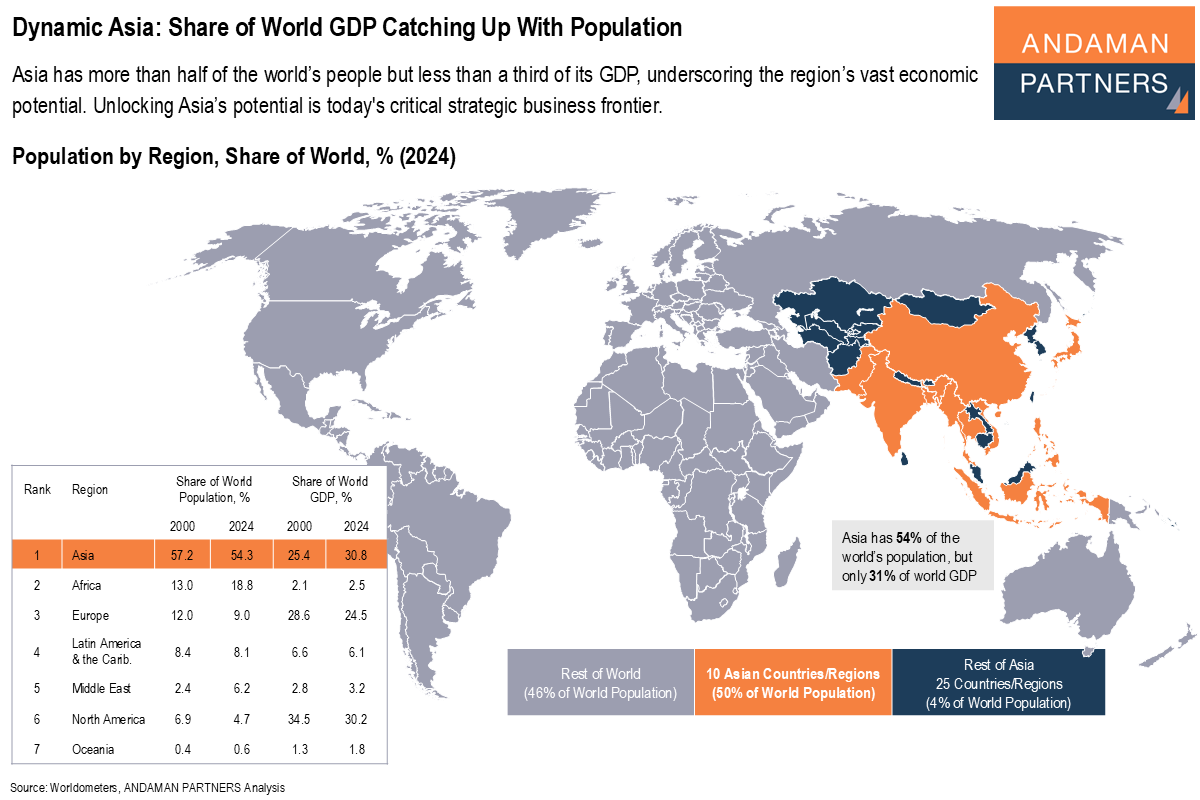

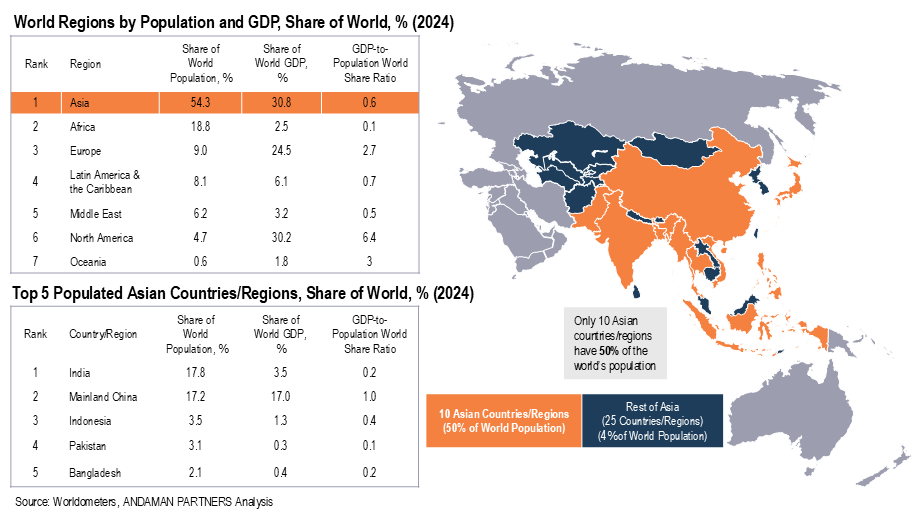

Asia has more than half of the world’s people but less than a third of its GDP, underscoring the region’s vast economic potential. Unlocking Asia’s potential is today’s critical strategic business frontier.

A regional comparison of world population and GDP in 2024 reveals some distinctive features:

- Asia accounts for 54% of the world’s population, yet only 31% of its GDP. Only ten Asian countries/regions account for half the world’s population, but only 29% of the world’s GDP.

- India and Mainland China combined represent more than a third of humanity; in terms of GDP, the two countries account for only 20.5%, with Mainland China contributing 17%.

- Conversely, Europe has 9% of the world’s population and North America has less than 5%, but they account for 24.5% and 30.2% of the world’s GDP, respectively.

By looking back to 2000 and projecting into the future beyond 2024, we can observe some clear historical trends that are of vital importance to companies and investors operating in the world of today:

- From 2000 to 2024, Asia’s share of the world’s population decreased slightly from 57.2% to 54.3%, due primarily to declining population growth in several Asian countries (e.g., China, South Korea, Japan). Africa (13% to 18.8%) and the Middle East (2.4% to 6.2%) were the only regions whose share of the world’s population increased significantly.

- From 2000 to 2024, Asia’s share of the world’s GDP increased from 25.4% to 30.8%, the only region whose share increased significantly. Both Africa and the Middle East’s share of world GDP increased by only 0.4% to 2.5% and 3.2%, respectively, while the share of Europe, North America and Latin America all declined.

- From the current vantage point, if faster-than-global growth persists for the next few decades in large Asian economies (e.g., India, Indonesia, ASEAN) and the region’s population growth continues to decline, Asia’s share of the world’s GDP could catch up with its share of the world’s population by around 2055-2065.

The Asian Century (and Opportunity)

The coming equalisation of Asia’s share of the world population and GDP will be a profound global development with immense implications for the world economy. Over the next few decades, economic power will be massively redistributed to Asia, the world’s most dynamic region, radically transforming trade routes, capital flows, markets and political influence.

Unlocking Asia’s potential is today’s critical strategic business frontier, and it is imperative to shift capital investments to Asia and build deeper trade relationships in the region. Investors and companies worldwide must confront the reality that the global economy is gradually but inexorably shifting towards Asia and take the appropriate actions to turn this reality into a business opportunity.

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

AAMEG Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to sponsor and support the AAMEG pre-Mining Indaba Cocktails & Canapes event.

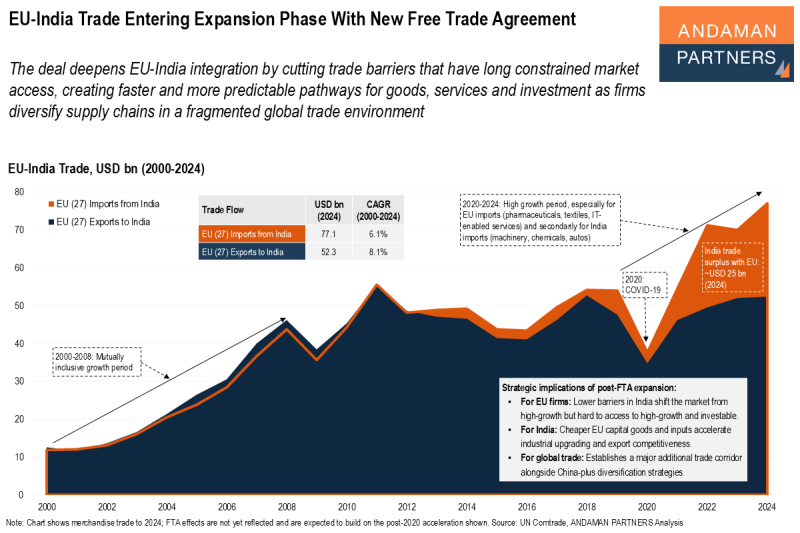

EU-India Trade Entering Expansion Phase With New Free Trade Agreement

The deal deepens EU-India integration by cutting trade barriers that have long constrained market access.

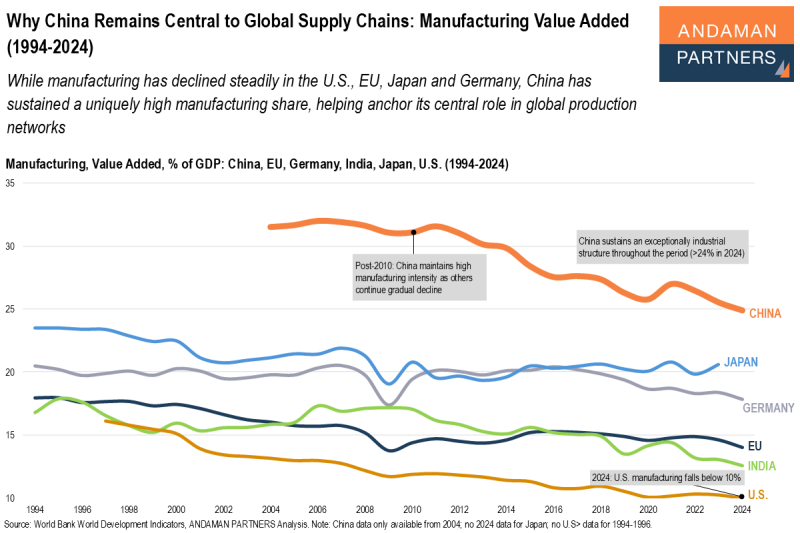

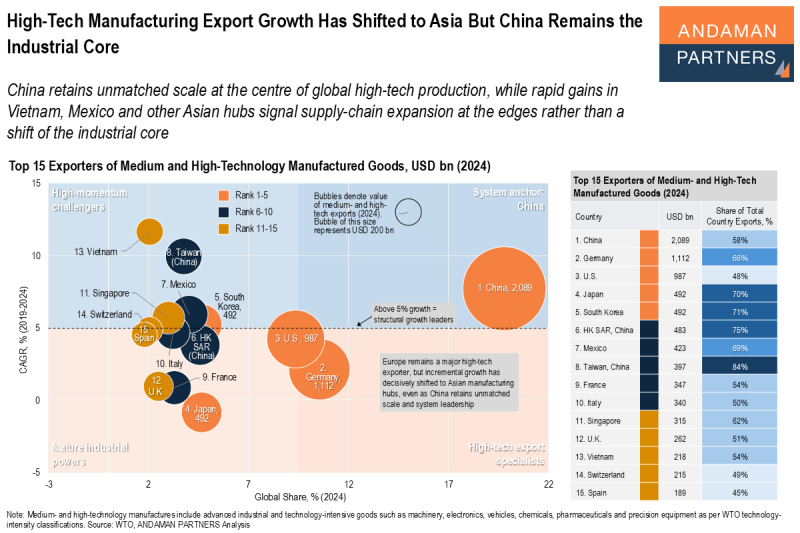

High-Tech Manufacturing Export Growth Has Shifted to Asia, But China Remains the Industrial Core

China retains unmatched scale at the centre of global high-tech production, while rapid gains in Vietnam, Mexico and other Asian hubs.

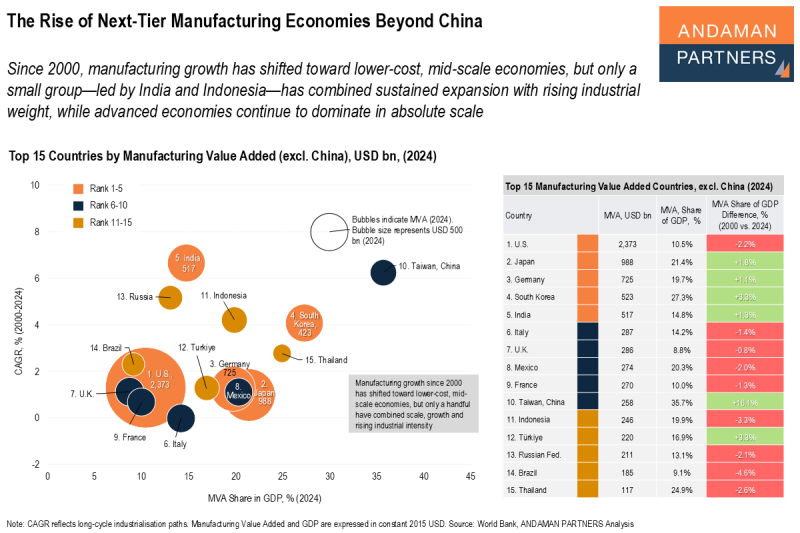

The Rise of Next-Tier Manufacturing Economies Beyond China

Manufacturing growth shifted toward lower-cost, mid-scale economies, but only a small group has combined sustained expansion with rising industrial weight.