The expanding BRICS bloc has emerged as a cornerstone of global economic growth, even as its members differ significantly in size and assertively compete. As the global economy transitions towards a multipolar structure, BRICS, now reinforced by new members under the BRICS+ framework, is setting the stage for a new economic order. For businesses that operate in global markets, this implies new opportunities that can be leveraged.

Highlights:

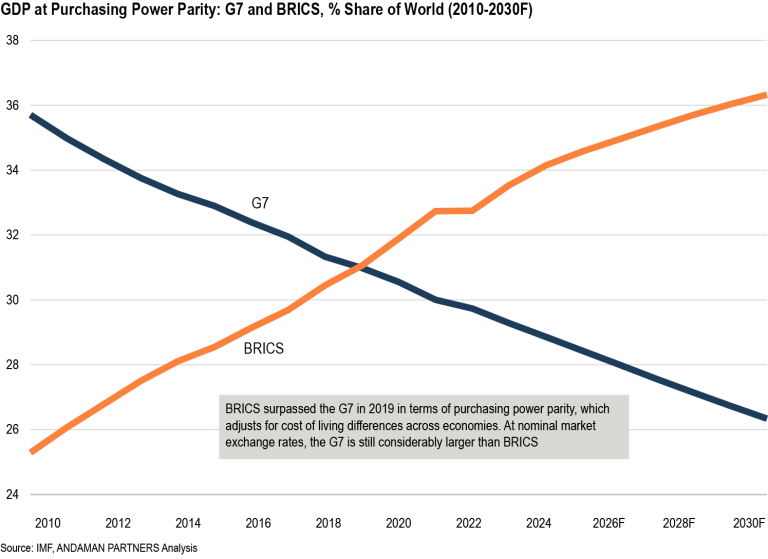

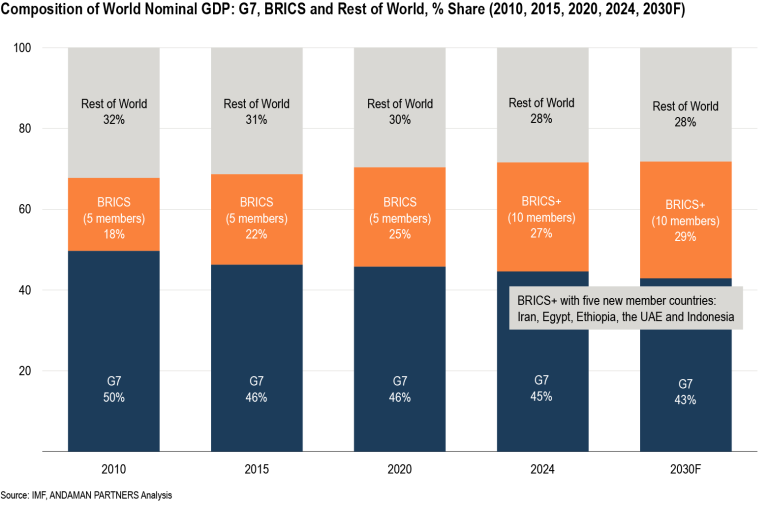

- The combined BRICS GDP in 2019 surpassed that of the G7 for the first time in purchasing power parity, but the G7 is still significantly larger in nominal GDP.

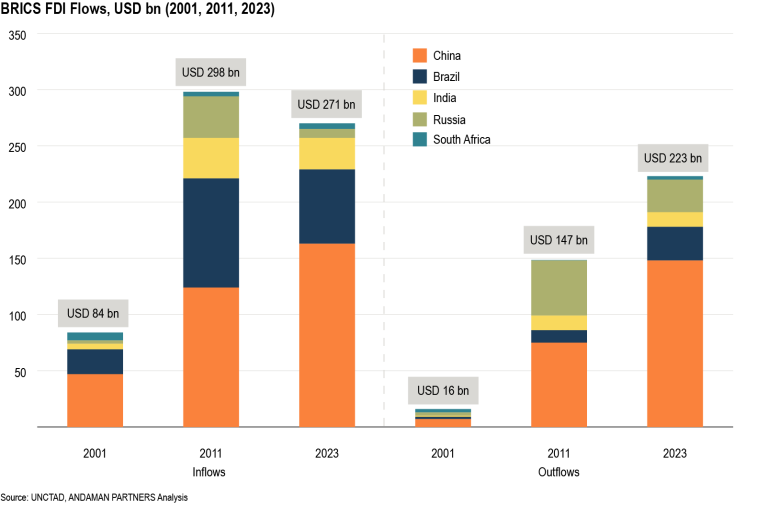

- BRICS attracted USD 271 billion in foreign investment in 2023, and outbound investment amounted to USD 223 billion.

- BRICS accounted for almost a quarter of global exports in 2023.

- The inclusion of new members and partner countries in 2024 and early 2025 elevated the importance of BRICS as a geopolitical bloc.

- In navigating this new global economic order, the importance of BRICS cannot be overlooked even though its members differ significantly in ‘size, system and nature’ nor because they assertively compete.

Since its formation in 2009, the BRICS bloc of countries has steadily expanded its economic influence. According to the World Bank, in 2024, the combined BRICS GDP (adjusted for purchasing power parity, PPP), which adjusts for cost of living differences across economies, reached USD 61 trillion, compared to USD 56.6 trillion for the G7 economies collectively.

According to the IMF, the BRICS GDP at PPP surpassed that of the G7 in 2019, and the gap has continuously increased. By 2030, the BRICS share of global GDP at PPP is forecast to reach 36.3%, while that of the G7 is forecast to reach 26.3%.

The growth in the BRICS GDP has primarily been driven by China and India, which are critical markets for consumer goods, technology and services with large and (in the case of India) rapidly growing working-age populations.

In terms of real GDP, BRICS still lag behind the G7, reflecting the different price levels and economic structures between the two blocs of countries. By 2030, the enlarged BRICS+ bloc is projected to account for 29% of global real GDP, compared to 43% for the G7.

BRICS+

Saudi Arabia, the UAE, Iran, Egypt and Ethiopia were invited to become new BRICS member states effective 1 January 2024 (all except Saudi Arabia attended the BRICS Summit in 2024 as full members). On 6 January 2025, Indonesia, one of the world’s leading nickel producers, formally joined BRICS as the tenth official member state after its application was approved at the 2023 BRICS Summit in Johannesburg. The official member countries are currently the eponymous five countries as well as the UAE, Iran, Egypt, Ethiopia and Indonesia.

On 1 January 2025, eight additional nations joined BRICS as partner countries: Belarus, Bolivia, Cuba, Kazakhstan, Malaysia, Thailand, Uganda and Uzbekistan. On 17 January, Nigeria also joined the bloc as a partner country, bringing the total number of partner countries to nine.

With this enlarged membership (including prospective member Saudi Arabia), the bloc gained substantial leverage in global energy markets. BRICS+ controls over 40% of global oil production and 35% of oil consumption.

Beyond energy, the BRICS+ expansion enhances the bloc’s geographical and economic connectivity. Integrated networks of ports, land routes, railways and air links across member countries reduce cargo transit times and allow for more efficient trade channels. Expanded infrastructure cooperation and enhanced regional connectivity will accelerate economic growth, solidifying BRICS+ as a significant geopolitical body.

Trade

BRICS are critical players in global trade. From USD 3.2 trillion in 2012, total BRICS exports reached USD 5.8 trillion in 2023, accounting for almost a quarter (23.3%) of global merchandise exports.

The expansion in trade reflects deepening economic integration among BRICS countries and the rest of the world, underscoring the bloc’s expanding influence in global trade. China dominates BRICS exports, contributing a share of 71%, while India has expanded its share to 9%, reflecting its rising capabilities in manufacturing and technology.

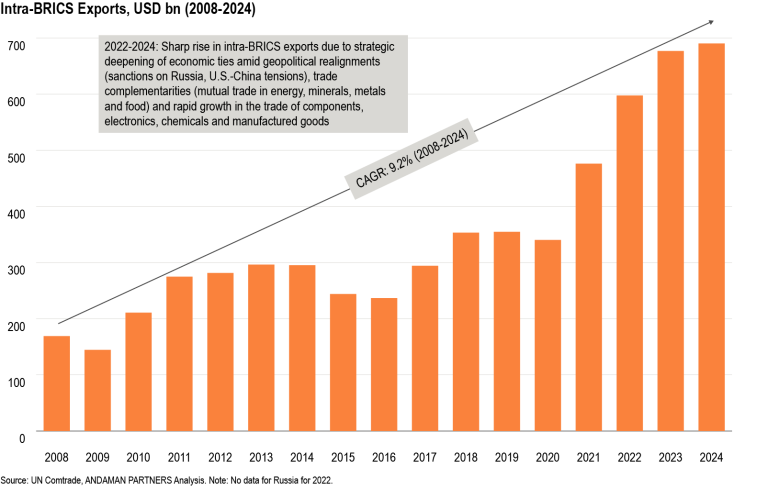

Intra-BRICS trade expanded by an annual growth rate of 9.2% from 2008 to 2024, with total trade values surging from USD 169 billion in 2008 to just below USD 700 billion in 2024, reflecting deepening economic integration among BRICS countries.

Intra-BRICS exports surged in 2022 and have continued to increase as geopolitical realignments, notably due to sanctions imposed by G7 countries on Russia and ongoing U.S.-China tensions, caused a strategic deepening of economic ties as BRICS countries leveraged trade complementarities within the bloc. China and India increased imports of resources and minerals from Russia, Brazil and South Africa, and China exported more electronics, chemicals and manufactured goods.

The intensification of intra-BRICS trade presents an opportunity to tap into new supply chains and markets. Businesses that can strategically position themselves within these trade networks will gain access to large and growing consumer bases. In addition, increasing regional interdependence within BRICS is reshaping global supply chains, offering an opportunity to integrate into these evolving networks.

Investment

Foreign Direct Investment (FDI) flows into the BRICS bloc have fluctuated in recent years, primarily influenced by global economic conditions and the COVID-19 pandemic. However, China, Brazil and India continue to attract significant FDI inflows due to their large and growing markets, expanding technological capabilities and relatively favourable investment climates.

In 2023, China attracted USD 163 billion in FDI, Brazil USD 66 billion and India USD 28 billion. These figures underscore the sustained confidence of global investors in BRICS growth prospects. In 2023, BRICS collectively attracted a record high of USD 173 billion in greenfield FDI investments, with China and India attracting the largest share.

For businesses, these investment trends highlight the ongoing potential of BRICS markets, particularly in high-growth sectors like technology, green energy and infrastructure.

Navigating a New Global Economic Order

With an expanded membership of ten countries and increasing shares of global GDP and trade, BRICS+ exemplifies the ongoing shift towards a multipolar world. To navigate this new global landscape, businesses must consider the following strategic actions:

- Leverage BRICS markets for growth: Prioritise market entry and expansion within BRICS to capitalise on large consumer bases and growing purchasing power. Tailored strategies that align with these countries’ unique economic environments will be crucial to success.

- Capitalise on intra-BRICS trade opportunities: Integrate into BRICS supply chains and explore new trade partnerships within the bloc. This can help businesses mitigate risks associated with external economic shocks and gain access to emerging markets.

- Invest in high-growth sectors: Focus on sectors like technology, green energy and infrastructure, which are poised for significant growth in BRICS. Early investments in these areas will position businesses to benefit from the next wave of global economic expansion.

- Adapt to local economic dynamics: Customise products, services and business models to meet the needs and preferences of regional markets. Understanding and navigating the bloc’s diverse regulatory and economic landscapes will enhance market penetration and competitiveness.

- Monitor BRICS+ policies and expansion: Monitor the evolving BRICS+ framework, which offers new avenues for market access and strategic partnerships, especially in energy, natural resources and financial services.

- Utilise BRICS+ as a networking ‘club’: Appreciate that BRICS, despite differences between members and their assertive competition, represents a ‘club’ for accelerating networks, trade links, value chains, investment flows and shared ideas.

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

ANDAMAN PARTNERS Was a Co-Sponsor of the South African National Day Reception in Shanghai on 30 May 2025

ANDAMAN PARTNERS was a cosponsor of the South African National Day Reception in Shanghai on 30 May 2025.

Asia’s Shifting Role in Global Supply Chains — Perspectives by ANDAMAN PARTNERS Co-Founder Rachel Wu

Analysis by ANDAMAN PARTNERS Co-Founder Rachel Wu on changing patterns in global supply chains.

ANDAMAN PARTNERS Co-sponsored the West Australian Mining Club Luncheon in Perth on 27 February 2025

WA Mining Club luncheons are valuable ways to network with colleagues and clients and learn about the latest industry insights.

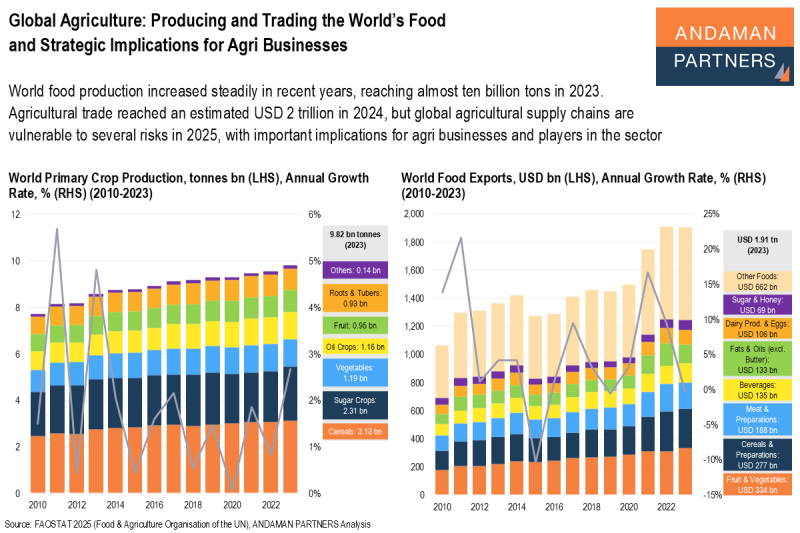

Global Agriculture: Producing and Trading the World’s Food and Strategic Implications for Agri Businesses

Global agricultural supply chains are vulnerable to several risks in 2025, with important implications for agri businesses and players in the sector.

Southeast Asia: The USD 4-trillion Economy

With rapid GDP growth, expanding trade networks and investment inflows, Southeast Asia retains its enduring appeal as a vital destination for multinational corporations seeking to diversify their supply chains and tap into Asia’s growing consumer markets.

Indonesia’s Dynamic Economic Growth Story Offering Opportunities for Global Businesses

Indonesia’s dynamic, services-led and consumption-driven economy is poised to become one of the world’s largest by mid-century, presenting many opportunities for businesses and investors.