ANDAMAN PARTNERS Wishes You a Happy and Prosperous Year of the Horse!

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

NOTE: This is a brief summary of the full Country Profile, which can be viewed or downloaded at the link below.

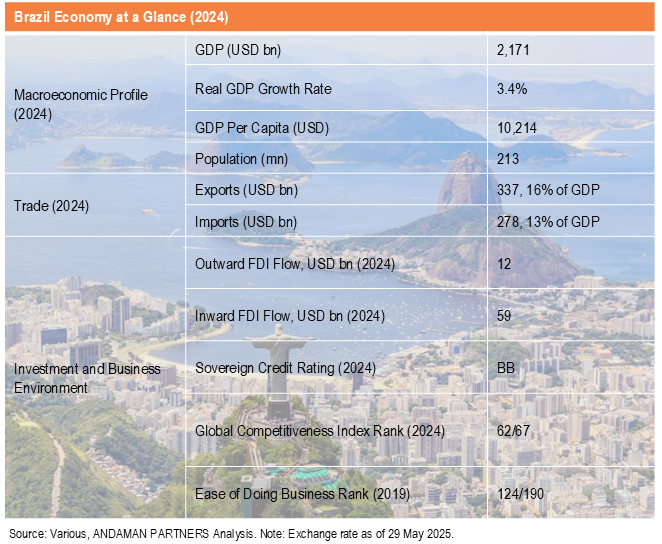

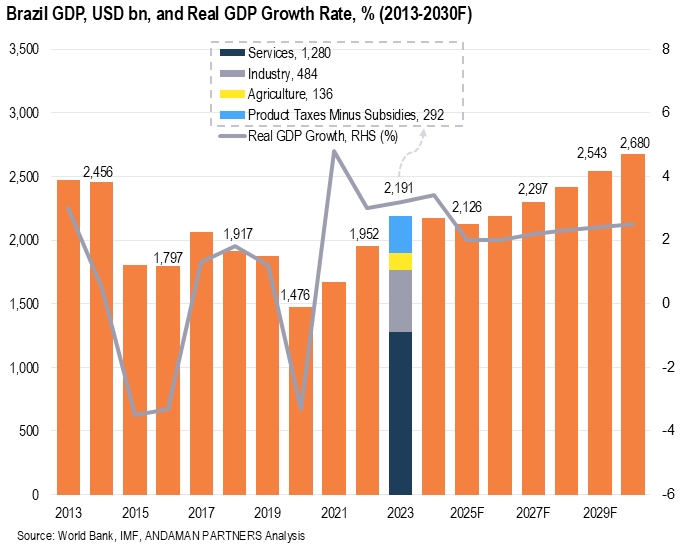

Brazil’s USD 2.2 trillion economy is the world’s ninth-largest by nominal value, with agriculture, mining, manufacturing and services as key sectors. GDP is forecast to reach USD 2.7 trillion in 2030.

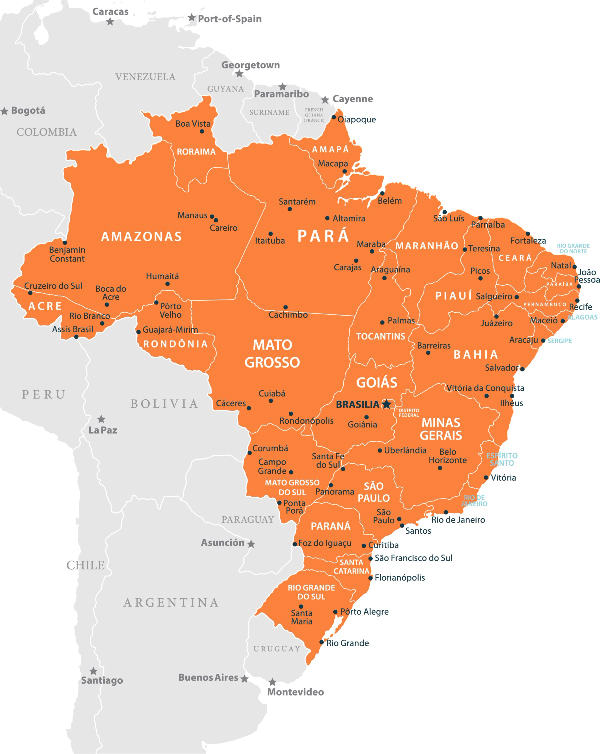

Brazil has a total land area of 8.51 million square kilometres.

Government is a democracy with a presidential and federal system.

Main economic hubs: Sao Paulo, Rio de Janeiro, Belo Horizonte, Porto Alegre.

Brazil’s economy recovered steadily post-2020 driven by services, with modest contributions from industry and agriculture. Real GDP growth is forecast to stabilise at around 2% in the second half of the 2020s.

Brazil is weathering recent economic challenges, including unemployment, currency depreciation and inflation, via falling unemployment, steady inflation control and a recovering currency.

Economic recovery is marked by a decline in central government debt from a 2020 peak, with a strong rebound in household consumption. Gross Fixed Capital Formation remained subdued at 16.5% of GDP in 2023.

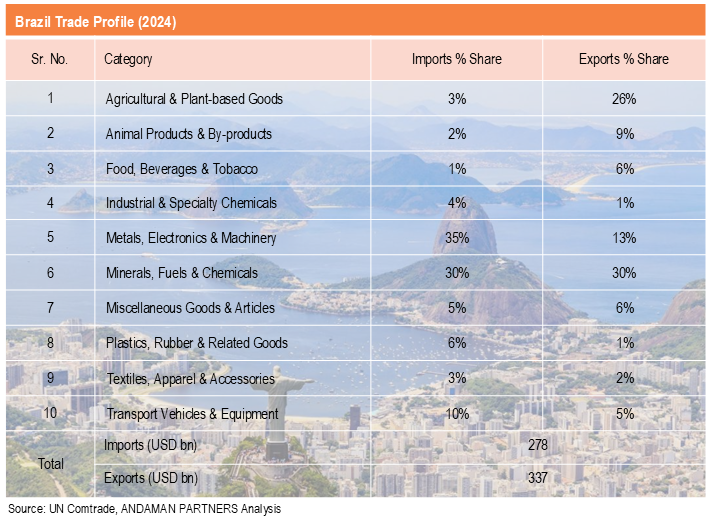

Total trade reached USD 615 billion in 2024, driven by strong export growth in Agricultural Goods and Minerals, Fuels & Chemicals, which accounted for 56% of total exports. Metals, Electronics & Machinery accounted for 35% of imports.

Leading export partners (2024): China (USD 94.4 billion), U.S. (USD 40.9 billion), Argentina (USD 13.8 billion).

Leading import partners (2024): China (USD 69.2 billion), U.S. (USD 43.2 billion), Germany (USD 14.1 billion).

To download the full Country Profile, please see the option below.

ANDAMAN PARTNERS supports international business ventures and growth. We help launch global initiatives and accelerate successful expansion across borders. If your business, operations or project requires cross-border support, contact connect@andamanpartners.com.

Compliments of the Chinese Lunar New Year to all our clients, customers, suppliers and partners.

ANDAMAN PARTNERS Co-Founders Kobus van der Wath and Rachel Wu will attend Investing in African Mining Indaba 2026 in Cape Town, South Africa.

ANDAMAN PARTNERS is pleased to support and sponsor this popular Pre-Indaba event in Cape Town.

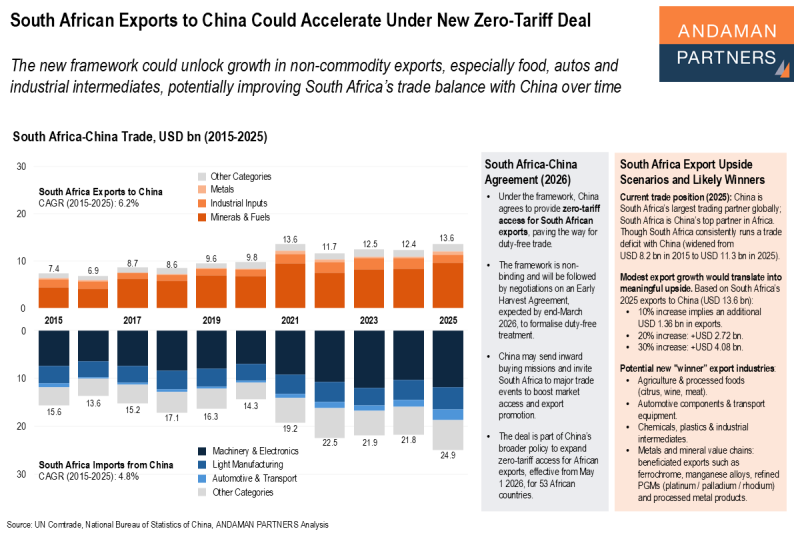

The new framework could unlock growth in non-commodity exports, especially food, autos and industrial intermediates.

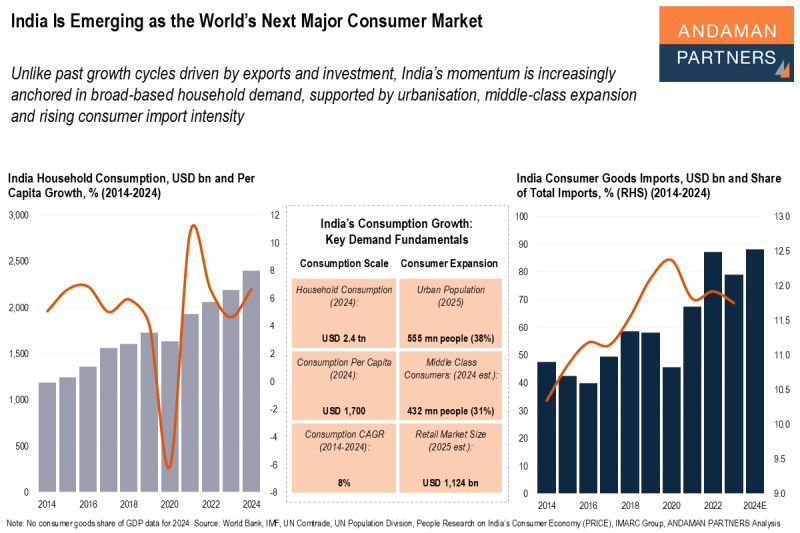

India’s momentum is anchored in broad-based household demand, supported by urbanisation, middle-class expansion and consumer import intensity.

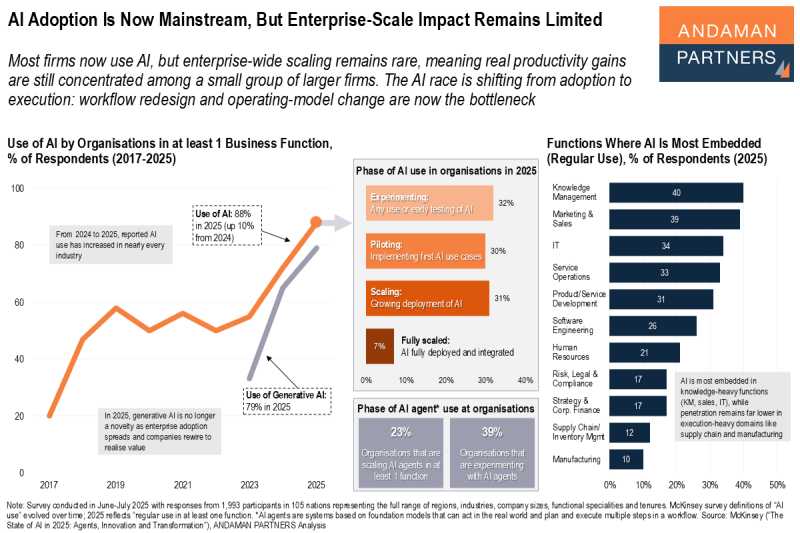

Most firms now use AI, but enterprise-wide scaling remains rare, meaning productivity gains are concentrated in a small group of larger firms.