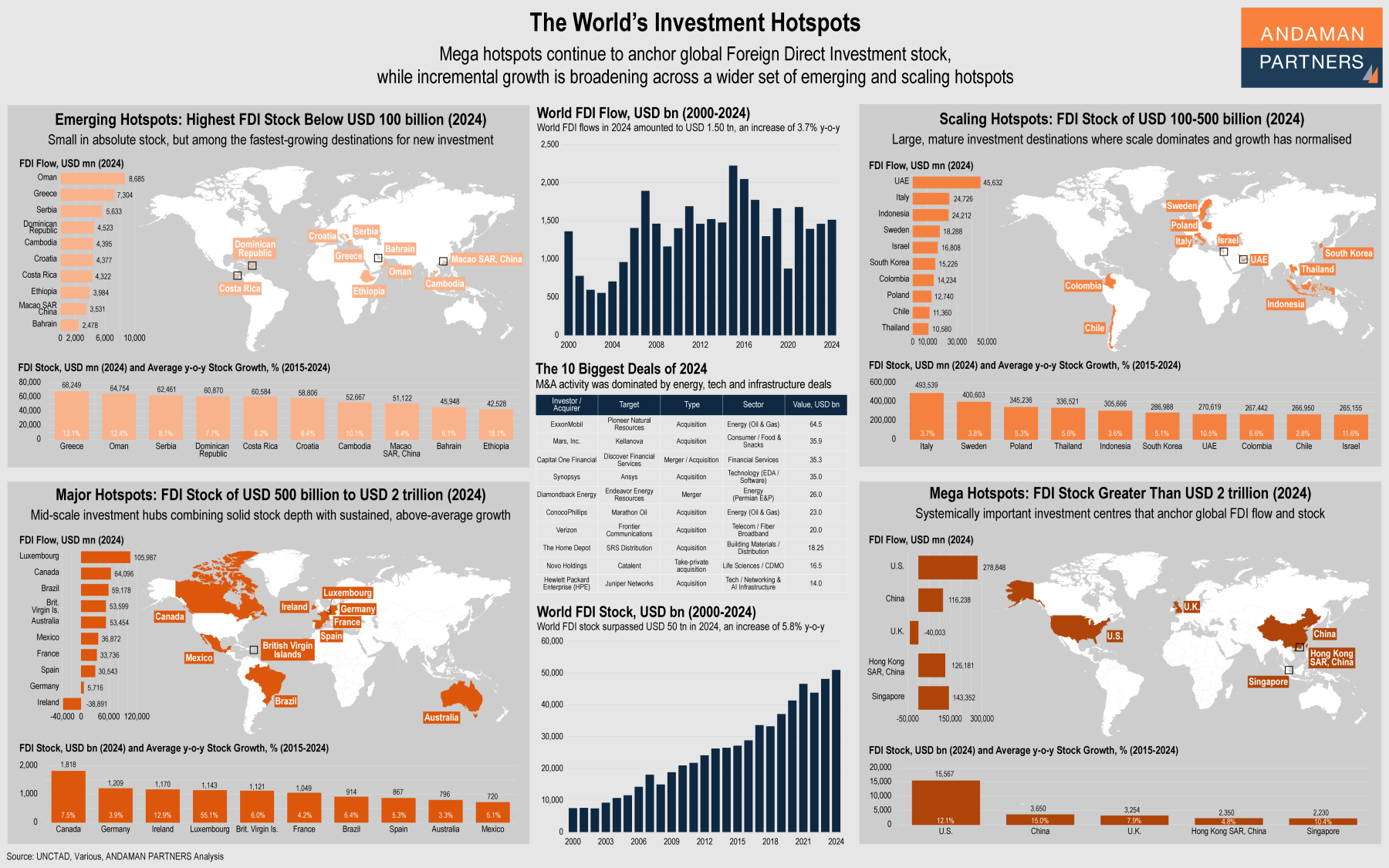

Global investment today is defined less by a single set of winners than by a widening gap between where capital already operates and where new momentum is emerging.

Mega Hotspots: The Anchors of Global Investment

At the top end, a small group of mega hotspots continues to anchor the global system. The U.S., China, the U.K., Hong Kong SAR and Singapore account for a disproportionate share of global Foreign Direct Investment (FDI) stock. These economies benefit from deep capital markets, institutional scale, legal certainty and dense corporate ecosystems. Their dominance is structural, not cyclical. Even when annual investment flows fluctuate, accumulated stock remains highly concentrated, reinforcing their central role in global capital allocation, financing and control of multinational value chains.

Both the U.S. and China continue to post solid FDI stock growth in absolute terms, underscoring that scale and growth are not mutually exclusive at the top of the system.

Major Hotspots: Scale With Diminishing Momentum

The next tier comprises large, mature investment destinations such as Canada, Germany, Ireland and Luxembourg. These economies hold substantial investment stock, often built around advanced manufacturing, finance and high-value services. Growth in these markets has moderated compared with earlier phases, reflecting market maturity rather than loss of relevance. In several cases, headline volatility in annual flows masks stable long-term accumulation driven by reinvested earnings and intra-company financing.

This tier represents depth, institutional stability and operational reliability, but with fewer growth opportunities than in smaller markets.

Scaling Hotspots: Where Expansion Is Most Balanced

Investment growth dynamics are no longer confined to the largest economies. While mega and major hotspots continue to expand in absolute terms, incremental growth is increasingly spread across a broader set of destinations. This is visible in the rise of scaling and emerging hotspots, countries with smaller absolute stock, but higher growth over the past decade.

These economies are not replacing the mega and major hubs. Instead, they are absorbing new investment at the margin, often driven by manufacturing relocation, supply-chain diversification, infrastructure expansion, energy projects and nearshoring or friendshoring strategies. In many cases, policy reform, improved investment frameworks and targeted incentives are allowing smaller markets to capture flows that would previously have defaulted to established centres.

Scaling hotspots sit at the intersection of size and momentum. Countries such as Italy, Sweden, Poland, Indonesia and Thailand have combined meaningful stock levels with sustained expansion over the past decade. These are increasingly important recipients of manufacturing relocation, regional supply-chain reconfiguration and infrastructure investment. Unlike emerging markets, they offer scale and absorptive capacity; unlike mega hubs, they still exhibit room for rapid expansion. For many firms, this tier offers the most attractive balance between growth, resilience and execution risk, particularly as companies seek to diversify footprints without moving too far down the risk curve.

Emerging Hotspots: Early Signals of Future Relevance

The emerging tier captures smaller economies with limited absolute stock but high growth rates. Countries such as Oman, Greece, Serbia, Costa Rica, the Dominican Republic and Cambodia illustrate how targeted reforms, logistics positioning, energy investment and niche manufacturing can attract sustained inflows. While these markets remain small on a global scale, their growth trajectories matter because they often mark the first stage of new regional investment ecosystems. This tier is less about immediate scale and more about optionality and identifying where future production, sourcing or market-access advantages may be forming.

Scale and Momentum: Planning for New Investment Opportunities

The global investment system remains concentrated at the apex, but is increasingly plural below the top. Global businesses that understand both dimensions (scale and momentum) will be better positioned to allocate capital, manage risk and capture the next phase of international investment.

Taken together, the global investment landscape is not shifting away from large economies but is becoming more layered. Mega hotspots retain gravity; major hubs provide stability; scaling markets absorb diversification; emerging destinations define future optionality. The strategic challenge is no longer where to invest, but how to distribute exposure across these tiers as growth broadens beneath a concentrated core.

For decision-makers, the implication is straightforward. Investment strategy should no longer be framed as a binary choice between developed and emerging markets. The real question is how exposure is distributed across tiers, and whether capital, partnerships and supply chains are aligned with where growth is broadening, not just where stock already resides.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

Media

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

AAMEG Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to sponsor and support the AAMEG pre-Mining Indaba Cocktails & Canapes event.

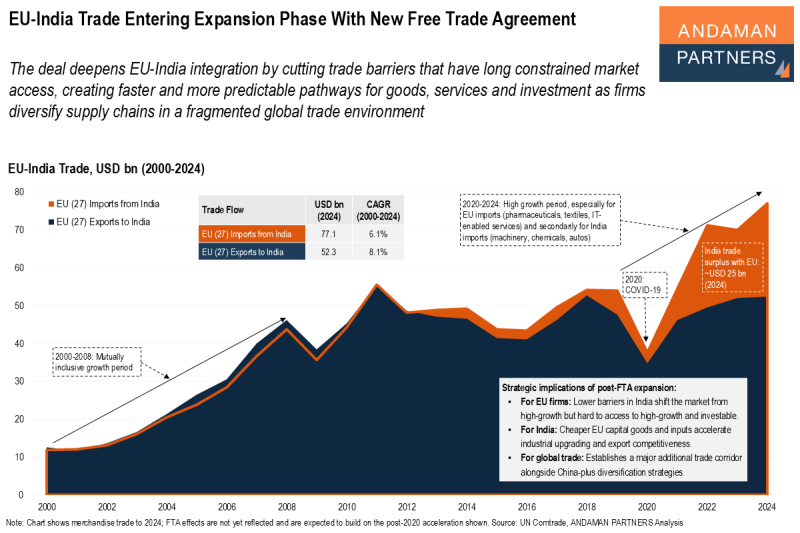

EU-India Trade Entering Expansion Phase With New Free Trade Agreement

The deal deepens EU-India integration by cutting trade barriers that have long constrained market access.

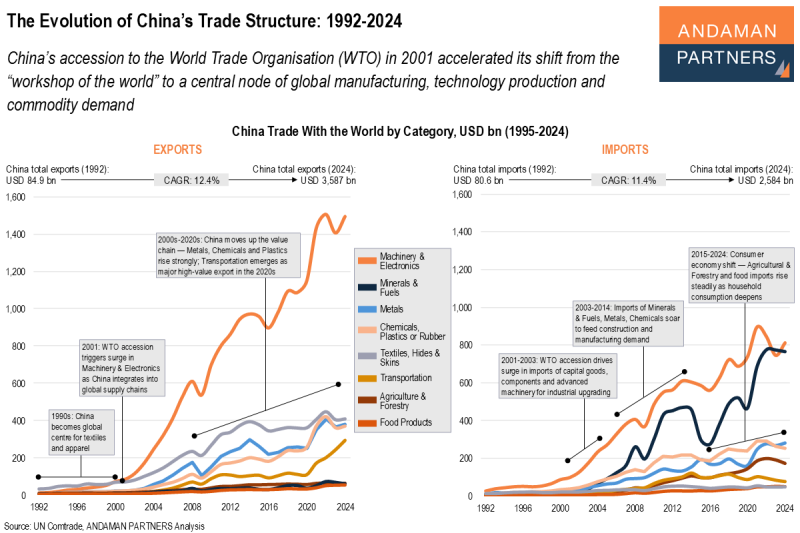

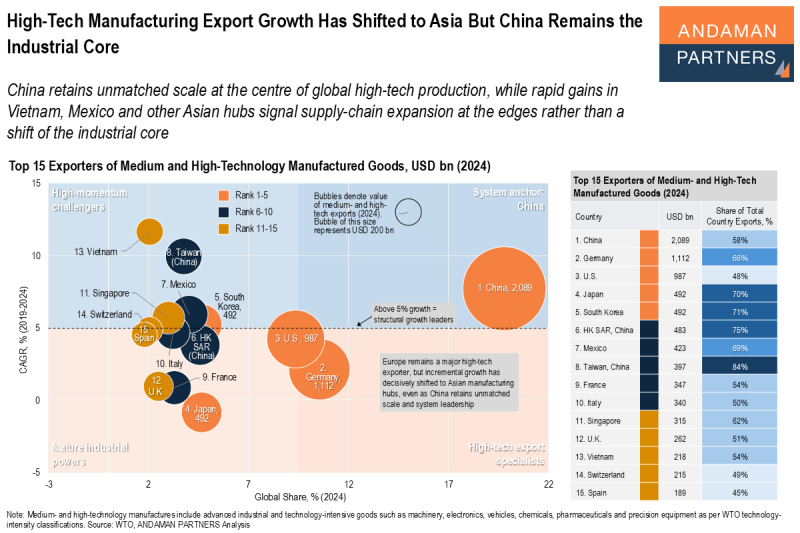

High-Tech Manufacturing Export Growth Has Shifted to Asia, But China Remains the Industrial Core

China retains unmatched scale at the centre of global high-tech production, while rapid gains in Vietnam, Mexico and other Asian hubs.

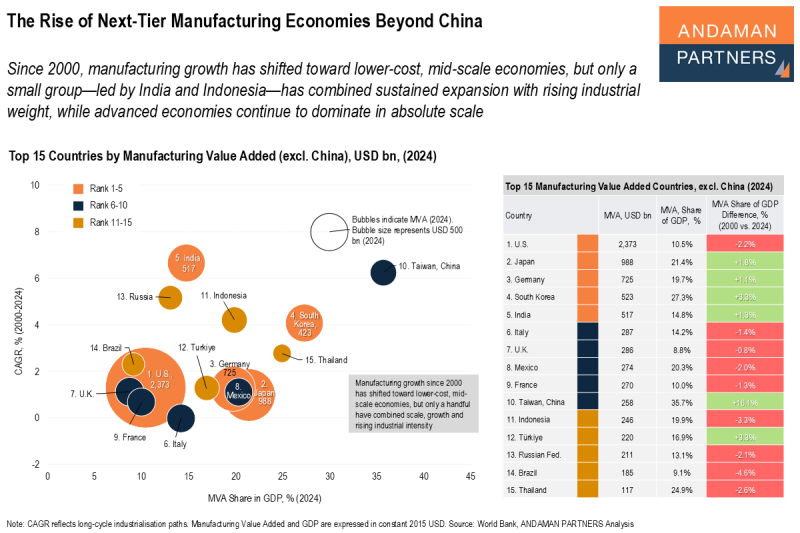

The Rise of Next-Tier Manufacturing Economies Beyond China

Manufacturing growth shifted toward lower-cost, mid-scale economies, but only a small group has combined sustained expansion with rising industrial weight.