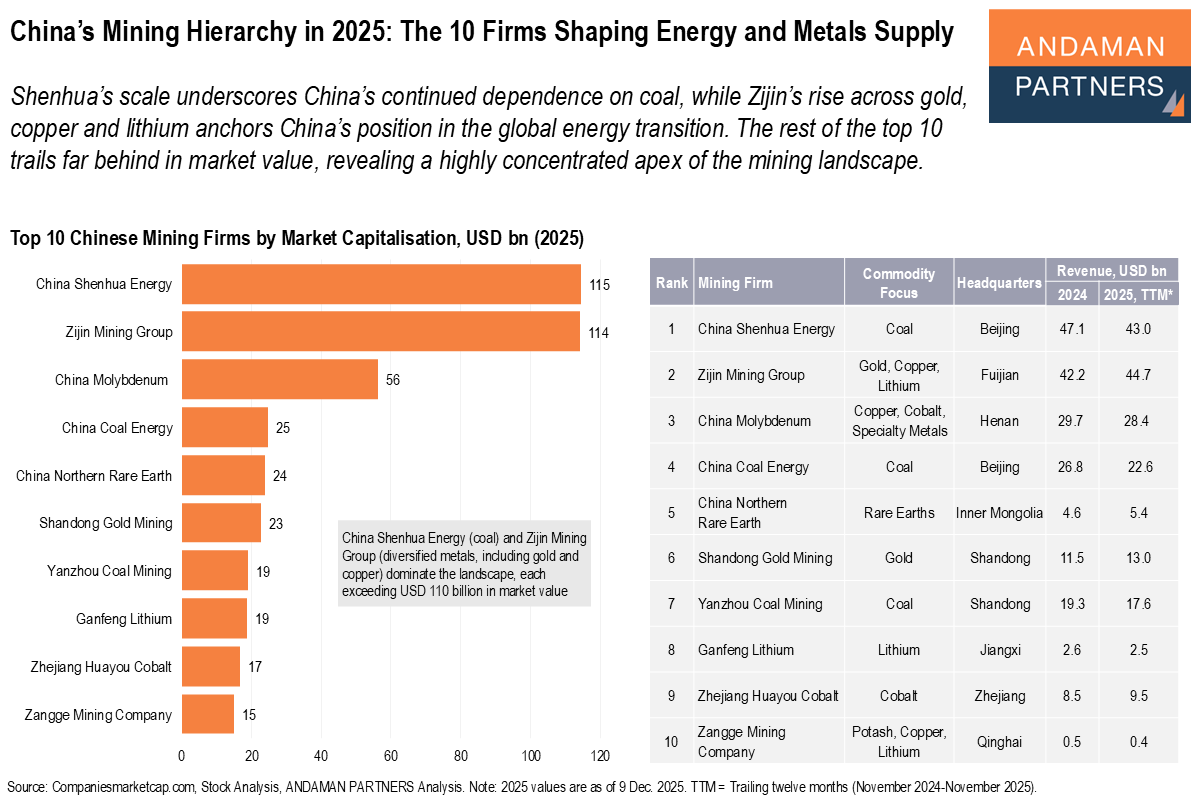

Shenhua’s scale underscores China’s continued dependence on coal, while Zijin’s rise across gold, copper and lithium anchors China’s position in the global energy transition. The rest of the top 10 trails far behind in market value, revealing a highly concentrated apex of the mining landscape.

China’s mining sector in 2025 is defined by a steep hierarchy in which two firms, China Shenhua Energy and Zijin Mining Group, tower over the rest of the industry and illustrate the dual structure of China’s resource base. Shenhua’s market capitalisation of USD 115 billion underscores China’s enduring dependence on coal for baseload power and industrial energy. Zijin’s nearly equivalent scale reflects China’s rapid push into transition-critical metals such as copper, lithium and gold.

The remaining firms in the top ten, from China Molybdenum (market cap of USD 56 billion) and Northern Rare Earth (USD 24 billion) to Ganfeng Lithium (USD 19 billion) and Huayou Cobalt (USD 17 billion), operate far below the scale of the two leaders, highlighting both the fragmentation and strategic specialisation that characterise China’s mid-tier mining landscape.

China’s resource footprint is simultaneously anchored in legacy fossil assets and aggressively expanding into the metals underpinning global electrification, creating both supply-chain dependencies and competitive pressures across coal, rare earths, battery materials and precious metals.

Also by ANDAMAN PARTNERS:

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS to Attend Investing in African Mining Indaba 2026 in Cape Town

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

Join ANDAMAN PARTNERS at Networking Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

AAMEG Event in Cape Town Ahead of Mining Indaba 2026

ANDAMAN PARTNERS is pleased to sponsor and support the AAMEG pre-Mining Indaba Cocktails & Canapes event.

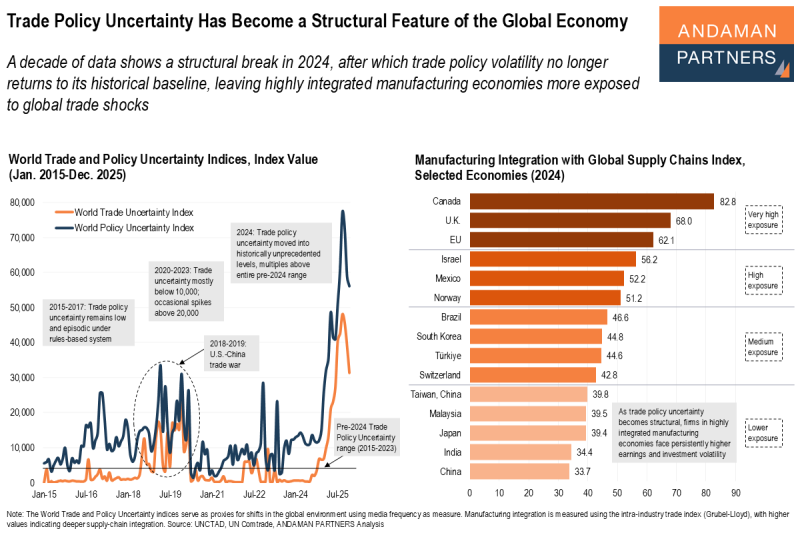

Trade Policy Uncertainty Has Become a Structural Feature of the Global Economy

A decade of data shows a structural break in 2024, after which trade policy volatility no longer returns to its historical baseline.

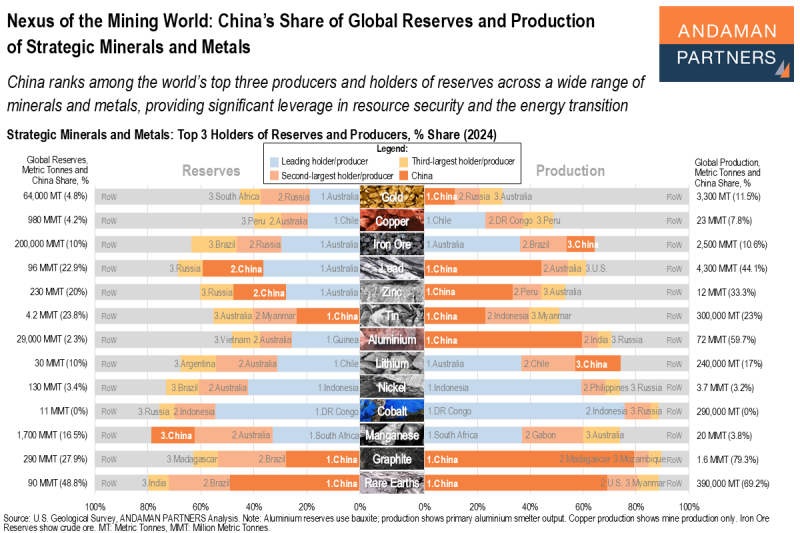

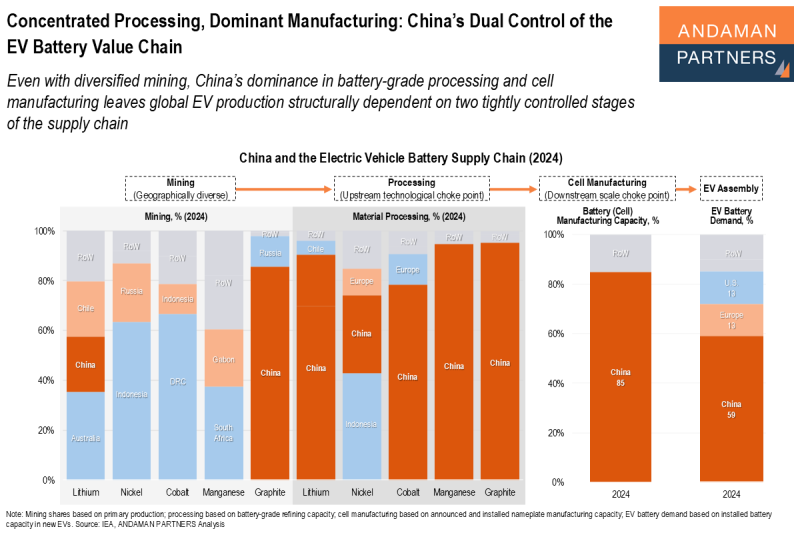

Concentrated Processing, Dominant Manufacturing: China’s Dual Control of the EV Battery Value Chain

China’s dominance in battery-grade processing and cell manufacturing leaves global EV production dependent on two stages of the supply chain.

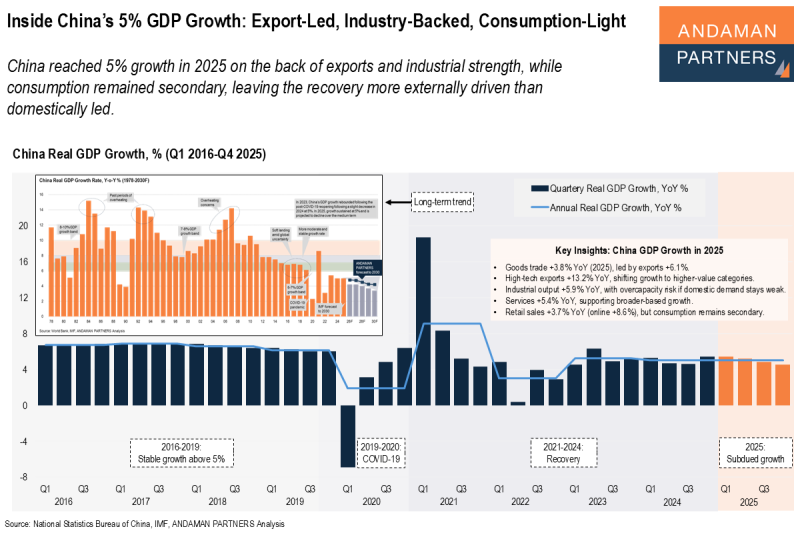

Inside China’s 5% GDP Growth: Export-Led, Industry-Backed, Consumption-Light

China reached 5% growth in 2025 on the back of exports and industrial strength, while consumption remained secondary.