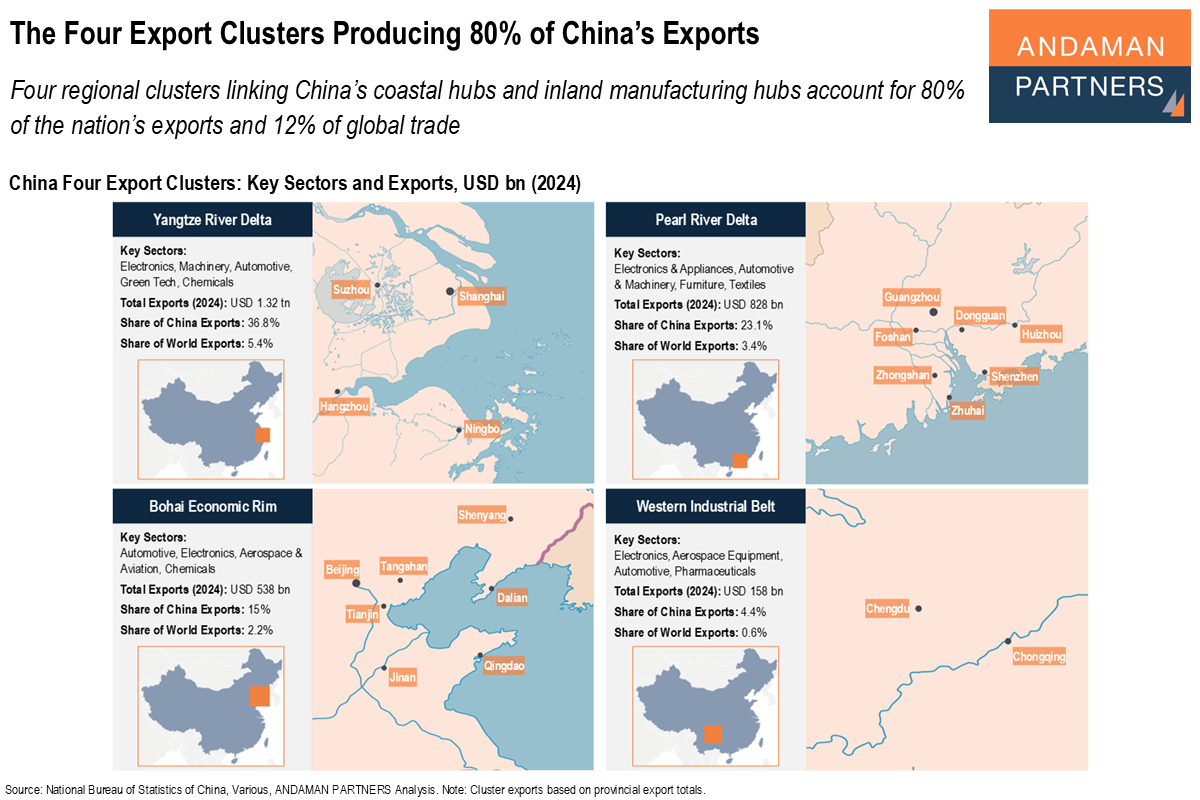

China’s export structure is remarkably concentrated. Four industrial clusters—the Yangtze River Delta, Pearl River Delta, Bohai Economic Rim and Western Industrial Belt—collectively generate about 80% of China’s exports and roughly 12% of global exports. Each reflects a distinct stage in the country’s economic evolution and regional specialisation.

Yangtze River Delta (YRD)

Led by Shanghai, Suzhou and Hangzhou, the YRD is China’s most advanced manufacturing and green technology hub.

- Shanghai specialises in electronics, automobiles, biopharmaceuticals and chemicals.

- Suzhou is a centre for high-tech manufacturing, particularly semiconductors, renewable-energy equipment (notably solar panels) and pharmaceuticals.

- Hangzhou anchors the region’s digital economy and advanced industries such as integrated-circuit design, network communications and fibre-optic manufacturing.

In 2024, Shanghai, Jiangsu and Zhejiang collectively recorded exports of USD 1.32 trillion, accounting for 36.8% of China’s total exports

Pearl River Delta (PRD)

Centred on Shenzhen and Guangzhou, the PRD remains China’s most extensive electronics and consumer manufacturing base, while rapidly upgrading to electric vehicles and advanced components.

- Guangzhou exports smartphones, home appliances, industrial equipment, textiles, auto parts and EVs.

- Shenzhen is focused on high-tech and advanced manufacturing, including telecommunications equipment, electronics and lithium-battery production.

In 2024, Guangdong Province exported USD 828 billion, accounting for 23.1% of the nation’s exports, the highest among all provinces.

Bohai Economic Rim (BER)

The BER in northern China forms a heavy-industrial and automotive corridor centred on Beijing, Tianjin and Shenyang, extending across Shandong and Hebei.

- Beijing concentrates on high-tech and advanced manufacturing, including communications equipment and automotive products.

- Tianjin exports mechanical and electronic goods such as EVs, integrated circuits and industrial robots, and is also a key aerospace base.

- Shenyang and the wider northeast contribute automobiles, heavy machinery, chemicals and aviation components.

In 2024, the five provinces and municipalities of the region exported USD 538 billion, accounting for approximately 15% of China’s total.

Western Industrial Belt (WIB)

The inland Chengdu–Chongqing corridor has become China’s leading interior export base, integrating into global electronics and automotive supply chains.

- Chengdu manufactures electronics, EVs, aerospace equipment, pharmaceuticals and advanced materials.

- Chongqing focuses on electronics, automobiles and mechanical-electrical products.

Together, Sichuan and Chongqing exported USD 158 billion in 2024, accounting for 4.4% of the country’s total exports.

These four regional clusters illustrate how China’s manufacturing and export capacity is geographically concentrated yet industrially diverse. Together, they remain the structural backbone of China’s trade performance and a cornerstone of global manufacturing.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

Media

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

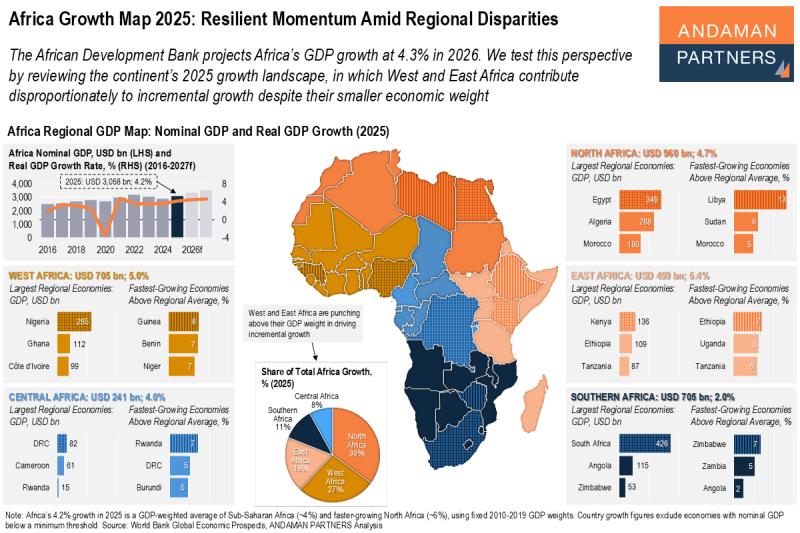

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

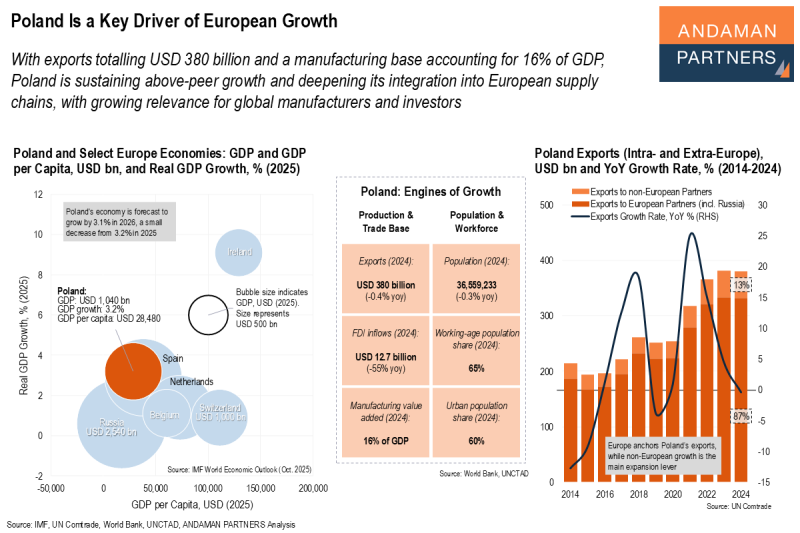

Poland Is a Key Driver of European Growth

Poland is sustaining above-peer growth and deepening its integration into European supply chains.

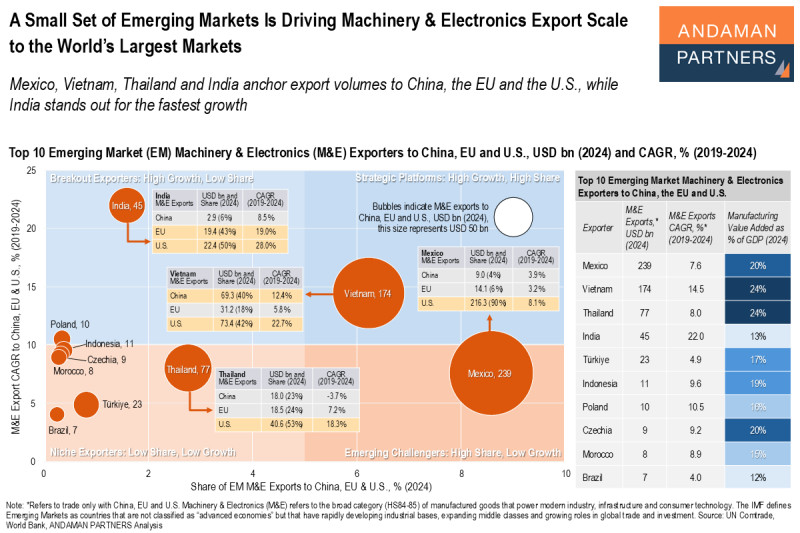

A Small Set of Emerging Markets Is Driving Machinery & Electronics Export Scale to the World’s Largest Markets

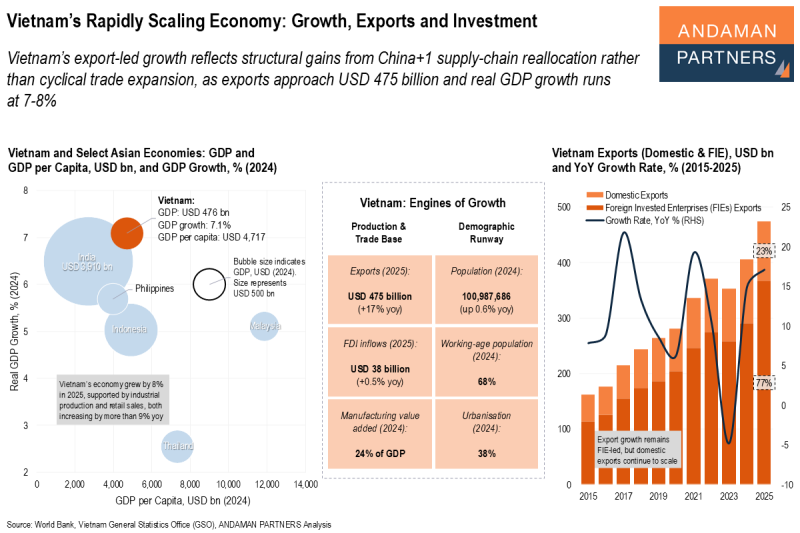

Mexico, Vietnam, Thailand and India anchor export volumes to China, the EU and the U.S., while India stands out for the fastest growth.

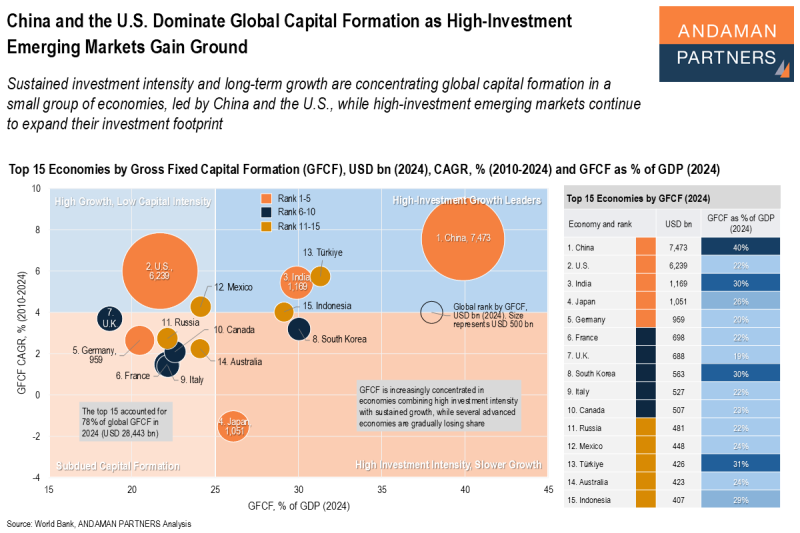

China and the U.S. Dominate Global Capital Formation as High-Investment Emerging Markets Gain Ground

Sustained investment intensity and long-term growth are concentrating global capital formation in a small group of economies, led by China and the U.S.