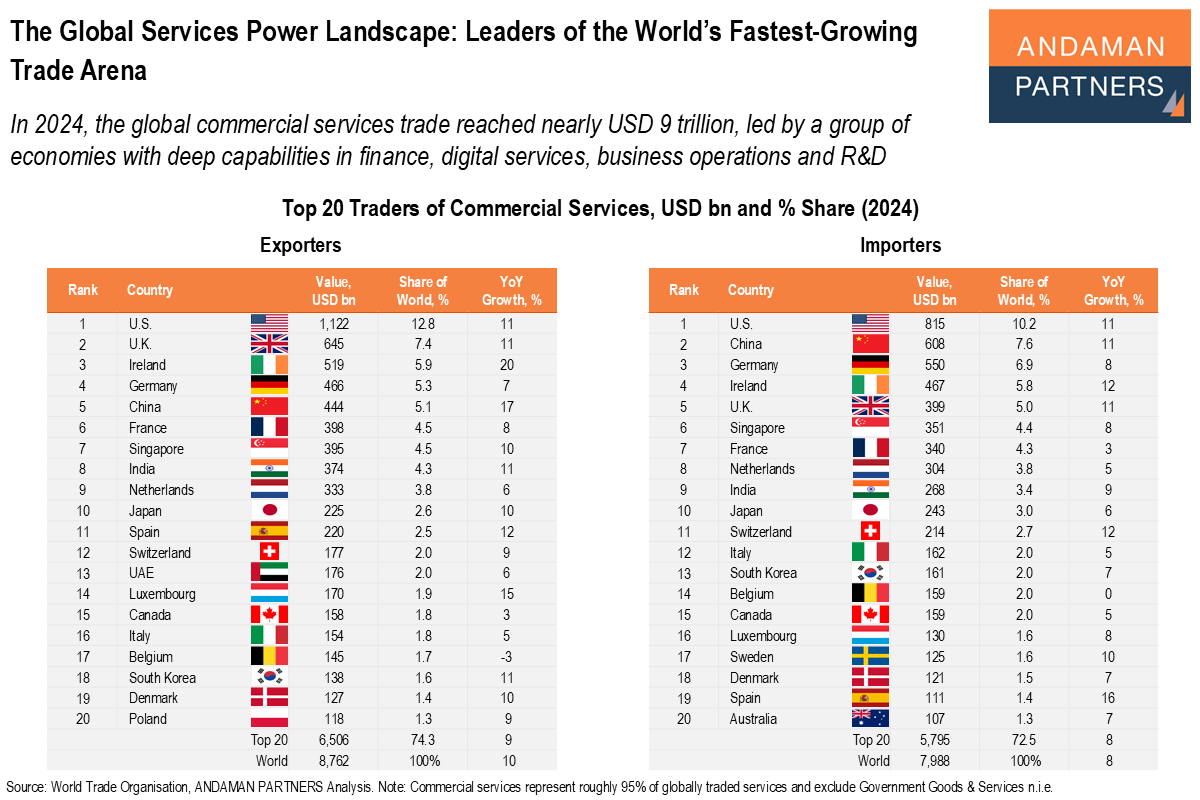

In 2024, the global commercial services trade reached nearly USD 9 trillion, led by a group of economies with deep capabilities in finance, digital services, business operations and R&D.

Global services trade has become a new competitive battleground in the world economy. Commercial services, which account for around 95% of global services trade, surged by 10% in 2024, while merchandise trade grew by only 2% over the same period. The commercial services category captures the world’s most scalable, knowledge-intensive activities, notably finance, technology, digital services, intellectual property, professional services, logistics and high-end tourism, making it a direct indicator of where global competitiveness and talent clusters now reside.

The market is remarkably concentrated: the top 20 economies account for roughly 75% of all commercial services traded worldwide, underscoring how a relatively small set of countries shapes global flows of capital, data, operations and innovation. The U.S. remains dominant on both the export and import sides of services trade, reflecting unmatched depth in finance, technology, business services and creative industries.

The U.K. and Ireland’s high rankings underline how specialised financial and digital ecosystems scale globally, while Germany, France, Switzerland and the Netherlands reflect Europe’s strength in engineering, R&D, consulting, logistics and corporate headquarters functions.

Singapore and the UAE have become strategic hubs for finance, data and multinational operations, while India’s rapid rise highlights its global scale in IT services, outsourcing and digital delivery. China, now the world’s second-largest services importer and a top-five exporter, is undergoing a structural transition from manufacturing-led to services-enabled growth, reshaping global demand patterns.

Services—not goods—are increasingly where margins, innovation and global demand are growing. The geography of service capabilities is consolidating into a smaller set of indispensable markets, and success in international expansion increasingly depends on access to the talent pools, regulatory environments and digital infrastructure found in these top services economies.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

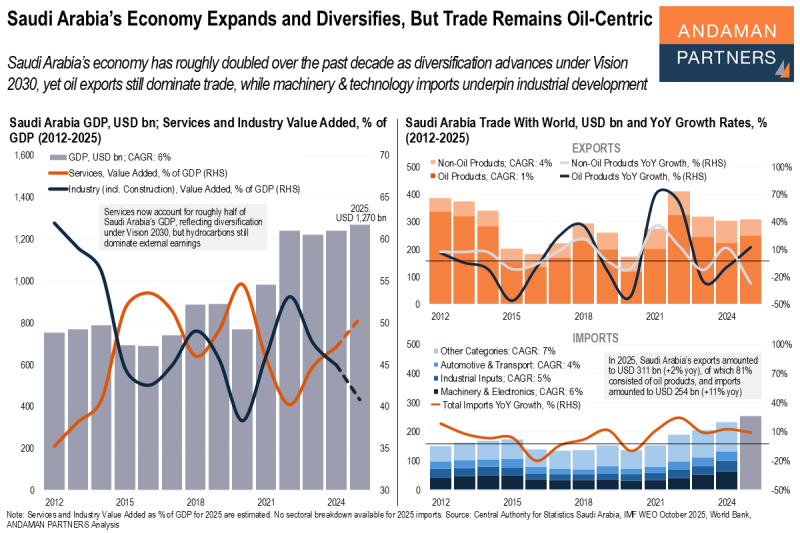

Saudi Arabia’s Economy Expands and Diversifies, But Trade Remains Oil-Centric

Saudi Arabia’s economy has roughly doubled over the past decade, yet oil exports still dominate trade.

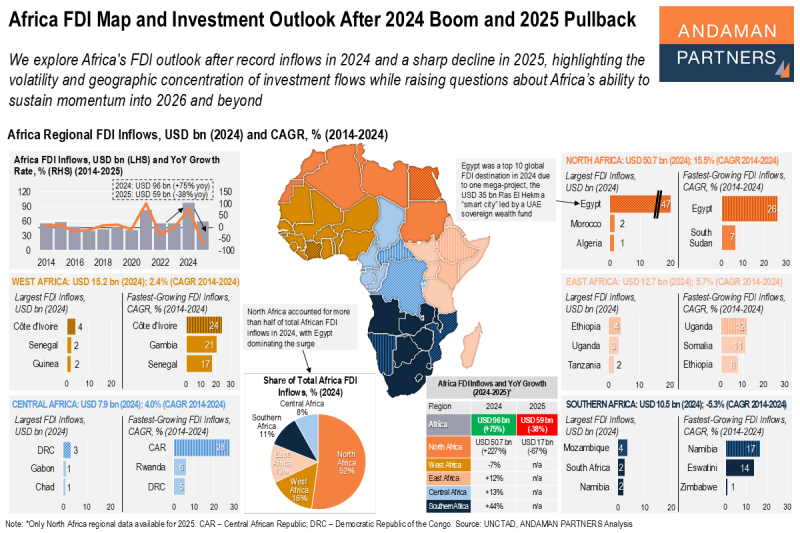

Africa FDI Map and Investment Outlook After 2024 Boom and 2025 Pullback

The volatility and geographic concentration of investment flows raises questions about Africa’s ability to sustain momentum into 2026 and beyond.

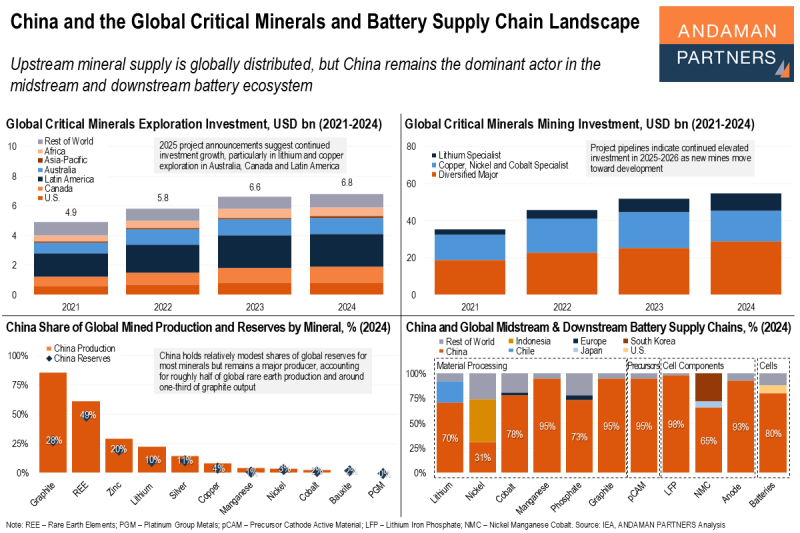

China and the Global Critical Minerals and Battery Supply Chain Landscape

Upstream mineral supply is globally distributed, but China remains the dominant actor in the midstream and downstream battery ecosystem.