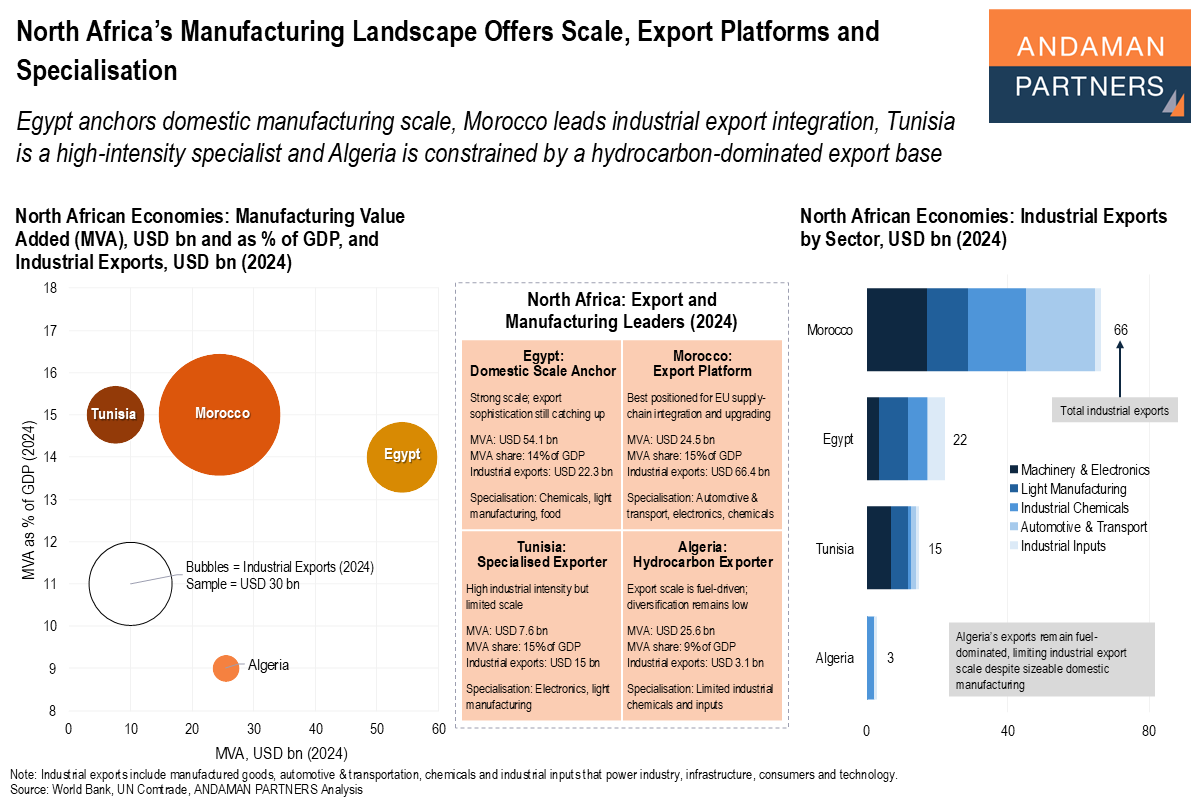

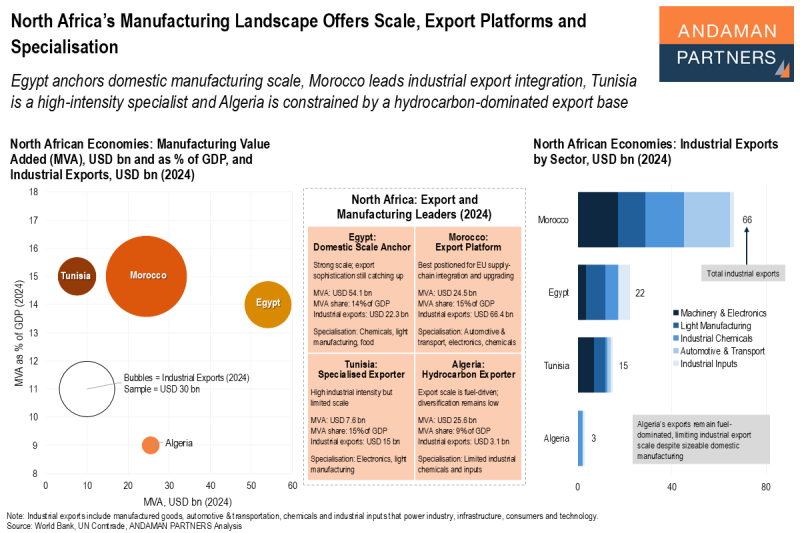

Egypt anchors domestic manufacturing scale, Morocco leads industrial export integration, Tunisia is a high-intensity specialist and Algeria is constrained by a hydrocarbon-dominated export base.

North Africa offers a compelling manufacturing proposition for global firms seeking nearshore capacity, cost-competitive production and proximity to European and Middle Eastern demand. The region’s industrial opportunity is concentrated in four economies—Egypt, Morocco, Tunisia and Algeria—which collectively account for the overwhelming majority of North Africa’s manufacturing value added (MVA) and export scale, and represent four distinct models for industrial growth.

Egypt is the region’s clear domestic scale anchor, with USD 54.1 billion in manufacturing value added in 2024 and an MVA share of 14% of GDP. Industrial exports total USD 22.3 billion, reflecting a broad base across chemicals, light manufacturing, and food-linked industries, but export sophistication still lags behind the scale of domestic production.

Morocco is North Africa’s standout export platform. While its MVA is smaller at USD 24.5 billion, its industrial export engine is the region’s largest at USD 66.4 billion, underpinned by strong integration into European supply chains. Export strength is concentrated in automotive and transport, machinery and electronics and industrial chemicals, all of which are aligned with higher-value-added manufacturing.

Tunisia is a smaller but highly industrialised specialist, with MVA of USD 7.6 billion but a high MVA share of 15% of GDP. Its USD 15 billion in industrial exports highlights deep integration into export-oriented light manufacturing and electronics supply chains, though limited domestic scale constrains overall volume.

Algeria, by contrast, combines meaningful manufacturing value (USD 25.6 billion) with the lowest industrial export scale (USD 3.1 billion) and the lowest MVA intensity (9% of GDP), reflecting an export economy still dominated by hydrocarbons and limited diversification into tradable industrial sectors.

North Africa offers clear strategic options: scale in Egypt, export-led platforms in Morocco, specialised production in Tunisia and selective downstream potential in Algeria.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

North Africa’s Manufacturing Landscape Offers Scale, Export Platforms and Specialisation

Egypt anchors domestic manufacturing scale, Morocco leads industrial export integration and Tunisia is a high-intensity specialist.

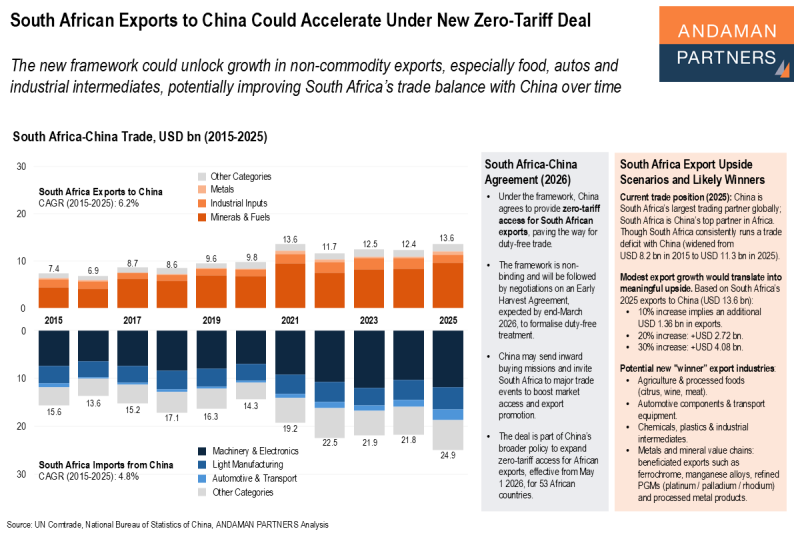

South African Exports to China Could Accelerate Under New Zero-Tariff Deal

The new framework could unlock growth in non-commodity exports, especially food, autos and industrial intermediates.

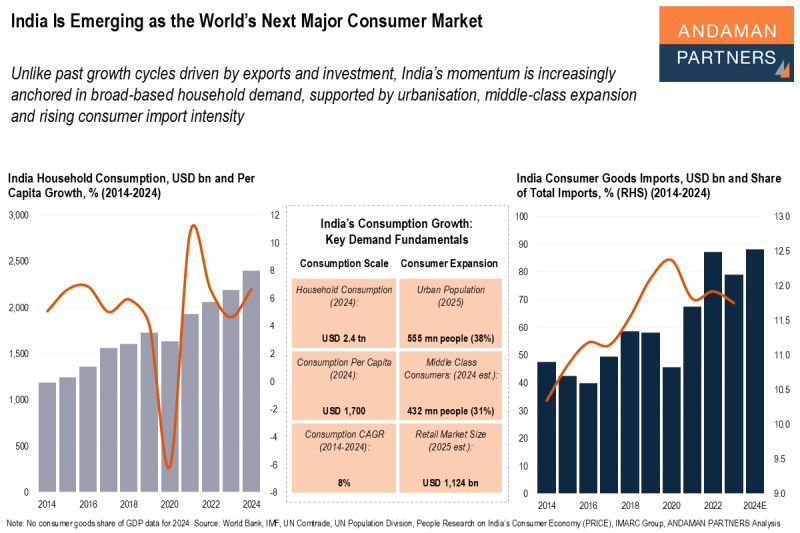

India Is Emerging as the World’s Next Major Consumer Market

India’s momentum is anchored in broad-based household demand, supported by urbanisation, middle-class expansion and consumer import intensity.