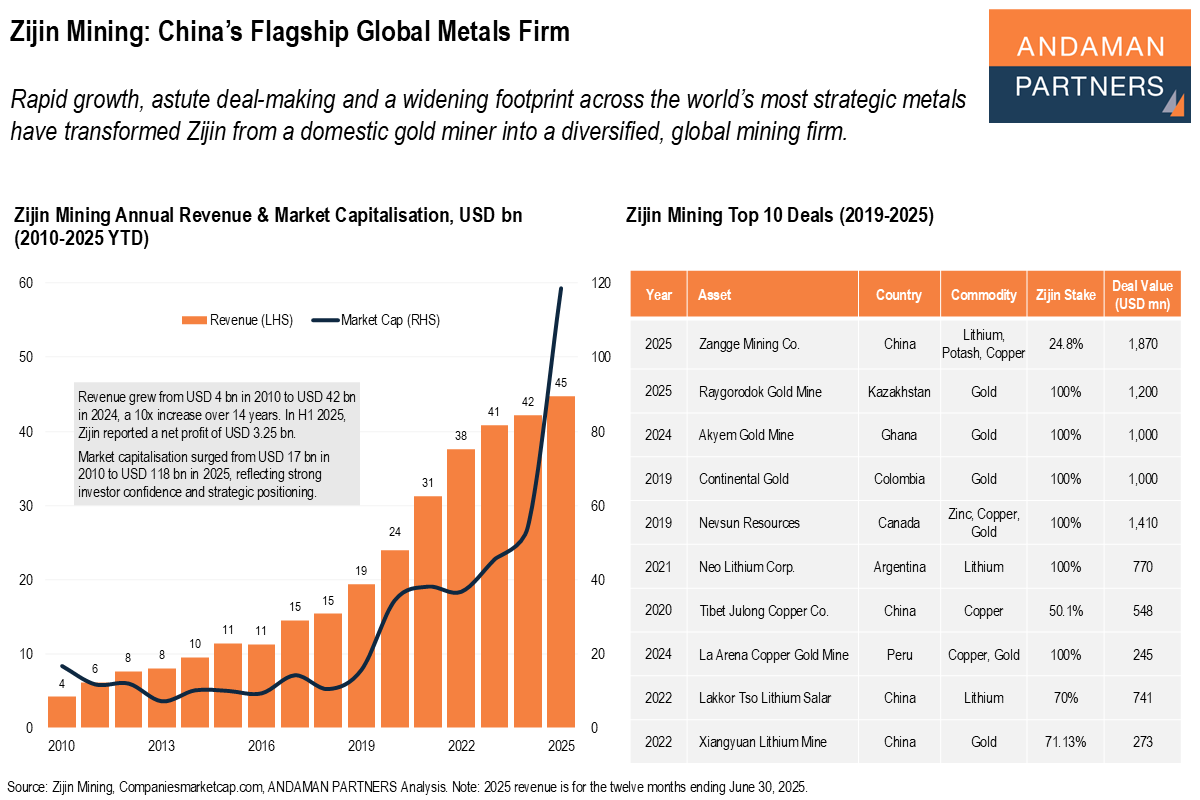

Rapid growth, astute deal-making and a widening footprint across the world’s most strategic metals have transformed Zijin from a domestic gold miner into a diversified, global mining firm.

Zijin Mining’s rise over the past decade is one of the most striking stories in global mining. Founded in 1986 as a gold producer in Fujian province, Zijin has transformed itself into a diversified, internationally active mining group spanning gold, copper, zinc and lithium, the metals that increasingly define both traditional resource security and the energy transition. What distinguishes Zijin is not just its incredible growth, but the way that growth has been executed: rapidly, globally and at scale.

Zijin’s expansion over the past few years has been dramatic. Revenues increased roughly tenfold between 2010 and the mid-2020s, while market capitalisation rose even faster, reflecting investor confidence in the firm’s asset base, execution capability and deal-making strategy. Unlike many mining firms that remain tightly linked to a single commodity, Zijin has steadily diversified its earnings streams, using gold cash flows to finance expansion into copper and lithium, metals critical to electrification, grid investment and battery supply chains.

In 2025, Zijin reached new heights. In H1 2025, the firm reported net profit of USD 3.25 billion, while its market capitalisation surpassed USD 118 billion by year-end, up more than 118% year-on-year. Elevated gold prices provided a robust earnings base, while rising copper volumes and prices amplified operating leverage across Zijin’s expanded asset portfolio. Markets responded by valuing Zijin as a diversified global metals firm with long-life exposure to structurally supported demand, rather than as a cyclical gold producer.

Operationally, Zijin has become one of China’s most crucial outward-facing resource companies. Its overseas portfolio now spans Africa, Latin America, Central Asia and Europe, anchored by long-life assets acquired over the past six years. Zijin’s 10 most significant acquisitions since 2019 reveal a clear pattern: controlling stakes, operational influence and exposure to substantial deposits. Deals such as Continental Gold in Colombia (2019), Nevsun Resources in Canada (2019) and major gold and copper assets in Ghana, Peru and Kazakhstan underscore a willingness to operate in complex jurisdictions where asset quality justifies the political and execution risks.

Zijin’s expansion closely mirrors China’s broader industrial priorities. Copper and lithium acquisitions directly support power generation, electric vehicles and advanced manufacturing, while gold continues to anchor profitability and balance-sheet resilience. The company’s growing lithium exposure, particularly in Argentina and China, signals an ability to pivot toward future-facing materials without abandoning its core strengths.

What makes Zijin particularly notable among Chinese miners is its technical and financial integration. The group combines exploration, mining, processing and smelting capabilities with in-house engineering and financing expertise, allowing it to move quickly from acquisition to production ramp-up. This integration has been a key factor behind its ability to extract value from assets that were previously underdeveloped or operationally constrained.

That said, Zijin’s expansion has not been without controversy. Some of the firm’s overseas operations have faced environmental scrutiny, community opposition and regulatory pushback, particularly in Europe and parts of Africa. These issues highlight the growing challenge for Chinese resource companies operating under heightened global ESG expectations. As Zijin’s footprint expands, reputational risk and regulatory compliance will increasingly shape its cost of capital and deal pipeline.

For CEOs and investors, Zijin Mining represents more than a fast-growing mining company. It is a case study in how China is translating its financial strength into long-term control over critical resource flows, using gold as a foundation and copper and lithium as bridges to the next industrial cycle.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

AAMEG Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to sponsor and support the AAMEG pre-Mining Indaba Cocktails & Canapes event.

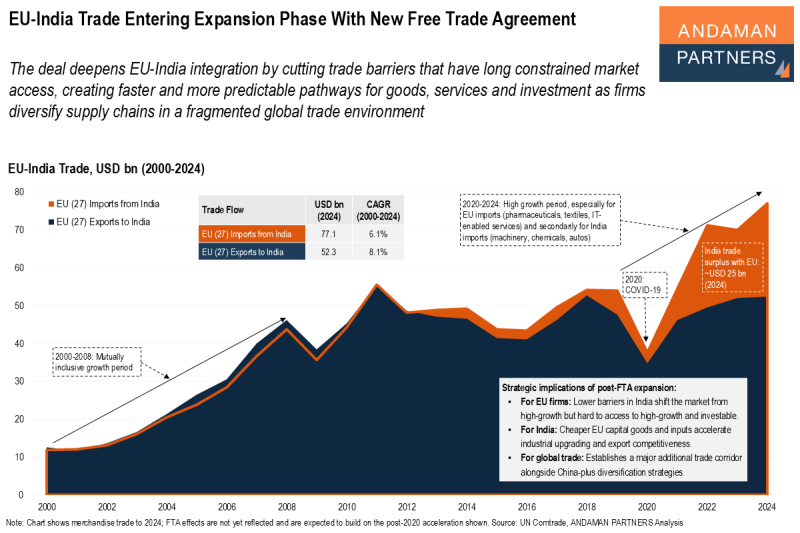

EU-India Trade Entering Expansion Phase With New Free Trade Agreement

The deal deepens EU-India integration by cutting trade barriers that have long constrained market access.

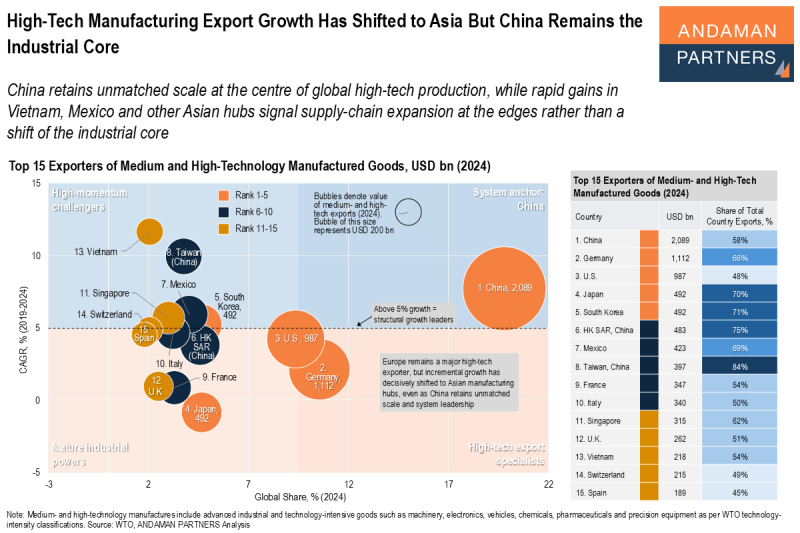

High-Tech Manufacturing Export Growth Has Shifted to Asia, But China Remains the Industrial Core

China retains unmatched scale at the centre of global high-tech production, while rapid gains in Vietnam, Mexico and other Asian hubs.

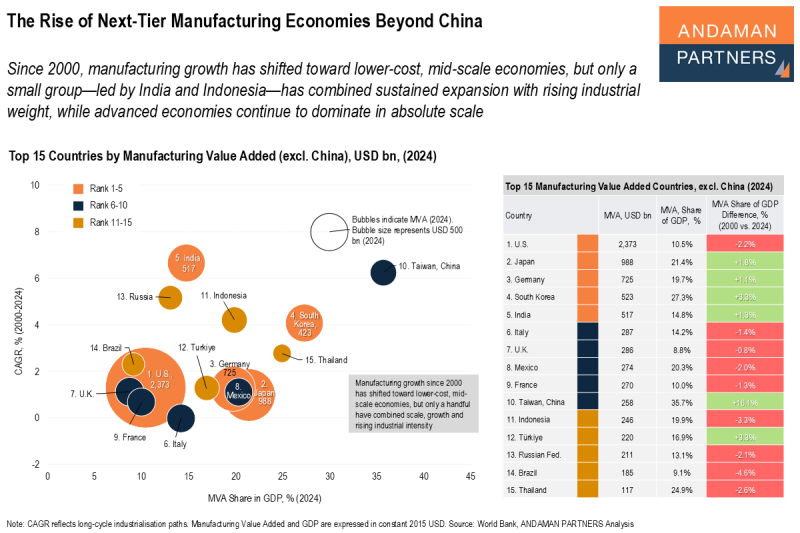

The Rise of Next-Tier Manufacturing Economies Beyond China

Manufacturing growth shifted toward lower-cost, mid-scale economies, but only a small group has combined sustained expansion with rising industrial weight.