China’s Five-Year Plans steered economic development from investment- and export-led expansion in the 1990s toward more balanced, high-quality growth and domestic consumption from the 2000s onwards.

China’s Five-Year Plans (FYPs) have been the central policy framework steering the country’s economic transformation since the 1950s. A strategy to mobilise investment, accelerate industrialisation and gradually integrate into global trade in the 1990s evolved into a more complex agenda from the 2000s onwards, focused on technological innovation, domestic consumption and sustainable growth.

Under successive FYPs, China moved from quantity to quality, from low-cost manufacturing to advanced industries, from infrastructure to innovation and from an export-driven model to one increasingly anchored in the domestic market.

Long-term policy continuity has been a defining feature of China’s rise as a global economic power, with each successive FYP making a significant contribution and building on the progress of the preceding plan.

From 1991 to 2005, China’s FYPs were fundamentally geared toward accelerating growth, expanding infrastructure, attracting investment, industrialising rapidly and integrating into global markets. From 2006 onward, beginning with the 11th FYP, the plans increasingly focused on rebalancing and adjustment, shifting emphasis from quantity to quality, from industry to services, from energy intensity to efficiency and from external demand to a more domestically anchored growth model.

8th FYP (1991–1995): Launching the Socialist Market Economy

The 8th Plan marked a decisive shift toward market-oriented reform, with massive investments in infrastructure, energy and coastal industries, leading to double-digit growth and creating the foundation for China’s manufacturing and export boom.

9th FYP (1996–2000): Consolidating Reform and Broadening Prosperity

With the restructuring of state-owned enterprises (SOEs) and the deepening of the market, the 9th Plan guided China through rapid modernisation while improving living standards. By 2001, China had entered the lower-middle-income category and stabilised economic growth at a high level.

10th FYP (2001–2005): Integration into the Global Economy

Following accession to the World Trade Organisation (WTO) in 2001, the 10th Plan focused on structural adjustment and competitiveness. Trade and FDI surged, industry was upgraded, and China’s export machine became central to global supply chains.

11th FYP (2006–2010): Rebalancing Toward Quality and Conservation

With the economy booming, the 11th Plan prioritised environmental protection, energy efficiency and higher-value-added sectors under the “Scientific Outlook on Development” framework.

The 11th FYP marked a strategic turning point, as policy shifted from maximising growth speed to managing structural imbalances, environmental costs, and social equity, themes that became central tenets of every subsequent plan.

12th FYP (2011–2015): Expanding Services and Emerging Industries

The 12th Plan aimed to rebalance growth by expanding domestic consumption, reducing inequality and nurturing strategic emerging industries. Services overtook industry as the largest sector, indicating a structural shift in the economy.

13th FYP (2016–2020): Innovation-Driven Growth and Addressing Poverty

The 13th Plan accelerated the push toward innovation, research & development (R&D) and supply-side reform, while completing the goal of eliminating extreme poverty. It also advanced the energy transition, setting new targets for fossil fuel emissions and renewable energy production.

14th FYP (2021–2026): Domestic Demand and the Green Transition

The 14th Plan focused on expanding domestic demand, digital transformation and green development, positioning China to compete more effectively in a more uncertain global environment. The plan emphasised tech self-reliance, innovation and a more balanced growth model.

The 15th FYP is currently in the final stages of drafting and will cover the period 2026-2030. Priorities for the upcoming plan could include an emphasis on economic resilience (e.g., diversifying trade partners and reducing reliance on imports of critical materials), boosting domestic consumption, improving domestic capabilities in key technologies, bolstering technological innovation and scientific research, expanding domestic demand and rural revitalisation.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

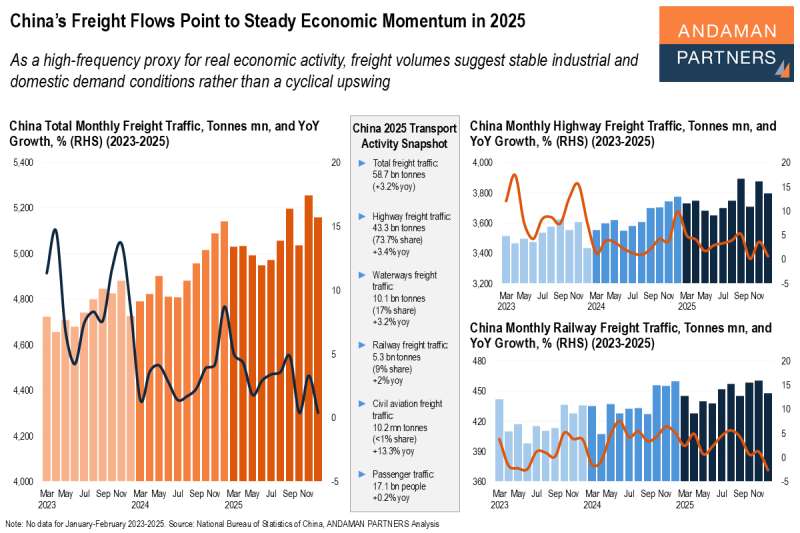

China’s Freight Flows Point to Steady Economic Momentum in 2025

Freight volumes suggest stable conditions in industrial and domestic demand rather than a cyclical upswing.

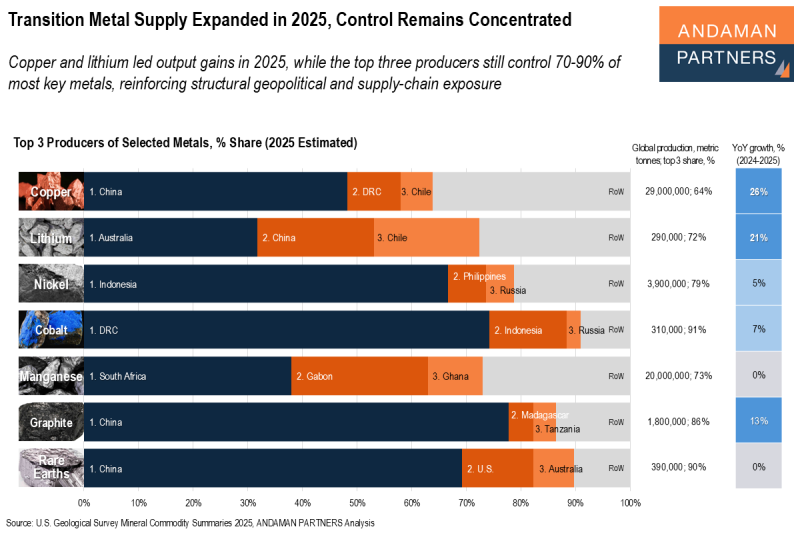

Transition Metal Supply Expanded in 2025, Control Remains Concentrated

Copper and lithium led output gains in 2025, while the top three producers still control 70-90% of most key metals.

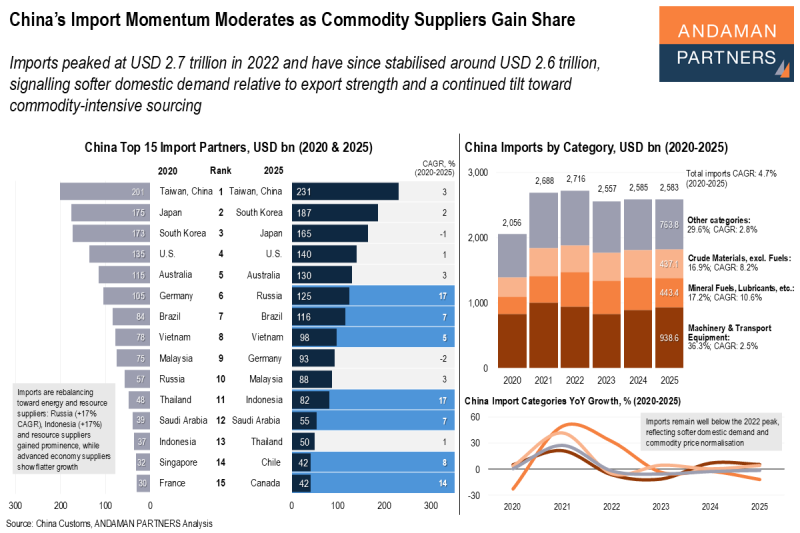

China’s Import Momentum Moderates as Commodity Suppliers Gain Share

Imports have stabilised around USD 2.6 trillion, signalling softer domestic demand and a continued tilt toward commodity-intensive sourcing.