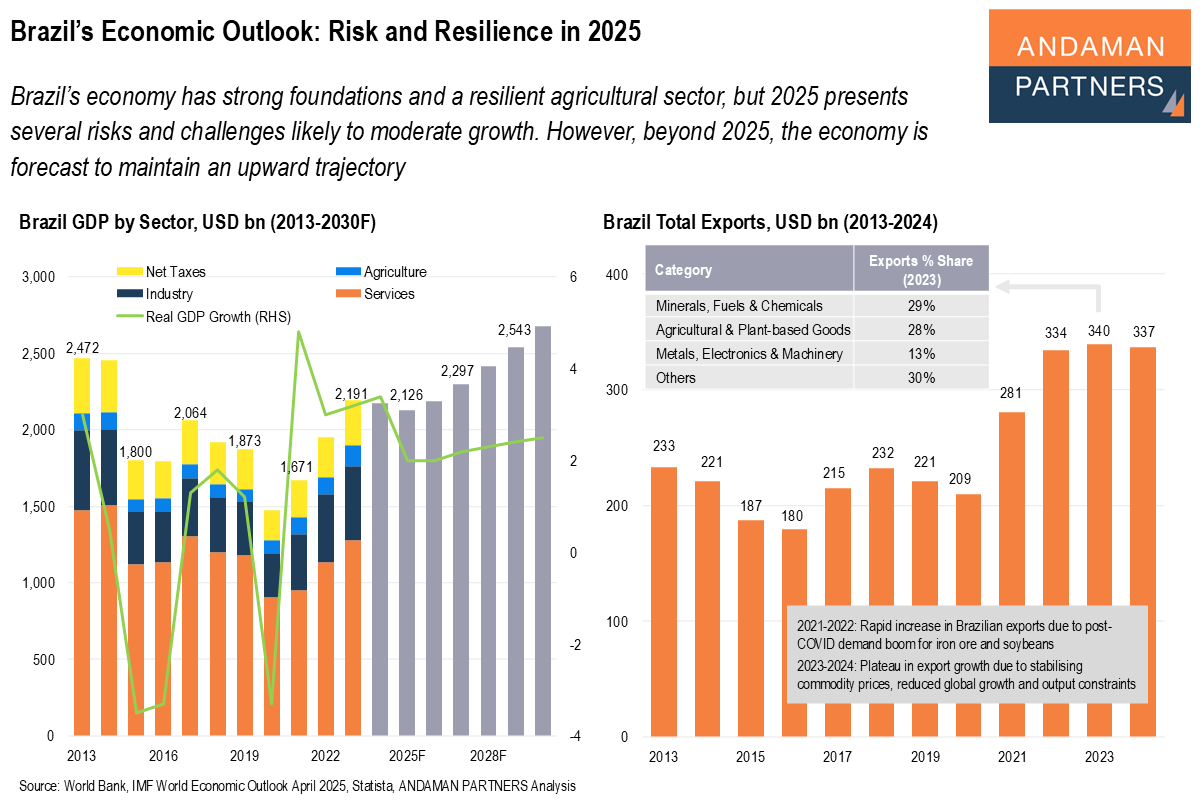

Brazil’s economy has strong foundations and a resilient agricultural sector, but 2025 presents several risks and challenges likely to moderate growth. However, beyond 2025, the economy is forecast to maintain an upward trajectory.

Brazil is the largest economy in Latin America and a cornerstone of global food security as the world’s largest exporter of soybeans, sugar, coffee and beef. The country is also one of the leading producers of iron ore and crude oil, making it vital to global commodity markets. As a member of BRICS, Brazil is a fundamental player in South-South cooperation and a key bridge between the Global North and the developing world.

Brazil’s USD 2.2 trillion economy performed relatively well in 2024, with real GDP growth of 3.4%. In 2025, however, the economy faces several serious challenges to growth, including a tighter monetary policy amid the threat of rising inflation. However, beyond 2025, the economy is forecast to maintain an upward trajectory.

Risks: Tighter Monetary Policy, Inflation and a Depreciating Currency

Headline inflation rose to 5.4% year-over-year in May 2025, the highest level since early 2023. On 7 May 2025, Brazil’s central bank raised the benchmark Selic rate by 50 basis points to 14.75%, the highest level in nearly two decades, as the bank seeks to bring inflation back to 3%.

Rising inflation in 2025 is likely to dampen Brazil’s robust consumer spending. As inflation accelerated in the second half of 2024, real wage growth fell by about 1.5 percentage points. So far in 2025, however, consumer spending is still robust. In February 2025, retail sales volumes rose 0.5% month-on-month and 1.5% year-on-year, reaching the highest level since the data series began in 2000. In March, retail sales grew by 0.8% month-on-month.

On December 18, the country’s currency fell 2.8% to an all-time low of 6.2 reais per U.S. dollar, losing a quarter of its value in 2024. As of 4 June, the real strengthened to 5.61 against the dollar, returning to the level of October 2024. The depreciating currency makes exports more competitive, complicates debt servicing and undermines investor confidence.

Resilience: Exports and a Robust Agricultural Sector

Brazil’s exports are expected to perform better in 2025 than in the previous year. Although agricultural exports declined by 11% in 2024, the overall value of exports remained roughly unchanged compared to 2023, thanks to increased mining and industrial exports.

Agricultural exports, in particular, are expected to perform better in 2025. Brazil is the global leader in soybean production, with a share of 40%, as well as coffee (38%) and sugarcane (23%). The country is also the third-largest producer of maize (corn), accounting for 10% of global production.

As a country that maintains a trade deficit with the U.S., Brazil may be spared the worst of the tariffs imposed by the U.S. government, although this remains to be seen. On 2 April, U.S. President Trump announced a raft of new tariffs, which included a 10% duty on Brazilian imports.

Brazil’s annual GDP growth is expected to moderate from 3.4% to 2% in 2025. First-quarter growth of 2.3% is likely to recede slightly as the year progresses.

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

AAMEG Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to sponsor and support the AAMEG pre-Mining Indaba Cocktails & Canapes event.

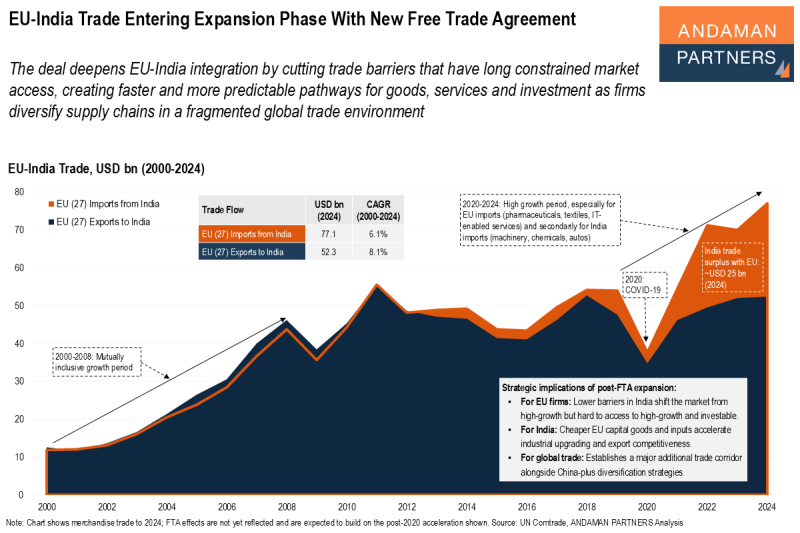

EU-India Trade Entering Expansion Phase With New Free Trade Agreement

The deal deepens EU-India integration by cutting trade barriers that have long constrained market access.

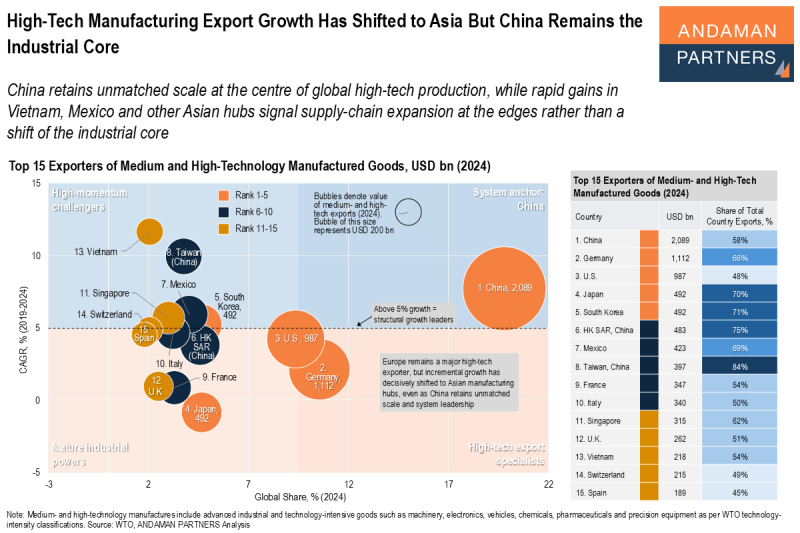

High-Tech Manufacturing Export Growth Has Shifted to Asia, But China Remains the Industrial Core

China retains unmatched scale at the centre of global high-tech production, while rapid gains in Vietnam, Mexico and other Asian hubs.

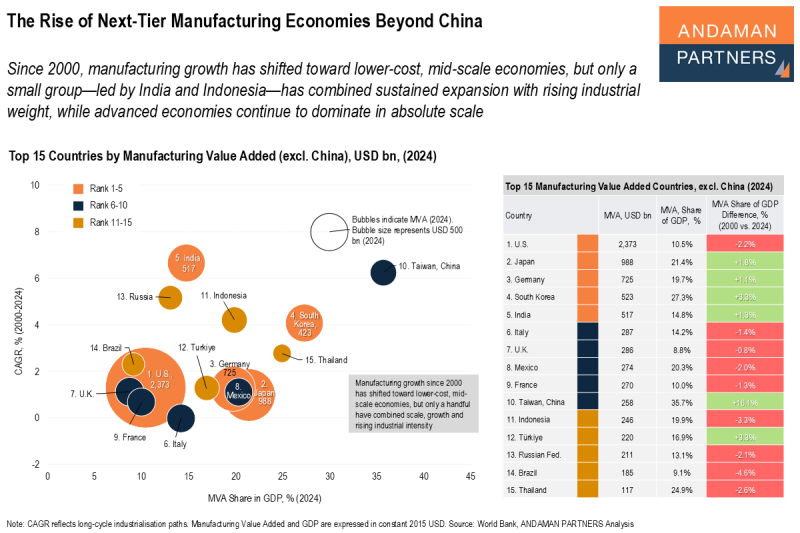

The Rise of Next-Tier Manufacturing Economies Beyond China

Manufacturing growth shifted toward lower-cost, mid-scale economies, but only a small group has combined sustained expansion with rising industrial weight.