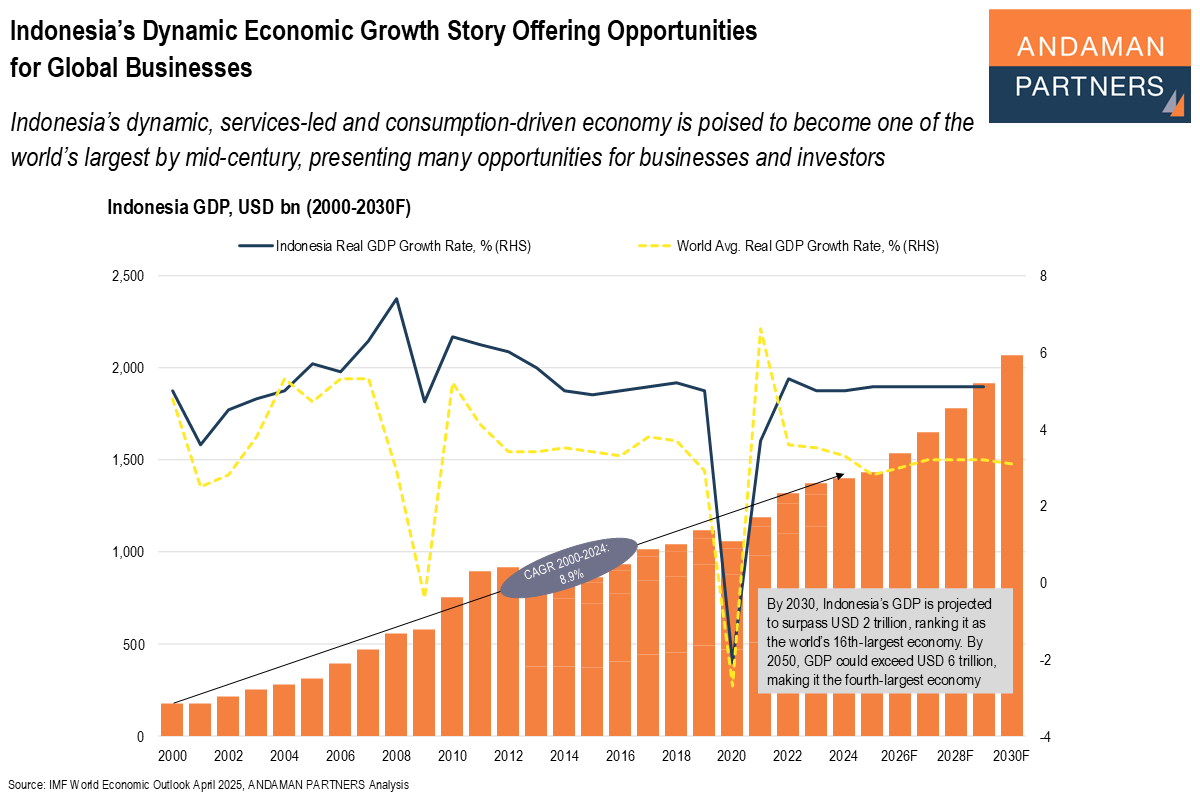

Indonesia’s dynamic, services-led and consumption-driven economy is poised to become one of the world’s largest by mid-century, presenting multiple opportunities for global businesses.

From under USD 180 billion in 2000 to USD 1.42 trillion in 2024, Indonesia’s economy has grown rapidly, averaging around 9% annual growth over the past two decades. With a population exceeding 277 million in 2023, 70% of whom are under the age of 40, Indonesia’s economic prospects are bright.

By 2030, GDP is projected to surpass USD 2 trillion, ranking it as the world’s 16th-largest economy. By 2050, it could exceed USD 6 trillion, positioning Indonesia fourth globally, behind only China, the U.S. and India.

The services sector is the largest contributor to GDP, accounting for approximately 43% of the total in 2023. The shares of agriculture (13%) and manufacturing (19%) have gradually declined over the past two decades. High-value service industries, including logistics, healthcare and tourism, are thriving.

Although its share of GDP has declined since the 2000s, final consumption expenditure remains the cornerstone of Indonesia’s economy, contributing 62% to GDP in 2023, higher than China’s 55.6%. At the same time, gross fixed capital formation rose to 29% in 2023, mainly driven by infrastructure development and public-sector investment.

The contribution of net exports to GDP has declined over time, standing at just 2.2% in 2023. Total exports in 2024 reached USD 265 billion, dominated by minerals, fuels, and chemicals. However, Indonesia is diversifying from traditional commodities like coal, palm oil, rubber and raw nickel ore toward processed nickel, machinery, and electronics.

The exports-to-GDP ratio fell from 34.6% in 2000 to a low of 14.9% in 2019, stabilising at 18.9% in 2024. This trajectory highlights Indonesia’s transition from an economy reliant on exports to one increasingly driven by domestic consumption and value-added services.

Guidelines for Businesses Seeking to Partake in Indonesia’s Growth Story

Businesses seeking to be part of Indonesia’s growth story must take note of the following key considerations:

- Understand Indonesia’s sourcing capabilities: Indonesia is a major global supplier in several sectors, and making the right connections can open up lucrative sourcing channels. Of particular focus in Indonesia are agricultural commodities, mining and metals, as well as electronics and automotive parts.

- Open up channels to sell to and supply Indonesia: Indonesia has large industrial and consumer markets, and the country has large requirements for foreign supply. High-demand categories include consumer goods, machinery and equipment, as well as healthcare and pharmaceutical products.

- Tap strategic intelligence to open up the Indonesian market: It is imperative to acquire, assess and interpret strategic intelligence on Indonesia based on thorough research, analysis and data. Choosing the right partners to facilitate market entry will be crucial in providing a secure platform for informed decision-making.

- Establish the appropriate presence on the ground: Strategic intelligence and the right partners will facilitate the proper business structure, based on the company’s priorities and objectives. These structures range from a local distributor to a representative office, a foreign-owned company or a joint venture.

- Get the right team in place: It will be essential to get an Indonesia-literate team in place that has the right capabilities to execute the company’s business objectives, whether in Jakarta or several strategic locations around the country. Implement the optimal hiring strategy and establish a strong, fully compliant local management culture.

- Carefully consider the business model: Indonesia is a growing but complex market, and the business entry model should balance control, compliance, speed and local credibility. Direct investment will ensure complete control but requires a higher upfront cost. Other options, such as a joint venture, co-investment in a local business, strategic partnership and franchising, all have pros and cons that need to be carefully evaluated based on the company’s focus, risk appetite and strategic goals.

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

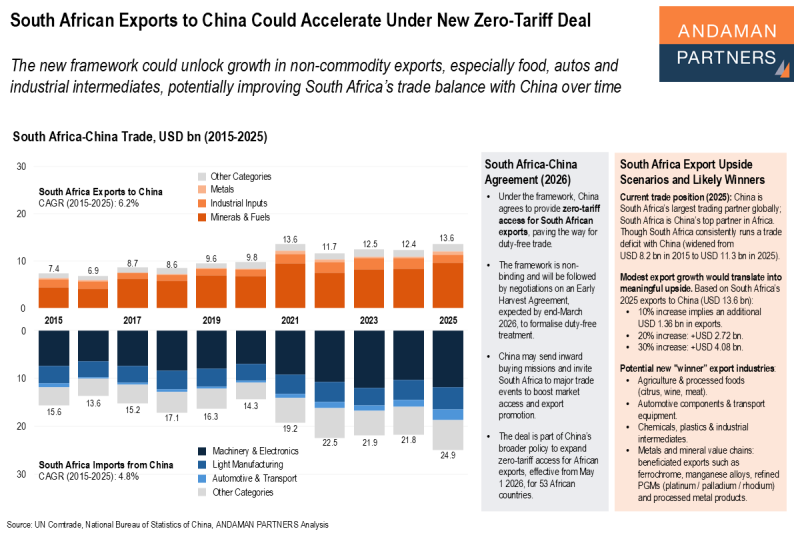

South African Exports to China Could Accelerate Under New Zero-Tariff Deal

The new framework could unlock growth in non-commodity exports, especially food, autos and industrial intermediates.

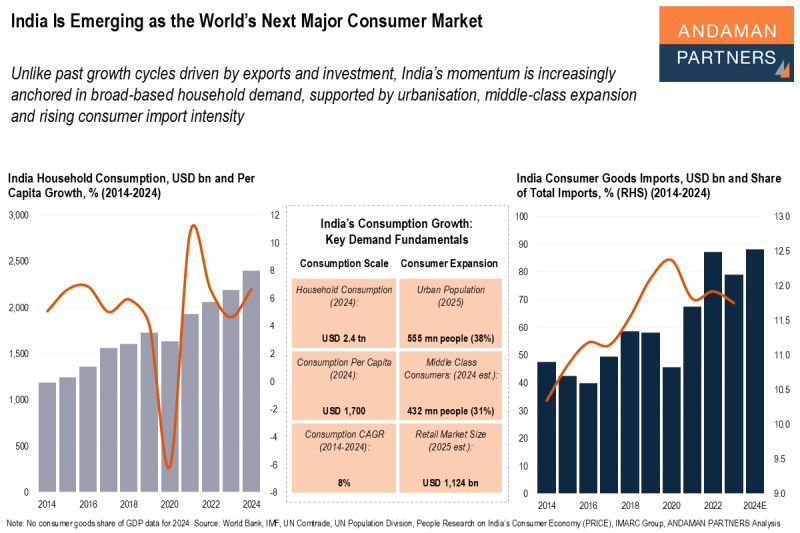

India Is Emerging as the World’s Next Major Consumer Market

India’s momentum is anchored in broad-based household demand, supported by urbanisation, middle-class expansion and consumer import intensity.

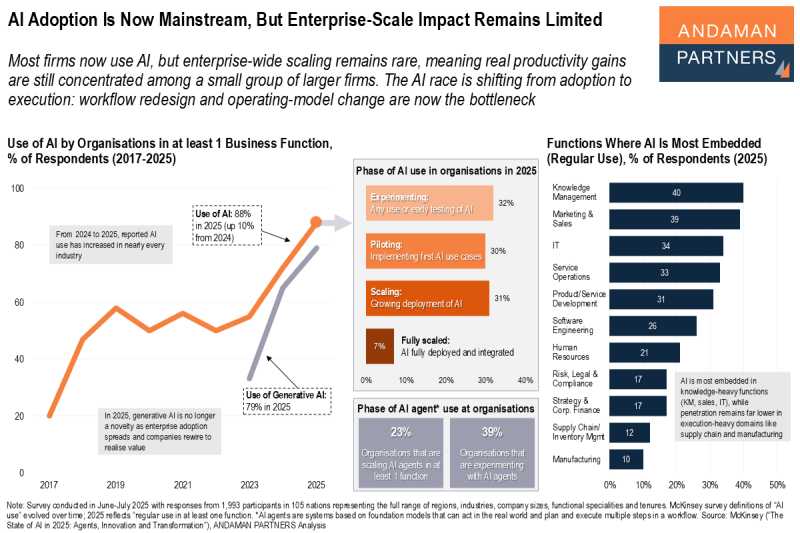

AI Adoption Is Now Mainstream, But Enterprise-Scale Impact Remains Limited

Most firms now use AI, but enterprise-wide scaling remains rare, meaning productivity gains are concentrated in a small group of larger firms.