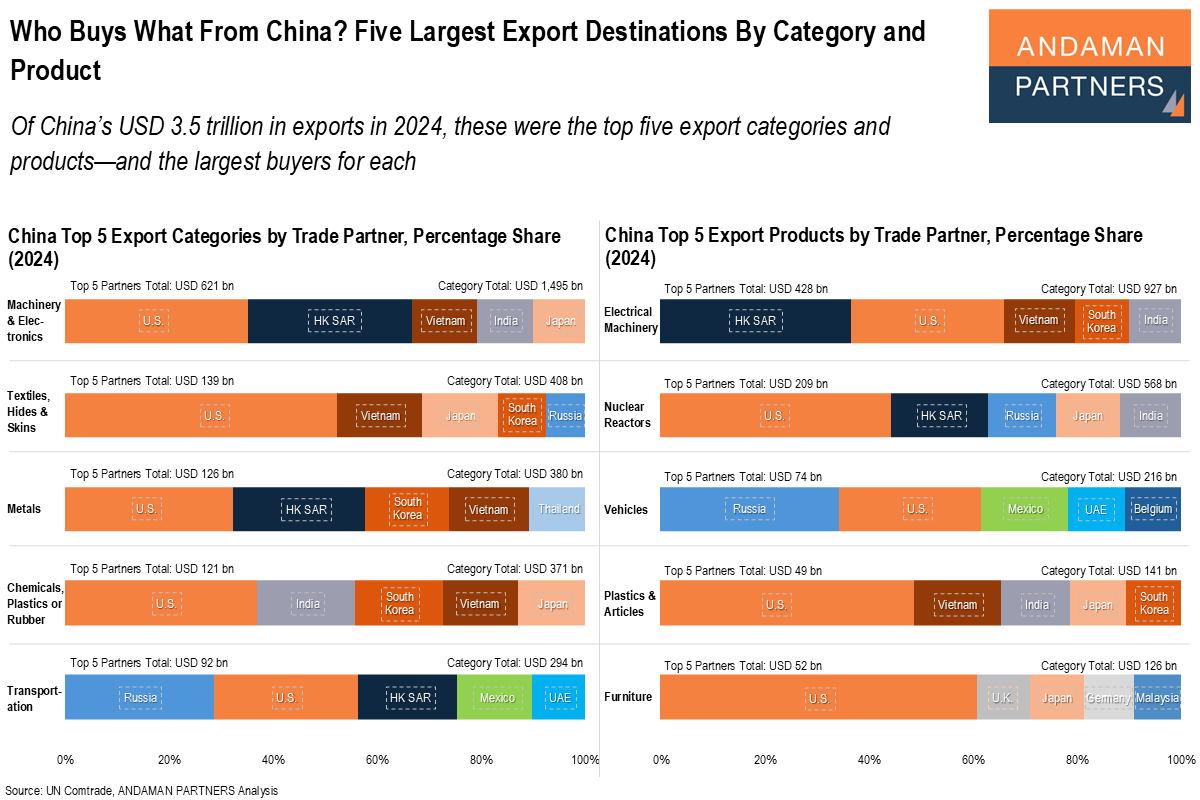

Of China’s USD 3.6 trillion in exports in 2024, these were the top five export categories and products—and the largest buyers for each.

China has been the world’s leading exporter since 2009. In 2024, its exports reached USD 3.6 trillion, up 5.8% year-on-year, giving China a 15.9% share of global trade—roughly one in every seven export dollars worldwide.

Top 5 Export Categories

At just under USD 3 trillion, the top five categories accounted for 82% of China’s total exports in 2024. The dominant sector was Machinery & Electronics at USD 1.5 trillion (42% of total exports), followed by Textiles (USD 408 billion), Metals (USD 380 billion), Chemicals (USD 371 billion) and Transportation (USD 294 billion).

Despite softer overall exports to the U.S. in 2024-2025, the U.S. remained China’s single largest buyer across most major categories, leading in Machinery & Electronics, Textiles, Metals and Chemicals, and ranking second in Transportation.

Russia emerged as the top buyer of China’s transportation-related exports, reflecting the surge in Chinese vehicle and auto-parts shipments amid Western sanctions. Russia also appeared among China’s top textile buyers.

Hong Kong continued to serve as a key re-export hub, ranking second in Machinery & Electronics, Metals and Transportation. India and Japan featured among the largest buyers of Machinery & Electronics, while India was also China’s second-largest Chemicals customer.

Vietnam stood out as one of China’s most consistent regional partners, ranking within the top five across four of the five categories, underscoring its role in China’s regional supply chains. South Korea also appeared prominently among the top buyers of Textiles, Metals and Chemicals.

Top 5 Export Products

China’s top five individual export products, worth nearly USD 2 trillion in 2024 (about 55% of total exports), reveal similar geographic concentrations.

Electrical Machinery (USD 927 billion) was the leading product, with top buyers being Hong Kong, the U.S., Vietnam, South Korea and India.

Nuclear Reactors, Boilers, and Machinery (USD 568 billion) ranked second, again led by the U.S., followed by Hong Kong, Russia, Japan and India—a customer base that highlights how both advanced and emerging economies depend on Chinese industrial machinery.

Vehicles (USD 216 billion) were the third-largest product group, with Russia far ahead as the primary buyer, followed by the U.S., Mexico, the UAE and Belgium, reflecting China’s rapidly growing automotive exports to new markets.

Plastics and Articles (USD 141 billion) ranked fourth, led by the U.S., Vietnam, India, Japan and South Korea.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

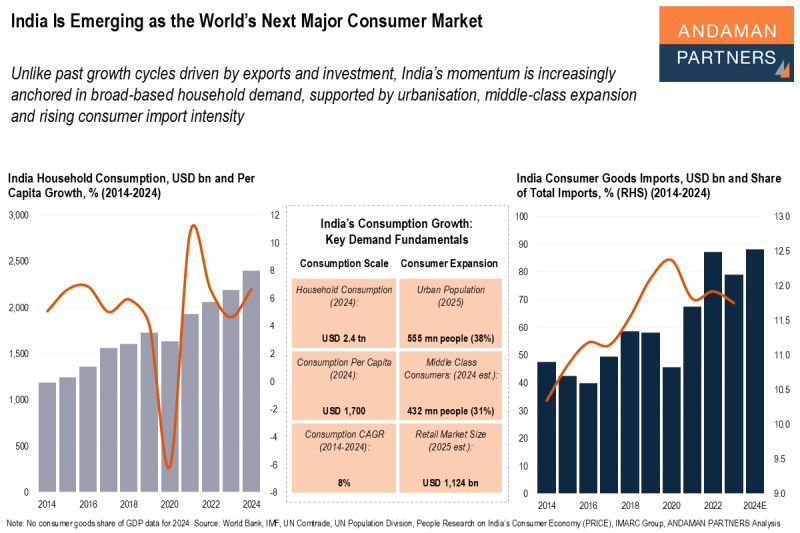

India Is Emerging as the World’s Next Major Consumer Market

India’s momentum is anchored in broad-based household demand, supported by urbanisation, middle-class expansion and consumer import intensity.

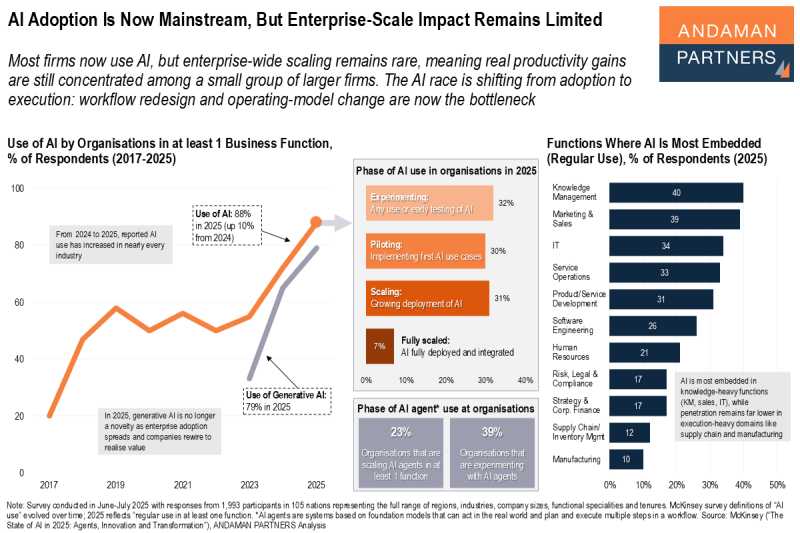

AI Adoption Is Now Mainstream, But Enterprise-Scale Impact Remains Limited

Most firms now use AI, but enterprise-wide scaling remains rare, meaning productivity gains are concentrated in a small group of larger firms.

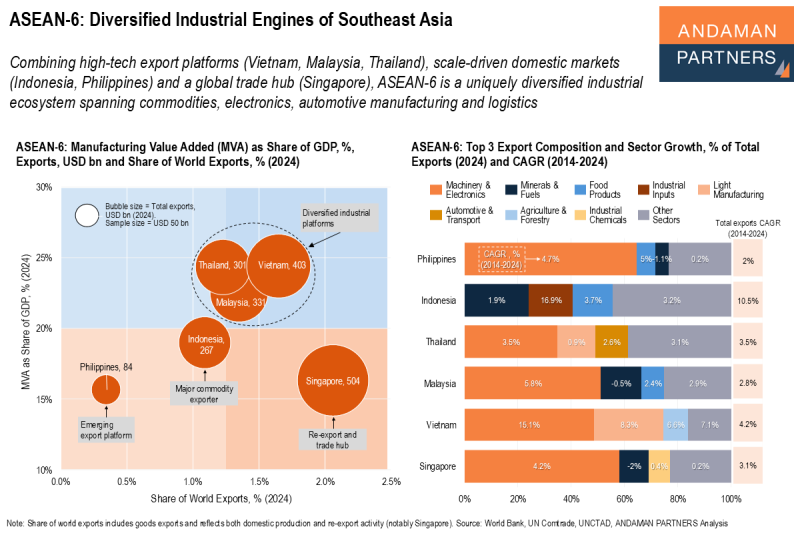

ASEAN-6: Diversified Industrial Engines of Southeast Asia

Combining high-tech export platforms, scale-driven domestic markets and a global trade hub, ASEAN-6 is a uniquely diversified industrial ecosystem.