Beyond copper and lithium carbonate, Chile is a major supplier of fruit, fish, pulp, metals and chemicals, with China as the largest buyer.

In 2024, Chile’s exports amounted to USD 99 billion, a 2.6% decline from the USD 104.5 billion exported in 2023. From 2004 to 2024, Chile’s exports expanded at a CAGR of 7.3%.

Chile’s exports are dominated by copper, with the two largest export products in 2024 being copper ores (USD 31 billion) and copper alloys (USD 16 billion), and the seventh-largest being unrefined copper (USD 1.9 billion). In all, copper accounted for about half (just under USD 50 billion) of Chile’s total exports in 2024.

Minerals & Fuels, mainly copper ores but also molybdenum ores, iron ores and petroleum oils, was the largest export category at USD 36.5 billion, or 37% of the total. Metals, mostly copper alloys and unrefined copper but also gold and silver, was the second-largest category at USD 22.5 billion (23%).

Agriculture & Forestry was the third-largest category at USD 21.1 billion (21%). Chile’s leading exports in this category include a variety of products such as stone fruits (USD 3.8 billion) and fish meat (USD 3.8 billion)—the third- and fourth-largest export products—as well as frozen and fresh fish, grapes, apples, pears and nuts.

Chemical wood pulp was the fifth-largest export product at USD 2.9 billion.

Lithium is another vital Chilean export—especially lithium carbonate, a white refined chemical (used in electric vehicle batteries) produced from brines in the country’s Atacama salt flats. In 2024, Chile was the world’s leading exporter of lithium carbonate at USD 2.6 billion, accounting for about 65% of the global export value. According to the Undersecretariat for International Economic Relations (SUBREI) at Chile’s Ministry of Foreign Affairs, Chile exported a record 314,000 tons of lithium carbonate equivalent in 2024, an increase of 26% from 2023.

Chile’s total lithium exports in 2024—consisting of lithium carbonate (89%) and lithium hydroxide (11%)—amounted to USD 2.9 billion, and 71% of this total was exported to China, along with about half of Chile’s copper exports.

Hence, China is the largest recipient of Chile’s total exports, with a share in 2024 of 38%, followed by the U.S. (15%), Japan (5%), Brazil (5%) and South Korea (5%).

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

AAMEG Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to sponsor and support the AAMEG pre-Mining Indaba Cocktails & Canapes event.

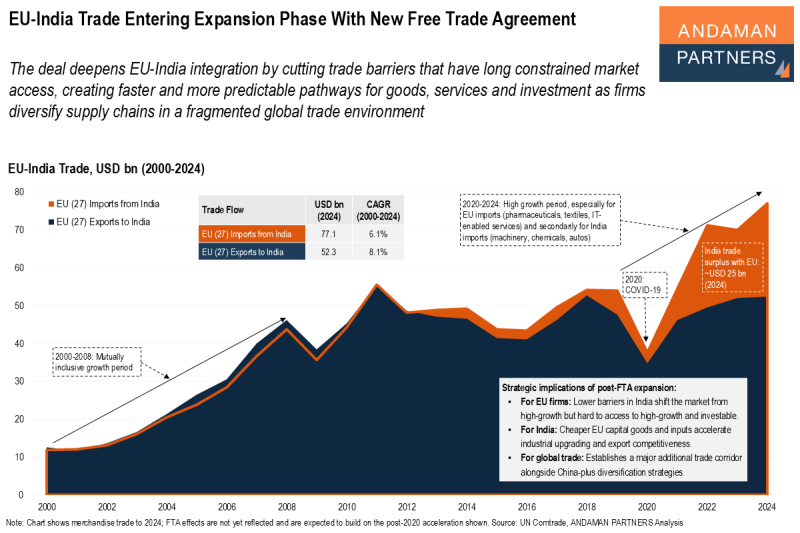

EU-India Trade Entering Expansion Phase With New Free Trade Agreement

The deal deepens EU-India integration by cutting trade barriers that have long constrained market access.

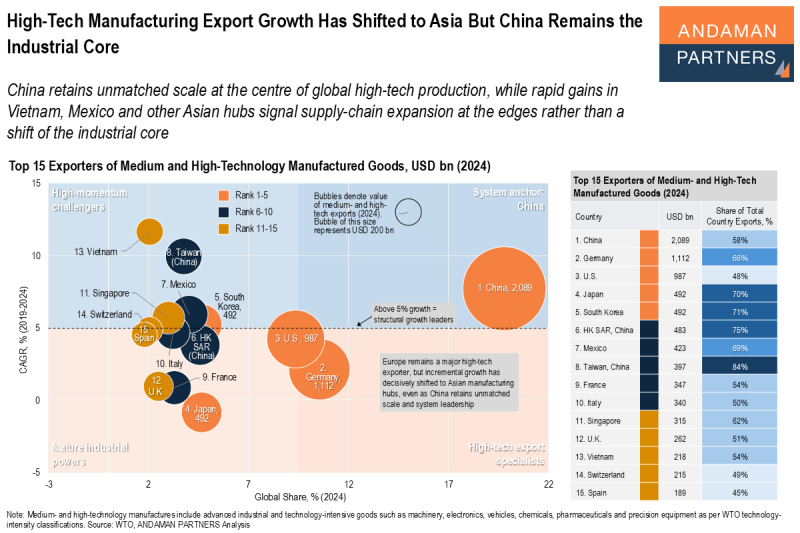

High-Tech Manufacturing Export Growth Has Shifted to Asia, But China Remains the Industrial Core

China retains unmatched scale at the centre of global high-tech production, while rapid gains in Vietnam, Mexico and other Asian hubs.

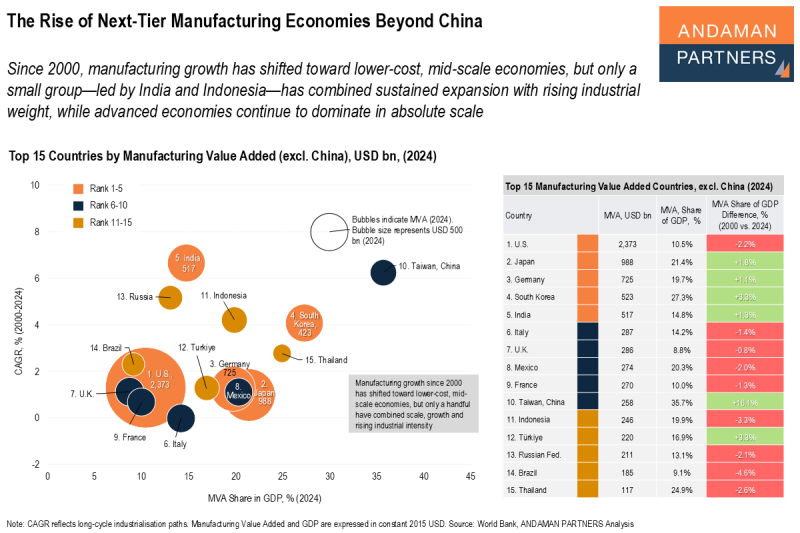

The Rise of Next-Tier Manufacturing Economies Beyond China

Manufacturing growth shifted toward lower-cost, mid-scale economies, but only a small group has combined sustained expansion with rising industrial weight.