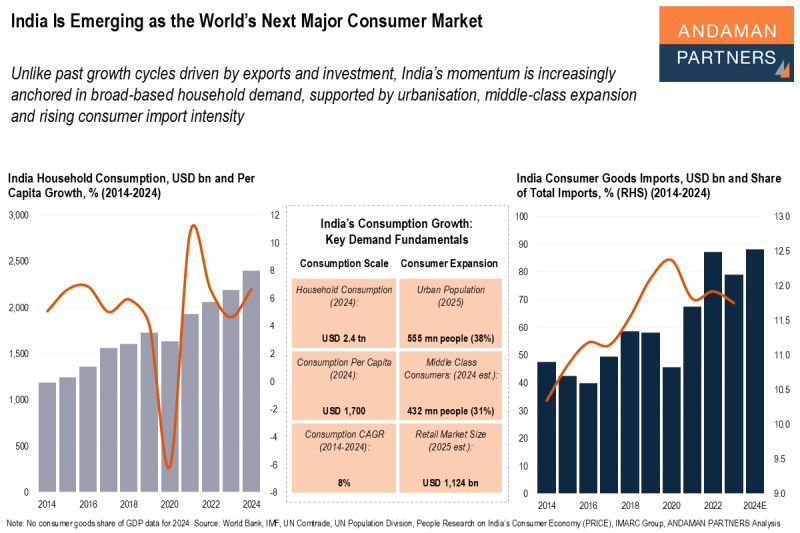

India Is Emerging as the World’s Next Major Consumer Market

India’s momentum is anchored in broad-based household demand, supported by urbanisation, middle-class expansion and consumer import intensity.

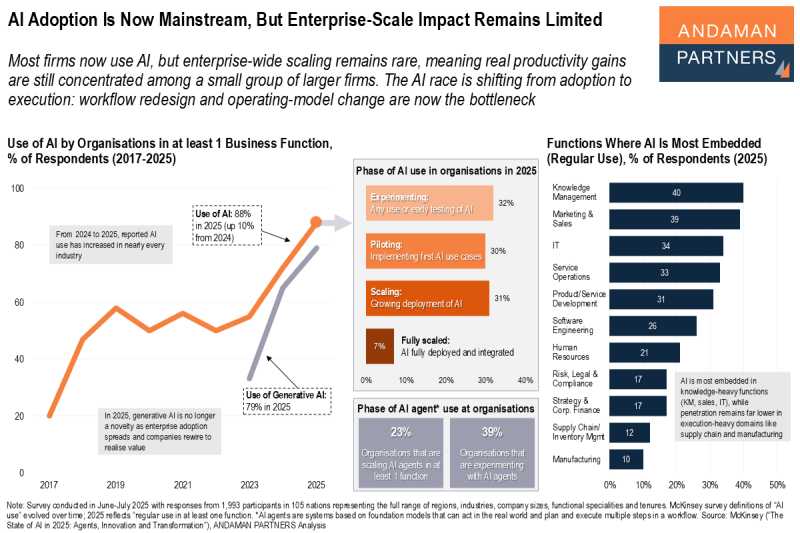

AI Adoption Is Now Mainstream, But Enterprise-Scale Impact Remains Limited

Most firms now use AI, but enterprise-wide scaling remains rare, meaning productivity gains are concentrated in a small group of larger firms.