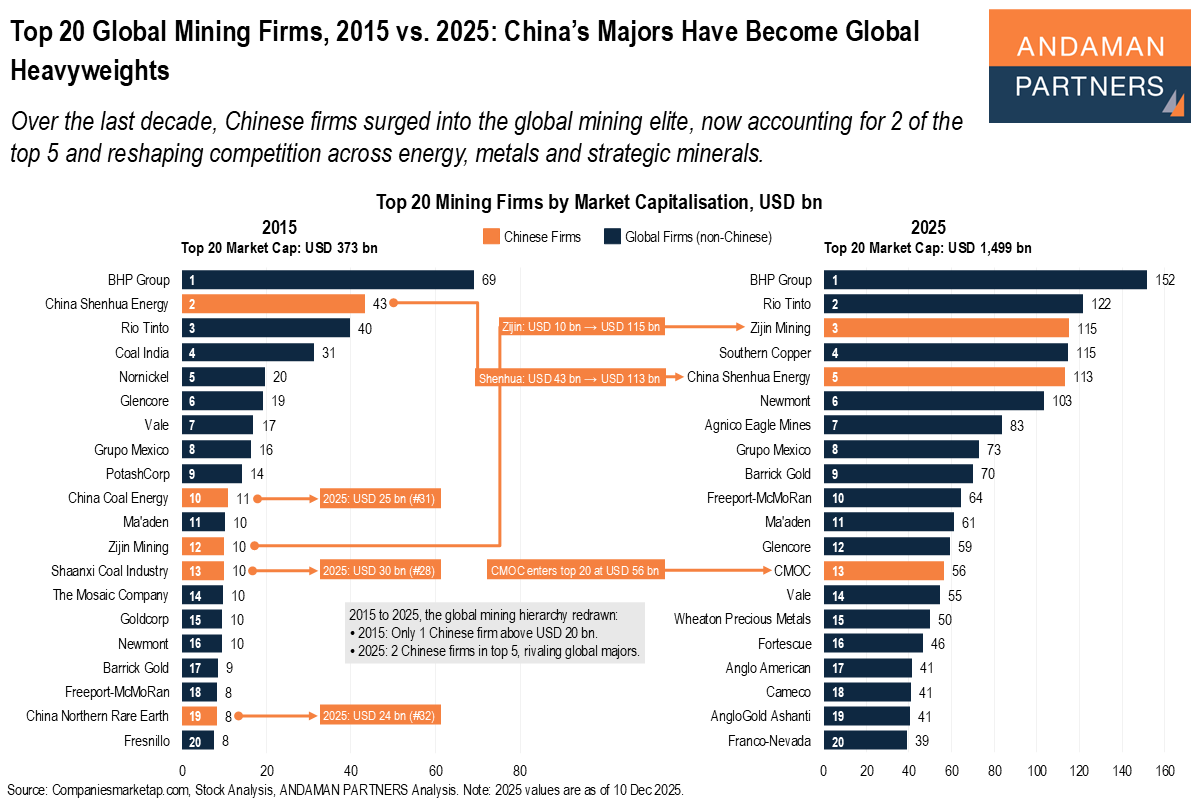

Over the last decade, Chinese firms surged into the global mining elite, now accounting for 2 of the top 5 and reshaping competition across energy, metals and strategic minerals.

From 2015 to 2025, the global mining hierarchy shifted decisively as Chinese firms moved from mid-tier positions into the industry’s top ranks, reshaping competitive power across energy, metals and strategic minerals.

In 2015, only one Chinese miner, China Shenhua, stood among the global heavyweights with a market cap of USD 43 billion, while the rest of China’s majors occupied the lower half of the top 20. By 2025, the picture had transformed: Zijin Mining and China Shenhua were both among the global top five, with valuations exceeding USD 110 billion, while CMOC joined the top 20, increasing its market cap from below USD 10 billion in 2015 to USD 56 billion in 2025.

The global non-Chinese majors still anchor the sector—BHP remains #1 and Rio Tinto #2—but China’s rapid rise signals a structural realignment in control over key resources such as copper, gold, battery metals and coal. China is no longer a peripheral player but a central force shaping capital flows, supply security and long-term strategic competition in the global mining system.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

AAMEG Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to sponsor and support the AAMEG pre-Mining Indaba Cocktails & Canapes event.

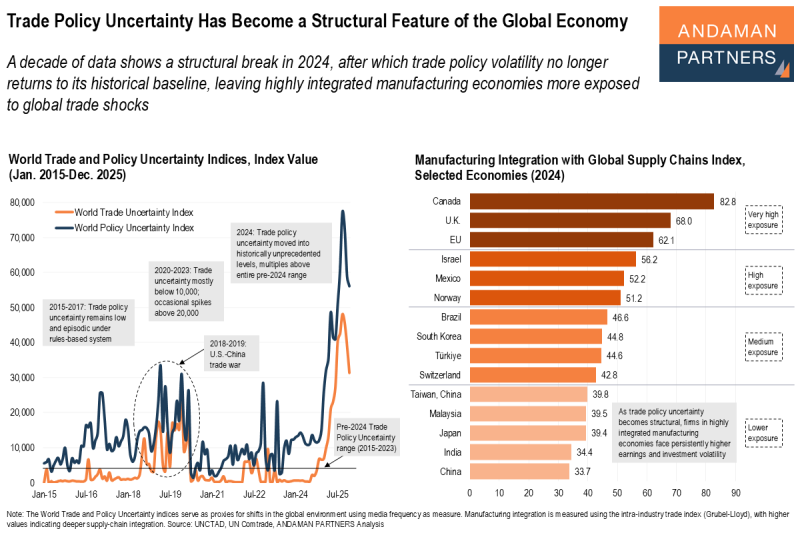

Trade Policy Uncertainty Has Become a Structural Feature of the Global Economy

A decade of data shows a structural break in 2024, after which trade policy volatility no longer returns to its historical baseline.

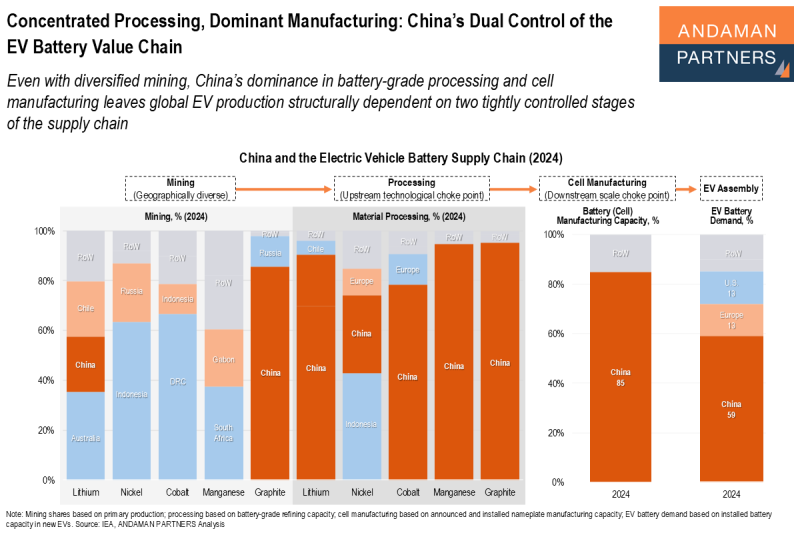

Concentrated Processing, Dominant Manufacturing: China’s Dual Control of the EV Battery Value Chain

China’s dominance in battery-grade processing and cell manufacturing leaves global EV production dependent on two stages of the supply chain.

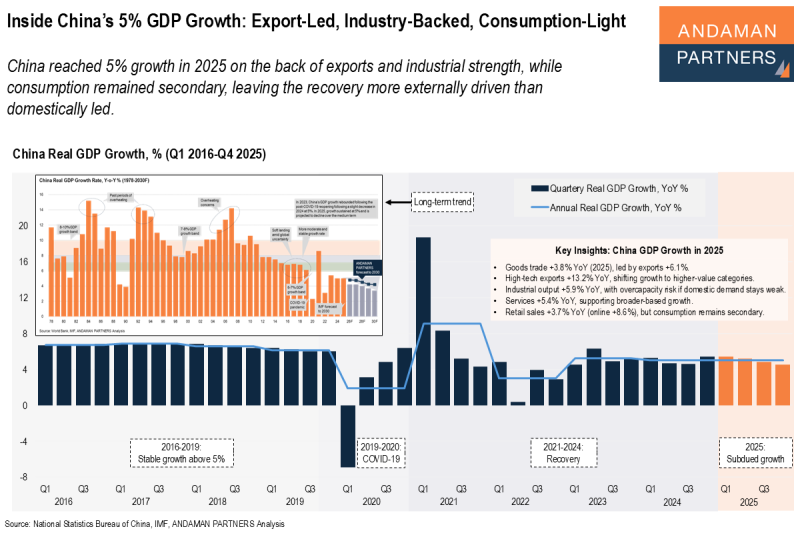

Inside China’s 5% GDP Growth: Export-Led, Industry-Backed, Consumption-Light

China reached 5% growth in 2025 on the back of exports and industrial strength, while consumption remained secondary.