The Kingdom of Saudi Arabia’s trillion-dollar economy is undergoing government reform to diversify from a dependency on oil revenue, with vast investment devoted to developing a range of new industries. The country is rapidly growing as a new consumer market, offering multiple investment and trade opportunities for foreign companies.

In 2024, Saudi Arabia’s nominal GDP reached USD 1.08 trillion, almost doubling from 2010 (USD 528.20 billion). As the world’s largest oil exporter, Saudi Arabia has been the largest economy in the Middle East since the 2000s, based mainly on oil and petrochemical export revenues.

Saudi Arabia has evolved, however, from a pure oil state to an increasingly diversified, investment-driven economy, while maintaining a dominant role in global energy markets. The country now has a rapidly growing non-oil economy, driven by massive public investment in sectors like tourism, logistics, entertainment and green energy. In 2023, the contribution of non-oil revenues to GDP passed 50%, the highest share ever recorded.

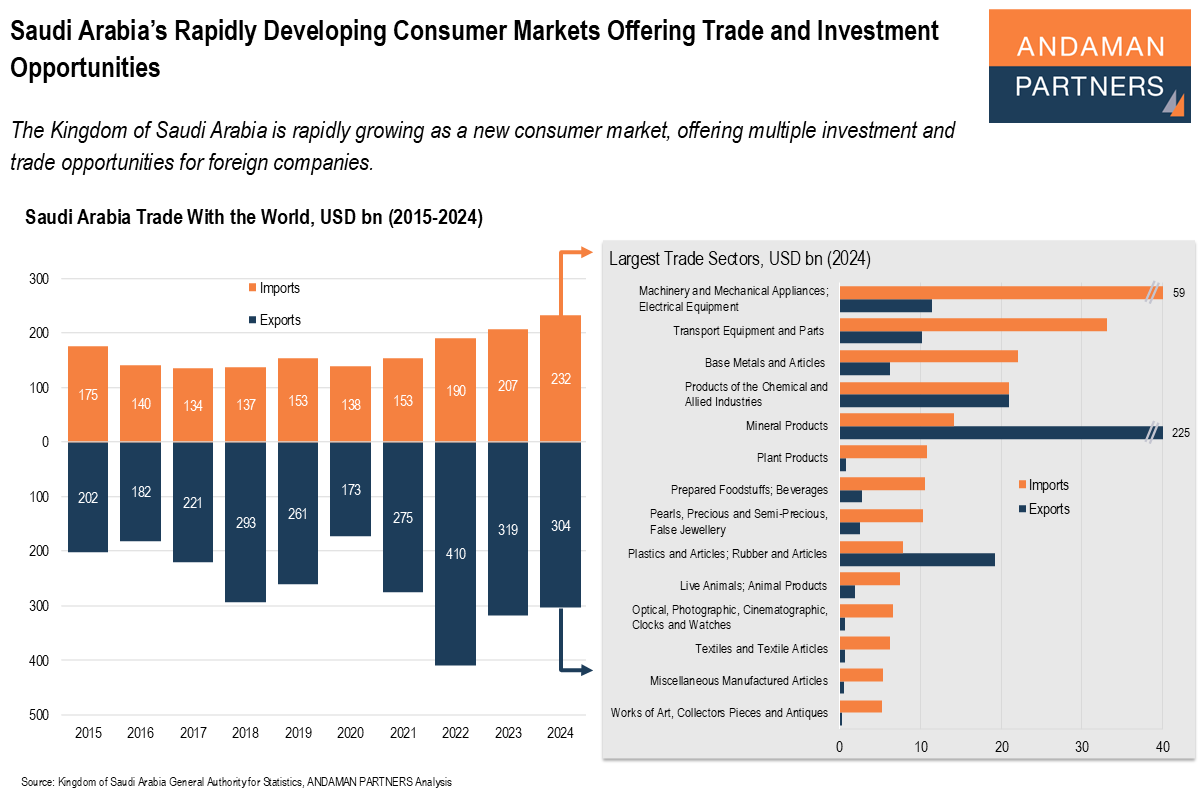

In 2024, Saudi Arabia’s total trade amounted to USD 536 billion, with exports of USD 304 billion. The country has maintained a positive trade balance based mainly on oil revenue, and a sharp rise in exports in 2022 was due to a surge in oil prices. Saudi imports have also increased steadily since 2020, reaching USD 232 billion in 2024, a CAGR of 13.8% from 2020.

In 2023, household final consumption expenditure in Saudi Arabia reached USD 426.50 billion, accounting for 40% of GDP, a CAGR increase of 6.5% from USD 225.80 billion in 2013.

With the rapid growth of the non-oil sector, economic diversification has fostered the emergence of various consumer markets in Saudi Arabia, notably arts and entertainment, food and beverages, household appliances, fashion and luxury goods, transport and storage, health and education, restaurants and hotels, jewellery and art, and communications.

A review of the country’s largest import sectors in 2024 illustrates some of the emerging opportunities for foreign exporters:

Saudi Arabia relies heavily on imports of finished goods, mainly Machinery (USD 58.7 billion) and Transport Equipment (USD 33.1 billion), the two largest import categories.

Base Metals was the third-largest category (USD 22.1 billion), and Chemical Products (USD 21.0 billion) the fourth-largest.

Plant Products and Prepared Foodstuffs & Beverages both registered over USD 10 billion in imports.

Saudi Arabia imported over USD 10 billion of Pearls & Jewellery.

Other notable import categories were Plastics & Rubber (USD 7.8 billion), Live Animals & Animal Products (USD 7.4 billion), Optical, Photographic & Cinematographic Equipment (USD 6.6 billion) and Textiles (USD 6.3 billion).

Vision 2030

Saudi Arabia’s rising imports and expanding trade profile make the country an auspicious location for market entry and trade opportunities. Vision 2030, a government programme launched in 2016 to diversify the economy and develop new economic sectors, is a key factor enhancing Saudi Arabia’s investment landscape.

The following are some of the key sectors in which Vision 2030 is creating new business opportunities:

Infrastructure: The government is making significant investments in transportation networks, energy facilities and urban infrastructure, such as the Riyadh Metro, the redevelopment of central Jeddah and Riyadh’s King Salman International Airport, set to open in 2030.

Technology, renewable energy and innovation: Vision 2030 aims to foster a digital and knowledge-based economy with government initiatives to support startups, research & development and digital transformation. Investing in wind and solar energy is a key objective for reducing the economy’s reliance on oil revenue.

Tourism, entertainment, healthcare and education: Tourism is one of the priority sectors for Vision 2030, and government initiatives to create non-oil revenue are driving investment in education, training and healthcare. The entertainment and sporting events sector is also growing rapidly, with the opening of new movie theatres. In December 2024, Saudi Arabia was formally confirmed as the 2034 FIFA Football World Cup host nation.

Automotive, pharmaceuticals and financial services are some of the target industries for broadening the country’s industrial base.

Foreign companies should be mindful of these key factors to take advantage of Saudi Arabia’s increasingly favourable investment climate and the opportunities facilitated by Vision 2030:

Understand the market: This seems obvious, but Saudi Arabia’s economy is developing and diversifying rapidly, and the country’s imports and consumption patterns are likewise changing and expanding. It will be essential to identify key sectors and products (even some that may be new to Saudi Arabia, such as home automation systems) that are aligned with Vision 2030.

Localisation is key: Vision 2030 government contracts carry specific localisation requirements, such as criteria for sourcing locally, establishing regional headquarters in-country and hiring local staff. The programme does, however, contain incentives and support services for foreign companies to comply with the requirements.

Form strategic partnerships: Partnering with the right local companies can be very beneficial for navigating and adhering to local regulations, localising products and services and using existing supply networks.

Leverage Special Economic Zones (SEZs): Saudi Arabia currently has five SEZs, each focused on specific sectors with incentives for foreign businesses, such as tax breaks and simplified regulations. In Riyadh, for example, there are two SEZs, one dedicated to technology and innovation and another focusing on logistics and supply chain management.

Utilise co-investment opportunities: Vision 2030 provides various opportunities to undertake co-investment ventures with Saudi investors, especially in industries such as renewable energy, technology and innovation, venture capital and healthcare. The Public Investment Fund (PIF), Saudi Arabia’s sovereign investment fund, partners with global investors to fund technology, renewable energy and infrastructure projects.

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

AAMEG Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to sponsor and support the AAMEG pre-Mining Indaba Cocktails & Canapes event.

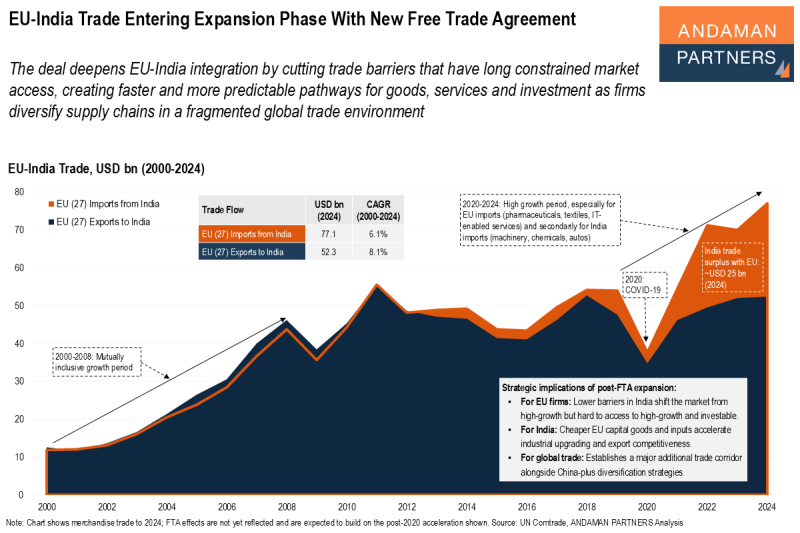

EU-India Trade Entering Expansion Phase With New Free Trade Agreement

The deal deepens EU-India integration by cutting trade barriers that have long constrained market access.

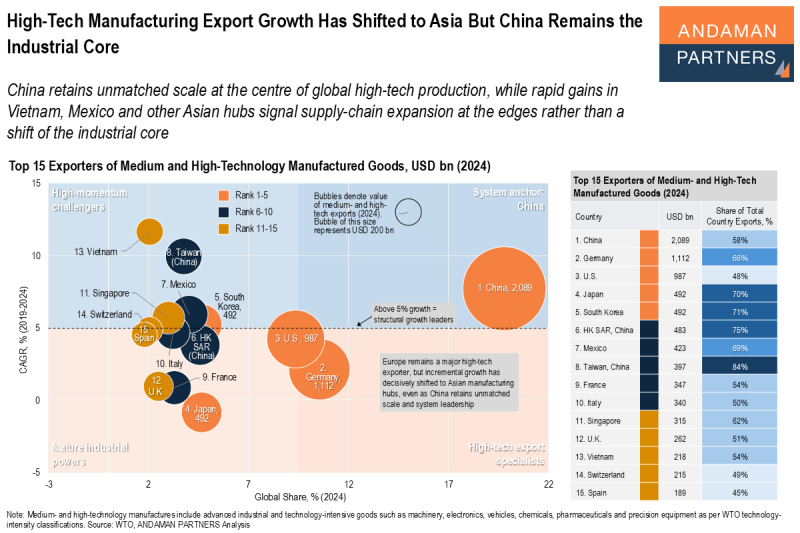

High-Tech Manufacturing Export Growth Has Shifted to Asia, But China Remains the Industrial Core

China retains unmatched scale at the centre of global high-tech production, while rapid gains in Vietnam, Mexico and other Asian hubs.

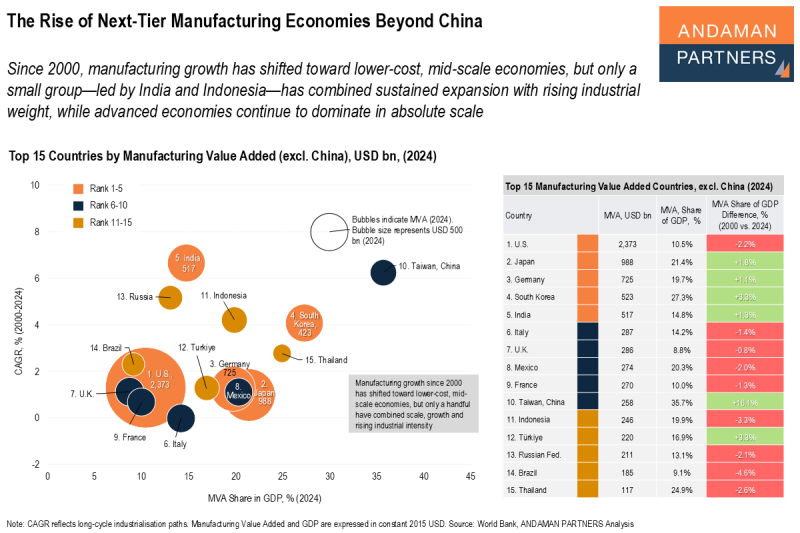

The Rise of Next-Tier Manufacturing Economies Beyond China

Manufacturing growth shifted toward lower-cost, mid-scale economies, but only a small group has combined sustained expansion with rising industrial weight.