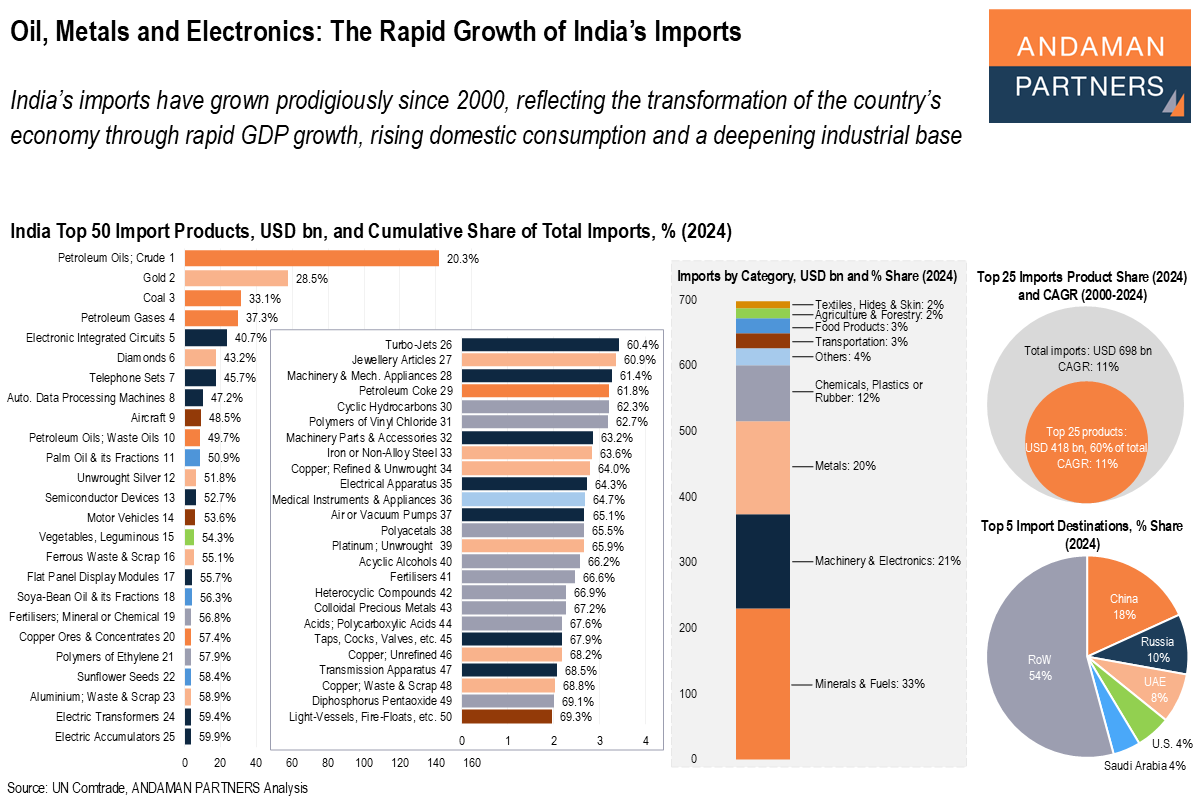

India’s imports have grown prodigiously since 2000, reflecting the transformation of the country’s economy through rapid GDP growth, rising domestic consumption and a deepening industrial base.

Highlights:

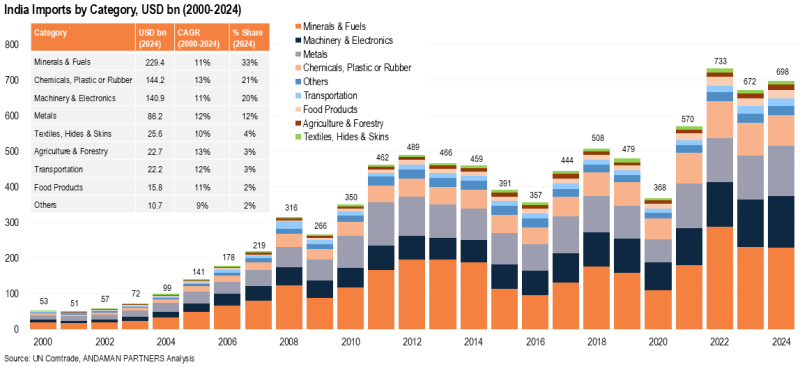

- In 2024, India’s imports reached USD 698 billion, a small increment from 2023.

- From 2000, when the country imported a mere USD 53 billion, to 2024, India’s imports achieved a CAGR of 11.3%.

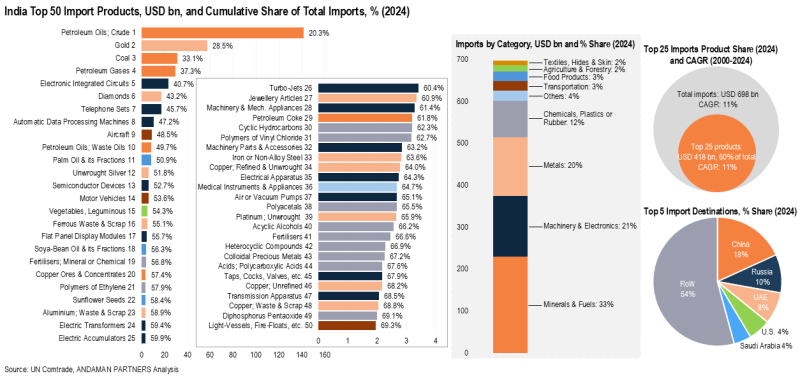

- One product, crude oil, accounted for a fifth of India’s total imports in 2024, and the category of Minerals & Fuels accounted for 33%, followed by Machinery & Electronics (21%) and Metals (20%).

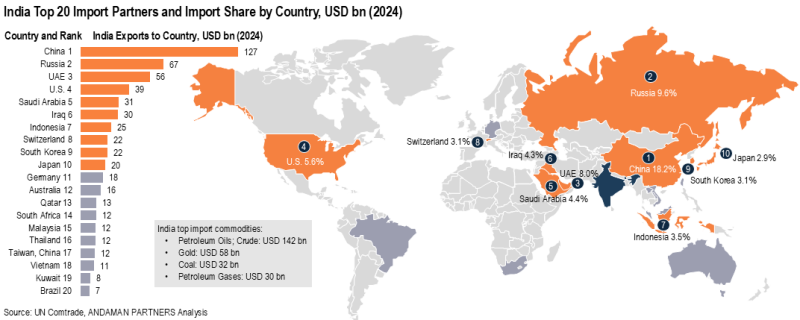

- China was the source for almost a fifth of India’s total imports in 2024.

- India’s top ten import partners are primarily located in the Middle East and Asia.

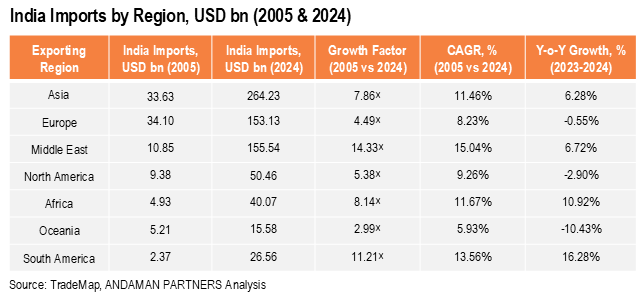

- On a regional basis, from 2005 to 2024, India’s imports from the Middle East expanded at the fastest rate, with a CAGR of 15%.

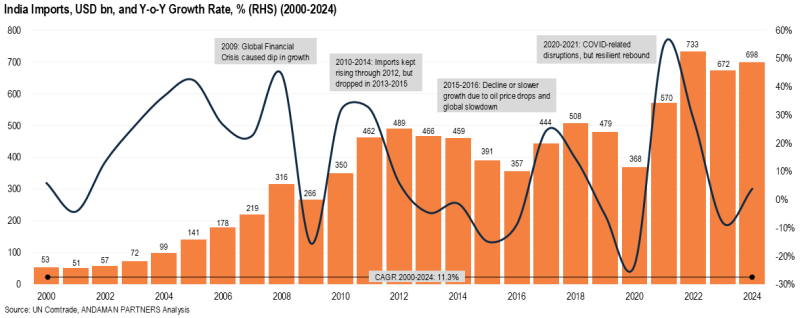

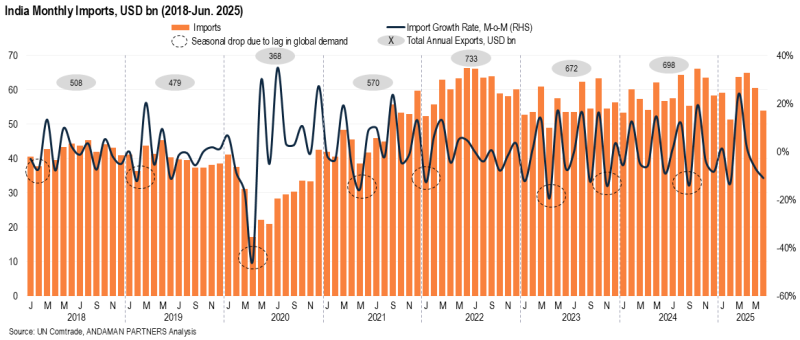

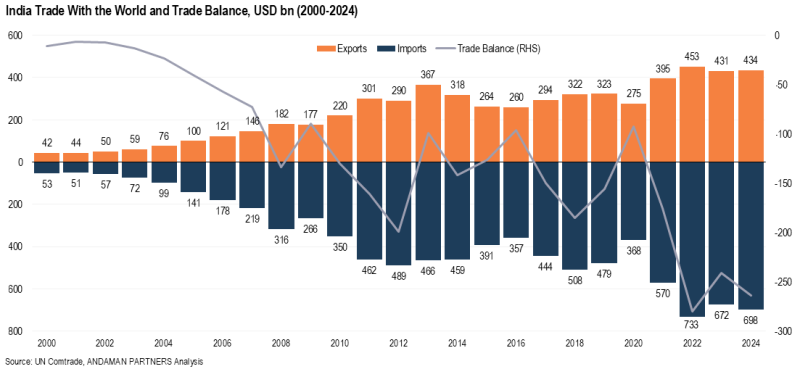

In 2024, India’s imports reached USD 698 billion, a year-on-year increase of 3.8% and a 4.8% decrease from the record high level of USD 733 billion in 2022. From 2000 to 2024, India’s imports had a CAGR of 11.3%.

India’s import bill expanded almost thirteenfold between 2000 and 2024, rising from around USD 50 billion at the start of the century to nearly USD 700 billion in 2024. This long-term surge reflects the structural transformation of India’s economy, with rapid GDP growth, rising domestic consumption, a deepening industrial base and increasing integration with global trade.

Import growth, however, has not been linear. Over these 25 years, India experienced sharp swings tied closely to global economic and financial cycles rather than abrupt domestic policy shifts. The most pronounced spikes came in 2008 (44% year-on-year growth), 2011-2012 (>30%) and 2021 (55%), each coinciding with periods of strong global growth, high commodity prices and robust domestic demand.

Conversely, contractions in 2009 (-15.6%), 2015 (-14.9%) and 2023 (-8.2%) reflected global downturns or price corrections.

Initial indications are that India’s imports will increase in 2025 compared to the previous year. In the first six months of 2025, imports reached USD 353.8 billion, up 3% year-on-year. In March, April, and May, monthly imports exceeded USD 60 billion; in 2024, this level was exceeded only in 5 of the 12 months.

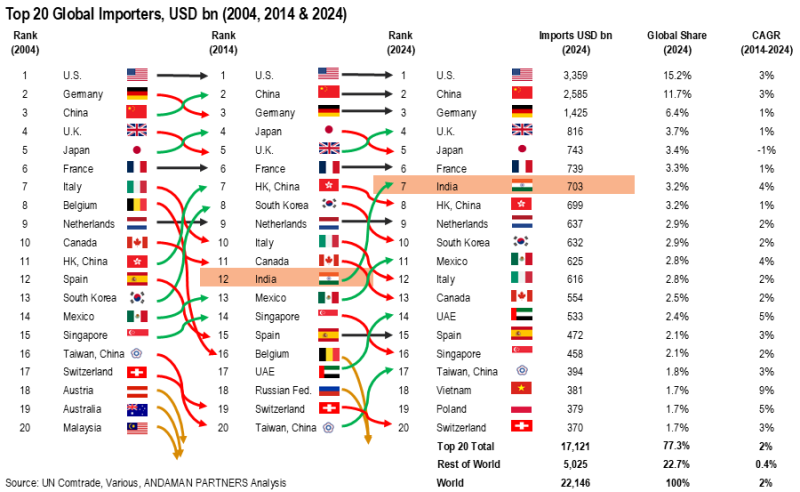

In 2024, India was the world’s seventh-largest importer, with imports on par with those of France (USD 739 billion) and Japan (USD 743 billion). From 2014 to 2024, India rose five places on the ranking of the world’s leading importers.

Among the top 20 importers, India had a CAGR of 4% over this period, behind only Vietnam (9%), the UAE (5%) and Poland (5%).

India’s imports have shown high sensitivity to external conditions, with world growth cycles, price levels, and exchange rate movements rapidly affecting import values. Unlike export-oriented economies such as Vietnam, Singapore and Ireland, India’s trade balance has typically remained structurally negative, with imports regularly exceeding exports.

Since 2010, India has consistently maintained an annual trade deficit, except for four years; the trade deficit reached a record high of USD 280 billion in 2022 and USD 264 billion in 2024.

The scale and volatility of its import bill have thus become a defining feature of India’s macroeconomic landscape, shaping its current account dynamics, fiscal policy and geopolitical stance.

What India Buys

One product, crude oil, accounted for a fifth of India’s total imports in 2024, at USD 141 billion. With crude oil, coal (USD 32 billion), petroleum gases (USD 30 billion), waste petroleum oils (USD 9 billion) and copper ores (USD 4 billion), the category of Minerals & Fuels accounted for 33% (USD 229 billion) of India’s total imports in 2024.

Machinery & Electronics accounted for 21% (USD 144 billion), with the leading import products including electronic integrated circuits (USD 23 billion), telephone sets, i.e., mobile phones (USD 17 billion), automatic data processing machines (USD 10 billion), semiconductor devices (USD 6 billion), flat panel display modules (USD 4 billion), electric transformers (USD 4 billion) and electric accumulators (USD 4 billion).

Metals accounted for a share of 20% (USD 141 billion), with the leading products including gold (USD 58 billion), diamonds (USD 17 billion), unwrought silver (USD 6 billion), ferrous waste & scrap (USD 5 billion) and aluminium waste & scrap (USD 4 billion).

Chemicals, Plastics or Rubber (USD 86 billion) accounted for 12%, including fertilisers (USD 4 billion). Transportation (USD 23 billion) accounted for 3%, consisting primarily of aircraft (USD 9 billion) and motor vehicles (USD 6 billion).

Minor categories among India’s imports were Food Products (3%), Agriculture & Forestry (2%) and Textiles (2%). Food imports included palm oil (USD 9 billion) and soybean oil (USD 4 billion). Agriculture & Forestry included leguminous vegetables (USD 5 billion).

All trade categories in India’s imports grew at a CAGR of 10% or more from 2000 to 2024. Chemicals and Agriculture & Forestry grew the fastest (both at 13%), followed by Metals and Transportation (both 12%); and Minerals & Fuels, Machinery & Electronics and Food Products (all 11%).

Where India Buys

China was India’s single largest import partner in 2024, accounting for almost a fifth (18.2%; USD 127 billion) of total imports, followed by Russia at USD 67 billion (9.6%), the UAE at USD 56 billion (8%) and the U.S. at USD 39 billion (5.6%). India’s top ten import partners were primarily located in the Middle East and Asia, including Saudi Arabia, Iraq, Indonesia, South Korea and Japan.

The only partners not in Asia or the Middle East were the U.S. and Switzerland (the eighth-largest import partner).

Import partners ranked 11-20 were more widely distributed around the world, including Europe (Germany), Africa (South Africa), Asia (Malaysia; Thailand; Taiwan, China; Vietnam), the Americas (Brazil), Australia and the Middle East (Qatar, Kuwait).

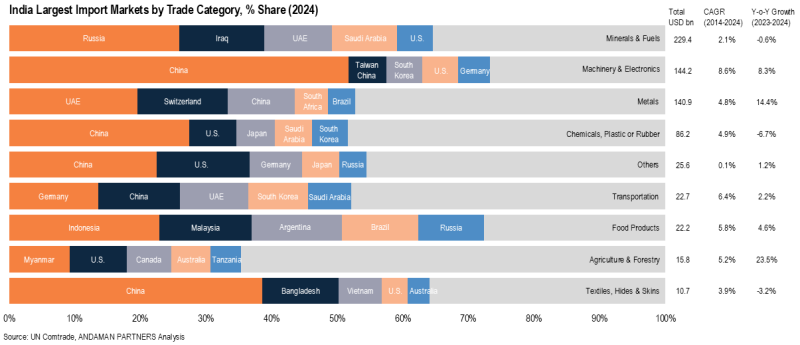

More than 50% of India’s Machinery & Electronics were imported from China, with the remainder from Taiwan (China), South Korea, the U.S., and Germany. China was also the primary source of India’s chemical imports, accounting for almost 30%, with the remainder mainly coming from the U.S., Japan, Saudi Arabia and South Korea. Nearly 40% of Textiles were imported from China, with smaller shares coming from Bangladesh, Vietnam, the U.S. and Australia.

Around a quarter of India’s Minerals & Fuels were imported from Russia, with smaller shares imported from Iraq, the UAE, Saudi Arabia and the U.S. Around 20% of Metals were imported from the UAE, followed by Switzerland, China, South Africa and Brazil. Transportation products were mainly imported from Germany, China and the UAE.

Food Products were mainly imported from Indonesia, Malaysia, Argentina, Brazil and Russia, while Agriculture & Forestry products were primarily imported from Myanmar, the U.S., Canada, Australia and Tanzania.

On a regional basis, from 2005 to 2024, India’s imports from the Middle East expanded at the fastest rate, with a CAGR of 15% and a growth factor of 14.3. Imports from South America also expanded rapidly over this period, with a CAGR of 13.5% and a growth factor of 11.2, followed by Africa (CAGR: 11.7%), Asia (11.5%), North America (9.3%) and Europe (8.2%). India’s imports from Oceania grew at only 6% over this period, the slowest among all the regions.

On a regional basis, from 2005 to 2024, India’s imports from the Middle East expanded at the fastest rate, with a CAGR of 15% and a growth factor of 14.3. Imports from South America also expanded rapidly over this period, with a CAGR of 13.5% and a growth factor of 11.2, followed by Africa (CAGR: 11.7%), Asia (11.5%), North America (9.3%) and Europe (8.2%). India’s imports from Oceania grew at only 6% over this period, the slowest among all the regions.

Conclusions: The Rise of India's Imports

India’s rapid and sustained import growth has made it a central player in global trade flows, with ripple effects across commodity markets, manufacturing supply chains and trade balances worldwide:

- A Major Demand Engine:

India’s import bill grew more than thirteenfold from 2000 to 2024, making it the world’s seventh-largest importer. Its sheer scale now shapes global demand for fuels, metals, electronics and agricultural commodities. - Highly Sensitive to Global Cycles:

Major import peaks and troughs align closely with global economic and commodity price cycles, underscoring India’s exposure to external shocks rather than domestic policy volatility. - A Structurally Negative Trade Balance:

Unlike export-led economies, India’s imports consistently exceed exports, resulting in some of the world’s most significant trade deficits in absolute terms (USD 264 billion in 2024), with global implications for energy and capital flows. - Strategic Linkages with Asia and the Middle East:

More than half of India’s imports come from Asia and the Middle East, reinforcing deep trade corridors with China, Gulf oil producers and East Asian manufacturing hubs. - A Fast-Growing Market for Suppliers Worldwide:

India’s steady import growth across all categories (CAGR ≥10% in every sector since 2000) makes it a key long-term destination market for exporters of energy, commodities, equipment and technology.

As India’s economy expands, its import profile will remain one of the defining features of global trade, linking resource suppliers in the Middle East, Africa and the Americas to manufacturing hubs in Asia and consumers at home. India’s role as a demand anchor in global markets will only continue to deepen and expand.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

AAMEG Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to sponsor and support the AAMEG pre-Mining Indaba Cocktails & Canapes event.

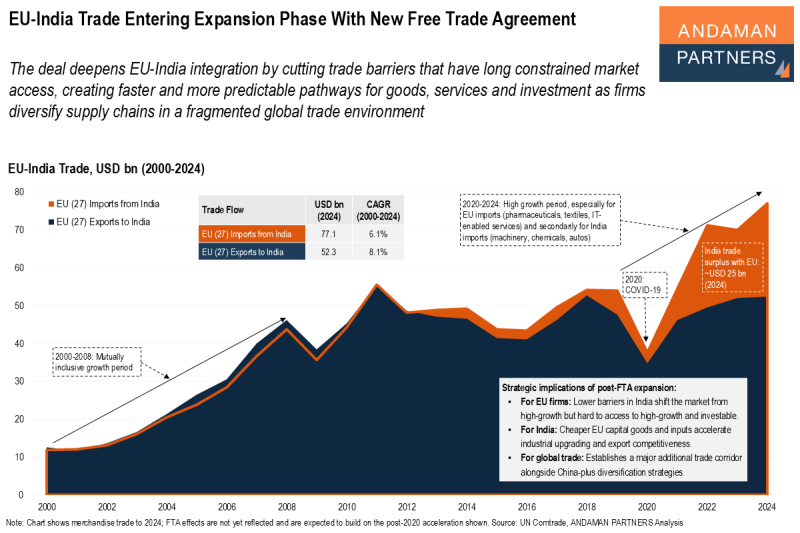

EU-India Trade Entering Expansion Phase With New Free Trade Agreement

The deal deepens EU-India integration by cutting trade barriers that have long constrained market access.

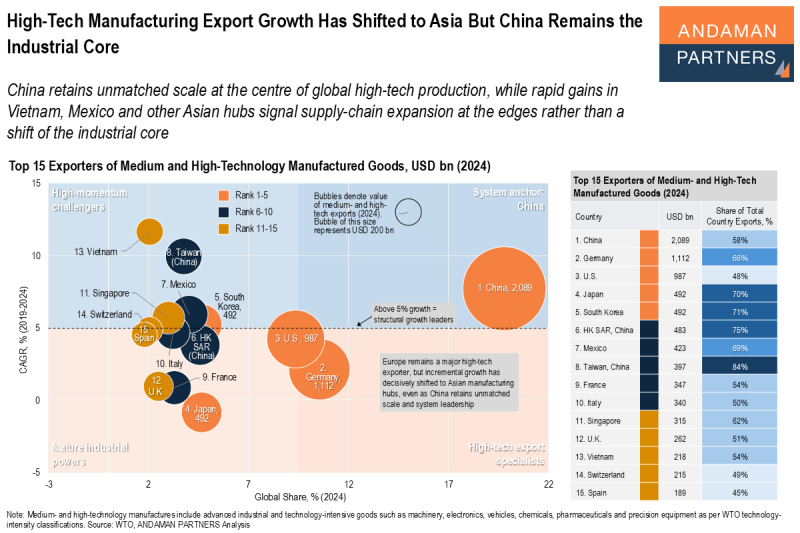

High-Tech Manufacturing Export Growth Has Shifted to Asia, But China Remains the Industrial Core

China retains unmatched scale at the centre of global high-tech production, while rapid gains in Vietnam, Mexico and other Asian hubs.

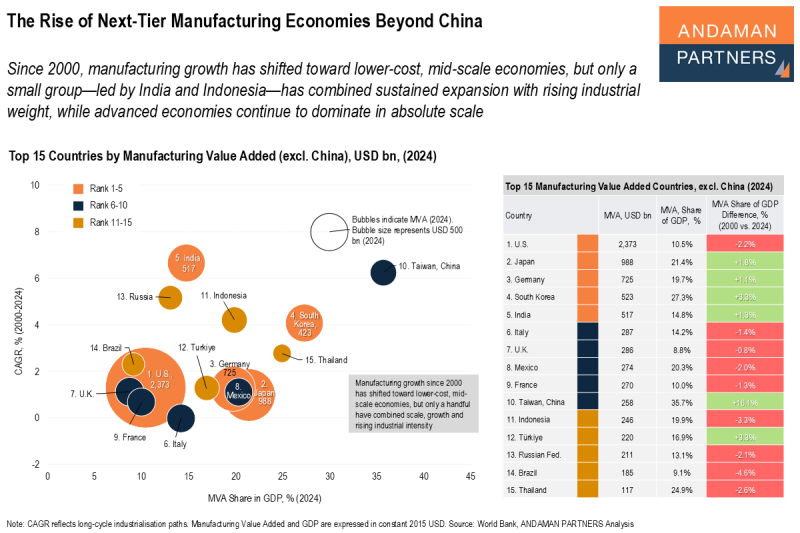

The Rise of Next-Tier Manufacturing Economies Beyond China

Manufacturing growth shifted toward lower-cost, mid-scale economies, but only a small group has combined sustained expansion with rising industrial weight.