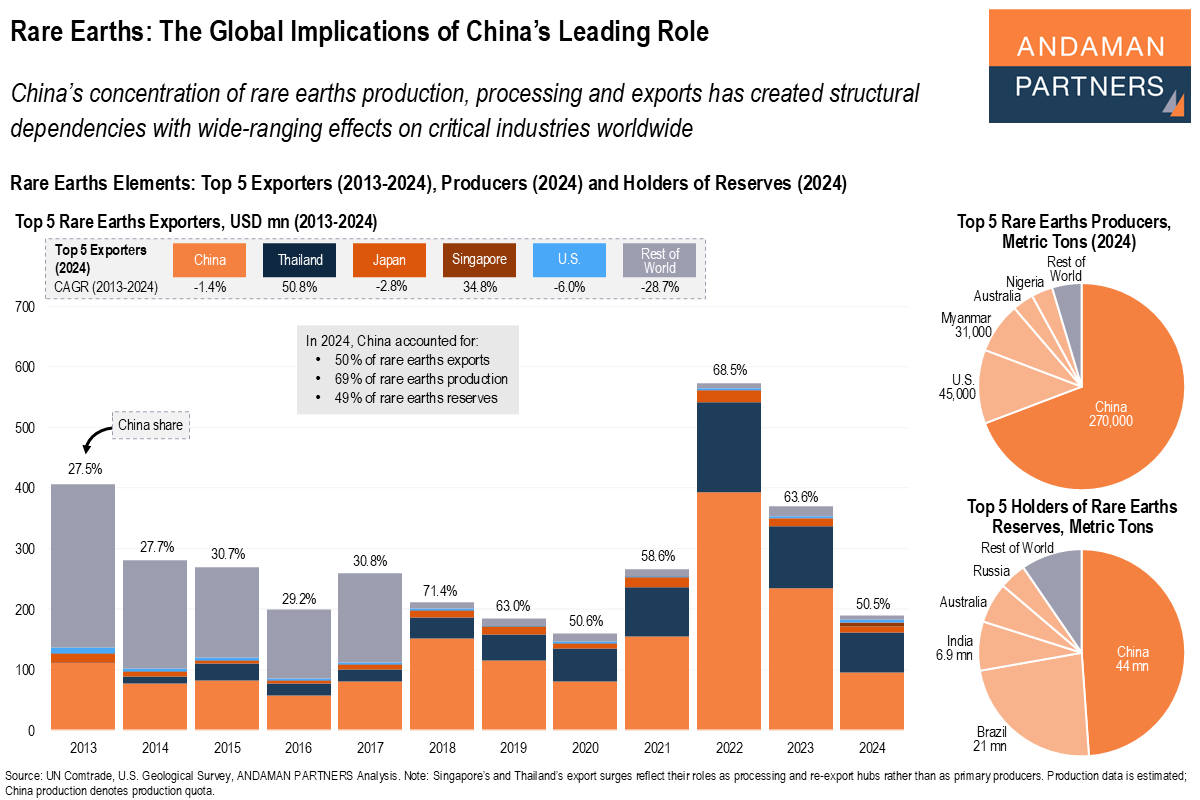

China’s concentration of rare earths production, processing and exports has created structural dependencies with wide-ranging effects on critical industries worldwide.

On 9 October 2025, China’s Ministry of Commerce announced expanded export controls on rare earth elements, magnets and related technologies, set to take effect in December. The new rules broaden licensing requirements to include additional rare earths and extend to foreign-made goods—from magnets to components used in electric vehicles (EVs), smartphones and wind turbines—that contain Chinese materials and technologies.

These measures highlight China’s central role in the supply chain of rare earths, a group of 17 soft and heavy metals crucial for modern technologies due to their unique magnetic, optical and conductive properties. China accounts for roughly 70% of global mine production, 49% of exports and more than 90% of processing and refining.

China also holds around half of global reserves. While large deposits exist in countries such as Brazil, India, Australia and Russia, only China has the integrated processing capacity at scale to bring rare earths to market.

Global Implications

The implications of China’s dominance of rare earths exports and production are far-reaching, even more so now with expanded export controls set to take effect in December.

The global economy is heavily exposed to disruptions in Chinese supply. Because most advanced manufacturing sectors—from clean energy to electronics and defense—depend on Chinese-produced or processed rare earths, any tightening of export rules or supply interruptions will have immediate downstream effects.

Even if countries increase their own mining, ores often still need to be sent to China for refining. Building alternative supply chains requires major investment, long lead times and technical expertise that China has developed over decades.

The concentration of rare earths production, exports and processing in China created a structural dependency for critical industries worldwide. Rare earths supply constraints in China can quickly lead to price spikes, production delays and higher costs across multiple industries, from wind turbines and EVs to semiconductors and medical devices.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

AAMEG Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to sponsor and support the AAMEG pre-Mining Indaba Cocktails & Canapes event.

AAMEG & ACBSA Event in Johannesburg Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to sponsor and support the AAMEG & ABCSA pre-Mining Indaba Connections & Canapes event.

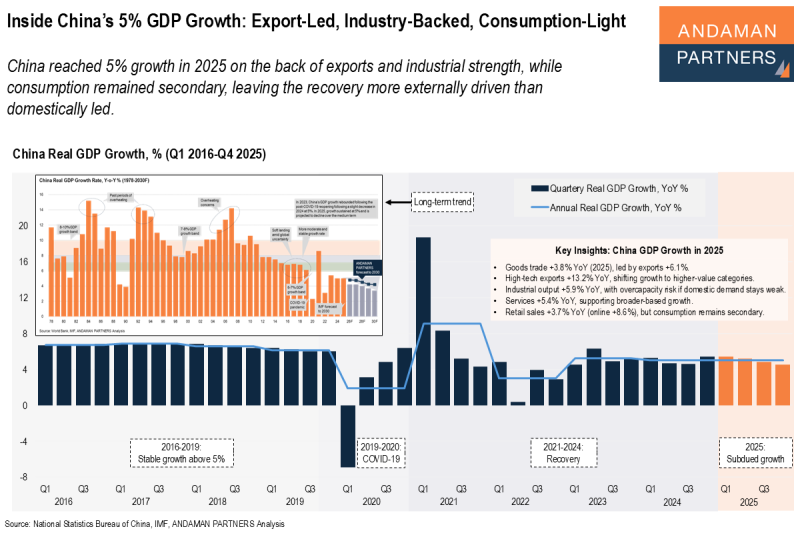

Inside China’s 5% GDP Growth: Export-Led, Industry-Backed, Consumption-Light

China reached 5% growth in 2025 on the back of exports and industrial strength, while consumption remained secondary.

China Navigator – Q1 2026

ANDAMAN PARTNERS outlines, unpacks and unravels some of the broad shifts and finer intricacies of China’s economic development and transition in 2026.

The Structure of Global Automotive Trade in 2024

The top ten exporters and importers of automotive products reveal a highly concentrated global trade system.