India is emerging rapidly as one of the world’s most dynamic economies, driven by its booming manufacturing sector, rising productivity and strategic trade relationships. The country is projected to have become the world’s fourth-largest economy in 2025, and global businesses must take note of opportunities to leverage the unfolding Indian Century.

Highlights:

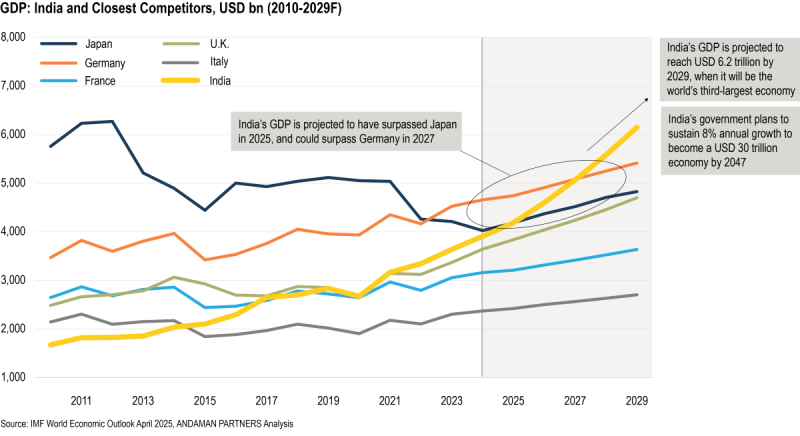

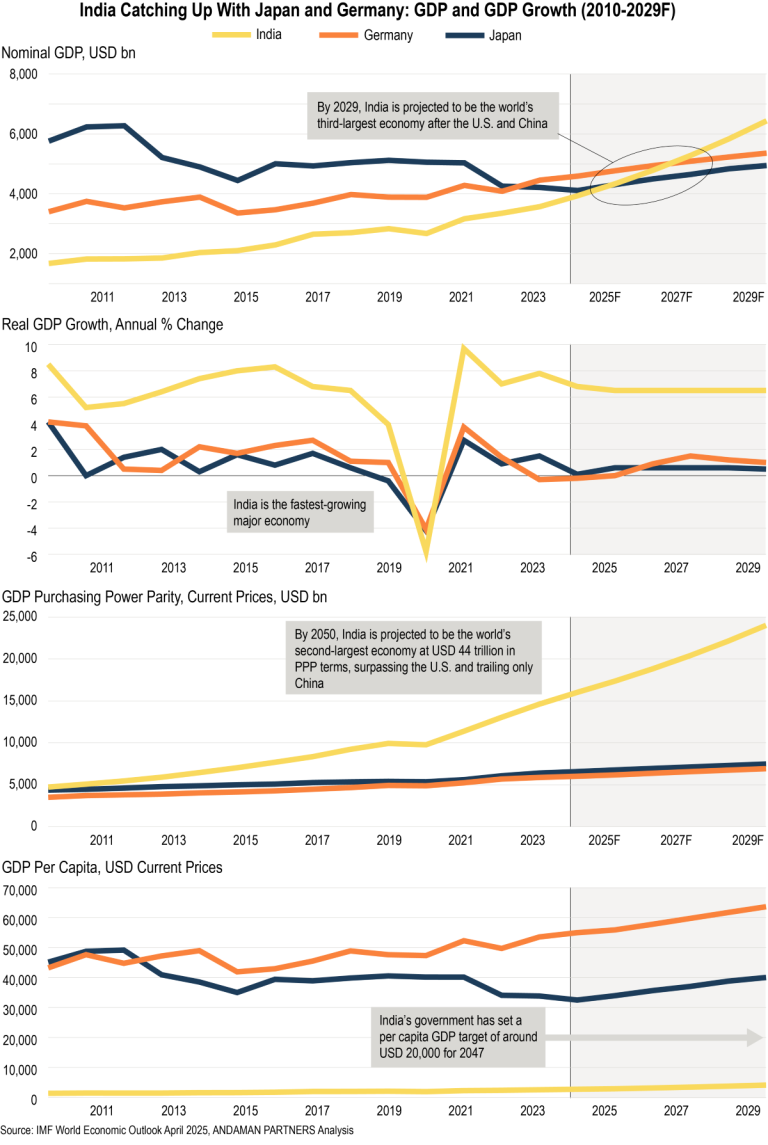

- India’s GDP surpassed USD 4 trillion in 2025 and is projected to reach USD 6.2 trillion by 2029, when India could have surpassed Germany to become the world’s third-largest economy.

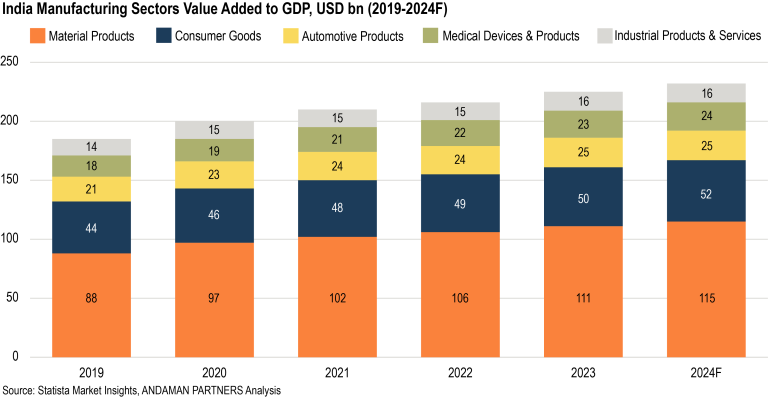

- Material Products is the largest manufacturing and value-added growth sector.

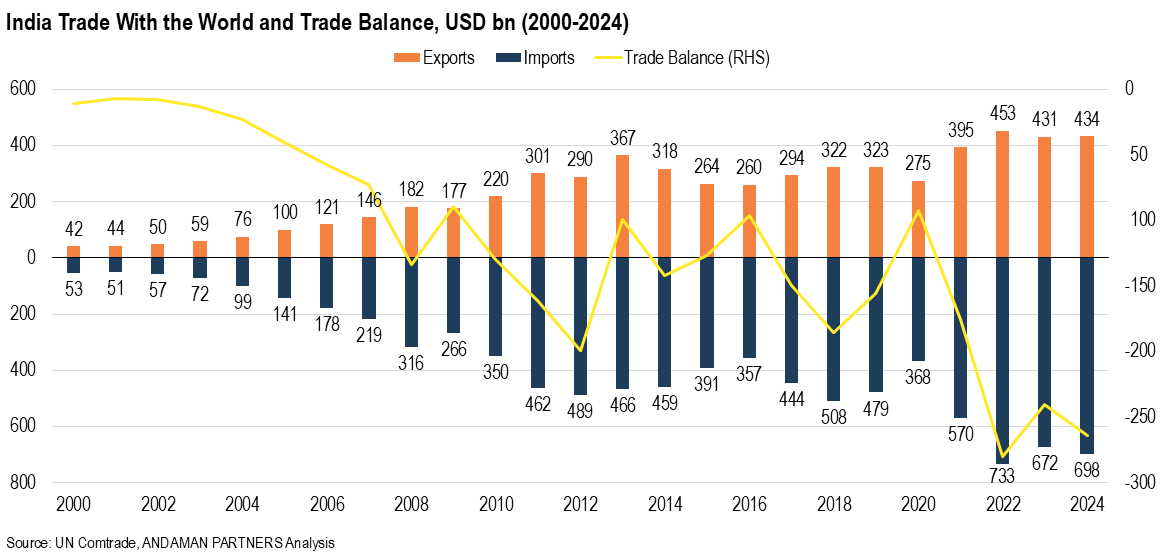

- Exports reached USD 441 billion in 2024, driven by refined petroleum, electrical machinery & equipment, mechanical machinery, diamonds and packaged medicaments.

- Imports reached USD 698 billion in 2024, driven by crude oil, coal briquettes, gold and petroleum gas.

- India’s economy will likely retain a positive growth outlook for the rest of the century, and businesses can leverage the global implications of the unfolding Indian Century.

At current prices, India became the world’s fourth-largest economy in 2025, with a projected nominal GDP of USD 4.187 trillion, surpassing Japan’s USD 4.186 trillion.

India’s GDP is projected to reach USD 6.19 trillion by 2029, when it will have surpassed Germany as the world’s third-largest economy.

India’s economic growth is supported by favourable demographics and domestic consumption, an emerging middle class and strategic reforms that attract domestic and international investment. Increased productivity, higher wages and improved employment opportunities primarily drive growth.

As the country urbanises and its workforce becomes more skilled, the manufacturing sector produces higher value-added goods and services, boosting incomes and fueling a cycle of increased consumption, savings and investment.

In 2023, India’s urbanisation rate stood at just over 36%, and this is set to surpass 40% by 2036, when the country’s urban areas will be home to around 600 million people. To serve this vast urban population, between 2024 and 2030, the government plans to spend around USD 1.7 trillion on infrastructure projects.

Per capita GDP is projected to reach USD 4,089 by 2029, which is still far behind the U.S., China, Germany, and Japan. The government has set ambitious growth targets for 2047, when the country will celebrate 100 years of independence, including a USD 30 trillion economy and per capita GDP of USD 18,000-20,000.

Material Products Industrial Base

Manufacturing is a critical driver of India’s economic transformation, with the most prominent sectors being Material Products (including metals, fabricated metal chemicals, non-metallic minerals, coke & refined petroleum, pulp & paper, rubber & plastics, textiles and wood), Consumer Goods, Automotive Products and Medical Devices.

Material Products is India’s most significant manufacturing sector, with output and value added reaching USD 847 billion and USD 115 billion, respectively, in 2024. The technology, pharmaceutical and automobile sectors are also experiencing rapid growth.

The manufacturing sector benefits from domestic consumption and export demand. Due to strong government support via initiatives like Make in India, the Automotive Products and Medical Devices sectors are emerging as important contributors to GDP. The Make in India initiative encourages companies to produce domestically and export to global markets, enhancing India’s position as a key player in global manufacturing.

Government policies such as the Production-Linked Incentive (PLI) Scheme encourage industries to scale domestic production while attracting foreign direct investment. The PLI Scheme has been instrumental in driving domestic manufacturing and bolstering exports across several sectors. Launched to reduce import dependencies and establish India as a global production hub, the Scheme has attracted billions of dollars in investments across 14 key industries, including electronics, pharmaceuticals, food processing and textiles.

Trade Profile

From just under USD 300 billion in 2017, India’s exports crossed the USD 450 billion mark in 2022, reaching USD 453 billion. This was followed by a decline to global trade disruptions. Since 2008, India has generally maintained an annual trade deficit, which was around USD 257 billion in 2024.

In 2024, India was the world’s 18th-largest exporter. Refined petroleum is the country’s largest single export, accounting for USD 75.3 billion or 17.1% of total exports in 2024. Other significant categories are electrical machinery (USD 40.2 billion) and nuclear reactors, boilers & mechanical machinery (USD 32.5 billion).

Mobile phone exports increased from USD 3.9 billion in 2020 to over USD 22.1 billion in 2024. This industry is an example of the success of the PLI Scheme. Global firms like Apple and Samsung have set up large-scale manufacturing operations in India and localised significant portions of their supply chains. This shift has reduced import dependency for key components and positioned India as a global hub for mobile phone production.

The rise of the country’s pharmaceutical sector has positioned India as a leading supplier of affordable, high-quality medicines to the world. Consumer goods exports to developed and emerging markets are also growing, driven by India’s competitive pricing and increasing manufacturing capacity.

In 2022, India’s imports exceeded USD 733 billion, making it the world’s eighth-largest importer. In 2024, imports declined to USD 698 billion. Crude petroleum accounted for almost a third (31% or USD 218 billion) of 2024 imports. Other large import categories were precious or semi-precious stones and articles thereof (USD 89 billion), electrical machinery (USD 84 billion) and mechanical machinery (USD 61 billion). India imported over USD 23 billion of integrated circuits in 2024, an increase of 131% from 2019.

Leveraging the Indian Century

India’s economy is expected to achieve sustained high growth throughout this century, benefiting from its young and growing population, technology-driven improvements in productivity and rising global influence. The country’s economic rise is supported by critical sectors such as manufacturing, exports and government initiatives to boost domestic production and self-reliance.

The implications of India’s rise will be substantial and complex, and global businesses must take note of the following opportunities to leverage the unfolding Indian Century:

- Tap into India’s consumption boom. A rapidly-growing middle class and increasing disposable incomes are driving demand across retail, e-commerce, food, fashion and lifestyle markets. Businesses must align with evolving preferences and digital-first shopping trends.

- Source strategically from India. India’s expanding role in global supply chains offers cost-effective sourcing opportunities, especially in textiles, pharmaceuticals, technology components and sustainable logistics.

- Set up manufacturing in India. Competitive labour, policy incentives and industrial growth make India a prime hub for production. Businesses can benefit from sector-focused government initiatives, including electronics, automotive and renewable energy.

- Utilise India’s services. India is a global leader in IT, financial services, logistics and healthcare. Businesses can leverage outsourcing, fintech innovation and AI-driven efficiencies to optimise operations.

- Attract Indian travellers abroad. With rising disposable incomes and a strong travel culture, Indian tourists are exploring international destinations in record numbers. Businesses can tailor offerings to their preferences, from luxury shopping and culinary experiences to digital-first booking solutions and visa facilitation.

- Stay ahead of India’s policy shifts. Trade regulations, import duties, export incentives and free trade agreements are evolving rapidly. Staying informed ensures businesses align with market advantages and regulatory compliance

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

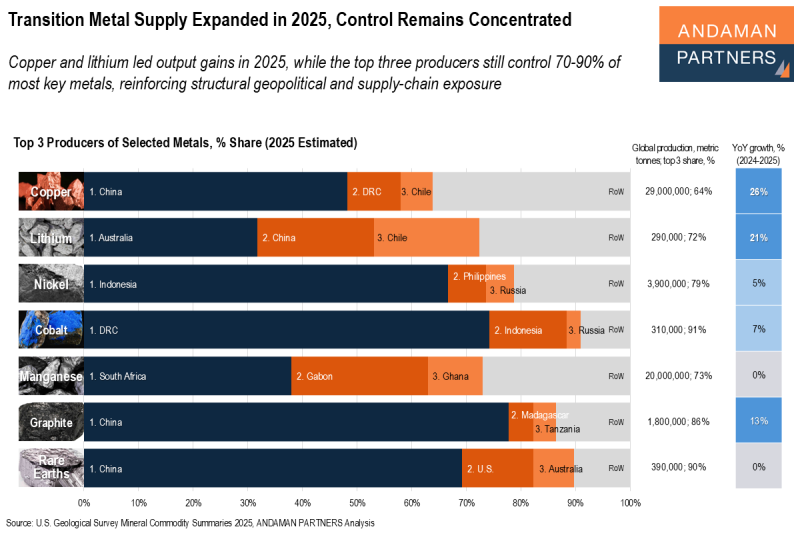

Transition Metal Supply Expanded in 2025, Control Remains Concentrated

Copper and lithium led output gains in 2025, while the top three producers still control 70-90% of most key metals.

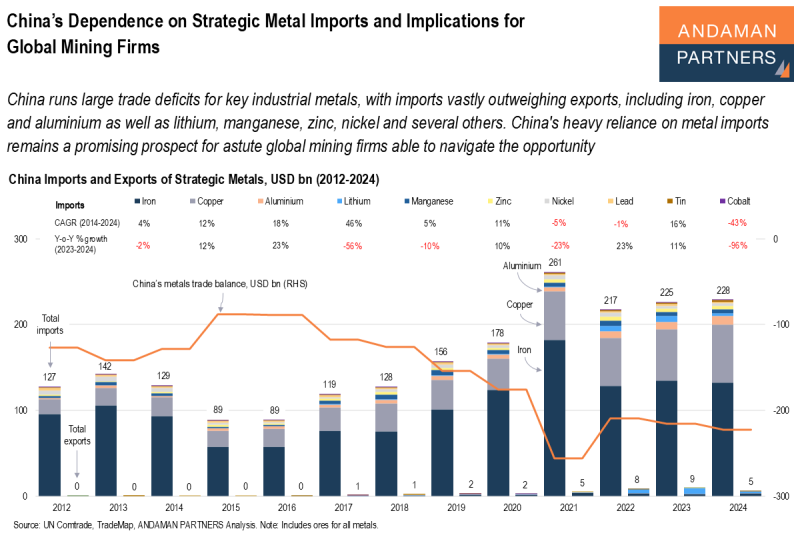

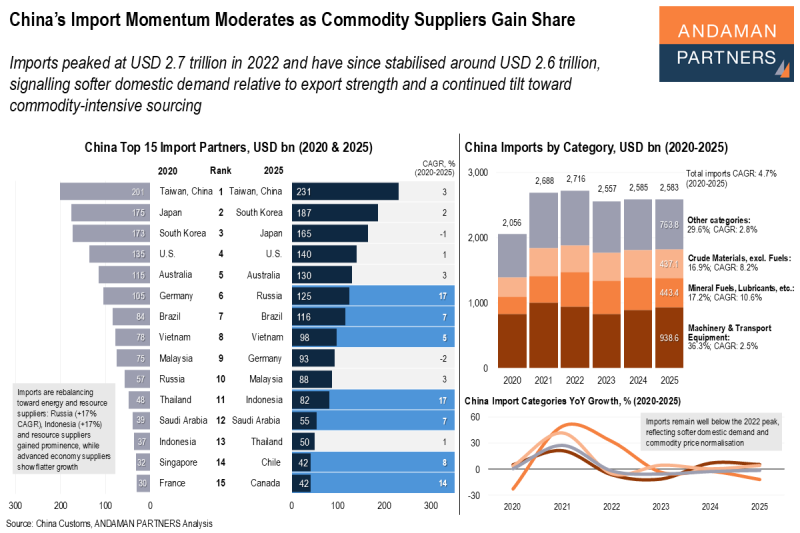

China’s Import Momentum Moderates as Commodity Suppliers Gain Share

Imports have stabilised around USD 2.6 trillion, signalling softer domestic demand and a continued tilt toward commodity-intensive sourcing.

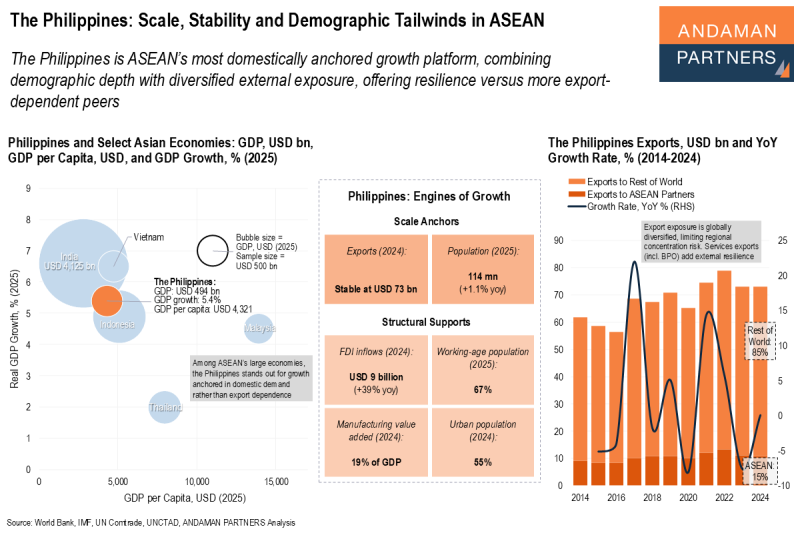

The Philippines: Scale, Stability and Demographic Tailwinds in ASEAN

The Philippines is ASEAN’s most domestically anchored growth platform, combining demographic depth with diversified external exposure.