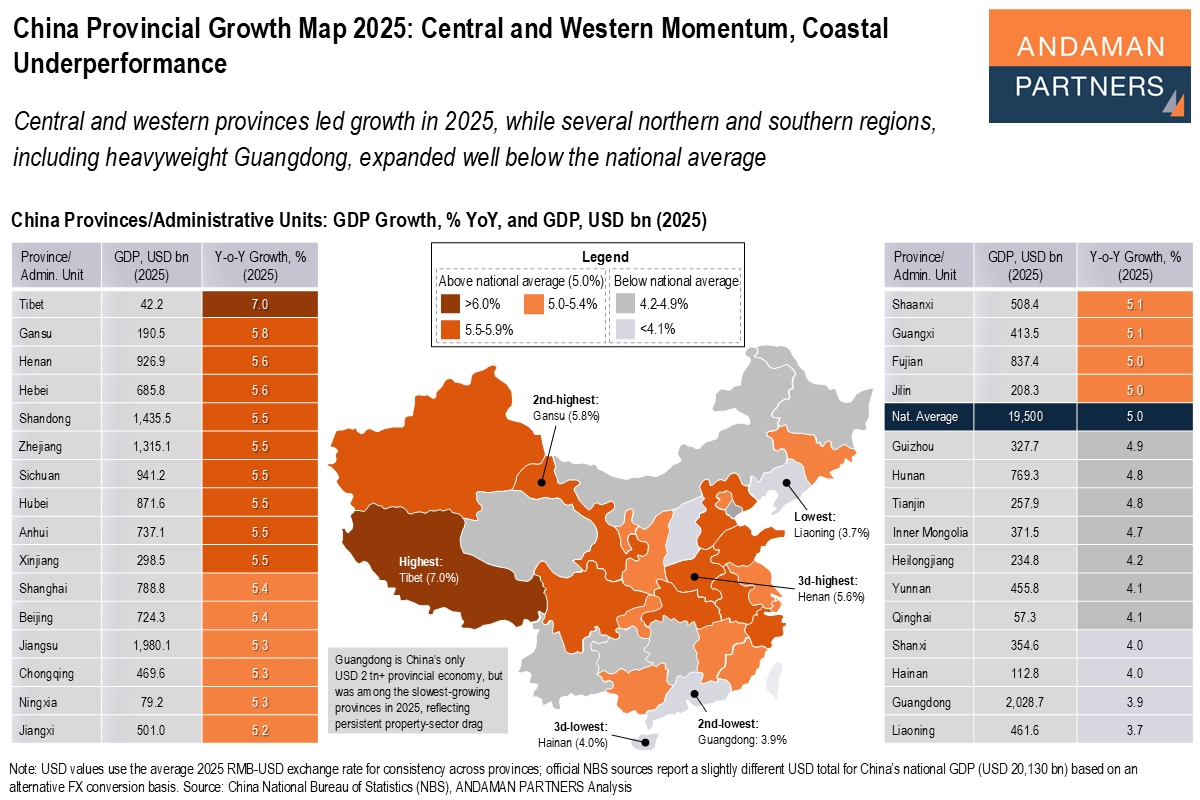

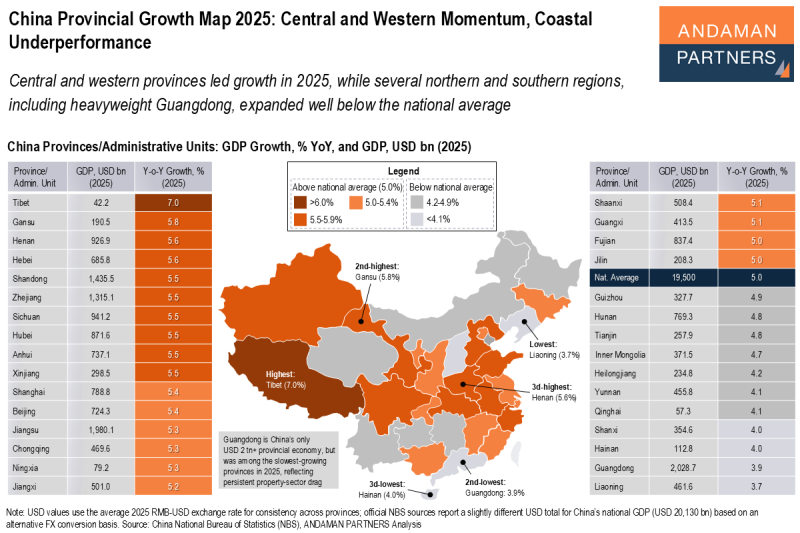

Central and western provinces led growth in 2025, while several northern and southern regions, including heavyweight Guangdong, expanded well below the national average.

China’s provincial growth map in 2025 highlights a clear regional divergence: momentum strengthened across the central and western interior, while several major coastal and peripheral provinces lagged the national pace.

On the upside, growth leadership came from the west and parts of central China. Tibet led all regions at 7.0%, followed by Gansu (5.8%) and Henan (5.6%), reinforcing that inland demand, public investment and infrastructure-heavy activity strongly supported growth in 2025.

A broad group of large central and eastern provinces also delivered solid above-average growth, including Hebei (5.6%), Shandong (5.5%), Zhejiang (5.5%), Sichuan (5.5%), Hubei (5.5%), Anhui (5.5%) and Xinjiang (5.5%). Major metropolises such as Shanghai (5.4%) and Beijing (5.4%) also outperformed modestly, while export-linked manufacturing giants like Jiangsu (5.3%) and Chongqing (5.3%) remained close to trend.

By contrast, underperformance was concentrated in parts of the northeast and the south. Liaoning posted the weakest growth at 3.7%, while Hainan (4.0%), Shanxi (4.0%), Qinghai (4.1%) and Yunnan (4.1%) all came in well below the national average of 5.0%.

The most notable laggard was Guangdong, China’s only USD 2 trillion-plus provincial economy, which expanded at just 3.9%. This reflects the continued drag from the property downturn, weaker construction-linked demand and slower momentum in consumer and export-facing activity. Guangdong’s slow pace highlights that even China’s most globally integrated coastal growth engines faced a more challenging operating environment in 2025.

Looking ahead to 2026, the key question is whether the inland-led pattern persists or whether coastal growth re-accelerates. If policy support continues to favour infrastructure investment, industrial upgrading and strategic manufacturing, central and western provinces are likely to remain resilient. However, a stabilisation in the property sector and a recovery in external demand would disproportionately benefit China’s coastal export and consumption hubs.

Overall, 2026 will likely be defined by whether China’s traditional coastal engines regain momentum or whether growth remains anchored in inland regions.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

China Provincial Growth Map 2025: Central and Western Momentum, Coastal Underperformance

Central and western provinces led growth in 2025, while several northern and southern regions expanded well below the national average.

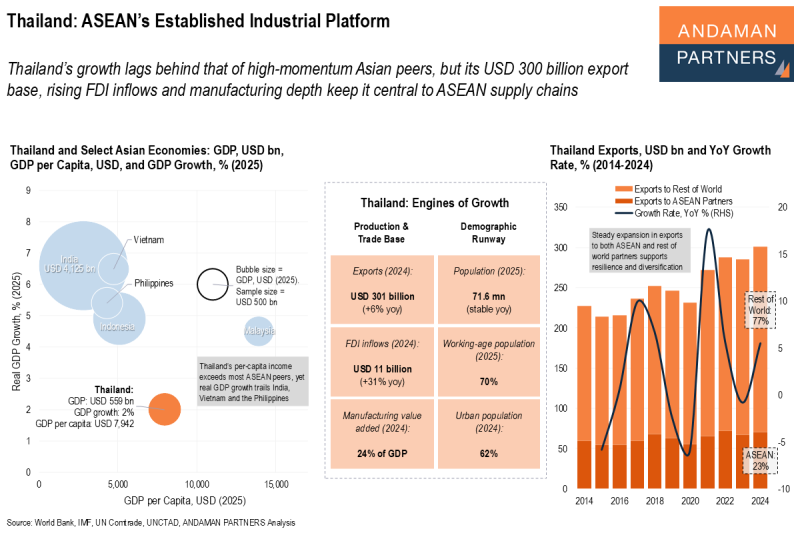

Thailand: ASEAN’s Established Industrial Platform

Thailand’s USD 300 billion export base, rising FDI inflows and manufacturing depth keep it central to ASEAN supply chains.

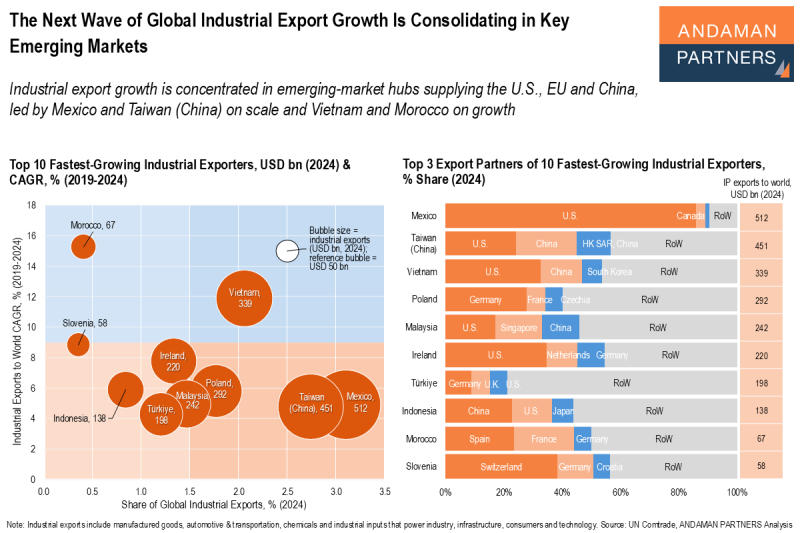

The Next Wave of Global Industrial Export Growth Is Consolidating in Key Emerging Markets

Industrial export growth is concentrated in emerging-market hubs supplying the U.S., EU and China, led by Mexico and Taiwan (China).