From energy and pharma to engineering and IT, India has emerged as a top-tier trading nation with a diverse export basket and global reach.

Highlights:

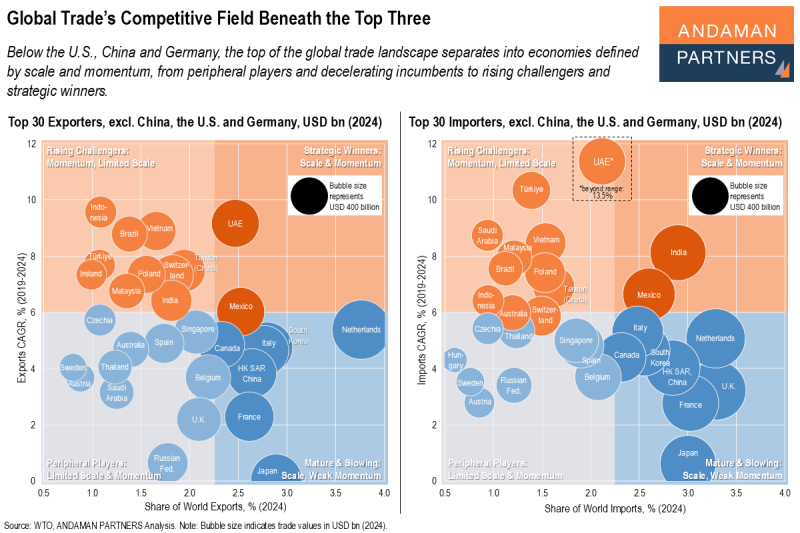

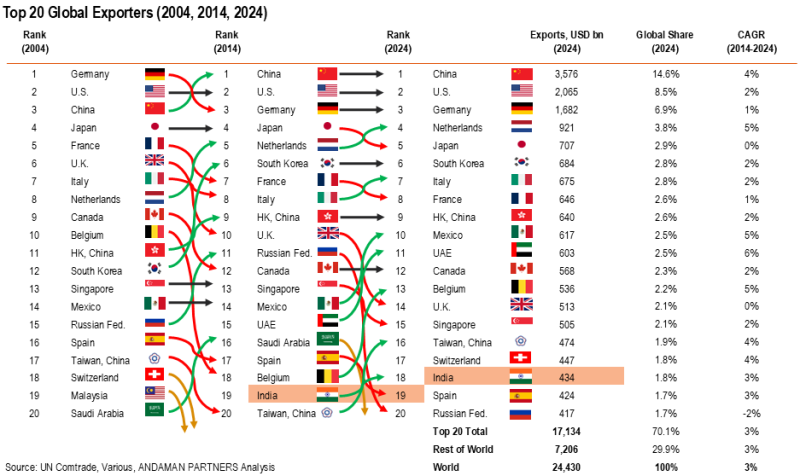

In 2024, India’s exports amounted to USD 434 billion (flat from 2023), accounting for 1.8% of world exports of USD 24.43 trillion, making India the world’s 18th-largest exporter. India’s exports in 2024 were on par with those of Taiwan (China), Switzerland, the Russian Federation and Spain, but far behind China (14.6% global share), the U.S. (8.5%) and Germany (6.9%).

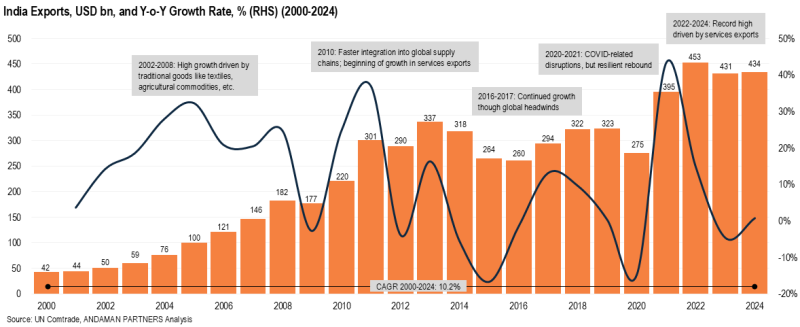

From 2000 to 2024, India’s exports expanded at a CAGR of 10.2%, including a particular growth spurt from 2000 to 2011. Over this period, the country’s exports grew more than eight times from USD 42 billion in 2000 to USD 337 billion in 2011. Goods like textiles and agricultural commodities drove India’s high export growth in the 2000s. The export y-o-y growth rate ranged from 14% in 2002 to 32% in 2005 and 24% in 2008.

From 2014 to 2024, the export CAGR was a more modest 3%. In the 2010s, India’s exports benefited from the country’s increased integration into global supply chains, and growth was driven mainly by service exports. Between 2014 and 2016, India’s exports experienced negative year-on-year (y-o-y) growth due to several factors, including weak demand from trading partners, a decline in crude oil prices, the appreciation of the rupee and high trade and transport costs.

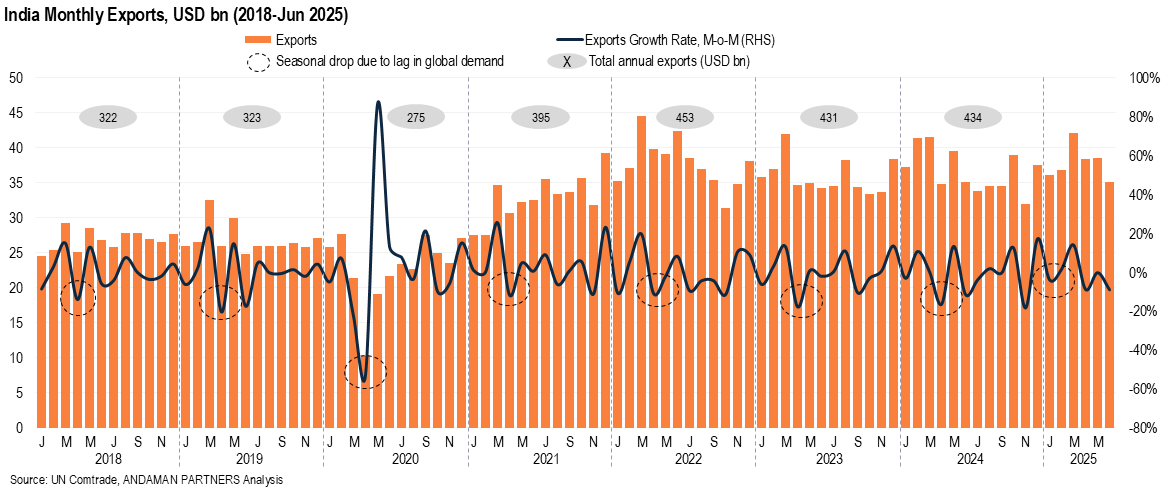

Following three years of positive growth, India’s exports reached USD 323 billion in 2019. COVID-related disruptions led to a -15% y-o-y growth rate in 2020, followed by a 43% post-COVID demand rebound in 2021 to a record high of USD 395 billion. In 2022, exports reached a new high of USD 453 billion, a 15% y-o-y increase, driven by services exports. In 2024, exports were slightly below this level at USD 434 billion.

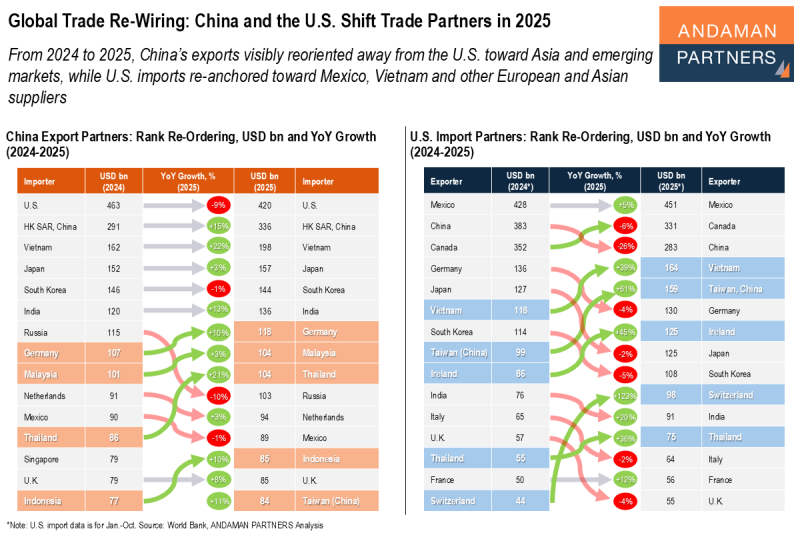

During the first six months of 2025, India’s exports reached USD 227 billion, indicating that full-year exports are on track to surpass the record high achieved in 2022. The country’s strong export performance in 2025 is driven by greater shipments of mobile phones, electronics and electric vehicle (EV) components; resilient services exports; and a diversification of the country’s export partners.

Expanding Export Basket: What India Sells

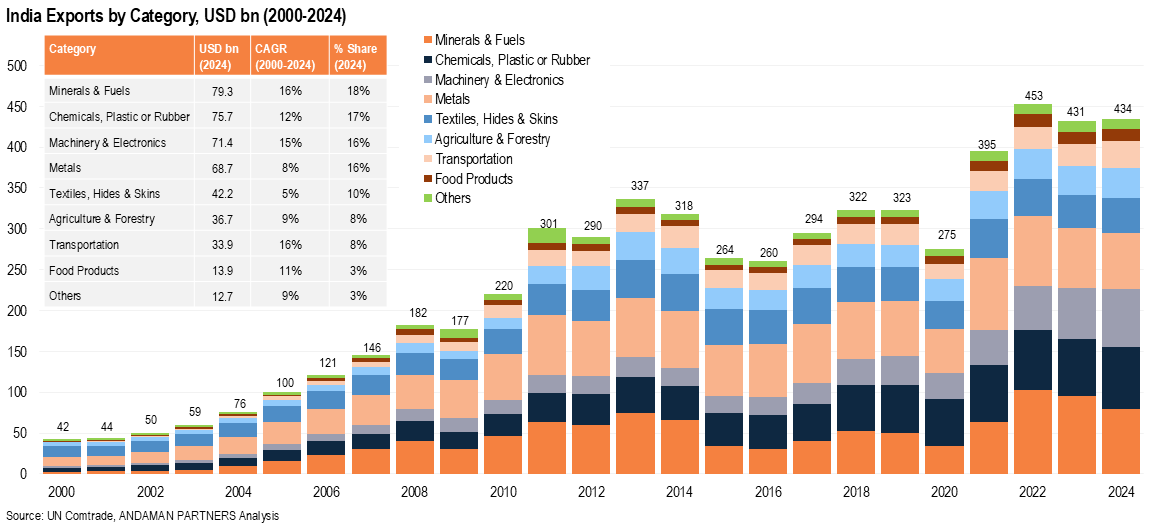

India’s exports have become increasingly diversified over the past few years. In the 2000s, the country’s export basket was dominated by petroleum products, gems & jewellery and textiles & garments. In the 2010s, petroleum products remained dominant, but new sectors emerged among the leading categories, particularly engineering goods (including machinery, automotive parts, metals and transport equipment), pharmaceuticals and IT services.

In the 2020s, India’s export basket became further diversified, with the top categories including engineering goods, electronics (especially smartphones), pharmaceuticals and agribusiness (mainly rice, spices, seafood, cotton and sugar), along with petroleum products and gems & jewellery.

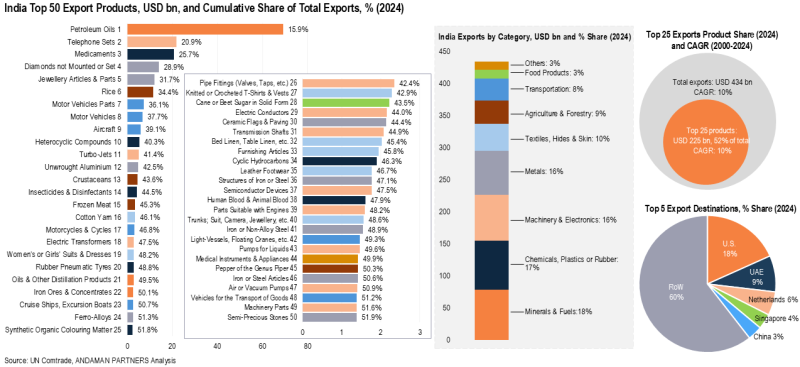

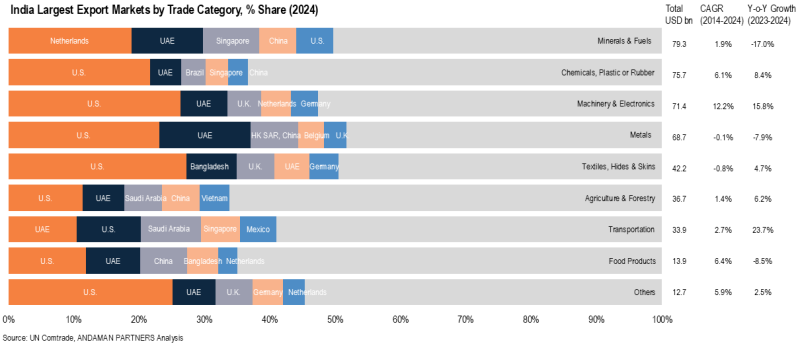

In 2024, the four largest categories of India’s exports were all of roughly equal size, namely Minerals & Fuels (18% of the total); Chemicals, Plastics or Rubber (17%), Machinery & Electronics (16%) and Metals (16%).

Transportation accounted for 8% of the total, but this category, along with Minerals & Fuels, grew the fastest from 2000 (both at a CAGR of 16%), followed by Machinery & Electronics (15%) and Chemicals, Plastics or Rubber (12%). By contrast, Textiles and Metals, which were more prominent in the 2000s, grew at only 5% and 8%, respectively.

Due to India’s role as a leading refining hub, the country imports high volumes of crude oil, which are refined in large-scale refineries and exported as refined products, such as diesel, gasoline, jet fuel, naphtha and lubricants. Refined petroleum oils consistently account for 15-20% of India’s exports; in 2024, this was, as usual, the single largest export product with a share of 16% of the total (USD 69 billion).

Aside from petroleum oils, India’s top ten largest export products provide a clear reflection of the country’s increasing export diversity. The second-largest export product in 2024 was mobile phones, accounting for 5% (USD 22 billion), followed by Medicaments at 4.8% (USD 21 billion).

Rounding out the top ten are two Metals (diamonds and jewellery), rice, three Transportation products (motor vehicle parts, motor vehicles and aircraft) and a chemical (heterocyclic compounds, an essential component of vitamins and numerous drugs).

Exporting Regions

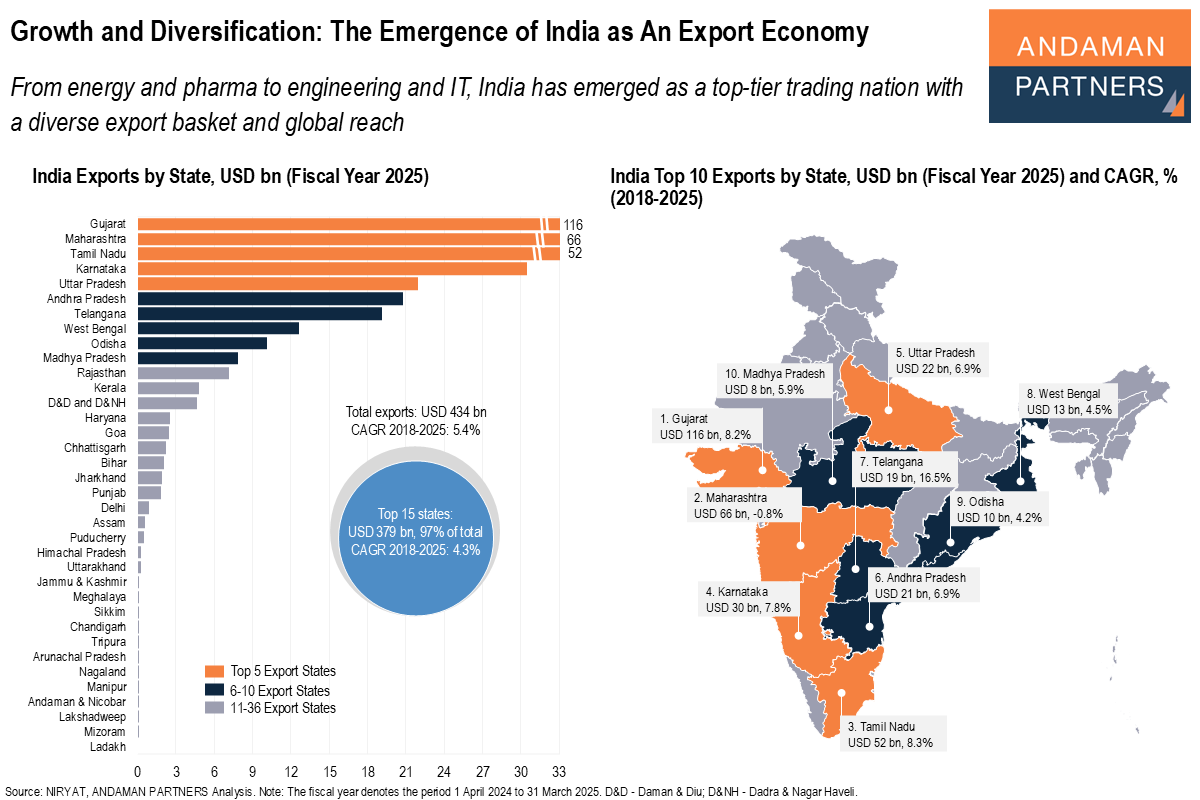

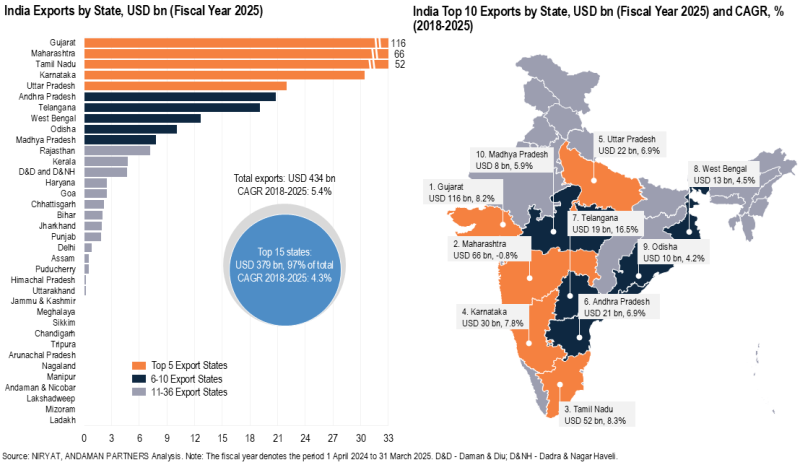

In 2024, 60% of India’s exports were produced by only four states situated in the southern and western regions of the country: Gujarat, Maharashtra, Tamil Nadu and Karnataka. Gujarat, the centre of India’s petroleum refining industry and home to the world’s largest refinery, the Reliance Jamnagar complex, accounted for more than a quarter (USD 116 billion, a share of 26%) of the country’s exports by itself.

Maharashtra, where a diverse range of export industries are located, accounted for USD 66 billion (15%) of total exports, while Tamil Nadu, the centre of automobile, textiles and electronics exports, accounted for USD 52 billion (12%).

Telangana, another state with a diverse export portfolio that accounted for USD 19 billion of India’s exports, a share of 4.3%, recorded the fastest growth in exports of all states from 2018 to 2025, growing by 16.5%. This state is a centre for the exports of pharmaceuticals, chemicals, IT services and engineering goods. It is one of India’s fastest-growing states in terms of economic growth, growing at an average annual rate of 14% since 2018.

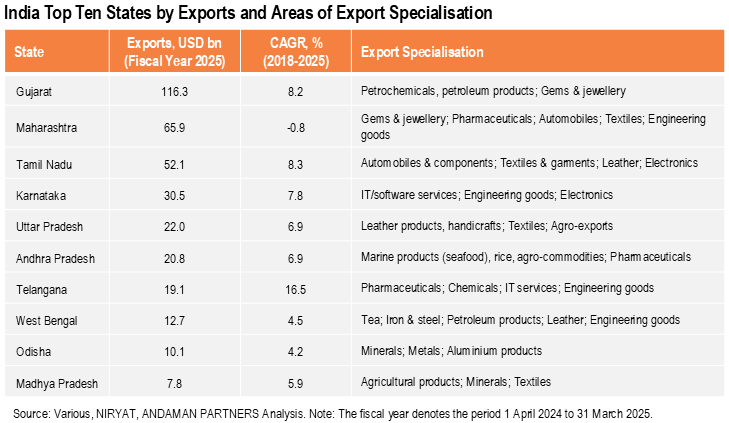

The following table lists the export specialisations of India’s ten leading exporting states.

A Growing List of Partners: Where India Sells

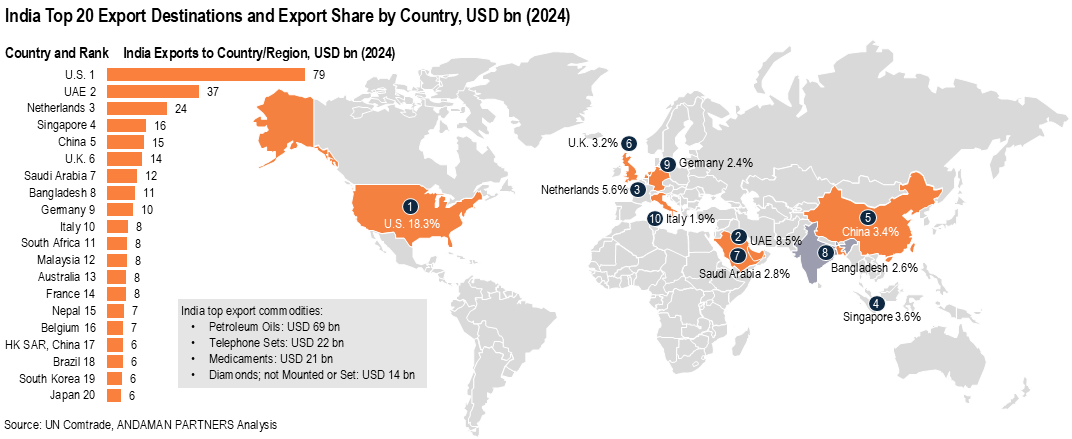

Since 2005, the U.S. has consistently been one of India’s largest trading partners. In 2024, the U.S. was India’s largest export destination, receiving USD 79 billion, or 18.3% of the country’s total exports. This was followed by the UAE (8.5%), the Netherlands (5.6%), Singapore (3.6%), and China (5.6%). The Netherlands has steadily risen as an export partner for India, from the 11th-largest partner in 2000 to sixth-largest in 2010 and third-largest in 2024. These five partners received 60% of India’s exports in 2024.

Several emerging markets and developing economies have become significant export partners for India in recent years, including China (15th-largest partner in 2000, rising to fifth-largest in 2024), Saudi Arabia (12th-largest to seventh-largest), and Bangladesh (14th-largest to eighth-largest). Other emerging markets and developing economies among India’s top 20 export partners are South Africa, Malaysia, Nepal and Brazil.

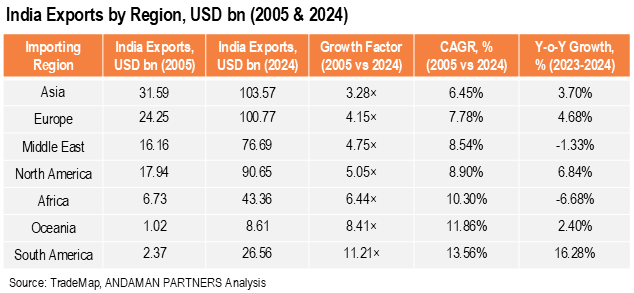

On a regional basis, India’s trade with all world regions increased from 2005 to 2024; however, exports to South America increased by the most significant margin, a factor of more than 11, while exports to Oceania increased by a factor of 8.41 and exports to Africa increased by a factor of 6.44. India’s substantially larger volumes of exports to North America, the Middle East, Europe and Asia also increased, albeit by smaller margins.

On a per-category basis, the U.S. is the largest buyer of all categories except Minerals & Fuels, which primarily goes to the Netherlands, and Transportation, which mainly goes to the UAE. The UAE is the second-largest buyer of India’s Chemicals, Plastics or Rubber as well as Machinery & Electronics, Agriculture & Forestry and Food Products.

Saudi Arabia is a major buyer of India’s Agriculture & Forestry and Transportation exports, while China is the third-largest buyer of Indian Food Products. Bangladesh is the second-largest buyer of Indian textiles.

Conclusions: The Global Impact of India's Exports

India’s exports have increased significantly over the last two decades. The following are some of the standout ways in which India’s exports have impacted global trade:

- India is Now a Top-Tier Trading Economy:

With exports approaching USD 500 billion, India has an increasing presence in global supply chains and trade negotiations. - A Diverse Export Basket Strengthening Resilience:

India has transitioned from a narrow dependence on petroleum, gems and textiles to a diversified portfolio that includes electronics, pharmaceuticals, agribusiness and services. A more diverse export basket provides India with greater resilience in the face of commodity price swings and global demand shocks. - An Important Supplier of Critical Goods:

India is the world’s largest supplier of generic medicines, a leading exporter of rice and a significant hub for refined petroleum products. - A Strategic Option for Supply Chain Diversification:

As firms seek to reduce their reliance on China, India is now emerging as an alternative hub for electronics, automotive components and clean-tech manufacturing. - Rising Interconnectedness and Geopolitical Influence:

India’s exports bind it to key partners. The U.S. is the country’s largest export market, the Middle East is an important energy partner, and Africa (and several other regions) are larger buyers of Indian food and pharma supplies. This interconnected export footprint provides India with greater geopolitical leverage in global affairs.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

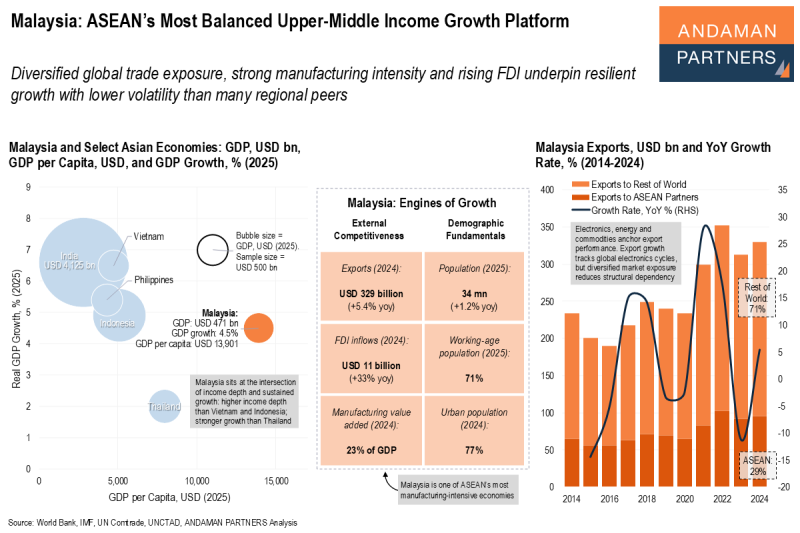

Malaysia: ASEAN’s Most Balanced Upper-Middle Income Growth Platform

Diversified global trade exposure, strong manufacturing intensity and rising FDI underpin resilient growth with lower volatility than many regional peers.

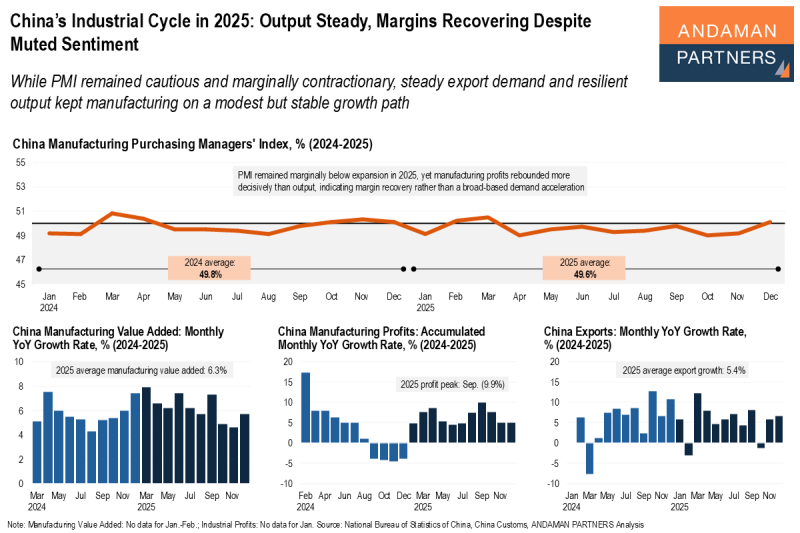

China’s Industrial Cycle in 2025: Output Steady, Margins Recovering Despite Muted Sentiment

While PMI remained cautious and marginally contractionary, steady export demand and resilient output kept manufacturing on a modest but stable growth path.

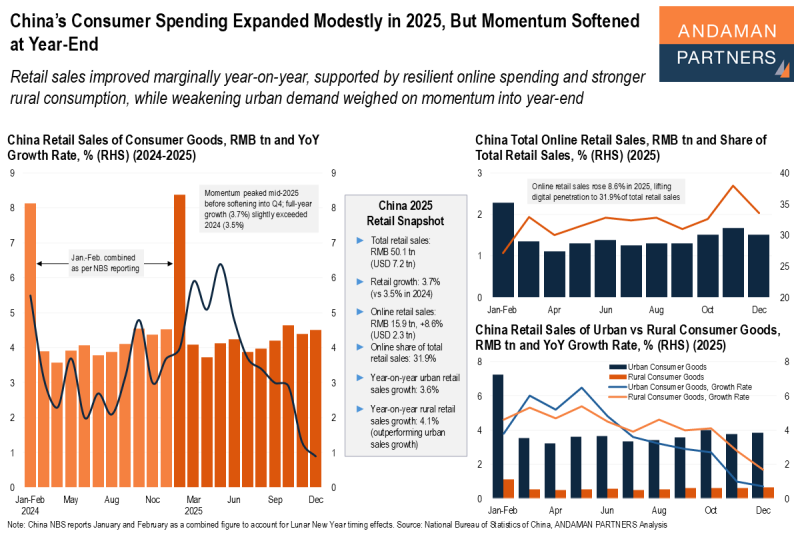

China’s Consumer Spending Expanded Modestly in 2025, But Momentum Softened at Year-End

Retail sales improved marginally year-on-year, supported by resilient online spending and stronger rural consumption.