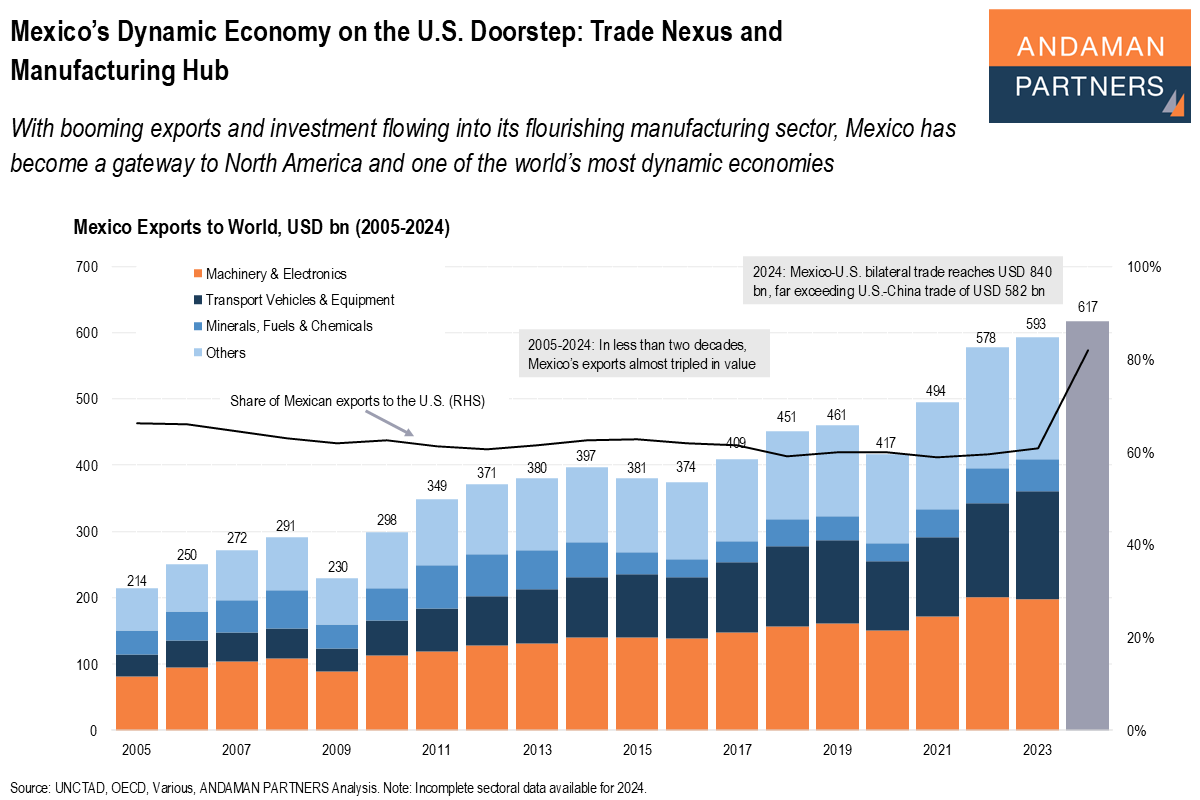

With booming exports and investment flowing into its flourishing manufacturing sector, Mexico has become a gateway to North America and one of the world’s most dynamic economies.

Mexico’s USD 1.82 trillion economy is among the world’s 15 largest economies. In less than two decades (2005-2024), Mexico’s exports almost tripled from USD 214 billion to USD 617 billion. By 2050, Mexico’s GDP could reach USD 5-7 trillion, ranking it among the world’s ten largest economies.

The country has become a North American trading and manufacturing linchpin, situated right next to the U.S., the largest consumer market in the world. How has Mexico achieved such an impressive economic trajectory?

Trading Nexus

With extensive networks of highways, ports and railways to its larger northern neighbour, Mexico is now the largest trading partner of the U.S., with bilateral trade of USD 840 billion in 2024, far exceeding U.S.-China trade of USD 582 billion.

In 2024, USD 505 billion of Mexico’s total exports of USD 617 billion, a share of 82%, went to the U.S. Of Mexico’s total 2024 imports of USD 625 billion, a share of USD 334 billion, or 40%, came from the U.S.

Mexico has capitalised on its favourable geographic location, integrating with the U.S. and Canada via the North American Free Trade Agreement (NAFTA), which was implemented in 1994 and eliminated most tariffs between member countries. NAFTA was superseded by the United States-Mexico-Canada Agreement (USMCA) in 2020.

Mexico is one of the most trade-friendly countries in the world. As of December 2024, it is party to the most free trade agreements (FTAs) of any country, i.e., 13 FTAs involving at least 50 partner countries. All these agreements make Mexico a highly favourable and cost-effective country for market access, manufacturing and supply chains.

Mexico also benefited from recent global trends. Ongoing and escalating U.S.-China tensions, COVID-19 disruptions and geopolitical instability caused companies to rethink their global supply chains. Mexico emerged as the leading nearshoring destination, thanks to its young, cost-effective workforce, proximity to the U.S. and trade-friendly policies.

Manufacturing Hub

Foreign Direct Investment (FDI) has flowed into Mexico, reaching USD 37 billion in 2024, of which USD 20 billion (54%) was allocated to the manufacturing sector. The 2024 total was the highest on record apart from 2013, when a single transaction—Anheuser-Busch InBev’s USD 20 billion purchase of Grupo Modelo, Mexico’s largest beer producer—caused a temporary spike.

FDI has flowed particularly into Mexico’s budding regional manufacturing clusters for the automotive (e.g., cars, trucks, engines), electronics (e.g., TVs, computers, phones) and aerospace (e.g., aircraft parts, turbines) sectors.

In 2024, the U.S. was the largest source of FDI in Mexico with USD 16.51 billion, a share of 45%. Japan accounted for USD 4.28 billion (12%), followed by Germany with USD 3.78 billion (10%) and Canada with USD 3.21 billion (9%).

This contributed to Mexico’s remarkable growth in exports, driven by two major sectors: Machinery & Electronics, which increased from USD 81 billion in 2005 to almost USD 200 billion in 2023; and Transport Vehicles & Equipment, rising from USD 33 billion in 2005 to USD 164 billion in 2023.

Mexico has been the world’s leading exporter of flat-screen TVs for several years. It is also the leading exporter of beer and avocados and is among the top five exporters of passenger vehicles, auto parts, medical devices and electrical machinery.

Mexico’s economy is poised to continue its rise unabated. With a young population and a growing middle class, the country’s demographic profile supports long-term industrial expansion and consumer growth.

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

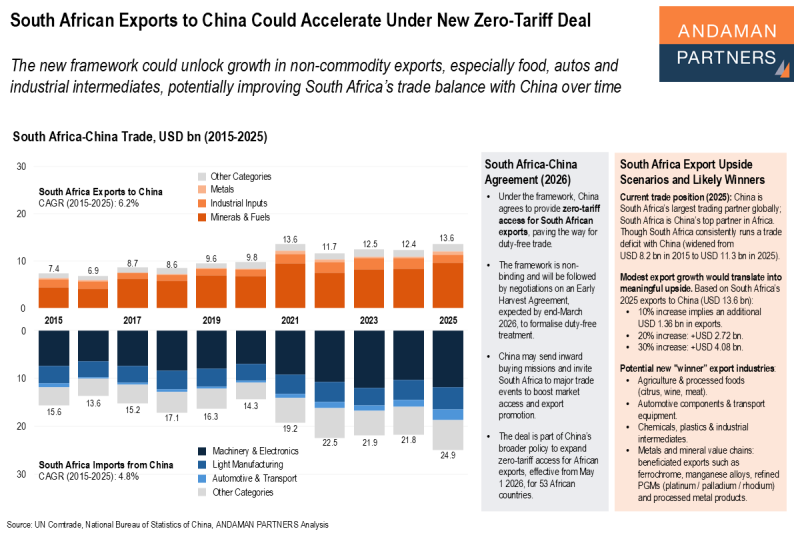

South African Exports to China Could Accelerate Under New Zero-Tariff Deal

The new framework could unlock growth in non-commodity exports, especially food, autos and industrial intermediates.

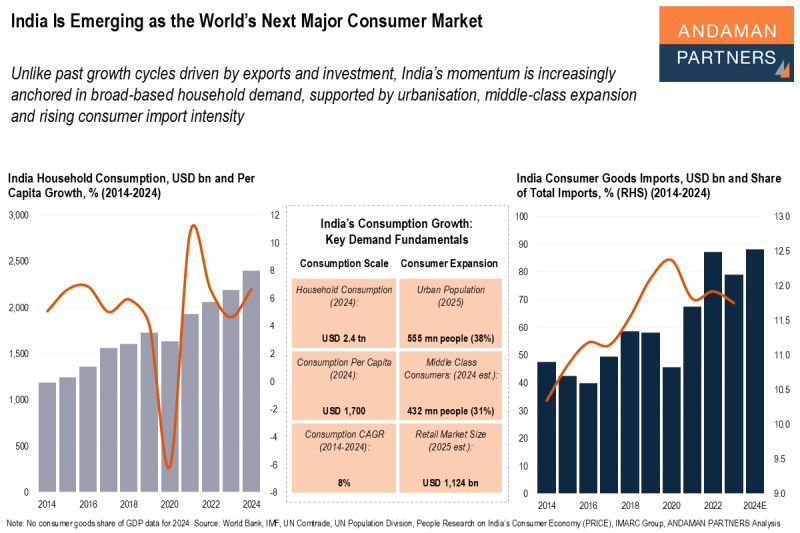

India Is Emerging as the World’s Next Major Consumer Market

India’s momentum is anchored in broad-based household demand, supported by urbanisation, middle-class expansion and consumer import intensity.

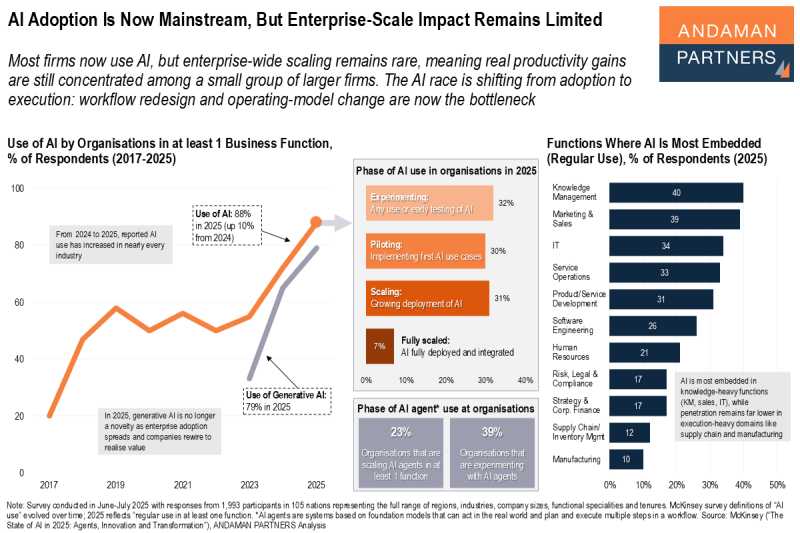

AI Adoption Is Now Mainstream, But Enterprise-Scale Impact Remains Limited

Most firms now use AI, but enterprise-wide scaling remains rare, meaning productivity gains are concentrated in a small group of larger firms.