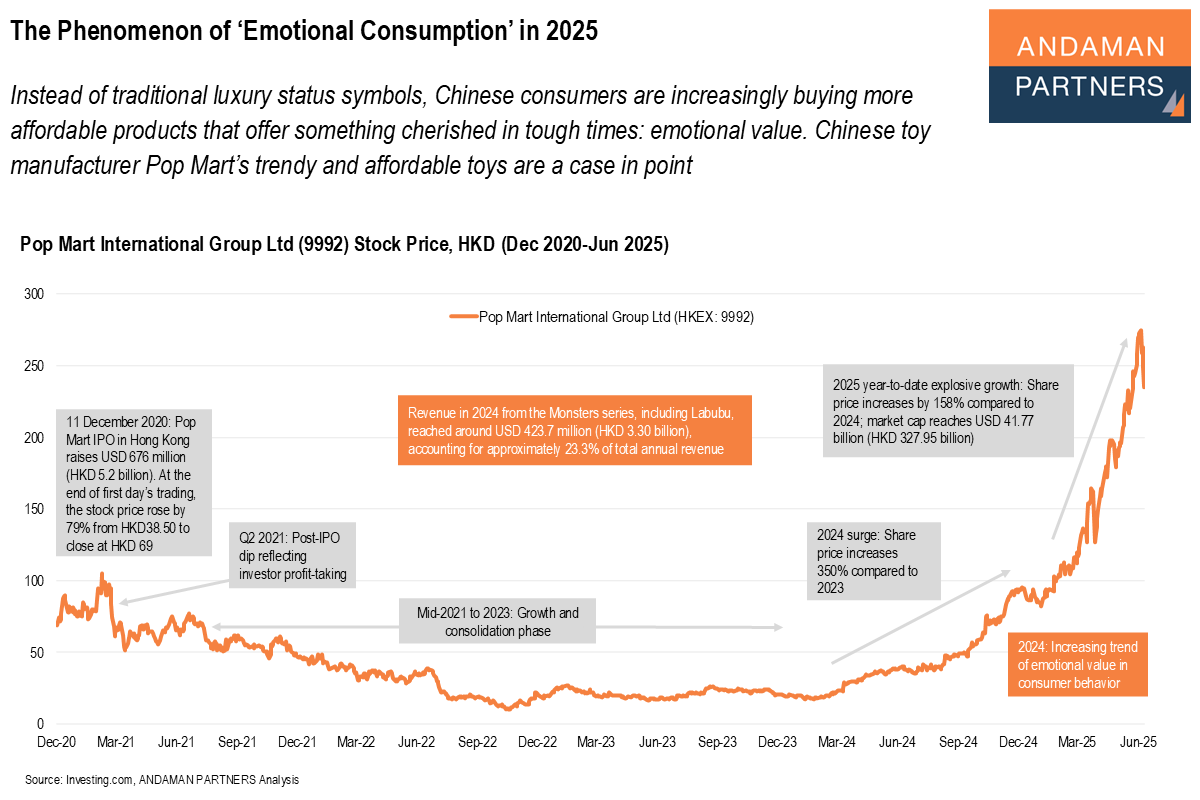

Instead of traditional luxury status symbols, Chinese consumers are increasingly buying more affordable products that offer something cherished in tough times: emotional value. Chinese toy manufacturer Pop Mart’s trendy and affordable toys are a case in point.

Consumption in China post-COVID has experienced no more than modest growth. In 2024-2025, the year-on-year growth rates of monthly retail sales hovered around the low single digits, compared to around 10% in the 2010s. The Chinese government has identified boosting consumption as a key priority for 2025, with various policies such as trade-in subsidies, vouchers and tax cuts.

One trend that has become popular in the current challenging economic environment is “emotional consumption.” It has taken off in China’s urban areas, especially among younger consumers. In essence, emotional consumption happens when consumers buy products not for their utility or status but for their emotional value, such as evoking nostalgia, whimsy or simple happiness.

In contrast to previous periods when brands could outcompete others in terms of quality, price and scale, brands competing on emotional value aim to connect emotionally with consumers. Emotional consumption is generally not for high-priced luxury status symbol items such as watches or designer handbags, but rather for more affordable products such as clothes, art, toys, niche perfumes or customised bicycles.

Emotional consumption took off during the COVID-19 pandemic, when consumers sought out emotionally comforting, playful or nostalgic products that could be used within the home. One company that exemplifies the unbridled success of emotional consumption in 2025 is Chinese toy manufacturer Pop Mart, particularly one line of their plush toys.

Pop Mart and the Labubu Phenomenon

Pop Mart started in 2010 when founder Wang Ning opened a single store in Beijing selling toys, comics and accessories. A little more than a decade later, Pop Mart is a pop culture phenomenon with a market cap of over USD 40 billion and over 500 stores globally — and Wang is one of China’s wealthiest men.

Pop Mart’s success is built on innovative products and clever branding. The company partners with popular artists to design their toys, and adopted the “blind box” model in 2016. Customers do not know exactly which toy they will receive when opening their purchase, only the type of toy, and if they are lucky, they might get a rare collector’s item. This has created a sense of mystery among consumers (not to mention a buying frenzy), and an “unboxing” phenomenon has become a viral social media trend.

In 2019, Pop Mart seemingly perfected its product model by launching the Labubu series of plush dolls based on comic book characters. The appeal of the Labubu dolls is that they are affordable indulgences and inspire joyful feelings reminiscent of childhood, which are all the more valuable in tough economic times. Generally priced at USD 20-40, the dolls appeal to customers because they fill an emotional void, reminding consumers that they can be happy about the simple things in life.

The success of Pop Mart and Labubu is an instructive case study on successful retail strategies during challenging economic times. Pop Mart is now expanding beyond toys, having opened its first jewellery store in Shanghai in June 2025, selling accessories adorned with Pop Mart’s top-selling characters.

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

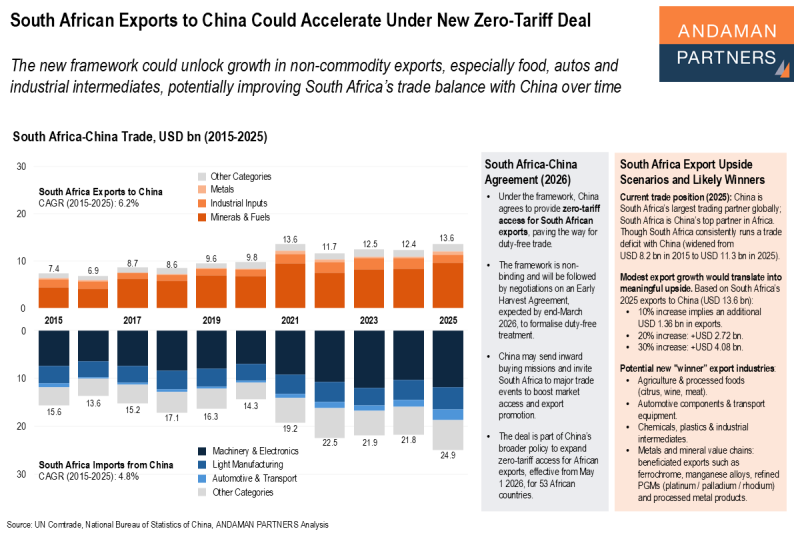

South African Exports to China Could Accelerate Under New Zero-Tariff Deal

The new framework could unlock growth in non-commodity exports, especially food, autos and industrial intermediates.

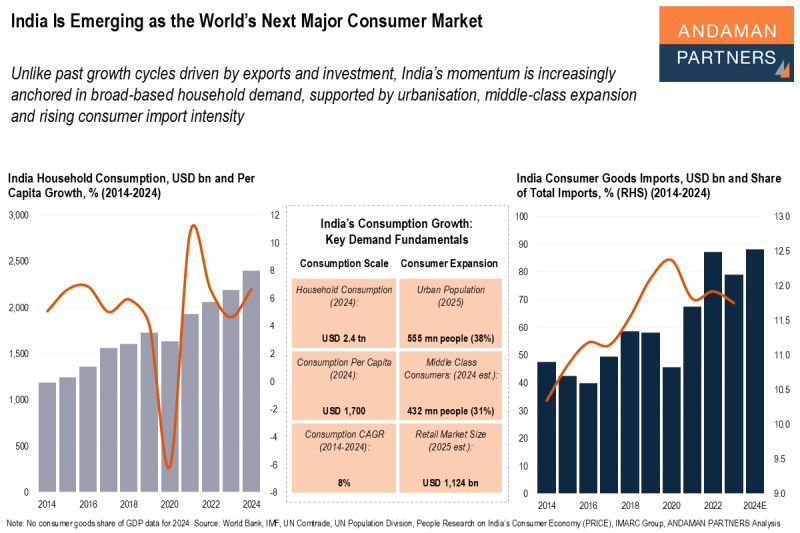

India Is Emerging as the World’s Next Major Consumer Market

India’s momentum is anchored in broad-based household demand, supported by urbanisation, middle-class expansion and consumer import intensity.

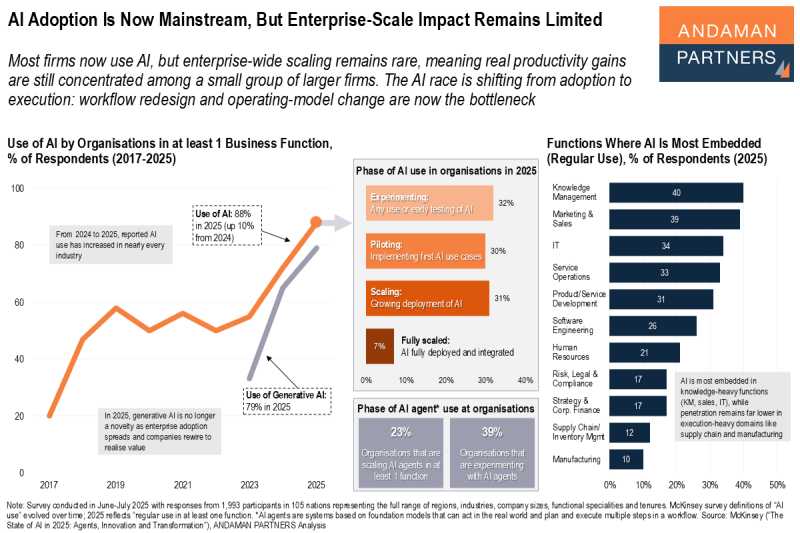

AI Adoption Is Now Mainstream, But Enterprise-Scale Impact Remains Limited

Most firms now use AI, but enterprise-wide scaling remains rare, meaning productivity gains are concentrated in a small group of larger firms.