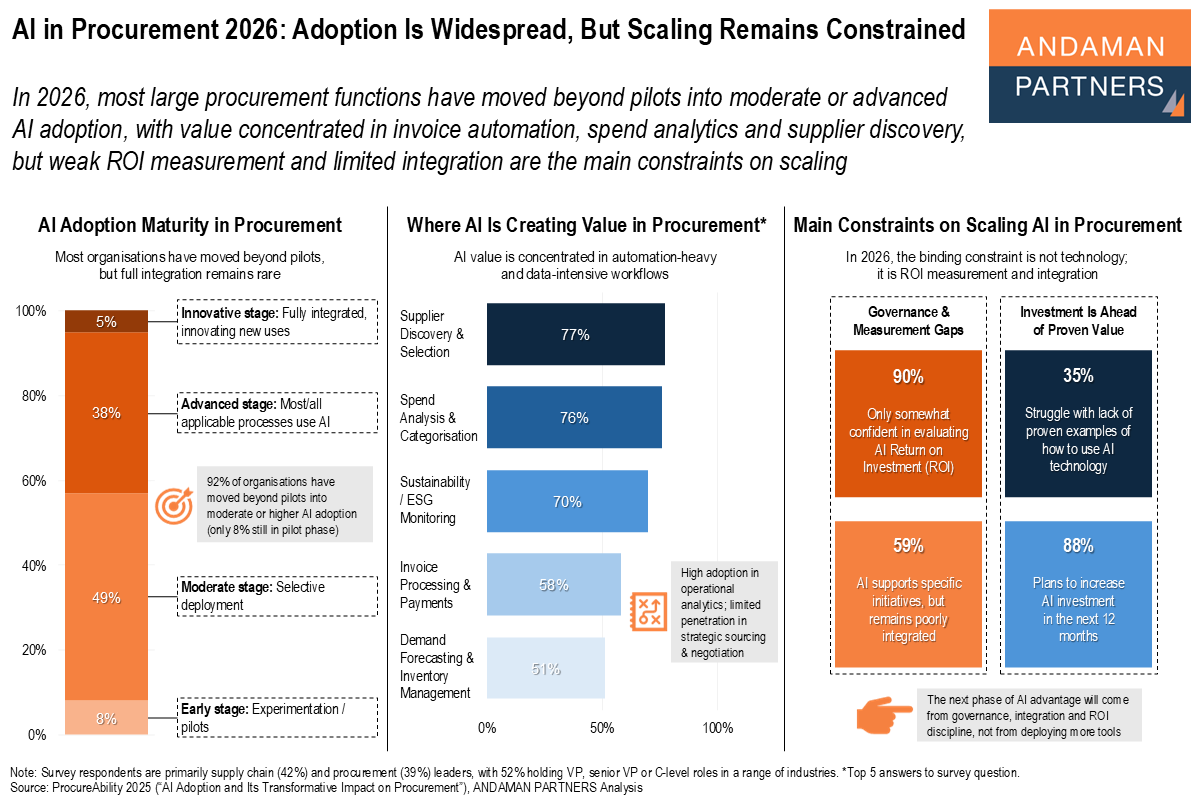

Most large procurement functions have moved beyond pilots into moderate or advanced AI adoption, with value concentrated in invoice automation, spend analytics and supplier discovery, but weak ROI measurement and limited integration are the main constraints on scaling.

In 2026, AI adoption in procurement is no longer the story. Scaling, integration and value discipline are.

Across large procurement functions, AI has moved decisively beyond pilots into mainstream deployment. The impact of AI remains concentrated, however, in a narrow set of operational workflows; weak return on investment (ROI) measurement and limited integration are now the binding constraints on further scaling.

The findings of the ProcureCon Insights/ProcureAbility survey published in 2025, AI Adoption and Its Transformative Impact on Procurement, provide a rare, practitioner-level view of how AI is actually being deployed inside procurement functions today. The survey primarily covers supply chain (42%) and procurement (39%) leaders, with more than half holding VP, senior VP or C-level roles across a broad range of industries and company sizes.

The AI maturity picture is already striking. Only 8% of organisations remain in pilot mode, while 92% have reached moderate adoption or higher. Nearly half are selectively deploying AI across core processes, and more than a third report advanced adoption across most applicable workflows. In other words, adoption is no longer the constraint.

Where AI is creating value, however, it is still highly concentrated. Usage is strongest in supplier discovery, spend categorisation, ESG monitoring, invoice processing and demand forecasting—all automation-heavy, data-intensive activities. By contrast, penetration remains limited in the strategic core of procurement, including sourcing, negotiation and RFX, underscoring that AI’s impact is still operational rather than transformational.

The main bottleneck is now governance. A complete 90% of organisations remain only somewhat confident in evaluating AI ROI, 59% report that AI still supports isolated initiatives rather than being fully integrated and 35% cite the lack of proven examples as their biggest roadblock, even as 88% plan to increase AI investment in the next 12 months.

The implication is clear: the next phase of AI advantage in procurement will come not from deploying more tools, but from governance, integration and ROI discipline.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

AAMEG Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to sponsor and support the AAMEG pre-Mining Indaba Cocktails & Canapes event.

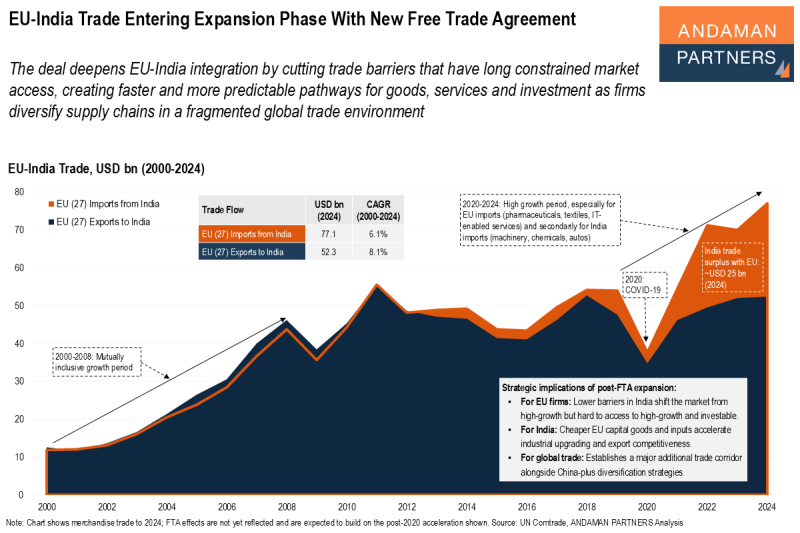

EU-India Trade Entering Expansion Phase With New Free Trade Agreement

The deal deepens EU-India integration by cutting trade barriers that have long constrained market access.

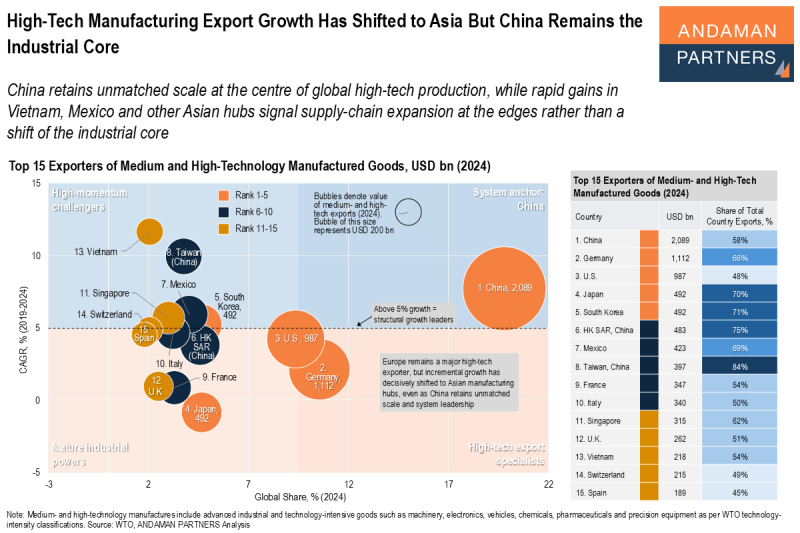

High-Tech Manufacturing Export Growth Has Shifted to Asia, But China Remains the Industrial Core

China retains unmatched scale at the centre of global high-tech production, while rapid gains in Vietnam, Mexico and other Asian hubs.

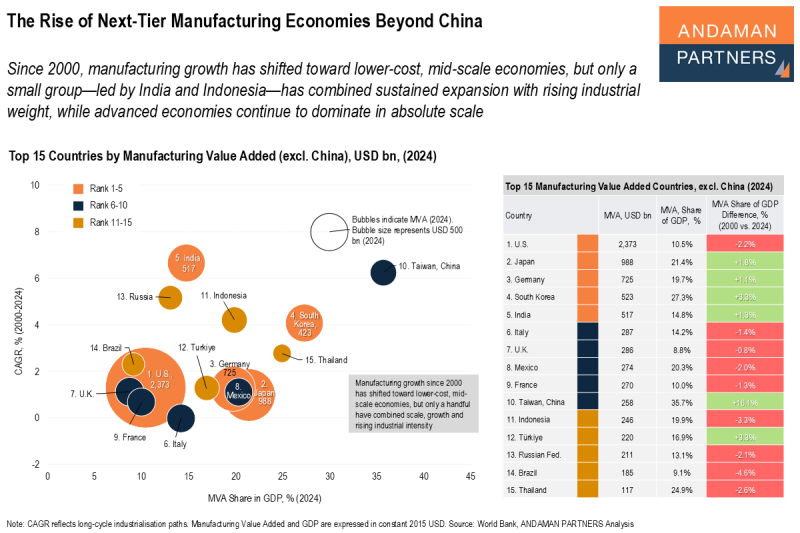

The Rise of Next-Tier Manufacturing Economies Beyond China

Manufacturing growth shifted toward lower-cost, mid-scale economies, but only a small group has combined sustained expansion with rising industrial weight.