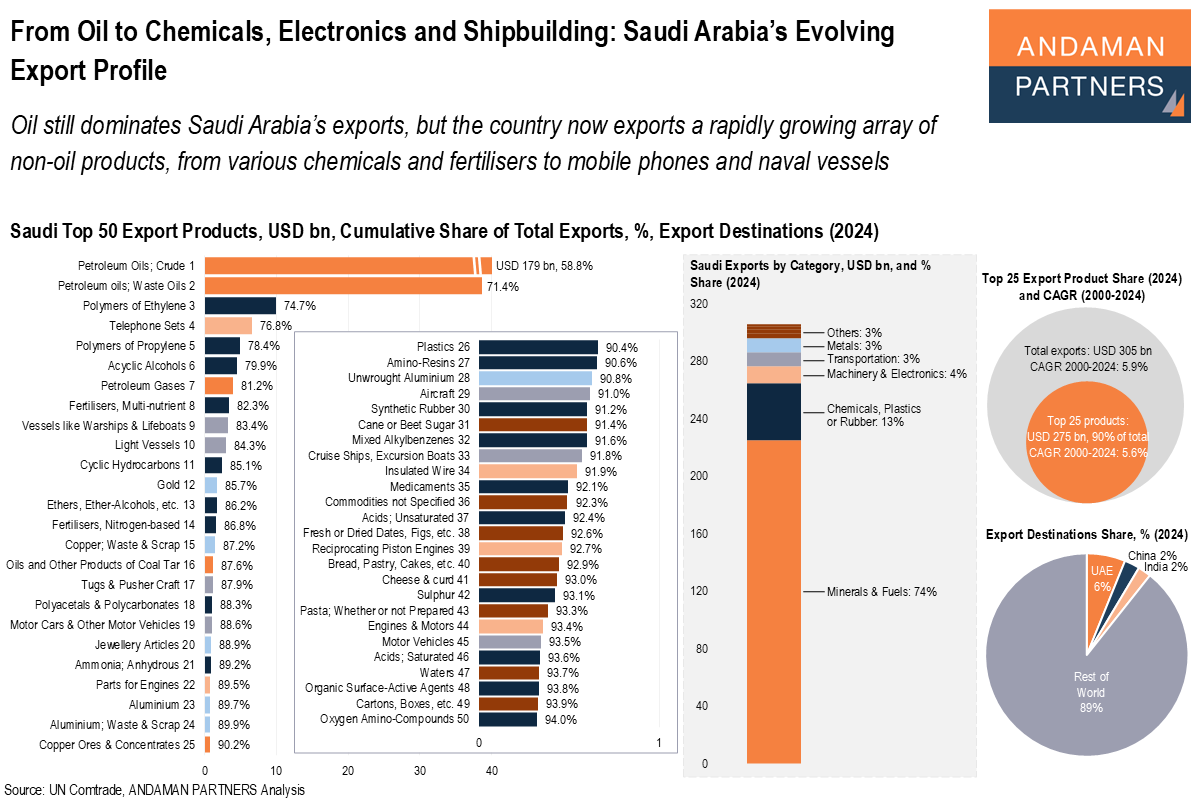

Oil still dominates Saudi Arabia’s exports, but the country now exports a rapidly growing array of non-oil products, from various chemicals and fertilisers to mobile phones and naval vessels.

Highlights:

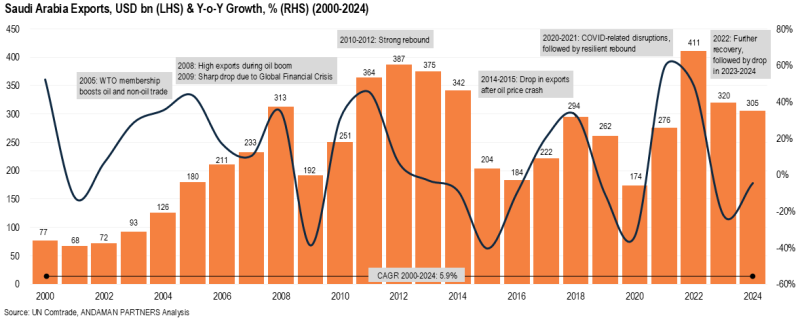

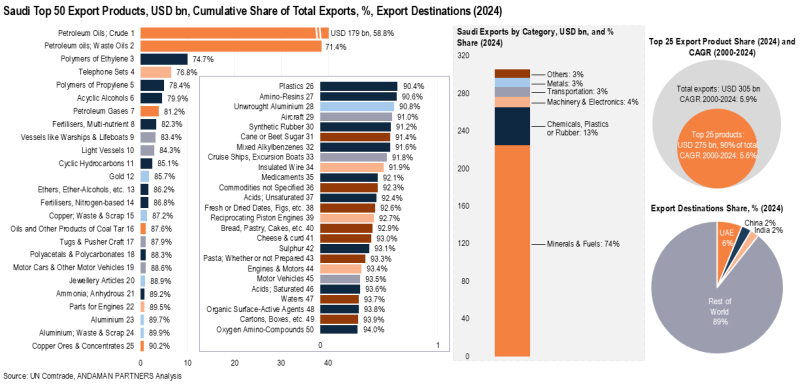

- In 2024, Saudi Arabia’s exports were worth USD 305 billion, a year-on-year decrease of 4.5%.

- Saudi Arabia is the world’s largest crude oil exporter, with a value of USD 179 billion in 2024.

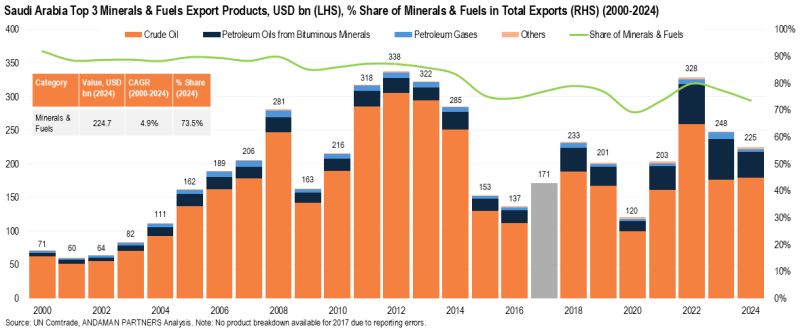

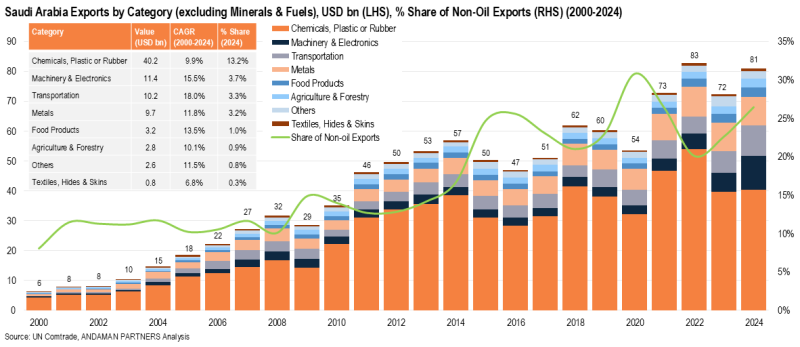

- The share of Minerals & Fuels in Saudi exports fell from 92% in 2000 to 74% in 2024, while the share of non-oil exports rose from 8% to 26%.

- Chemicals, Plastics or Rubber is the country’s second-largest export category, accounting for

USD 40 billion, a share of 14%. - While Saudi Minerals & Fuels exports grew at a CAGR of 5% from 2000 to 2024, all other export categories have grown much faster.

- Recent years have seen a notable surge in Saudi exports of mobile phones, various chemicals and a range of naval vessels.

In 2024, Saudi Arabia’s exports reached USD 305 billion, a year-on-year decrease of 4.5% and a 25% fall from the record high level of USD 411 billion in 2022. Surging oil prices and high production volumes caused the country’s exports to spike in 2022, with petroleum oils accounting for the majority of its exports.

Falling oil prices and production cuts in 2023-2024 contributed to a nominal decline in Saudi exports. However, while oil exports declined, Saudi non-oil exports increased, especially in the plastics, chemicals and machinery sectors.

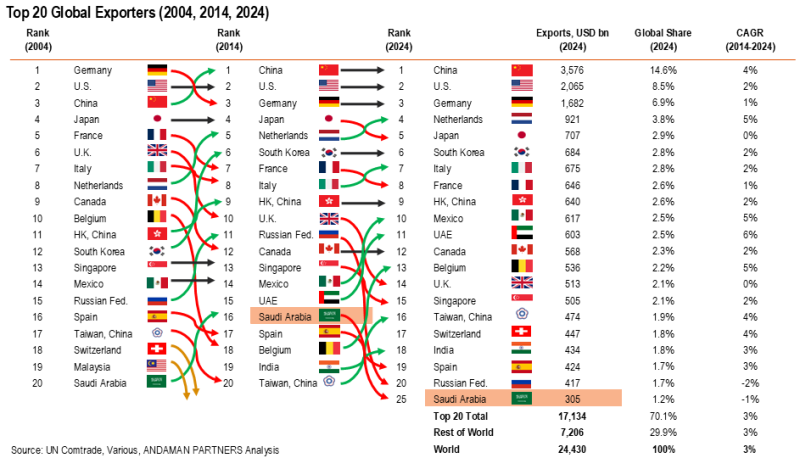

In 2024, Saudi Arabia was the world’s 25th-largest exporter, with exports on par with those of Brazil

(USD 340 billion) and Malaysia (USD 313 billion). This marked a drop from 2014, when the country was ranked 16th.

From 2000 to 2024, Saudi exports expanded at a CAGR of 5.9%, including growth spurts in 2008, 2011-2014 and 2022, coinciding with oil price surges and high production. In contrast, notable troughs in Saudi exports (2009, 2016 and 2020) coincided with global downturns and oil price collapses, which directly affected Saudi export earnings.

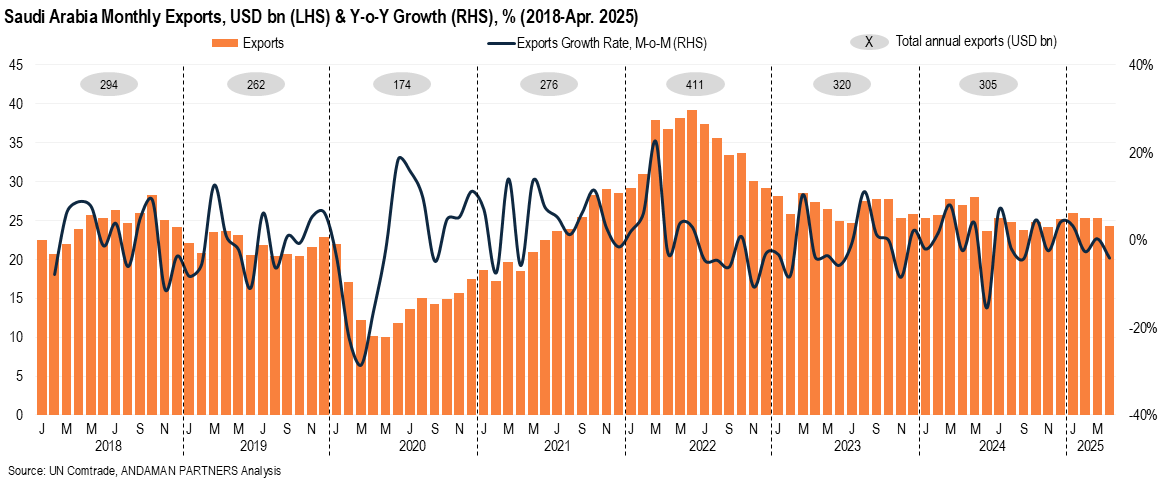

Saudi exports on a monthly basis from 2018 clearly illustrate the impact of global oil price cycles, with a sharp drop-off until mid-2020, followed by a steady climb until mid-2022. From early 2023 until April 2025, monthly exports hovered around USD 25 billion, with year-on-year growth rates mainly in the -10% to 10% range.

An Economy Built on Oil

In 2024, Saudi Arabia’s nominal GDP reached USD 1.08 trillion, almost doubling from 2010 (USD 528 billion). The country has been the largest economy in the Middle East since the 2000s, based mainly on oil export revenues.

Crude oil exports have long been the backbone of Saudi Arabia’s economy. The country has been the world’s largest annual crude oil exporter since the 1970s, leveraging its vast reserves, low production costs and substantial capacity to shape global energy markets.

In 2024, Saudi crude oil exports led the world with USD 179 billion, followed by the U.S. (USD 118 billion) and Canada (USD 104 billion). Oil revenues have financed Saudi state budgets, foreign reserves, economic development and current reform programmes.

The Saudi export performance has thus historically moved in lockstep with global oil cycles, with surges in oil prices leading to export booms and drops in oil prices causing export troughs. Non-oil exports were never large enough to thoroughly cushion the country’s exports from fluctuations in global oil prices.

However, a salient feature of the Saudi economy over recent years is the gradual decline of the share of Minerals & Fuels in the country’s exports, falling from 92% in 2000 to 74% in 2024, and the concomitant rise of the share of non-oil exports from 8% to 26% over the same period.

A Diversifying Export Basket

Minerals & Fuels accounted for USD 225 billion of Saudi exports in 2024, a share of 74%. At USD 179 billion, crude oil was by far the largest single export product, accounting for 59% of total exports, followed by waste petroleum oils at USD 39 billion. At USD 4 billion, petroleum gas was the seventh-largest export product.

Aside from relatively small exports of coal tar oil and copper ores, no other Minerals & Fuels featured among the top 50 export products, which were dominated by Chemicals, Machinery & Electronics, Transportation and Metals products.

Chemicals, Plastics or Rubber was the second-largest export category, accounting for USD 40 billion, a 14% share. At USD 10 billion, ethylene polymers ranked as the third-largest export product, used to manufacture packaging films, plastic bags, food wrap, cling film and other products. Other chemical products in the top 20 exports were polymers of propylene, acrylic alcohols, fertilisers, cyclic hydrocarbons and ethers.

Machinery & Electronics accounted for more than USD 11 billion, or 4% of Saudi exports, mostly consisting of telephone sets (i.e., mobile phones, USD 7 billion) and a small amount of engine parts. Although Saudi Arabia does not yet have globally recognised mobile phone brands, there has been a notable surge in mobile phone exports, especially since 2020, with the United Arab Emirates (UAE) as the primary recipient.

Transportation and Metals each accounted for around USD 10 billion (a 3% share) of Saudi exports. Over recent years, the country has significantly expanded its shipbuilding and defence manufacturing capacity, including naval vessels. The ninth- and tenth-largest export products in 2024 were vessels (warships & lifeboats) and light vessels, each at around USD 3 billion. Other Transportation products in the top 50 exports were tugs & pusher craft, motor cars & other vehicles, aircraft and cruise ships.

Saudi Arabia has set out to localise production of naval vessels, including patrol boats, corvettes and support ships. Transportation export values are still modest compared to oil, but the country’s naval shipbuilding industry is growing rapidly, built around state-led investments, technology transfers and export ambitions in the Arabian Gulf (also known as the Persian Gulf).

Gold was the 12th-largest export at USD 2 billion, and other Metals among the top exports were copper waste & scrap, jewellery and aluminium products.

A Future Beyond Oil

While Saudi Minerals & Fuels exports grew at a CAGR of 5% from 2000 to 2024, all other export categories grew much faster, including Transportation (18%), led by the budding Saudi shipbuilding industry, Machinery & Electronics (15.5%) and Metals (12%). These three categories, however, accounted for only 3-4% of total exports in 2024. Chemicals, which accounted for 13% of total exports, grew at a 10% CAGR from 2000 to 2024.

From 2023 to 2024, Minerals & Fuels exports declined by 9.3%, while Transportation grew by 42% and Machinery & Electronics by 79%.

While they accounted for 1% or less of total exports in 2024, Food Products and Agriculture & Forestry grew by 13.5% and 10%, respectively, from 2000 to 2024. Growing Saudi food exports include sugar cane, bread and pasta, while the leading agricultural exports were dates & figs, cheese & curd and milk & cream.

Vision 2030, a government reform programme launched in 2016 to diversify the economy and develop new economic sectors, has been a catalyst for the expansion and diversification of Saudi Arabia’s non-oil exports. The programme has driven investment into new industries and export infrastructure, and has seen some initial success. From 2016 to 2024, non-oil exports grew by 72%, reaching a record high of USD 83 billion in 2022. Non-oil export growth has been supported by industrial zones, trade facilitation and state-backed financing.

During the course of Vision 2030, Saudi Arabia has become one of the world’s top ten chemical exporters, with rapidly growing Asian markets. The country has invested heavily in logistics, ports and trade zones, notably the King Abdullah Economic City Special Economic Zone (SEZ) in Jeddah, King Abdullah Port on the Red Sea and the King Salman International Complex for Maritime Industries & Services at Ras Al Khair shipyard on the shores of the Persian Gulf.

Old and New Trade Partners

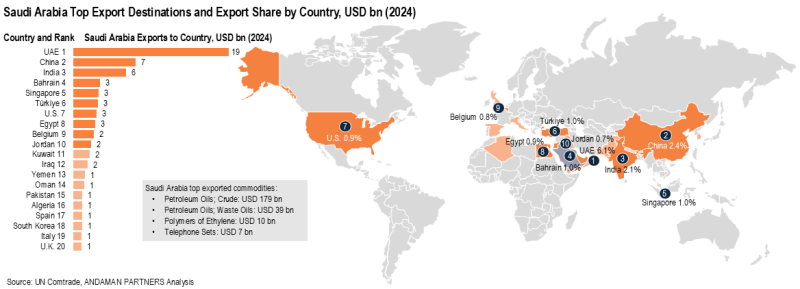

The UAE was the largest recipient of Saudi exports in 2024, with a share of 6%, followed by China (2%) and India (2%). Since at least the mid-2000s, the UAE has consistently ranked as the leading or second-largest destination for Saudi exports. This close trade relationship is based on geographic proximity, facilitated by the land border and adjacent Gulf ports.

A large portion of Saudi non-oil exports, moreover, especially plastics, chemicals, machinery and electronics, are first exported to the UAE before being re-exported to Asia, Africa, Europe and elsewhere, especially via Dubai’s global logistics network.

Overall, however, Saudi exports are not concentrated in a single market, but are distributed widely, reflecting the nature of oil and chemical exports that go to many markets rather than depending on a few buyers. Nevertheless, Saudi Arabia’s top 20 exporters are generally distributed across the Middle East, South Asia, Europe (the U.K., Italy and Spain), the U.S. and China.

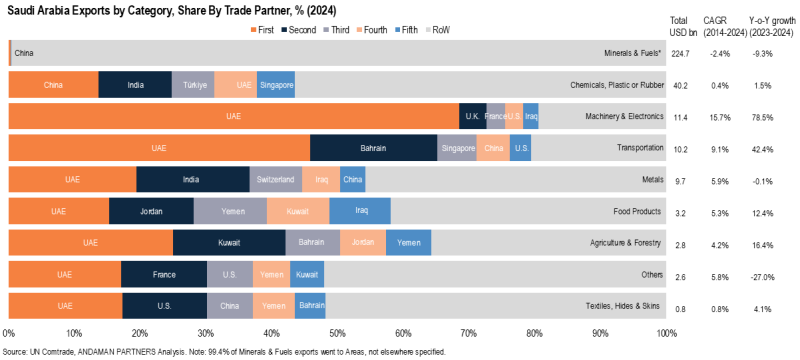

There are no precise data available for the leading recipients of Saudi Minerals & Fuels exports, but the UAE is the leading recipient of all Saudi export categories except Chemicals, which mainly go to China, followed by India and Türkiye. Aside from the UAE, Saudi Machinery & Electronics are exported to Europe (U.K., France) and the U.S., while Bahrain, Singapore, China and the U.S. are the leading recipients of Transportation exports.

Metals are exported to the UAE, India and Switzerland, while food and agricultural products are exported to countries in the Middle East, mostly Jordan, Kuwait, Yemen and Bahrain.

Conclusions: The Global Impact of Saudi Arabia’s Exports

While not one of the world’s largest exporters by volume, Saudi Arabia plays a vital role as an exporting economy. The following are five of the standout ways in which the country’s exports are impacting global trade:

- Central Pillar of Global Energy Trade:

Saudi Arabia is the world’s largest crude oil exporter, shaping flows and pricing across global energy trade routes and anchoring supply for major economies in Asia, Europe and the U.S. Saudi exports influence global oil price stability amid geopolitical and economic shifts. Market reactions to Saudi production decisions remain swift, affecting energy costs worldwide. - Distributed Trade Footprint:

Saudi exports are uncommonly globally distributed, deeply embedding the country’s exports in global shipping, logistics and refinery networks. - Expanding Non-Oil Footprint:

While oil still dominates Saudi exports, non-oil exports have doubled since 2016, led by chemicals, plastics, electronics and defence manufacturing, giving the country an expanding role in global value chains. Saudi exports are shifting toward intermediate and value-added goods, expanding the country’s role beyond energy into manufacturing supply chains. - Centre of Gulf Regional Trade Hub:

The UAE’s position as Saudi Arabia’s largest export destination highlights deep integration with Gulf logistics and re-export networks, reinforcing the region’s role as a global trade crossroads connecting with Asia, Africa and Europe. - Strategic Node in Global Trade Architecture:

By combining energy dominance with an expanding industrial base, Saudi Arabia functions as a critical trade node whose export patterns influence shipping lanes, trade balances and industrial input costs worldwide.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

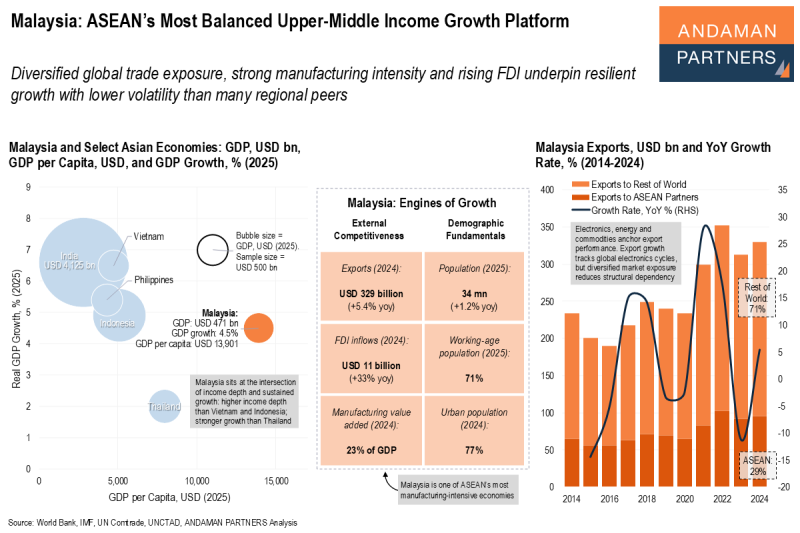

Malaysia: ASEAN’s Most Balanced Upper-Middle Income Growth Platform

Diversified global trade exposure, strong manufacturing intensity and rising FDI underpin resilient growth with lower volatility than many regional peers.

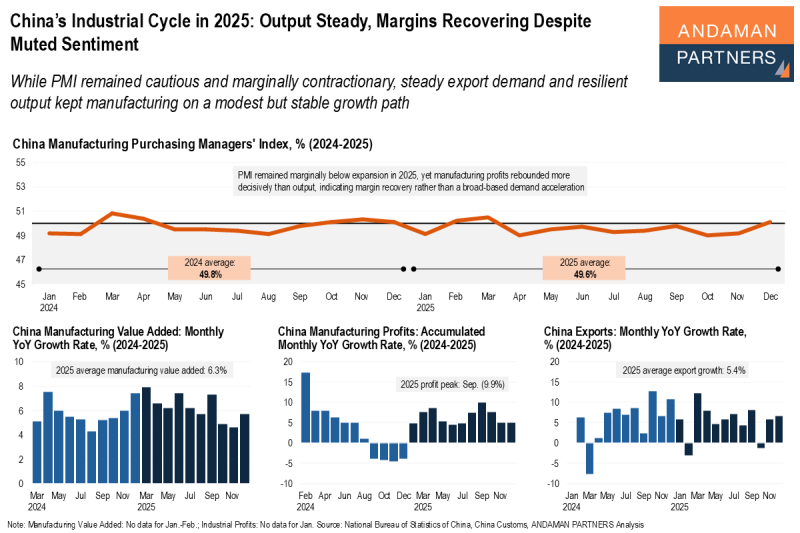

China’s Industrial Cycle in 2025: Output Steady, Margins Recovering Despite Muted Sentiment

While PMI remained cautious and marginally contractionary, steady export demand and resilient output kept manufacturing on a modest but stable growth path.

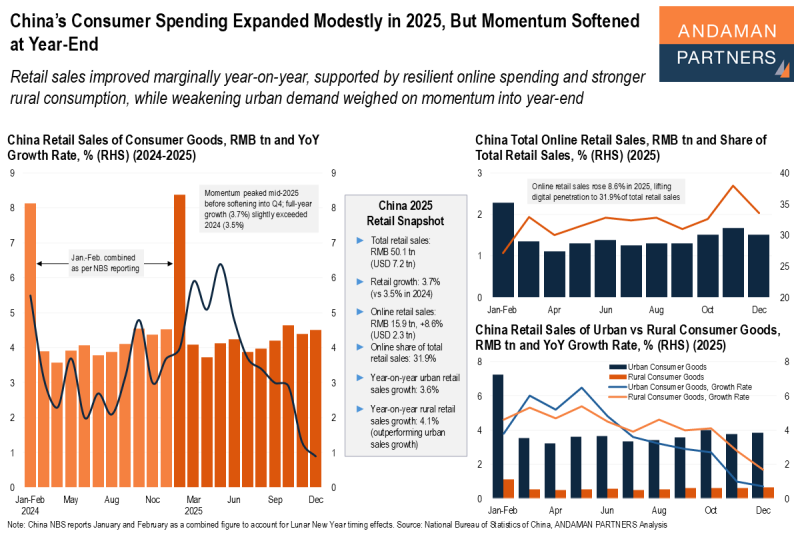

China’s Consumer Spending Expanded Modestly in 2025, But Momentum Softened at Year-End

Retail sales improved marginally year-on-year, supported by resilient online spending and stronger rural consumption.