China’s retail sales rose 4.8% in the first half of 2025, marking a steady recovery from the contraction in 2022. Consumer confidence remains subdued, but spending patterns show a decisive shift: Households are channelling their money into categories that enhance lifestyle, health and technology.

China’s economy in 2025 continues to face several macroeconomic headwinds, including slowing GDP growth, falling industrial output, the ongoing property sector crisis, external trade tensions and low consumer confidence. In 2025, however, while consumer confidence has remained constrained, retail sales growth overall has gradually begun to trend upward, and there are indications of more rapid increases in key retail categories.

China’s retail sales reached the equivalent of USD 3.38 trillion in the first half of 2025, with year-on-year growth of 4.8%, reflecting an upward trend from -4.4% in 2022 and 2% in both 2023 and 2024. China’s consumer markets are still recovering from the challenging year of 2022, when not only retail sales dropped sharply but the Consumer Confidence Index (which measures consumers’ optimism about the economy’s performance) crashed from 121.5 points at the beginning of the year to a record low of 85.50 in November. In the years since, the index has remained chiefly at or near this level, reaching 87.9 in June 2025.

While consumer confidence remains low, there are signs of rapid growth in key markets. In the first half of 2025, several retail categories vastly outperformed the overall growth rate, indicating areas where Chinese consumers are spending more this year:

- Gold, Silver & Jewellery: 11.3%.

- Grain, Oil & Food: 12.3%.

- Sports & Recreational Products: 22.2% (including sports apparel and footwear, outdoor gear and fitness accessories).

- Furniture: 22.9%.

- Communication Equipment: 24.1% (including mobile phones and phone accessories).

- Household Appliances: 30.7%.

- Passenger Vehicles 10.8%.

- Electric Vehicles 33.3%.

These high-growth categories suggest that Chinese consumers in 2025 are channelling spending into upgraded lifestyles, personal well-being, technology and sustainability, spending more on healthier food options, fitness and outdoor activities, electric vehicles, home upgrades and jewellery. In addition, travel and tourism in China this year have finally exceeded the levels of 2019, with 329 million domestic trips undertaken in the first half of 2025, which is 18% higher than 2019 levels.

China’s Ministry of Commerce expects full-year 2025 retail sales in China to exceed USD 7 trillion, which would represent year-on-year growth of 3%. For retailers, the opportunity lies in capturing demand in fast-growing, aspirational categories where Chinese consumers are proving willing to spend in 2025.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

AAMEG Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to sponsor and support the AAMEG pre-Mining Indaba Cocktails & Canapes event.

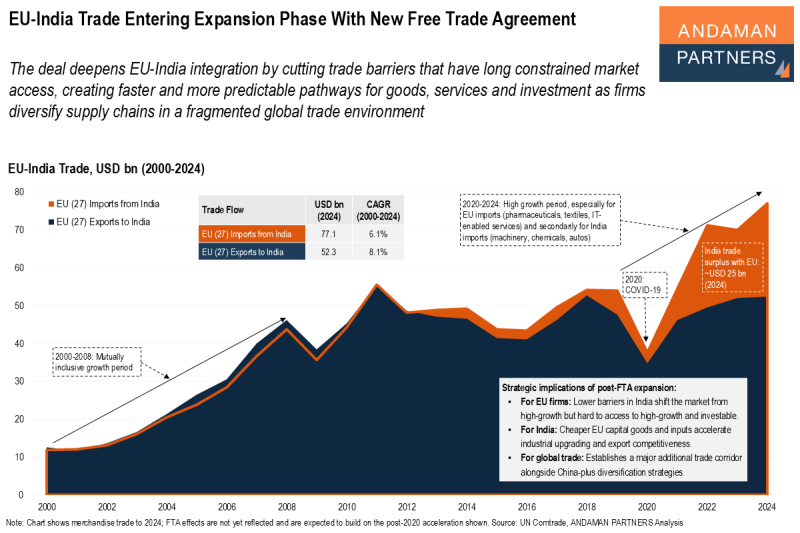

EU-India Trade Entering Expansion Phase With New Free Trade Agreement

The deal deepens EU-India integration by cutting trade barriers that have long constrained market access.

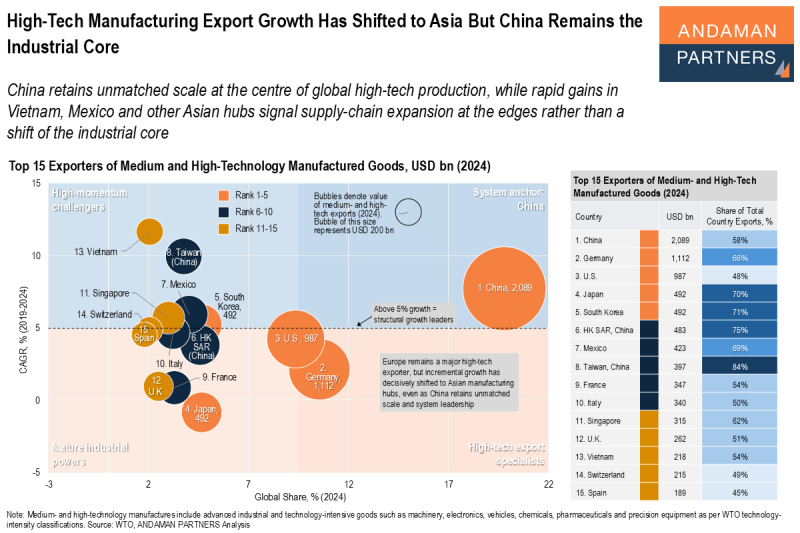

High-Tech Manufacturing Export Growth Has Shifted to Asia, But China Remains the Industrial Core

China retains unmatched scale at the centre of global high-tech production, while rapid gains in Vietnam, Mexico and other Asian hubs.

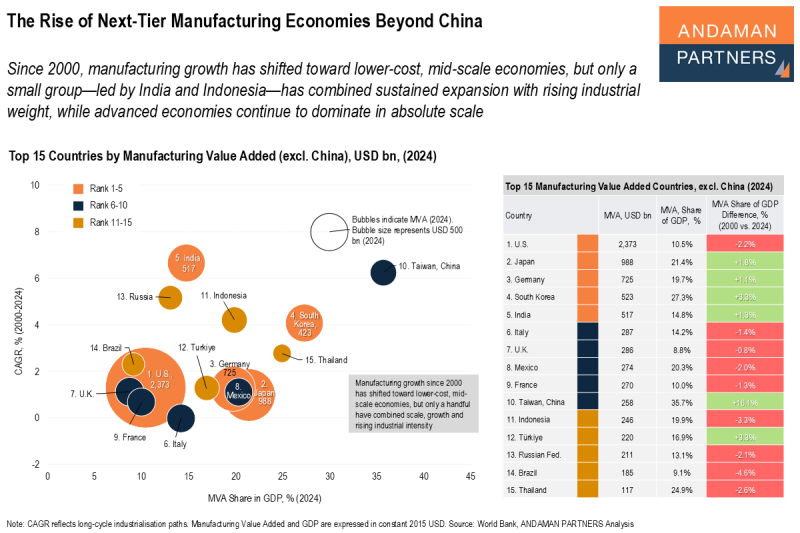

The Rise of Next-Tier Manufacturing Economies Beyond China

Manufacturing growth shifted toward lower-cost, mid-scale economies, but only a small group has combined sustained expansion with rising industrial weight.