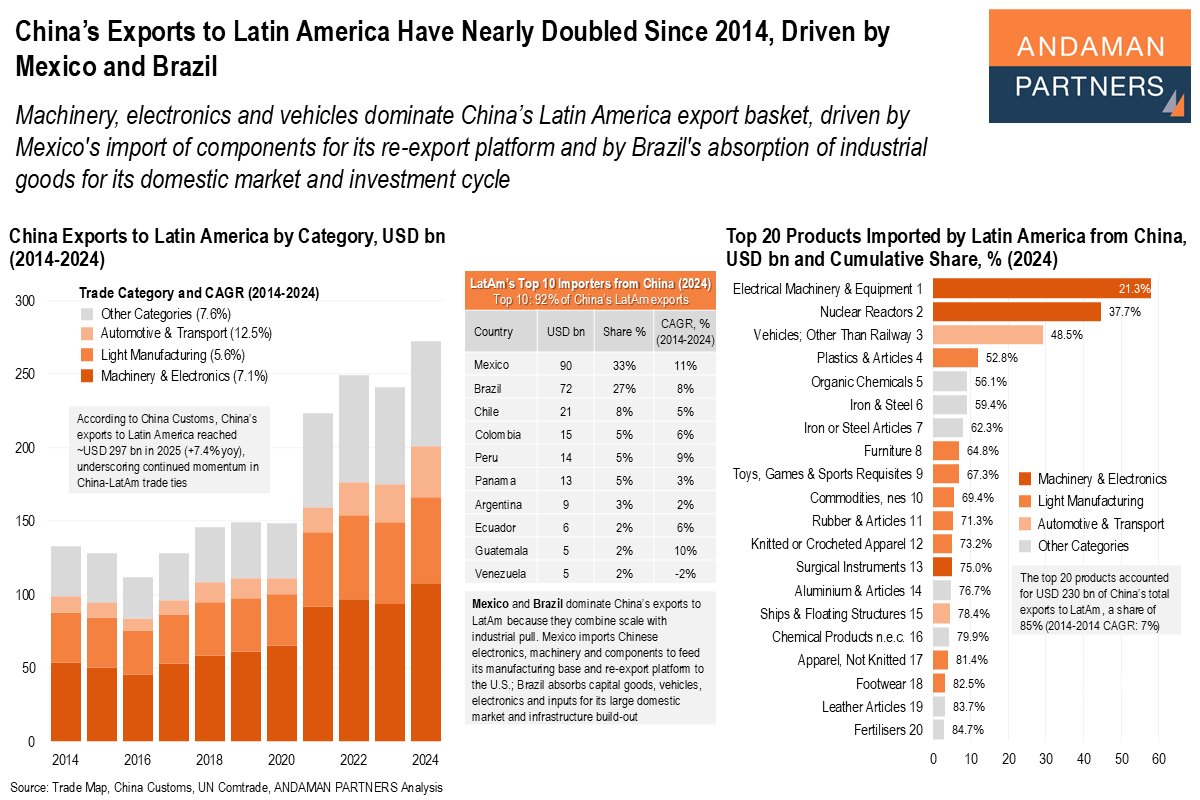

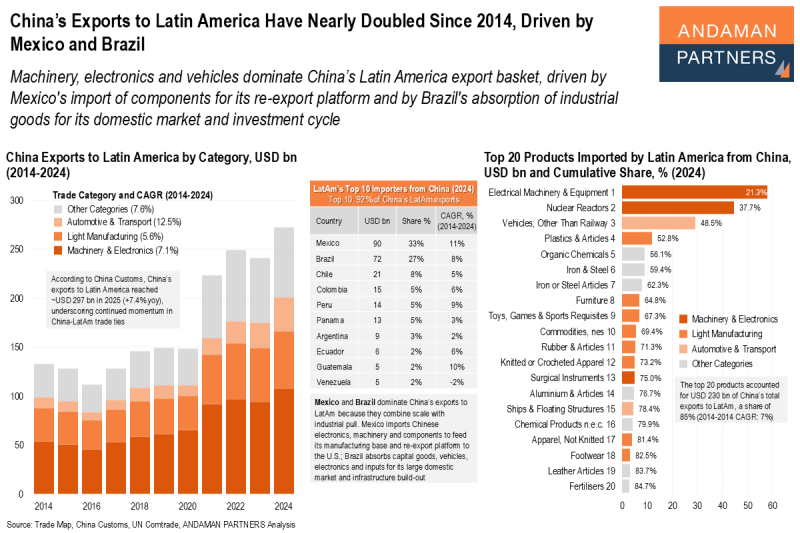

Machinery, electronics and vehicles dominate China’s Latin America export basket, driven by Mexico’s import of components for its re-export platform and by Brazil’s absorption of industrial goods for its domestic market and investment cycle.

China’s exports to Latin America have become a standout growth story, nearly doubling from around USD 130 billion in 2014 to USD 270 billion in 2024, with momentum continuing into 2025. Machinery and electronics remain the backbone of this expansion, rising at a 7.1% CAGR over 2014-2024 and accounting for the largest share of exports. Automotive and transport products are growing even faster (12.5% CAGR), reflecting Latin America’s rising demand for vehicles, parts and industrial mobility solutions, while light manufacturing continues to expand steadily.

Demand is also highly concentrated. In 2024, Mexico (USD 90 billion) and Brazil (USD 72 billion) alone accounted for roughly 60% of China’s exports to Latin America, underlining their role as the region’s two critical gateways. Mexico’s import demand is closely tied to its role as a manufacturing and re-export platform to the U.S., importing electronics, machinery and components. Brazil imports industrial goods and equipment to support its large domestic market and investment cycle. Chile (USD 21 billion) is a strong third market, while Colombia (USD 15 billion) and Peru (USD 14 billion) highlight additional scale opportunities in the Andean region.

The product mix shows where the strongest export opportunities lie. Electrical machinery and equipment (USD 58 billion) and mechanical machinery (USD 45 billion) dominate, followed by vehicles (USD 29 billion) and industrial inputs such as plastics, chemicals and steel. Together, the top 20 product categories represented USD 230 billion, or 85% of exports in 2024.

The most attractive opportunities for Chinese exporters to Latin America in 2026 will likely remain in industrial and supply-chain products such as electronics, machinery, vehicles, chemicals and metals, supported by continued manufacturing growth in Mexico and infrastructure and industrial upgrading demand in Brazil and across the region.

At the same time, Latin America’s import demand is likely to broaden into a new set of fast-growing product categories. Chinese exporters are well positioned to capture rising demand linked to electrification and the energy transition, including EV-related products such as batteries, charging equipment and power electronics, as well as solar modules, inverters, transformers and wider grid infrastructure equipment. Industrial automation and logistics systems, such as warehouse machinery, packaging equipment, forklifts and robotics, should also see stronger demand as manufacturing capacity deepens in Mexico and Brazil.

In parallel, continued investment in digital infrastructure is likely to support growing imports of telecom equipment, fibre-optic networks and data-centre hardware, while consumer upgrading across major markets should sustain demand for appliances and electronics. Together, these emerging categories show a clear next wave of export opportunities for Chinese firms looking to expand in Latin America in 2026.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

China’s Exports to Latin America Have Nearly Doubled Since 2014, Driven by Mexico and Brazil

Machinery, electronics and vehicles dominate China’s Latin America export basket, driven by Mexico and Brazil.

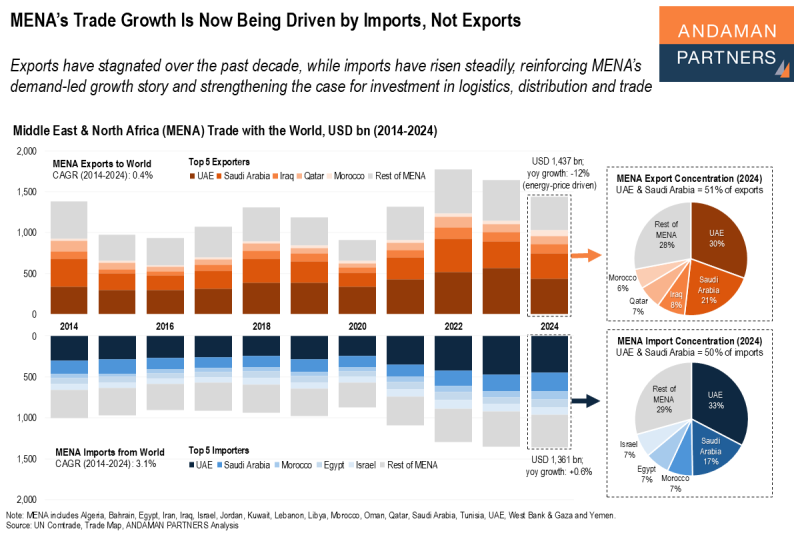

MENA’s Trade Growth Is Now Being Driven by Imports, Not Exports

Exports have stagnated over the past decade, while imports have risen steadily, reinforcing MENA’s demand-led growth story.

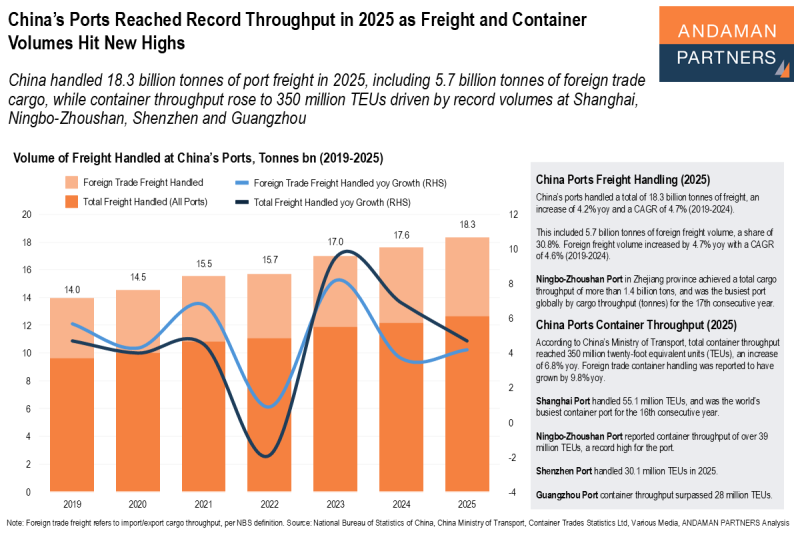

China’s Ports Reached Record Throughput in 2025 as Freight and Container Volumes Hit New Highs

China handled 18.3 billion tonnes of port freight in 2025, including 5.7 billion tonnes of foreign trade cargo.