ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS presents perspectives on selected key issues related to China in the global mining sector.

China remains one of the world’s largest producers of resources and the largest consumer, and it is typically the largest importer of commodities and, hence, a massive market (and customer) for global producers. It dominates much of the world’s mineral processing and related supply chains, including several critical minerals. And it is a significant investor and finance partner to the industry. Moreover, it has become a prominent engineering, procurement and construction partner for mining projects and operations worldwide.

China’s resource sector role is complex, comprehensive and consequential.

China’s growth may be slowing and its demand growth for selected minerals and fuels may be peaking. But now is the time to form a comprehensive view of China’s role in the sector and to become more — not less — strategically engaged.

Please see the option below to view or download the presentation in full.

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

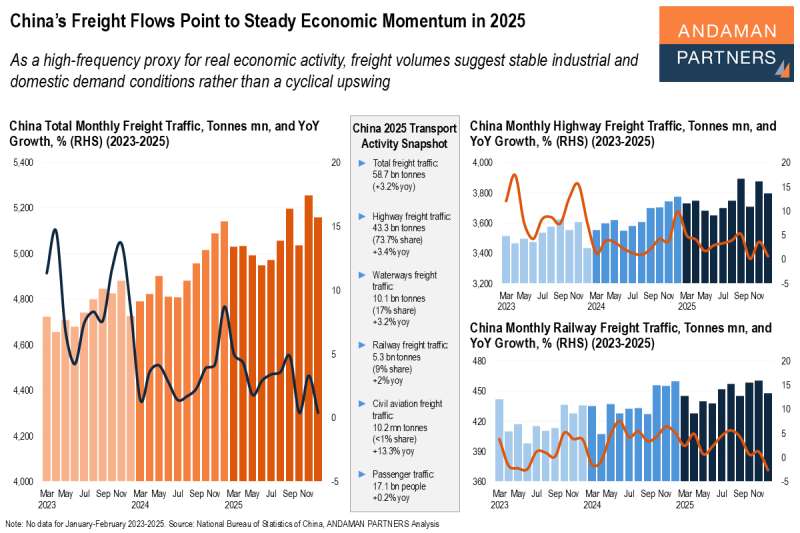

Freight volumes suggest stable conditions in industrial and domestic demand rather than a cyclical upswing.

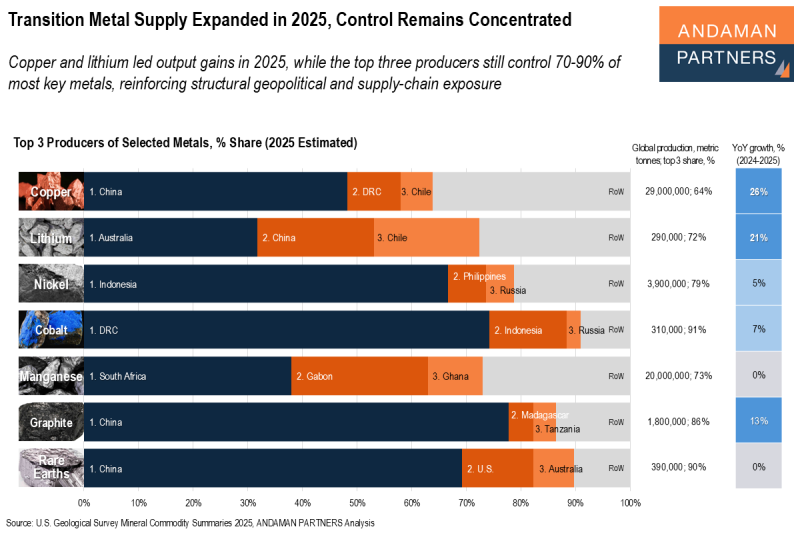

Copper and lithium led output gains in 2025, while the top three producers still control 70-90% of most key metals.

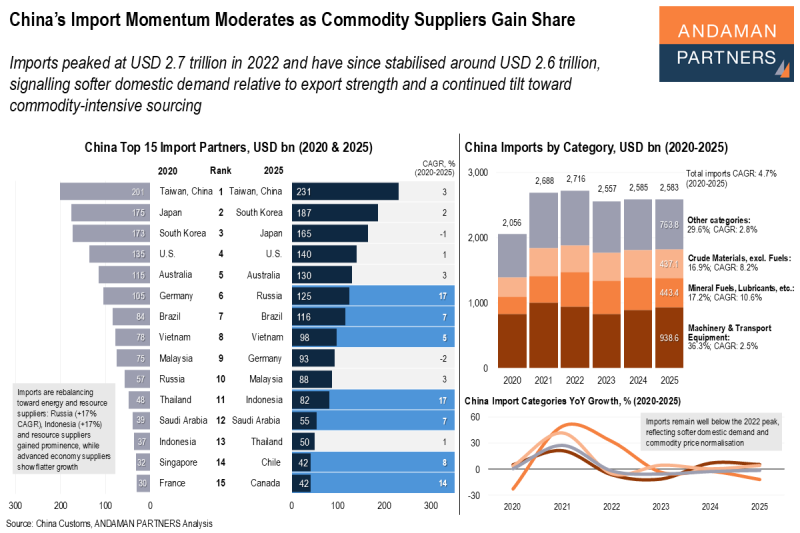

Imports have stabilised around USD 2.6 trillion, signalling softer domestic demand and a continued tilt toward commodity-intensive sourcing.