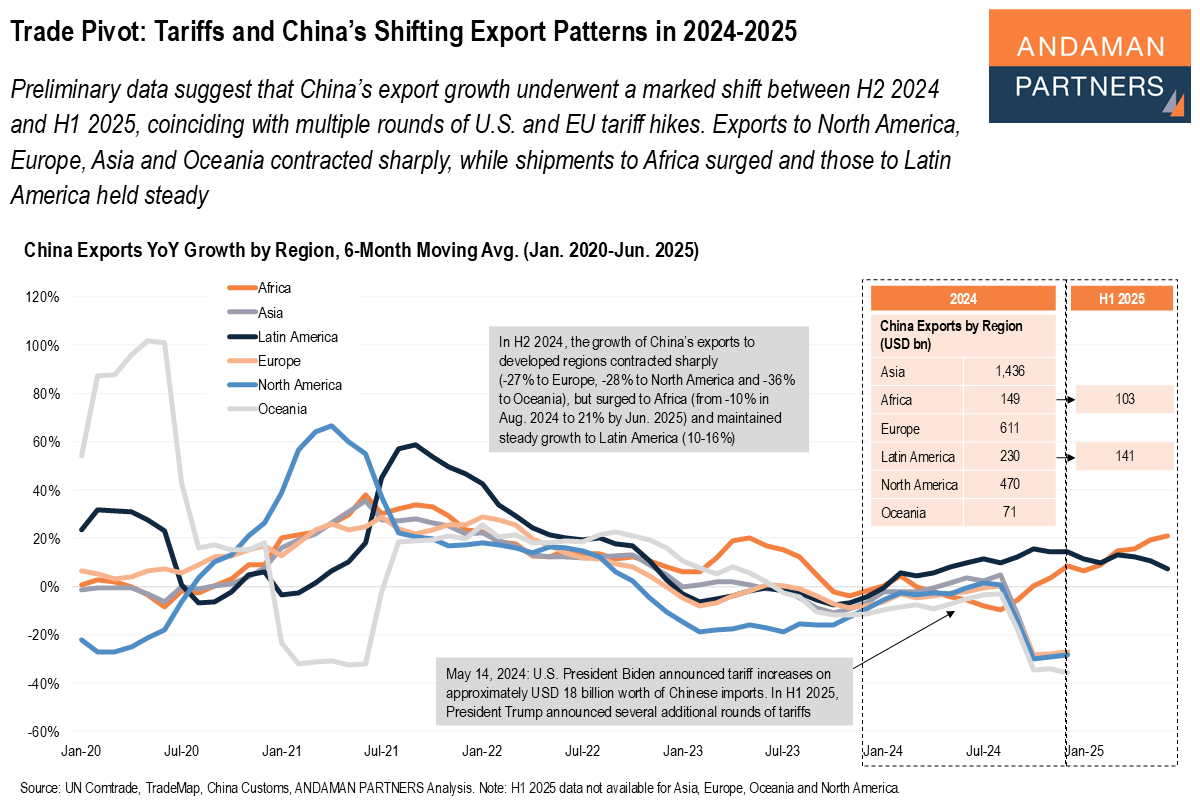

Preliminary data suggest that China’s export growth underwent a marked shift between H2 2024 and H1 2025, coinciding with multiple rounds of U.S. and EU tariff hikes. Exports to North America, Europe, Asia and Oceania contracted sharply, while shipments to Africa surged and those to Latin America held steady.

Preliminary data suggest that tariff actions by the U.S. and EU in 2024-2025 have triggered a notable redirection of Chinese exports from developed to developing markets. In May 2024, U.S. President Biden imposed tariffs on ~USD 18 billion of Chinese goods in strategic sectors, followed in early 2025 by President Trump’s broader tariff measures and reciprocal Chinese duties. The EU’s October 2024 anti-subsidy tariffs on Chinese EVs added further pressure.

Within months, China’s export growth to Europe, North America, and Oceania contracted sharply (–27%, –28%, and –36% in the second half of 2024, respectively), the steepest declines since the pandemic year of 2020. At the same time, growth to Africa swung from –10% in August 2024 to +21% by June 2025, while Latin America maintained steady gains of 10-16%.

While complete data for the first half of 2025 is still pending, the trajectory points to a structural pivot: China is cushioning tariff-related losses in advanced economies by deepening trade with developing partners—particularly those with lower barriers and strong infrastructure or commodity linkages to China. This shift may mark a longer-term realignment of China’s export geography.

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

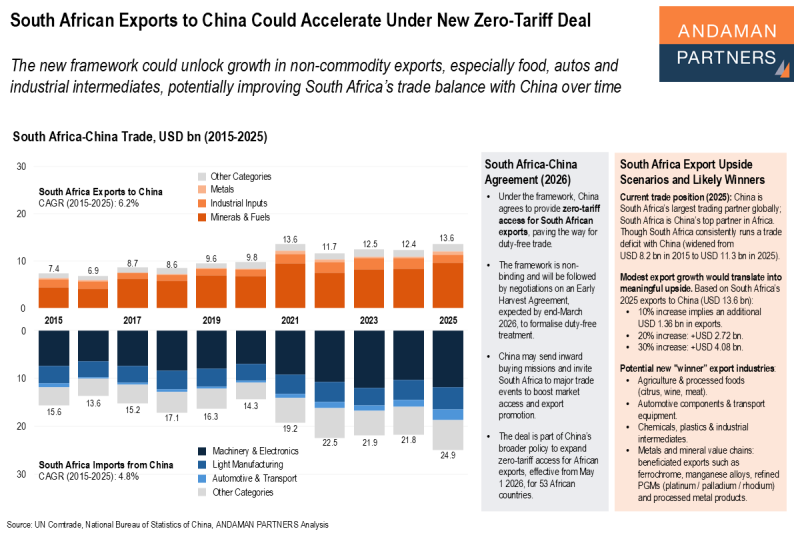

South African Exports to China Could Accelerate Under New Zero-Tariff Deal

The new framework could unlock growth in non-commodity exports, especially food, autos and industrial intermediates.

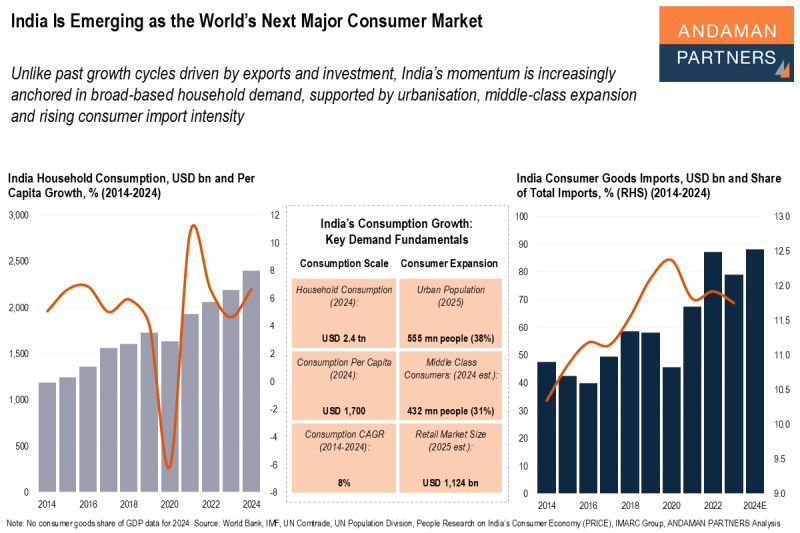

India Is Emerging as the World’s Next Major Consumer Market

India’s momentum is anchored in broad-based household demand, supported by urbanisation, middle-class expansion and consumer import intensity.

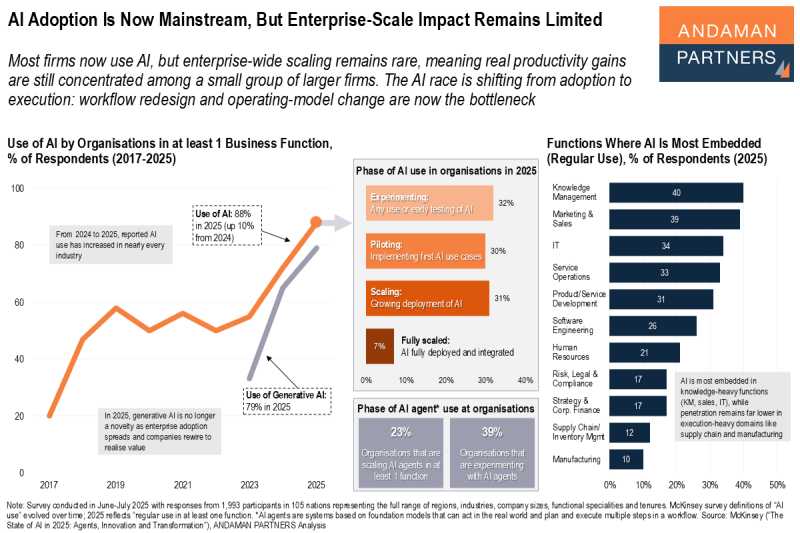

AI Adoption Is Now Mainstream, But Enterprise-Scale Impact Remains Limited

Most firms now use AI, but enterprise-wide scaling remains rare, meaning productivity gains are concentrated in a small group of larger firms.