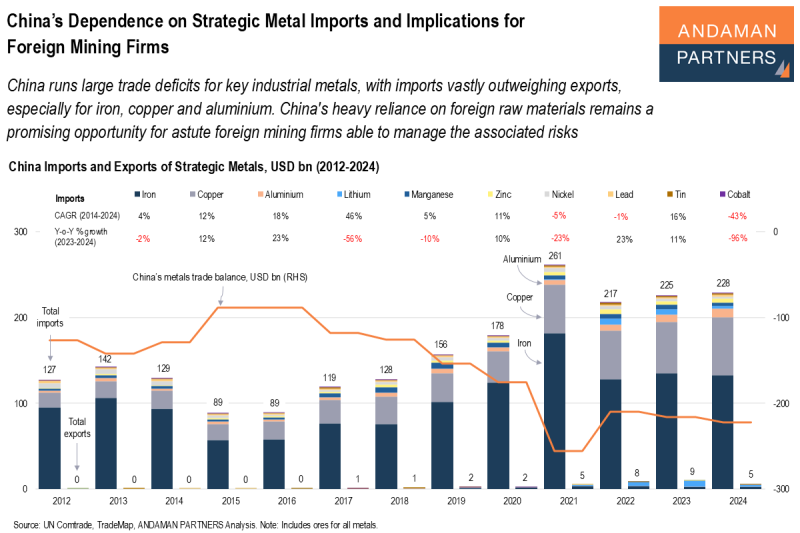

China runs large trade deficits for key industrial metals, with imports vastly outweighing exports, especially for iron, copper and aluminium. China’s heavy reliance on foreign raw materials remains a promising opportunity for astute foreign mining firms able to manage the associated risks.

Despite its industrial dominance, China remains heavily reliant on foreign raw materials, particularly iron, copper and aluminium, leaving its vast industrial engine exposed to foreign supply risks.

For a group of ten strategic industrial metals, namely iron, copper, aluminium, lithium, manganese, zinc, nickel, lead, tin and cobalt, China has consistently had a large trade deficit. The deficit for these ten metals expanded from –USD 126.8 billion in 2012 to –USD 222.4 billion in 2024. The most significant annual deficit of –USD 255.9 billion occurred in 2021, when China imported USD 261 billion of these metals, and exported only USD 5 billion.

China’s imports of strategic metals increased significantly in 2021 as post-COVID-19 global demand picked up. China also accelerated production lines for electric vehicles (EVs), batteries and renewables, creating structural demand for lithium, cobalt, nickel, manganese and aluminium.

In 2022-2024, China’s imports fell back slightly, but remained well above USD 200 billion annually.

Over the period 2012-2024, the growth of China’s imports of these strategic metals was remarkable, for example:

- Iron: Increased by 38% from USD 95.62 billion to USD 132.43 billion.

- Copper: More than tripled from USD 16.93 billion to USD 67.33 billion.

- Aluminium: Increased more than fivefold from USD 1.89 billion to USD 10.53 billion.

- Lithium: Increased more than tenfold from USD 66 million to USD 2.85 billion. (In 2024, lithium exports of USD 2.2 billion nearly matched imports, making it the only metal approaching import-export parity.)

- Manganese: Doubled from USD 2.19 billion to USD 4.41 billion.

For a few strategic metals, China’s imports decreased from 2012 to 2024, notably nickel (–5%) and cobalt (–43%).

Risk and Reward for Foreign Mining Firms

China’s dependence on imports of strategic metals means that global commodity price cycles directly affect Chinese industrial costs. But as China is the largest buyer of these metals, its fluctuating levels of imports create global price shocks that affect industrial supply chains worldwide.

To mitigate risk, China stockpiles resources, purchases equity stakes and long-term contracts abroad and invests in overseas mining rights and infrastructure to secure supply chains. China still relies on only a few countries for supplies of key metals, such as iron ore (Australia), copper (Chile, Peru) and cobalt (D.R.C.), and this concentration of supply can create geopolitical complications.

Overall, China is locked in intensified resource competition with the U.S., EU, Japan and India for critical metals and minerals. China’s import dependency remains a massive opportunity for foreign mining firms, with China ensuring reliable long-term demand, regardless of global cycles.

This opportunity is not without risk, however, as China’s demand is still subject to demand cycles, policy swings and geopolitics. In order to navigate this risk, mining firms must be astute and negotiate better deals, diversify their client base and secure ample financing.

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS is Hiring: Research Analyst (Brazil)

ANDAMAN PARTNERS is hiring a Research Analyst in Brazil (Full-time; Location Flexible/Virtual).

ANDAMAN PARTNERS Was a Co-Sponsor of the South African National Day Reception in Shanghai on 30 May 2025

ANDAMAN PARTNERS was a cosponsor of the South African National Day Reception in Shanghai on 30 May 2025.

Asia’s Shifting Role in Global Supply Chains — Perspectives by ANDAMAN PARTNERS Co-Founder Rachel Wu

Analysis by ANDAMAN PARTNERS Co-Founder Rachel Wu on changing patterns in global supply chains.

China’s Dependence on Strategic Metal Imports and Implications for Foreign Mining Firms

China runs large trade deficits for key industrial metals, which remains a promising opportunity for astute foreign mining firms.

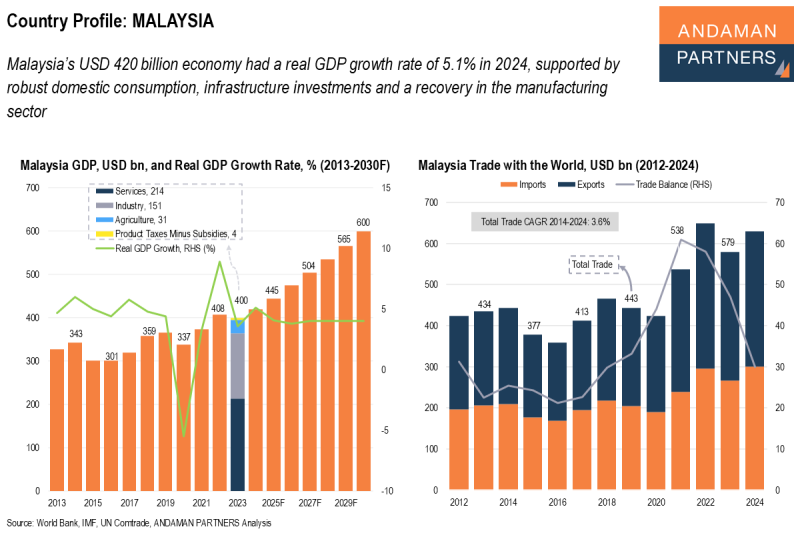

Country Profile – Malaysia

Malaysia has a USD 420 billion economy (2024) and real GDP growth of 5.1%.

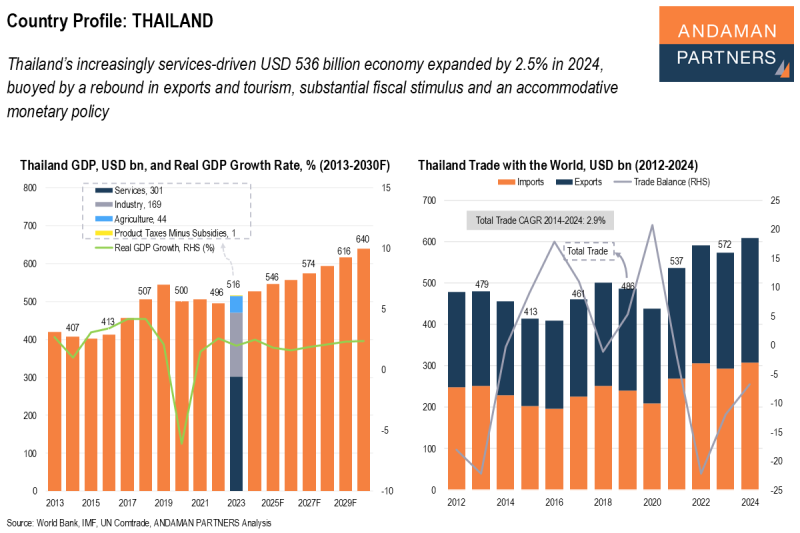

Country Profile – Thailand

Thailand has a USD 536 billion economy (2024) and real GDP growth of 2.5%.