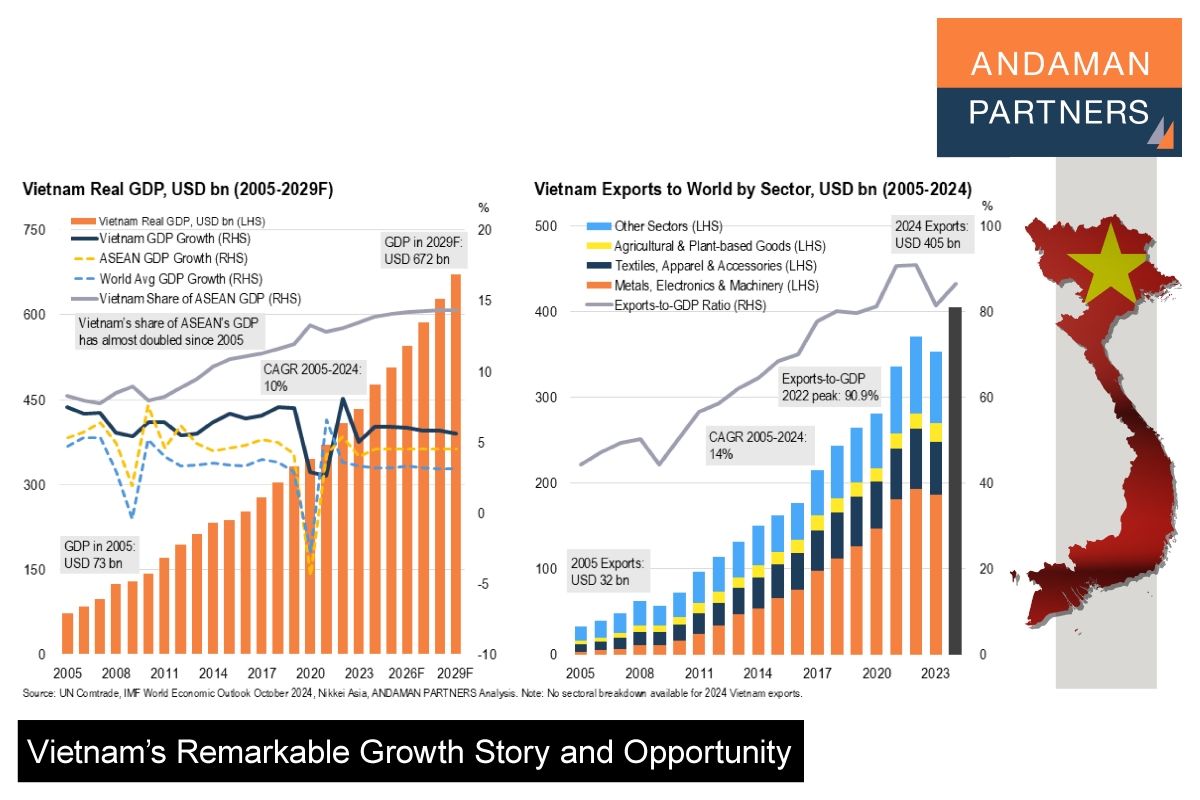

Vietnam’s resilient economy stands out clearly in the ASEAN region. The country’s rapid economic growth has been built on sustained high export growth.

From an economy of barely USD 70 billion in 2005, Vietnam’s GDP is estimated to have reached 476.3 billion in 2024; by 2029, it could exceed USD 670 billion. From 2005 to 2024, GDP grew by an average of 10% annually.

The foundation of Vietnam’s rapid economic growth is its exports, particularly of Metals, Electronics & Machinery. The country’s exports-to-GDP ratio — indicating the economy’s dependence on external trade — rose from below 50% in 2005 to a peak of over 90% in 2022.

Vietnam’s exports grew from just over USD 30 billion in 2005 to an estimated USD 405 billion in 2024, an average growth of 14%. The country’s main exports are electronics, textiles and agricultural products, which accounted for 76% of total exports in 2023.

This is how Vietnam’s four main export categories expanded from 2005 to 2023:

- Metals, electronics & machinery is by far the leading export category, surging from USD 3.89 billion to USD 186.55 billion.

- Textiles grew from USD 8.49 billion to USD 70.85 billion in 2022 before falling back to USD 61.89 billion in 2023.

- Agricultural exports grew from USD 3.68 billion to USD 21.17 billion.

- The Others category grew from USD 16.38 billion to USD 83.46 billion, highlighting broad-based export growth.

Vietnam’s sustained export growth, diversification and economic resilience make it a key player in global trade. Its high industrial output, expanding high-value manufacturing and solid agricultural base mean the country is well equipped to navigate global economic challenges.

Companies across regions and industries must consider how to tap into Vietnam’s dynamic export industries and the country’s dynamic industrial and consumer markets. The following are potential key levers for companies to engage the Vietnamese economy:

- Explore Vietnam for direct sourcing and consider its position in a China +1 or China +3 construct.

- Explore international distributorships for Vietnamese products and brands.

- Identify market opportunities for exports to Vietnam.

- Pursue a deeper engagement with a presence or partnerships on the ground in Vietnam.

- Consider Vietnam as a strategic greenfield investment destination for international expansion initiatives.

- Explore potential acquisitions of existing businesses in Vietnam

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

AAMEG Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to sponsor and support the AAMEG pre-Mining Indaba Cocktails & Canapes event.

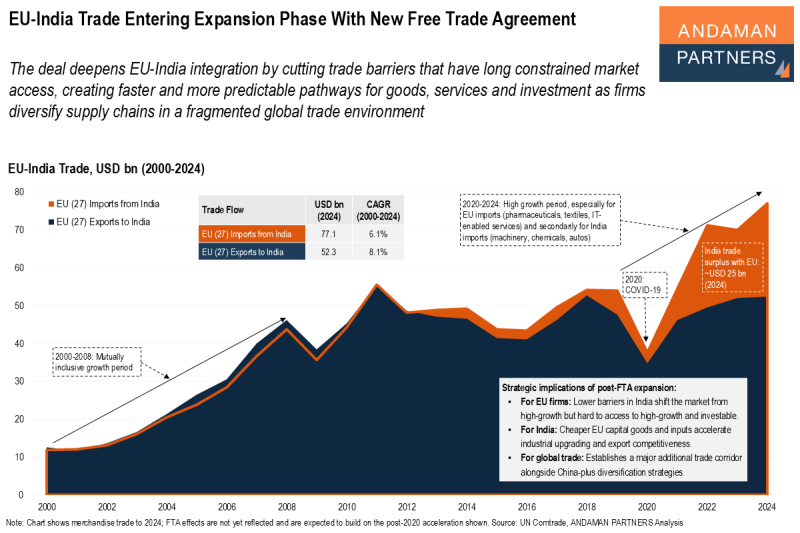

EU-India Trade Entering Expansion Phase With New Free Trade Agreement

The deal deepens EU-India integration by cutting trade barriers that have long constrained market access.

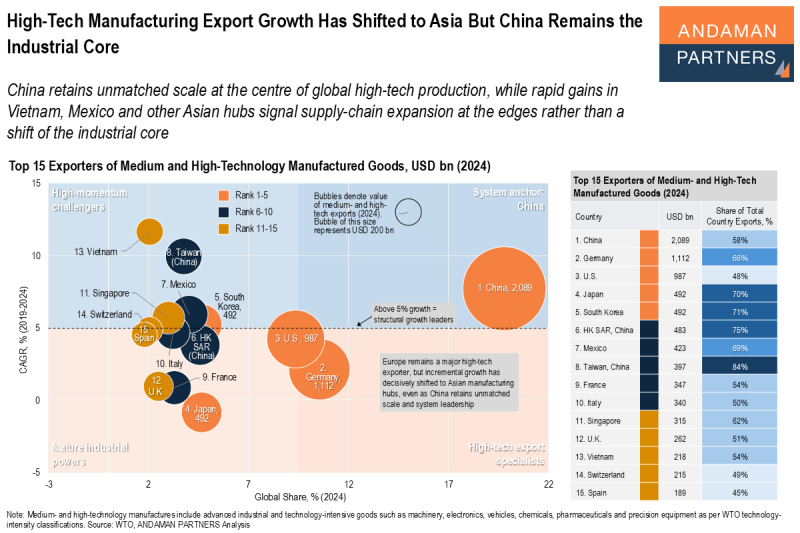

High-Tech Manufacturing Export Growth Has Shifted to Asia, But China Remains the Industrial Core

China retains unmatched scale at the centre of global high-tech production, while rapid gains in Vietnam, Mexico and other Asian hubs.

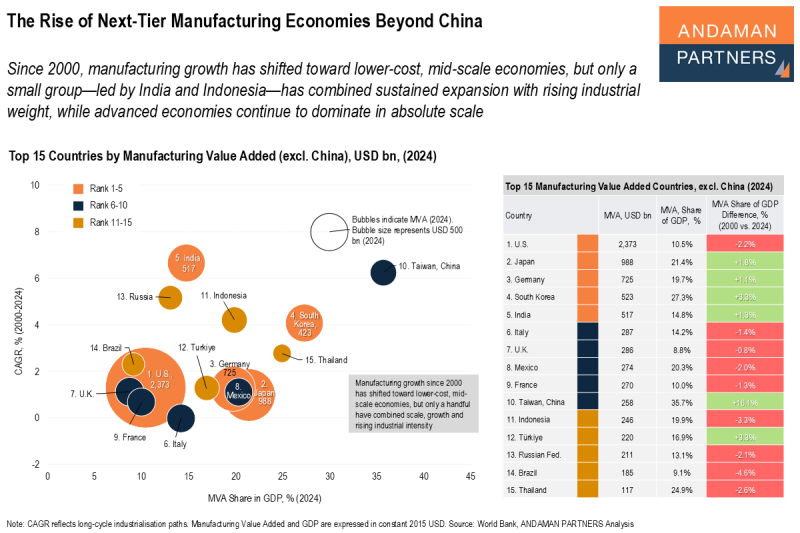

The Rise of Next-Tier Manufacturing Economies Beyond China

Manufacturing growth shifted toward lower-cost, mid-scale economies, but only a small group has combined sustained expansion with rising industrial weight.