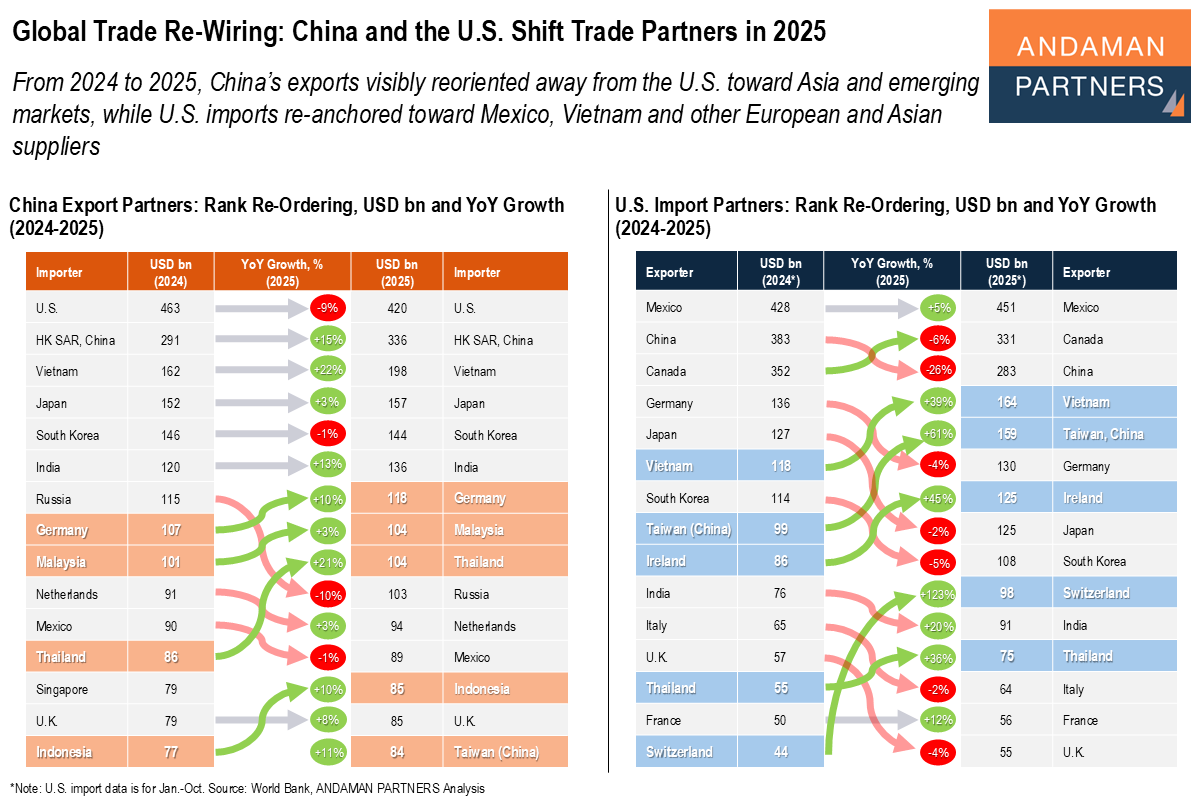

From 2024 to 2025, China’s exports visibly reoriented away from the U.S. toward Asia and emerging markets, while U.S. imports re-anchored toward Mexico, Vietnam and other European and Asian suppliers.

Between 2024 and 2025, the partner rankings behind China’s exports and U.S. imports both shifted in ways that signal a faster-than-expected re-wiring of the global trade system. This occurred not through radical changes in volumes, but through marginal growth among trade partners.

On China’s export side, the U.S. remains the largest single destination, but exports to the U.S. are in contraction (-9%). In contrast, the strongest momentum sits in Asia and adjacent emerging markets: Vietnam (+22%), Hong Kong (+15%) and India (+13%) all expanded at scale. Several climbers combined meaningful size with positive growth, such as Thailand (+21%), Indonesia (+11%) and Taiwan, China (+10%), indicating that much of China’s incremental export growth is being absorbed by regional and near-regional hubs rather than by the U.S. market.

On the U.S. import side, the story is even starker: imports from China fell steeply (-26%), while alternative suppliers surged. Vietnam (+39%), Taiwan, China (+61%), Ireland (+45%), Thailand (+36%) and Switzerland (+123%) all rose rapidly, and several moved up the ranking at the same time. Mexico grew modestly (+5%) but held its top position, reinforcing that the U.S. is not simply reshoring; it is deepening reliance on a new mix of nearshore and high-value overseas suppliers.

These changes in the trade patterns of the world’s two largest economies have widespread implications. Supplier concentration risk is changing shape: China exposure may be falling, but dependence is reappearing in fewer fast-rising substitutes. Pricing and negotiating leverage, moreover, is shifting toward the new winners, especially in Asia’s manufacturing belt and selected European niches. Competitive advantage will increasingly hinge on how quickly firms rebuild qualification, compliance and dual-sourcing across these new anchor partners.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

AAMEG Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to sponsor and support the AAMEG pre-Mining Indaba Cocktails & Canapes event.

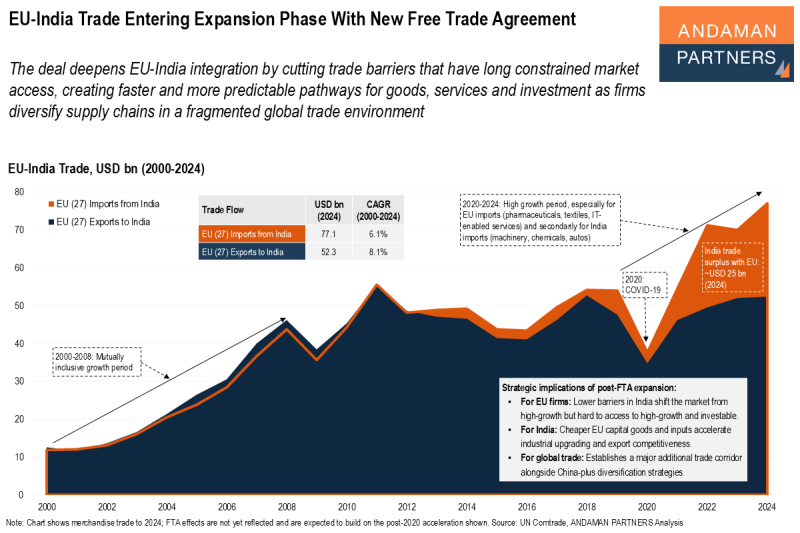

EU-India Trade Entering Expansion Phase With New Free Trade Agreement

The deal deepens EU-India integration by cutting trade barriers that have long constrained market access.

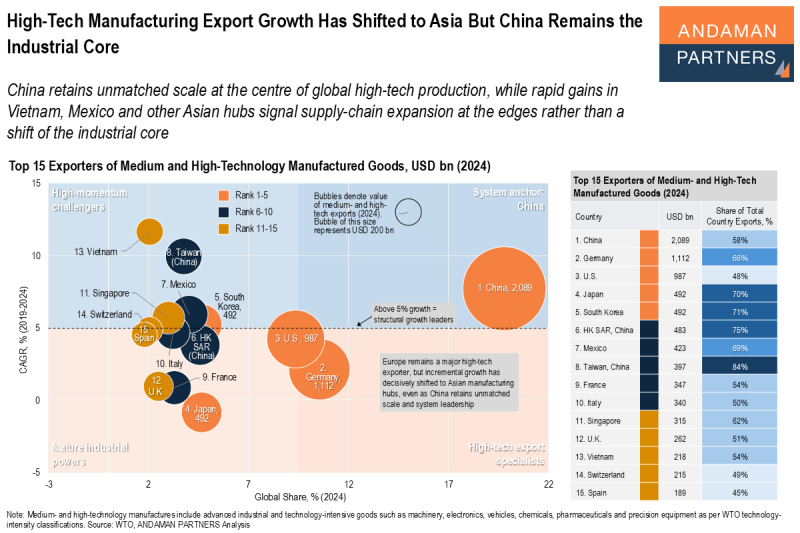

High-Tech Manufacturing Export Growth Has Shifted to Asia, But China Remains the Industrial Core

China retains unmatched scale at the centre of global high-tech production, while rapid gains in Vietnam, Mexico and other Asian hubs.

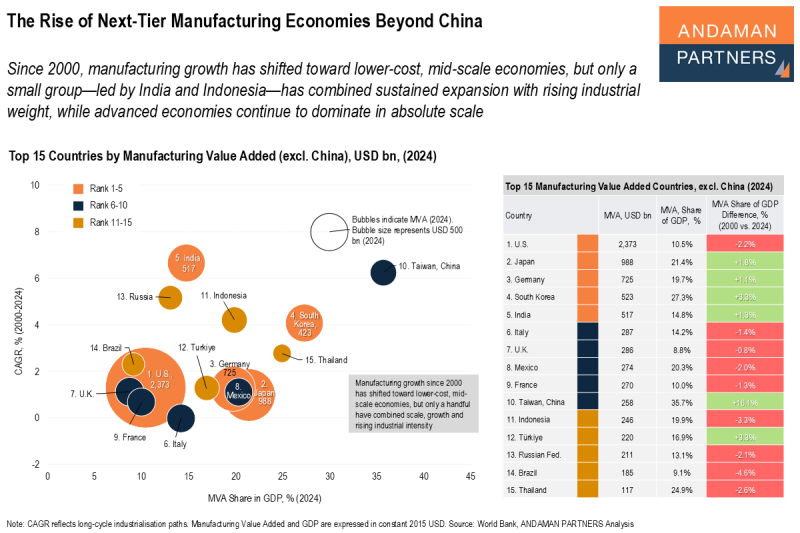

The Rise of Next-Tier Manufacturing Economies Beyond China

Manufacturing growth shifted toward lower-cost, mid-scale economies, but only a small group has combined sustained expansion with rising industrial weight.