Over the coming three decades, the global economy will experience a precipitous transition from developed to developing and emerging economies led by China, India and Indonesia. India and a group of smaller, rapidly growing economies will drive global growth. A new history is unfolding. Altered pathways to 2030, 2040 and 2050 mean CEOs and company leadership teams must lead from the front in transforming organisational plans and cultures.

Highlights:

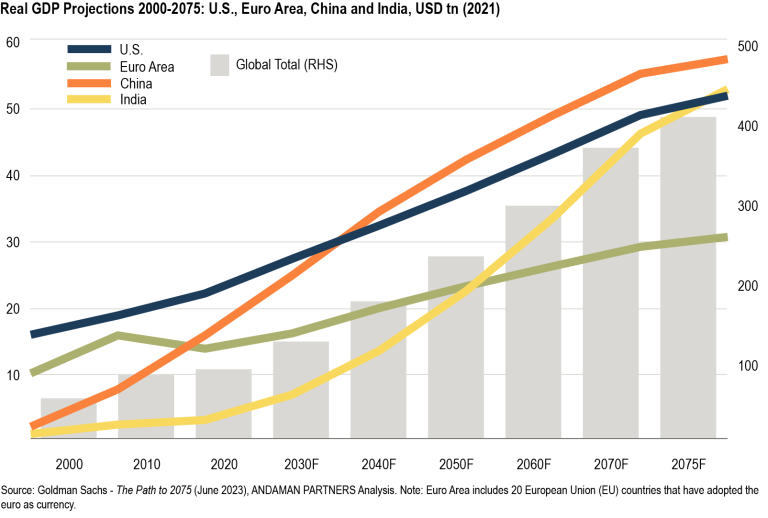

- Global Real GDP growth is projected to decline gradually over the next fifty years, but growth in emerging economies will considerably outstrip developed economies.

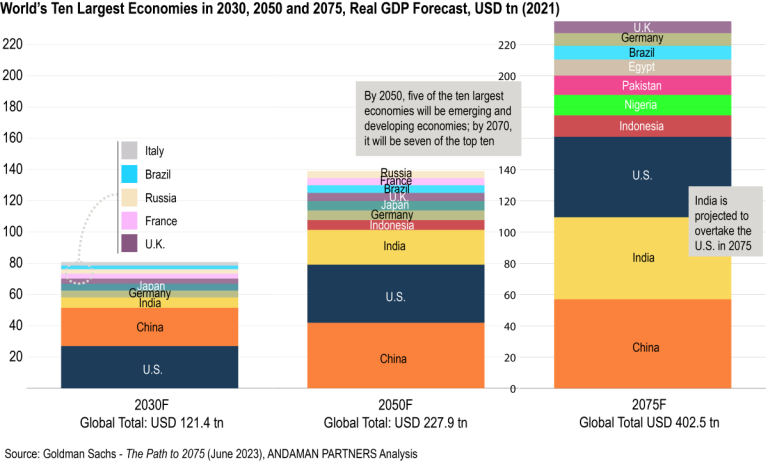

- China is projected to surpass the U.S. as the world’s largest economy by 2035, and India could do so by 2075, although China could lose some ground to the U.S. over the next five to ten years.

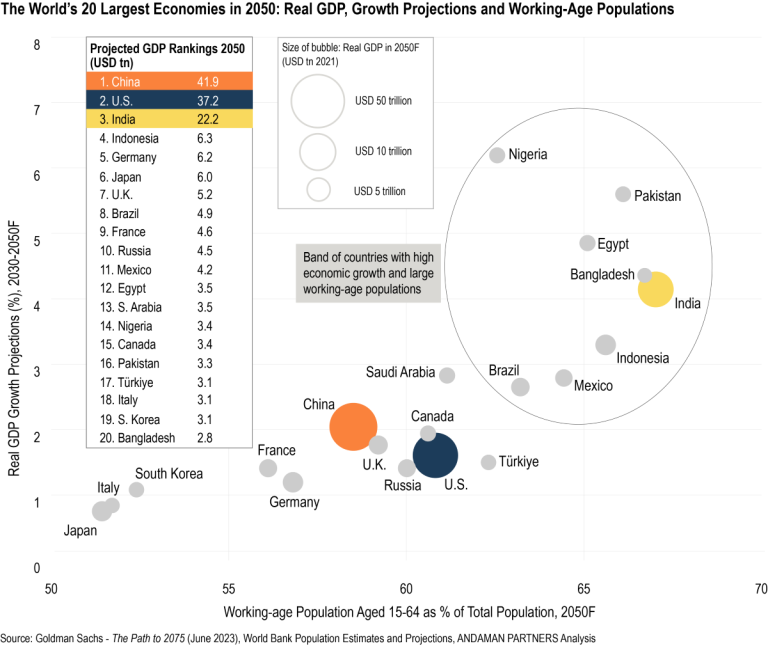

- In the decades up to 2050, emerging economies with large working-age populations, notably India, Ethiopia, Nigeria, and the Philippines, could drive global growth.

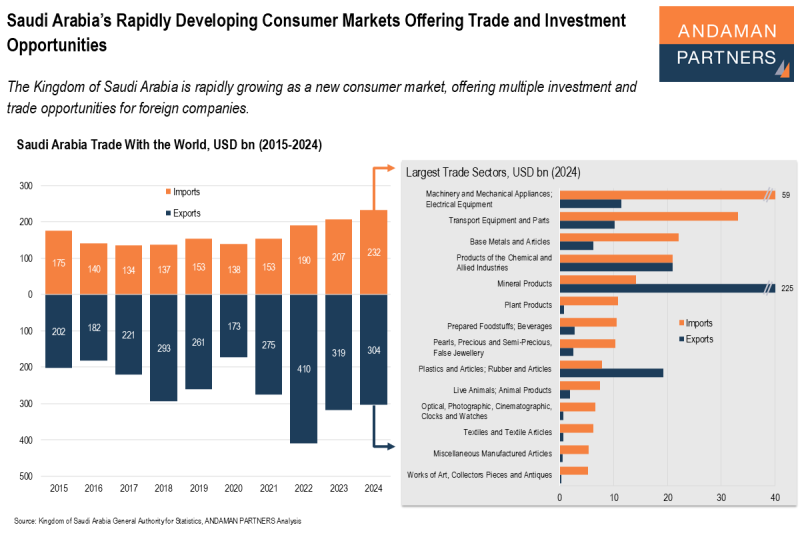

- By 2050, Mexico, Egypt, Saudi Arabia, and Nigeria could be among the 20 largest economies.

- The dynamic landscape of the next decade will offer an opportune window to enter emerging markets, and businesses must harness new technology and avoid certain pitfalls to remain competitive up to 2050.

- CEOs and company leadership teams must lead from the front in transforming organisational plans and cultures. They must identify key new trends early, along with the related opportunities and risks, and innovate and implement the required changes in business strategy promptly.

Global real GDP growth slowed from an average of 4.1% in the 2000s to 2.1% in the 2010s, and according to projections by Goldman Sachs, the outlook for the next three decades is of gradually diminishing growth due primarily to slower labour force growth. Real GDP is projected to average 4.2% between 2024 and 2029, then recede to 3.6% in the 2030s and 2.9% in the 2040s.

While also projected to decline overall, growth in developing and emerging markets will considerably outstrip developed markets. Developing and emerging markets are projected to grow by 4.5% in 2024-2029 and 6.2% in the 2030s, while developed markets could grow by 2.3% and 2%, respectively.

From 2024 to 2050, the U.S., Japan and Germany are projected to grow by an average of below 2%. Growth in China could slow from just over 4% in 2024-2029 to 2.5% in the 2030s and fall below 2% in the 2040s.

India’s economy could grow by almost 6% in 2024-2029 and 4.6% in the 2030s. By 2050, India’s Real GDP could surpass the Euro Area, and by 2075, it may catch up with the U.S.

Measured in Real GDP, Goldman Sachs projects the U.S. to still be the world’s largest economy in 2030 at USD 27 trillion, compared to China’s USD 24.5 trillion. But China could overtake the U.S. by around 2035 and stay ahead through 2075.

There is some doubt, however, when (and even if) China will overtake the U.S. In April 2025, the International Monetary Fund (IMF) released a forecast for U.S. nominal GDP to reach USD 37.1 trillion in 2030, with China further back at USD 25.8 trillion, partly due to a sluggish post-COVID-19 rebound.

Shifting Demographic Fortunes: China and India

Given the prolonged slowdown in its property sector from 2020, China’s long-term growth prospects are less certain than in previous years. The country still has tremendous growth potential, especially in developing its services sector and promoting private consumption and investment.

However, demographic changes pose a long-term growth risk. China had 209.78 million people aged over 65 in 2022, or 14.9% of the population and this is expected to reach 520 million by 2050, or 37.8% of the total.

According to the UN Population Division, in 2050, the working-age population (i.e., those aged 15-64 as a percentage of the total population) will be 58.5% in China and 67% in India. Based on current forecasts, there could be 1.17 billion people of working age in India in 2050, compared to 770 million in China.

Up to 2050 and beyond, the weight of global GDP will shift eastwards towards Asia. In 2050, China, India and Indonesia will be among the world’s five largest economies. With sustained population growth and the implementation of appropriate policies and institutions, Mexico, Egypt, Saudi Arabia and Nigeria could be among the top 15 countries. (By 2075, Nigeria could be the world’s fifth-largest economy, while Pakistan and Egypt could feature in the top ten and the Philippines in the top 15). This will represent a very different economic world and global business landscape.

Indeed, developing and emerging markets will drive economic growth up to 2050. Benefiting from young and large working-age populations and growing domestic demand and output, India, Ethiopia, Nigeria, the Philippines, Pakistan and Egypt could be the world’s fastest-growing economies in the decades up to 2050, with average annual growth rates above 4%.

In 2050, Ethiopia, the Philippines, Pakistan, Bangladesh, Indonesia and India will all have working-age populations above 65%, compared to 58.5% in China and 60.8% in the U.S.

How can we consider this new world and prepare long-term growth plans ahead of time? Below are preliminary suggestions.

Success Factors and Pitfalls to 2050

The world is changing rapidly and today’s CEOs must consider the following critical success factors and pitfalls as they prepare for 2030, 2040 and 2050.

Success Factors:

- An active and established presence in emerging economies: Businesses must gravitate toward these economies, which will increasingly be global centres of growth, investment and consumer markets. Good business opportunities will still be found in Beijing and Singapore, but increasingly also in Manila, Ho Chi Minh City and Lagos. Calibrating the timing and speed of business repositioning will be critical in these new markets.

- Utilise the current window of opportunity to act early: If businesses are not yet well established in relevant markets, the dynamic landscape of the next 5-10 years will offer an opportune window to enter these markets and gain a foothold. Emerging economies are undergoing fundamental economic reforms and improvements in government regulation of their private economies, with some more advanced along this process than others.

- Forge international partnerships: Few businesses can be global or international. Most are local or domestic businesses, while some become multi-domestic. However, good strategic international partnerships can give companies a regional, international or even global advantage. Invest in forging valuable international partnerships early.

- Embrace supply chain technology and automation: Smart supply chains are becoming the new normal in 2025, and the capabilities of new technology, such as generative AI, data analytics, automation, machine learning, the Internet of Things (IoT) and blockchain are radically transforming supply chain management. Businesses must fully embrace new technology and especially prioritise efficient data management. Automation technology will be widely used by 2050, and leaders must lay these foundations now to remain competitive.

Pitfalls:

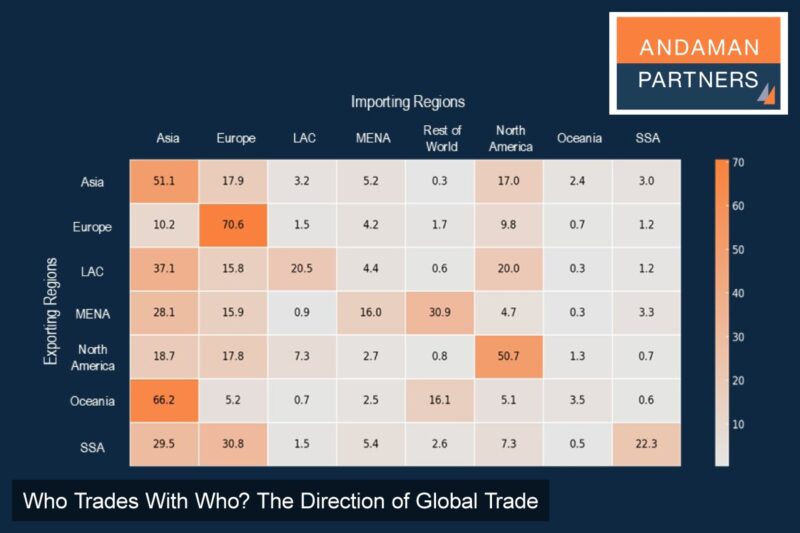

- Protectionism: Growing the right global footprint will be critical in the context of the increased risk of protectionism in global trade, partly due to the ongoing occurrence of populist nationalism in countries worldwide. The COVID-19 pandemic caused international supply chain disruptions and an increased focus on onshoring and supply chain resilience. Populism could exacerbate these disruptions, leading to shocks that can induce inflation risks, food and goods shortages, and social unrest.

- Climate: The world will likely continue to be severely affected by climate shifts and extreme weather. By 2050, water and food scarcity will be a critical challenge worldwide, and around 31% of global GDP (about USD 70 trillion) could be exposed to high water stress. Global food security is already at risk and will likely be a more severe crisis in 2050. These risks could cause social unrest worldwide and harm business and trade. Companies must anticipate these needs and stresses and, where possible, provide innovative solutions to the market.

- Resisting change and disruption: CEOs and business leaders must consider how much their business should embrace or resist change. In recent years, large multinational firms have come under pressure from smaller, more agile competitors that were able to cut out intermediaries and bring buyers and sellers together directly via digital platforms. Innovation will remain the key factor differentiating competitiveness, and CEOs must consider the tools and resources needed to stay innovative over the long term.

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com

ANDAMAN PARTNERS Was a Co-Sponsor of the South African National Day Reception in Shanghai on 30 May 2025

ANDAMAN PARTNERS was a cosponsor of the South African National Day Reception in Shanghai on 30 May 2025.

Asia’s Shifting Role in Global Supply Chains — Perspectives by ANDAMAN PARTNERS Co-Founder Rachel Wu

Analysis by ANDAMAN PARTNERS Co-Founder Rachel Wu on changing patterns in global supply chains.

ANDAMAN PARTNERS Co-sponsored the West Australian Mining Club Luncheon in Perth on 27 February 2025

WA Mining Club luncheons are valuable ways to network with colleagues and clients and learn about the latest industry insights.

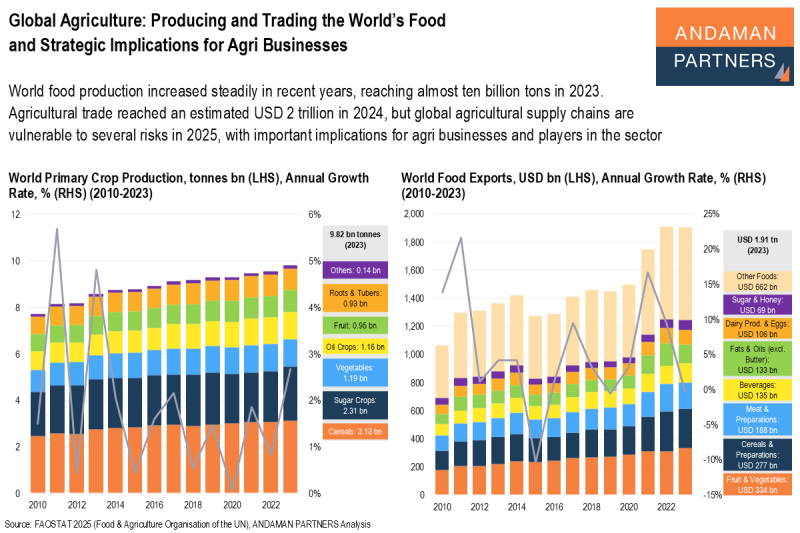

Global Agriculture: Producing and Trading the World’s Food and Strategic Implications for Agri Businesses

Global agricultural supply chains are vulnerable to several risks in 2025, with important implications for agri businesses and players in the sector.

Southeast Asia: The USD 4-trillion Economy

With rapid GDP growth, expanding trade networks and investment inflows, Southeast Asia retains its enduring appeal as a vital destination for multinational corporations seeking to diversify their supply chains and tap into Asia’s growing consumer markets.

Indonesia’s Dynamic Economic Growth Story Offering Opportunities for Global Businesses

Indonesia’s dynamic, services-led and consumption-driven economy is poised to become one of the world’s largest by mid-century, presenting many opportunities for businesses and investors.